Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Filing taxes as an S Corporation can be a very effective way to lower your self-employment taxes and could save you thousands a year (if you make over $70,000 a year, that is).

There’s just one issue, though — filing your taxes as an S Corporation is more complex than doing so as a sole proprietor or LLC. But that shouldn’t stop you from filing, particularly since you’ll see some big savings.

Below, we cover all of the steps you need to follow to file as an S Corporation, register for the right taxes, set up a payroll system, report on your earnings, pay estimated taxes and file your end-of-year returns in the right way.

Let’s get into it.

Our Step-by-Step Guide to Filing Taxes as an S Corporation

Next, we'll walk you through everything you need to do to register as an S Corporation, set up a payroll system, and prepare and file your taxes.

1. Register Your S Corp or Elect Your LLC as an S Corp

There are two ways to register as an S Corporation for tax purposes:

- Create an S Corporation.

- Form an LLC and elect to be taxed as an S Corporation.

We only recommend using option one if you need the advantages that an S Corporation provides over an LLC outside the taxation benefits. That’s because running a business formed as an S Corporation has several administrative overheads that you don’t have with an LLC. If you just want the tax benefits of an S Corporation, then option two is best. Here’s how to take advantage of option two:

- Form an LLC with Bizee. It’s fast and easy.

- File Form 2553 with the IRS to elect to be treated as an S Corporation for tax purposes.

- You can file Form 2553 as you’re forming your LLC or afterward — within two and a half months of forming your LLC or before March 16 in any tax year after formation.

- Bizee can take care of filing Form 2553 on your behalf.

Some business owners wonder, "Am I considered self-employed if I own an S Corp?" Owners of S Corporations are "employed by" the S Corporation and receive a salary. This means that strictly speaking, you are not self-employed since you’re considered an employee of the company.

2. Register for Payroll-Related Taxes

You will need to register for your employment- and payroll-related taxes, which you will need to file and pay as an S Corporation. Here’s how to do that:

- Visit the Employment Taxes portal on the IRS website.

- Review sections including “Understanding Employment Taxes,” “Depositing and Reporting Employment Taxes,” “Employment Tax Due Dates” and any other relevant sections.

- Search for employment and withholding taxes for your state.

- Understand reporting requirements and due dates for your state employment and withholding taxes.

Note that some of your filing requirements may be taken care of through your payroll system if it offers full-service payroll. We have more information on that in the next section of this guide.

You will also need to register and set up two new types of taxes that you pay if you run a payroll — FUTA (Federal Unemployment Tax) and SUTA (State Unemployment Tax). You can learn about FUTA and how you file it on the IRS website. SUTA requirements vary by state, so review your state’s employment and labor agencies for details.

3. Set Up a Payroll System

Although you can theoretically calculate, file and pay all of your S Corporation income and self-employment taxes manually, in practice, it’s much, much easier to use a dedicated payroll service. These payroll platforms will charge a monthly fee but will save you a considerable amount of time and frustration!

There are plenty of services to choose from, including standalone options like Gusto or services offered as part of an overall accounting and bookkeeping platform like Wave or QuickBooks. Depending on the service you choose and the state you live in, you will probably have a couple of options for the type of payroll service you use:

- Basic payroll will typically calculate payroll amounts and taxes and generate pay stubs, but it won’t actually file or pay taxes for you. You would need to do that using the instructions on the IRS and your state’s website.

- Full-service payroll will calculate payroll amounts and taxes, and will also file and pay all necessary taxes on your behalf, and take care of year-end payroll form filing.

Although full-service payroll is more expensive, it removes a lot of the burdens from you on filling in the right forms, remembering to file them, and taking care of year-end payroll returns.

Once you’ve signed up for a payroll service, you’ll need to go through the onboarding process. You will need to enter details like employee names, benefits, FUTA and SUTA tax rates, payroll frequency and other information. Read through the platform’s support guides in detail to ensure you’re filling out everything correctly.

4. Define a “Reasonable Salary”

The IRS requires that you pay yourself a “reasonable salary” as an employee of your own business. This is to prevent you from paying yourself a salary of, for example, $10,000 (that you pay self-employment tax on) and taking $60,000 out of your business as distributions (which you don’t pay self-employment tax on). The IRS does not provide specific information on how much a reasonable salary would be, but we do have some recommendations:

- Look at Glassdoor and similar websites on what someone doing your job would be paid in a standard, employed position at another company.

- Look for median amounts based on similar job roles and length of experience.

- Set your reasonable salary as the higher of that median amount or half of your company profits.

For example, if you’re a freelance designer, you might discover that a median salary is $40,000. If your company profits are $70,000 a year, you might set your salary at $40,000 and take out $30,000 as distribution. If your company profits are $100,000 a year, you might set your salary at $50,000 and take out $50,000 as a distribution.

Once you have a reasonable salary, enter it into your payroll software.

5. Run Your Payroll and File Your S Corporation Taxes on a Regular Basis

You can now run your payroll and pay yourself. Although the IRS does not require you to run payroll at a specific frequency, many business owners choose to run payroll and pay themselves every two weeks or every month. This ensures you’re regularly moving money into your personal account so you can meet your financial needs, and also means you’ll stay up-to-date with your taxes and filings and avoid large tax bills all at once.

With a full-service payroll, they will take care of paying taxes and filing forms like 940, 941, 943 and state payroll tax returns. If you’re running a basic payroll service, you’ll need to file those forms and pay those taxes yourself. Details are on the IRS and your state’s websites.

6. Pay Quarterly Estimated Taxes on Distribution Amounts

Your payroll service will only take care of the federal and state taxes that you pay on the amount you take out of your business as a salary. That means you’ll still owe federal and state income tax on the profits that remain in your business or that you take out as distributions. Here’s our guide to paying your quarterly estimated taxes.

7. File an S Corporation Return and a Personal Tax Return Every Year

S Corporation owners need to file a personal tax return using Form 1040 every year. Additionally, they must also file a Form 1120-S: U.S. Income Tax Return for an S Corporation.

Are you wondering, "Can I file my own S Corp taxes?" You can file your own S Corp taxes if you know how to fill in a Form 1120-S, but there are very few software applications that allow you to do this, and the form can be complex. If you're not confident about filling in that form, then Bizee's business tax preparation service or a CPA can help.

Important Concepts for Filing Taxes as an S Corporation

Here’s how S Corporations lower your taxes and the areas you need to be aware of:

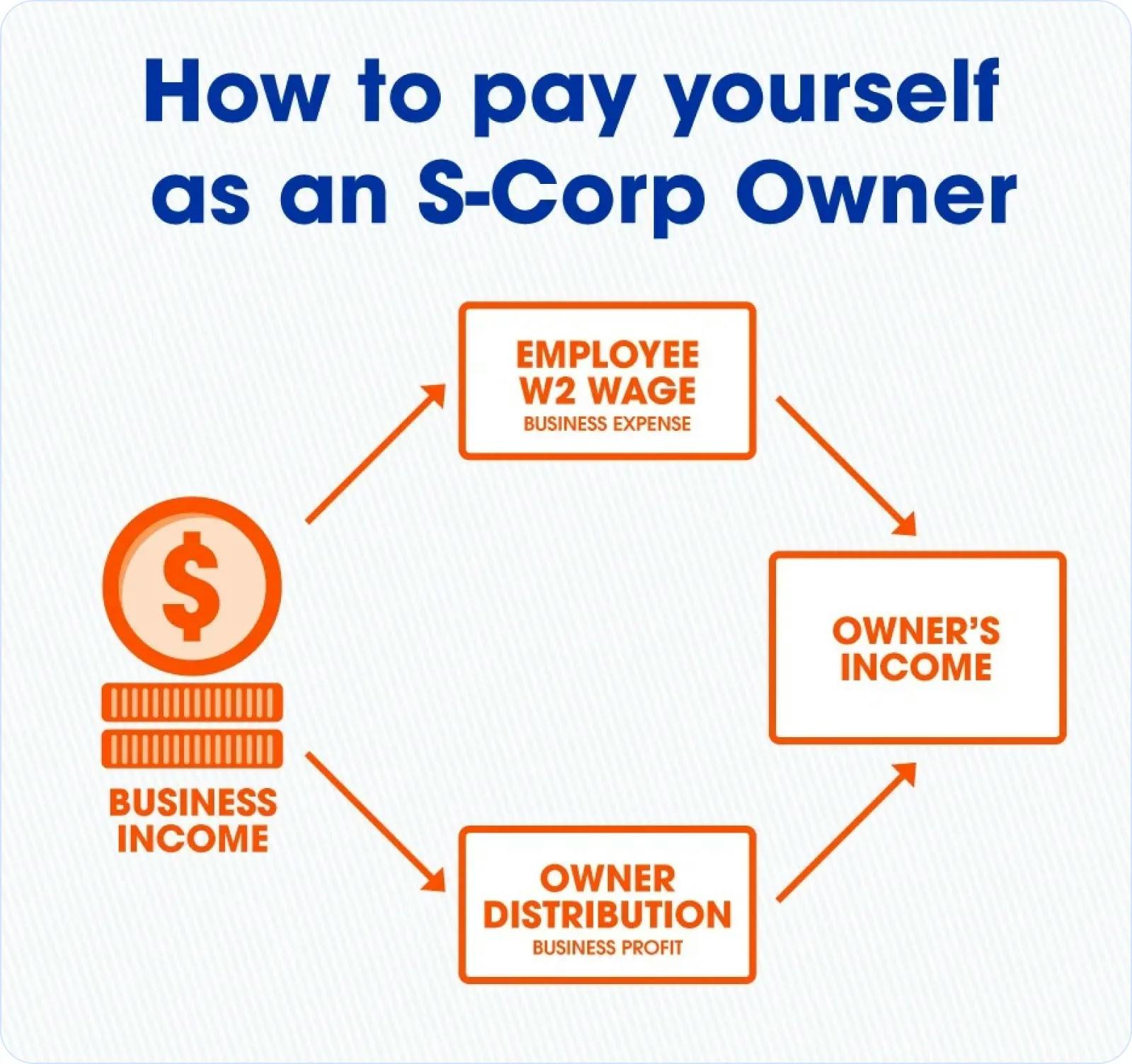

- S Corporations lower your taxes in one way — by reducing the amount of self-employment tax you need to pay.

- S Corporations, in common with sole proprietors, partnerships and LLCs, function as “pass-through” entities for tax purposes.

- You only pay self-employment tax on the money you pay yourself as part of a “salary,” using a payroll system.

- Money that you take out of the business as a “distribution” is not subject to self-employment taxes.

- S Corporation owners must pay themselves a “reasonable” salary.

- All profits earned by your business will be taxed for federal and state income taxes as normal. An S Corporation designation does not change the amount of income tax you pay.

- Salary paid via a payroll system is subject to a couple of small, additional taxes, known as FUTA and SUTA.

- S Corporations need to file additional tax forms, both as part of payroll and when filing yearly tax returns.

- You do not need to form an S Corporation to be taxed as one. Instead, you can form an LLC and file a specific form with the IRS to be treated as an S Corporation for tax purposes.

We hope you've found this guide to S Corporation taxes useful. They're a powerful type of business entity that can reduce the tax you pay. Due to their complexity, remember to check out Bizee’s tax service for a complete and hassle-free way to complete your end-of-year filings.

Paul Maplesden

Paul is a freelance writer, small business owner, and British expat exploring the U.S. When he’s not politely apologizing, he enjoys hats, hockey, Earl Grey Tea, mountains, and dogs.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC