Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

You've done all the legwork to form your business, but you're still left wondering, “Do I need an Employer Identification Number (EIN) for my LLC?” The short answer is that you might. An EIN is a nine-digit federal tax identification number used by the Internal Revenue Service (IRS) to identify business entities.

In this guide, you'll learn whether or not your LLC needs an EIN and why it would be beneficial to secure one, even if it’s not mandated. Got questions? This guide covers all the FAQs so you don't miss a thing.

Obtain Your Business EIN, Hassle Free.

Get in Touch TodayWhat Is an EIN? Is It the Same as an LLC?

An EIN is not the same as an LLC (Limited Liability Company).

An EIN, also known as a federal identification number or business tax ID, is a tax identity. The IRS assigns EINs to distinguish unique business entities, including sole proprietors, LLCs, corporations, partnerships, and nonprofit organizations.

What is an LLC? An LLC is a type of legal business entity created by state statutes. It's the fastest and easiest legal structure for your business to adopt. An LLC provides legal coverage of assets and liabilities as well as pass-through taxation.

The IRS doesn't require most sole proprietorships or single-member LLCs to have EINs. However, there may be some scenarios where your LLC is obligated to secure an EIN, so let's dig deeper.

If I Have an LLC, Do I Need an EIN?

If you have an LLC, you might need an EIN. Your LLC will require an EIN if any of the following scenarios apply:

- You have or are planning to hire employees.

- You're operating a multi-member LLC.

- You're a single-member LLC and want to be taxed as an S Corp or corporation.

- You pay employment, alcohol, excise, tobacco, or firearms taxes.

- You have a Keogh plan.

- You do business with trusts, nonprofit organizations, estates, real estate mortgage investments, plan administrators, and farmers’ cooperatives.

- You took ownership of an existing LLC.

- You wish to restructure as a corporation.

For more detailed information, visit the IRS website, or hire a tax or startup business consultant to guide you. Now, let's take a look at the benefits of having an EIN.

Benefits of Having an EIN

There are several business-related benefits of having an EIN for your LLC. Let's say you're running a new LLC and have no intention of hiring employees or setting up a retirement plan; therefore, you don't need an EIN. But should you get one? The answer is a resounding yes. An EIN does much more than just serve as a business tax identifier.

Even if obtaining an EIN is not mandated for you by the IRS, there are many benefits of getting an EIN for your LLC:

- Create a clear distinction between your business and yourself

- Make it easier to secure startup funding

- Enable yourself to open a business bank account

- Establish business credit

- Get assistance with bookkeeping and tracking of business finances

- Add an additional layer of security and privacy to your business

- Protect yourself from identity theft

- Build professional credibility with vendors and customers

- Speed up the process of attaining business licenses and permits

- Receive tax breaks and credits for business expenses, salaries, and wages

To minimize business costs and save time, we suggest getting an EIN sooner rather than later.

Is an EIN the Same as an SSN for an LLC?

The main difference between a Social Security number (SSN) and an EIN is that an SSN is for individuals, while an EIN is for businesses. The IRS tracks your business’s filings using an EIN. Many small business owners find it helpful to think of an EIN as an SSN for their business.

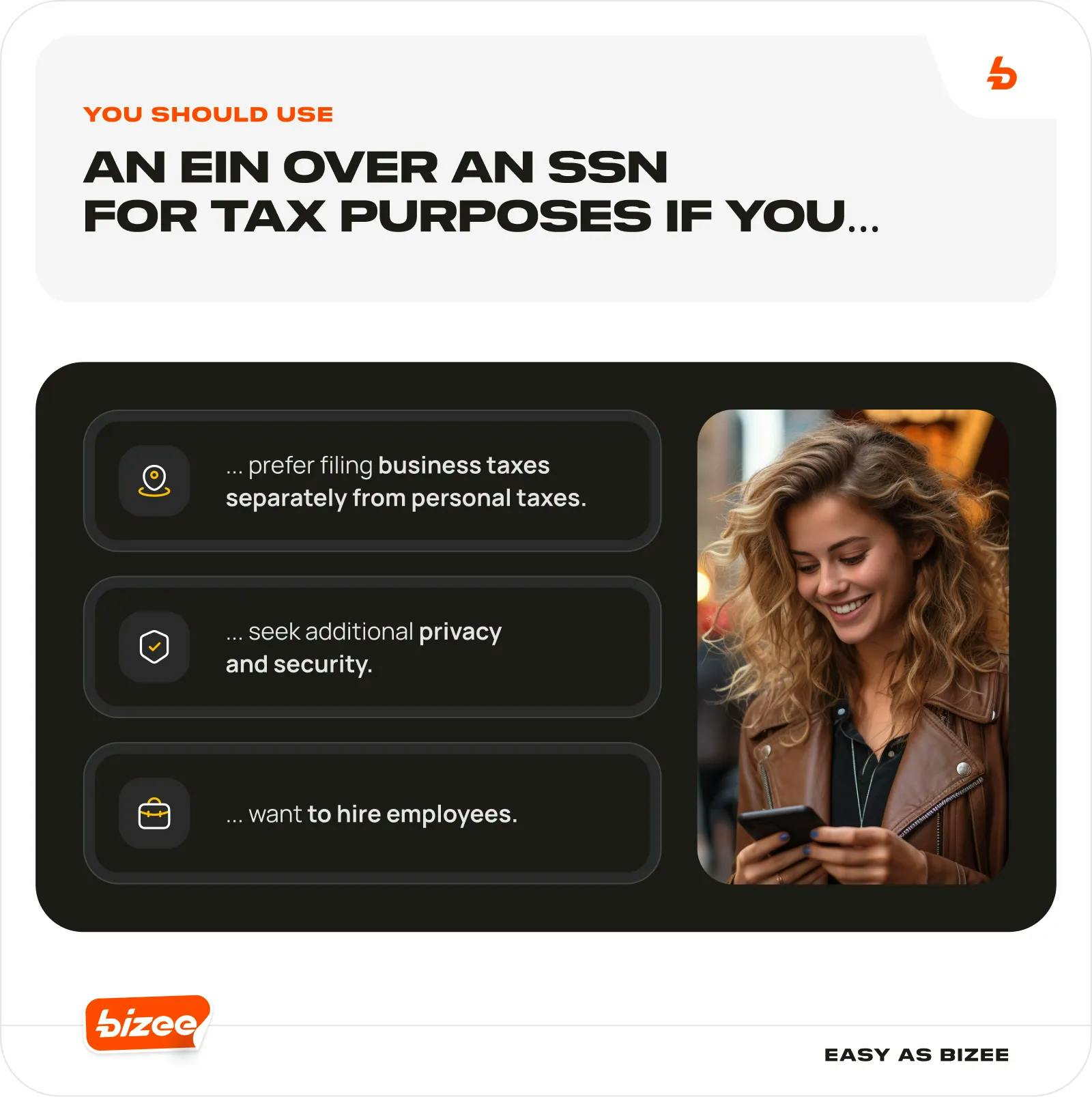

Should I Use an SSN or an EIN for Taxes?

If you do not have staff, a self-retirement plan, or excise tax payments, and you are a sole proprietor or single-member LLC, your SSN can be used for tax filing.

However, there are some compelling reasons for filing taxes using an EIN as opposed to an SSN. An EIN will do the following:

- Provide more privacy and security as your SSN number won't be on public documents

- Enable you to file business taxes separately and establish a business history

- Give you the flexibility to hire employees and secure funding without any delay

What Do I Need to Get an EIN for My LLC?

In order to obtain a new EIN, an SS-4 application form is required. To complete this application without any issues, you must have the following information available:

- Your business’s legal name and official address: Enter the legal name used on your formation documents. If you're operating under a “Doing Business As” DBA, use that name on the application, and add your official business address. Virtual addresses are accepted.

- Type of legal entity: Are you a sole proprietor, LLC, nonprofit organization, or corporation?

- Start date: If you have already filed as an LLC, enter the date of formation. Otherwise, enter the date you intend to start your business.

- Owner’s name and tax ID: For domestic LLCs, you can use your SSN as a tax ID. For international LLCs and business owners who don’t have an SSN, use your appointed Individual Taxpayer Identification Number (ITIN).

- Number of LLC members: How many members are in your LLC?

- Reason for applying for EIN: Are you hiring employees, creating a pension plan, or changing entity types?

- The maximum number of employees expected in the next 12 months: Include an accurate prediction of your future hiring needs.

- Will you pay employment taxes annually or quarterly? Once you decide, be sure to tell the IRS immediately.

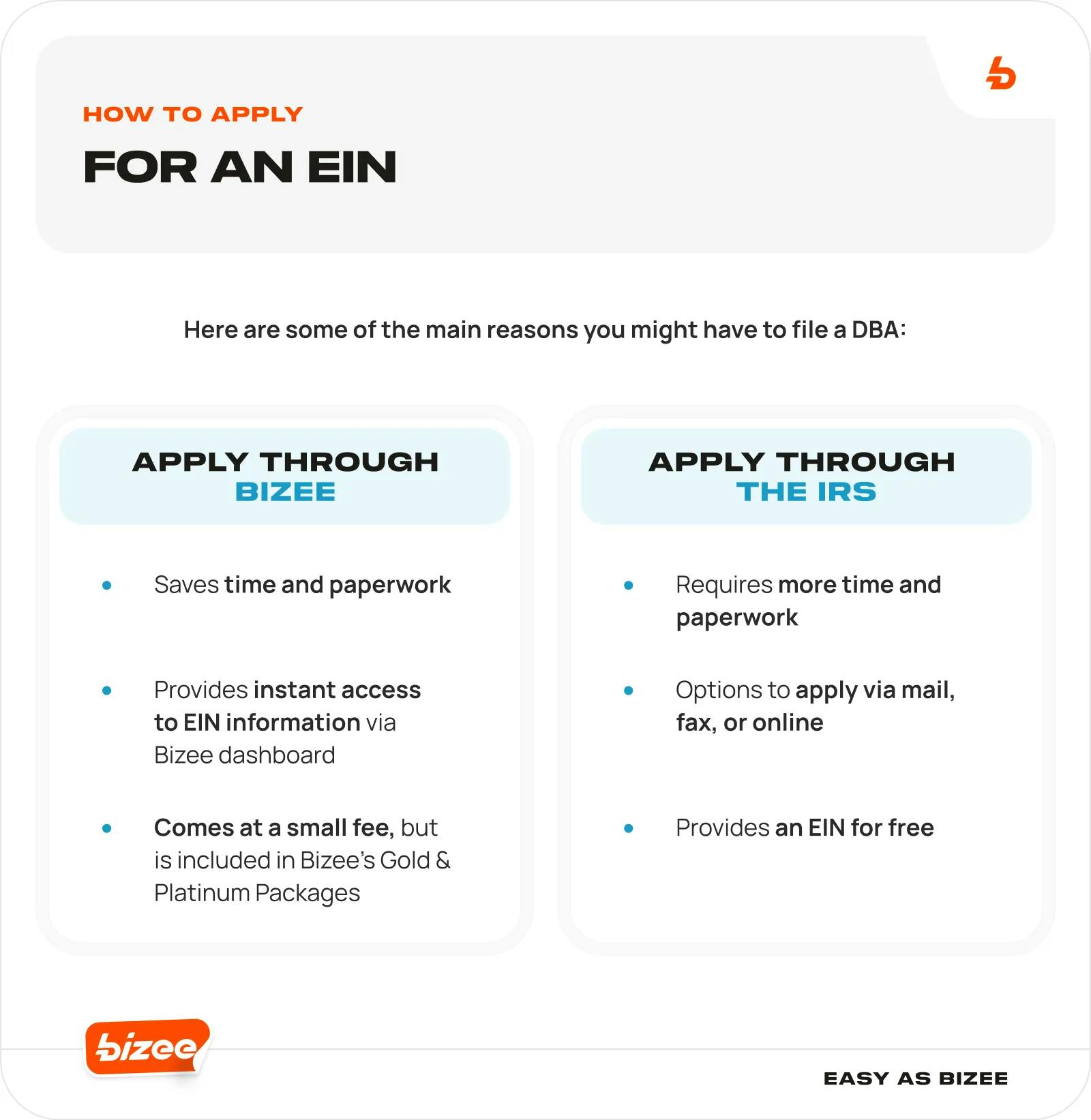

How to Apply for an EIN

You can apply for an EIN online, via fax or mail, or through Bizee’s EIN filing service.

To file directly with the IRS, complete the online application form between Monday and Friday, 7 a.m. to 10 p.m. EST. The IRS issues the EIN upon submission and verification of the form — this usually just takes a few minutes. However, the online application is only available for LLCs with a domestic, U.S.-based address.

To apply by fax, complete the SS-4 form and fax it to 855-641-6935. The fax line is open all seven days of the week, 24/7. Faxed EIN requests have a turnaround time of four business days.

Domestic LLCs can mail the hard copy of form SS-4 to the following address:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

The processing time for mailed applications ranges between four to five weeks.

LLC owners with international addresses and no legal U.S. address or a responsible party that can file on their behalf need to call 267-941-1099 between 6 a.m. and 11 p.m. EST, Monday through Friday, to get their EIN.

What to Do After Getting an EIN

Your EIN is active and ready as soon as you receive it from the IRS. Use it to open a dedicated business bank account, secure funding, or hire employees.

Will I Ever Need to Change My EIN?

Yes, there might be cases where you'll need to change your EIN. If you're changing ownership or the type of business structure you operate, you will need to apply for a new EIN.

Here are a few scenarios that require changing your EIN:

- You already got an EIN as a sole proprietor and now you are incorporating.

- You are currently registered as a single-member LLC and wish to restructure to a multi-member LLC or corporation.

- You have an LLC EIN and elect to file LLC taxes as an S Corp.

- You add new partners to an existing LLC.

Changing your business name or location does not require changing your EIN number. A business formation service can help you understand whether or not your LLC needs a change of EIN.

Frequently Asked Questions

Does EIN Mean You Own a Business?

Yes, having an EIN means you own a business, as it's administered by the IRS to identify business entities for tax purposes. But keep in mind that acquiring an EIN as a sole proprietor does not make your business a legitimate business entity. To form a legal business entity that provides liability and assets protection, like an LLC or corporation, you must register your business with your Secretary of State.

Can I Look Up My EIN?

I don’t remember my EIN, where can I find it? Unfortunately, the IRS doesn’t provide an EIN directory service where you can use your business name or any other identifier to find your EIN.

However, you can look up your LLC’s EIN on previous tax forms, bank statements (if you used it to open a business bank account), or your original confirmation notice. If none of these are handy, call the IRS Business and Specialty Tax Line at 1-800-829-4933.

When you incorporate with Bizee, you can easily access your EIN and crucial business documents via your online dashboard.

Can I Close or Cancel My EIN?

Once assigned, the IRS doesn’t cancel EINs. However, you can write to the IRS and ask them to close the EIN account if you deem it unnecessary. You need to provide the legal entity name, address, and reason for closing the account.

Establish Your Business With an EIN

Obtaining an EIN is an excellent way to establish and grow your business. To obtain an EIN, you must form a legal business entity, which guarantees the safety of your business and its assets. Bizee offers a standalone EIN service, or our Gold and Platinum Packages include this service for free. Join over 1 million thriving business owners who use Bizee as their go-to source.

Obtain Your Business EIN, Hassle Free.

Get in Touch Today

Swara Ahluwalia

Swara Ahluwalia is a freelance content writer with experience in the technical, B2B and SaaS domain. She also has curated content for various lifestyle brands. In her downtime, you will most likely find Swara training for her next marathon or spending time with her two daughters.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC