Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

LLC owners are busy people. Many, in addition to nurturing and growing their own business, also work part or full-time for an outside employer. That can certainly help create financial security during the uncertain early days of fledgling startups, but what does it mean if and when outside employment is terminated? The regulations regarding unemployment benefits for LLC owners are nuanced and varied. We’ve compiled the highlights of what you need to know about filing for and collecting unemployment.

ALERT: Filing Unemployment Due to COVID-19

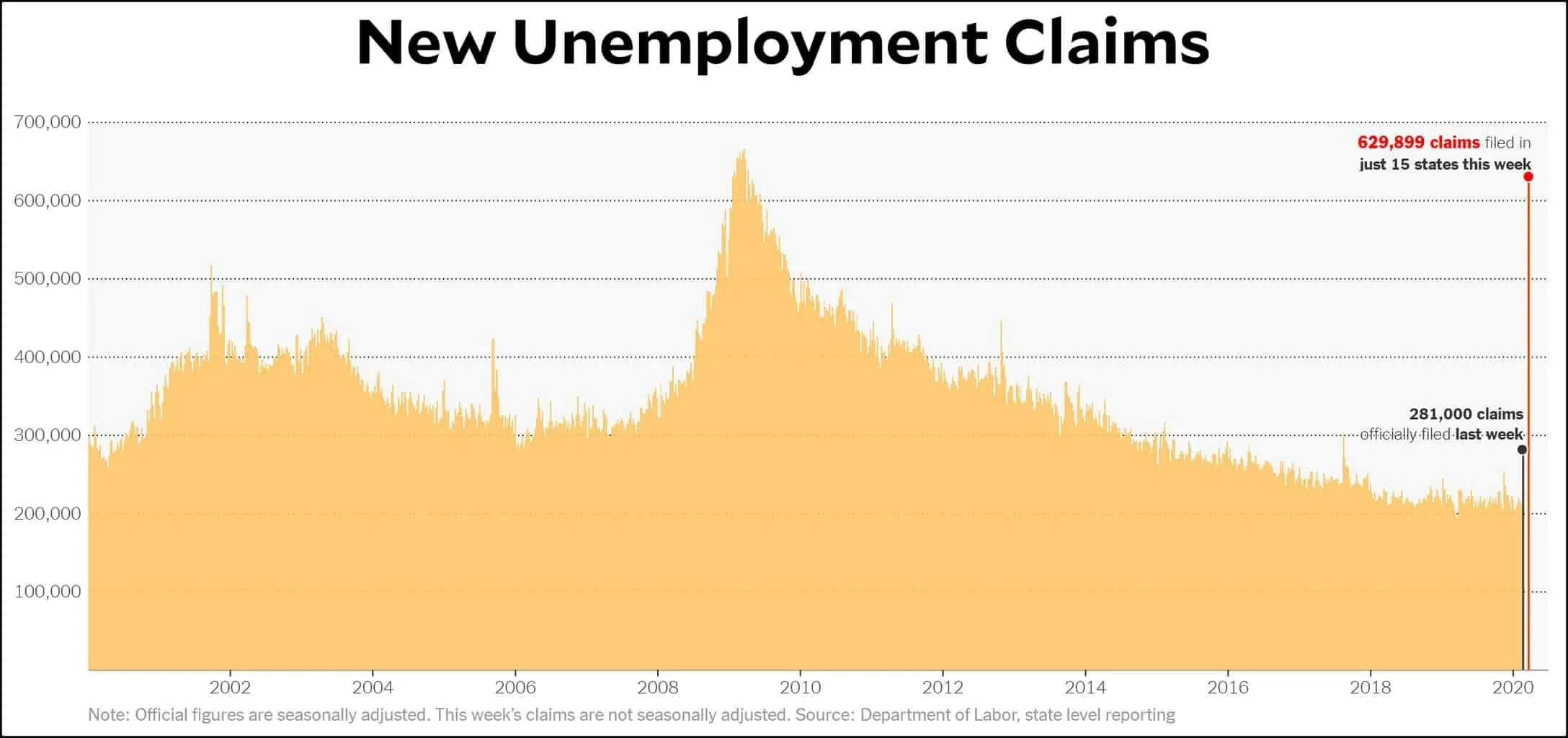

With the nation and the world thrust into an unprecedented time of uncertainty and worry, we’re following developments the U.S. Department of Labor (DOL) is making to unemployment laws and regulations. The situation is changing rapidly, but with unemployment claims skyrocketing by 33 percent in the last week, the government is rushing to make benefits available to those who need them most. And with state websites crashing as nearly 300,000 citizens attempt to file for aid, the situation is becoming critical. We've heard of a new tool called DoNotPay app that helps get unemployment claims processed quicker to get money to people faster. Here’s what else you need to know about COVID-19 and its impact on unemployment:

Every State Is Different

Each state in the U.S. operates its own Department of Labor and sets its own regulations regarding unemployment. In the current climate, the U.S. DOL is allowing states to rapidly amend their existing unemployment laws. You can check the Unemployment Benefits Finder database to find out how your state is responding to the coronavirus pandemic and begin your application for benefits.

We're More than Just Business Formation.

Get One Platform to Manage Your Whole Business & All the Services You Need.

Click HereRules Still Apply

The basic premise of unemployment — financial support after you’ve lost your job through no fault of your own — is still in effect. However, restrictions have been loosened in most states to include those who:

- Lost their jobs after their business shut down due to COVID-19

- Have been forced into quarantine to prevent the spread of the illness

- Are planning to return to their job, but cannot work during self-isolation

- Have been diagnosed with COVID-19 or are caring for a family member

The Job Hunt Is on Hold

This applies, particularly to LLC owners. Generally, states require individuals receiving unemployment benefits to prove they’re actively seeking work. These requirements are different for LLC owners (see below). However, many states are now suspending this stipulation in light of widespread self-quarantining, shutdowns, and travel restrictions.

The Sooner, the Better

Many states have a waiting period, both before you file for benefits and before you begin receiving them. In the wake of the pandemic, most states are waiving these restrictions, allowing immediate (same day or next day) applications and benefits to begin within a week.

Again, be sure you check with your state’s unemployment laws during this evolving situation.

In the meantime, here’s a general overview for LLC owners wondering if and how they can collect unemployment benefits.

General Rules for Collecting Unemployment Benefits

Regardless of whether you own and run an LLC or not, there are still certain criteria you will need to meet before you can think about claiming unemployment benefits.

You Must Have Been an Employee Paid Through Payroll Who Filed a W2

You can only make an unemployment claim if your employer paid you and also paid unemployment tax to the state and federal government. So, if you were paid a regular salary by an employer, that’s the first step toward claiming unemployment benefits.

The Loss of Work Must Not Have Been Your Fault

Typically, you’re only eligible for unemployment if you lost the job through no fault of your own. For example, if your department was downsized and you were laid off, you may be able to collect unemployment. If you were fired for persistent lateness or not meeting the standards of your workplace, that may impact your ability to make a claim.

You Must Be Actively Seeking Work and Able to Accept Employment Consistent with Your Skills and Training

Most states require you to actively be looking for work to provide you with unemployment benefits. This means you should be spending your time updating your resume, looking for positions, applying for roles and attending interviews. If you limit when you can work, unemployment benefits could be reduced or withheld.

Unemployment While Starting a Business

Let’s explore how these rules might apply when you’re self-employed and starting an LLC.

You Must Report Self-Employed LLC Income

Any income that you earn from your LLC or elsewhere must be reported to your state unemployment benefit office. This will reduce the amount you can collect as unemployment. Typically, your benefits will be reduced by the same amount as the money you’re earning.

Your New LLC Could Be Viewed as a Job (Whether You Earn Anything or Not)

Filing for and collecting unemployment relies on you actively seeking and being available for work. If you start a new LLC, your state unemployment agency may well see that as you already having a job and not being available to take on other work. Since that contravenes the need to be available for work, they could decide not to pay you benefits.

A Handful of States Allow You to Claim Unemployment While Starting a Business

If you live in Delaware, New York, New Hampshire, Oregon or Mississippi, you could be in luck. Each of these states has a Self-Employment Assistance program that lets you use unemployment benefits to start a business. According to the U.S. Department of Labor, “Individuals may be eligible even if they are engaged full-time in self-employment activities - including entrepreneurial training, business counseling, and technical assistance.”

In Most Cases, Using or Claiming Unemployment Benefits While Starting an LLC Is Not a Good Idea

Most state unemployment agencies are likely to take a dim view of continuing to pay unemployment while you try to start a new business. This is likely due to your lack of availability to look for other paying work.

Some state unemployment agencies will not be favorable to you using unemployment benefits to fund your new business. Remember, too, that you will need to report any income your new LLC generates, and that the unemployment agency will likely reduce your benefits by that amount.

In some states, the business activities of your new LLC must be different from the business activities of your former employer to allow you to file and claim unemployment.

We strongly recommend contacting your state unemployment agency and speaking to someone about what your options are. Explain the situation you’re in, and ask what you need to do to remain compliant with the law so you can continue claiming unemployment benefits. Do not try to “hide” your new business. It’s always best to be open and transparent about your plans, answer questions from your state unemployment agency and comply with their requirements.

Paul Maplesden

Paul is a freelance writer, small business owner, and British expat exploring the U.S. When he’s not politely apologizing, he enjoys hats, hockey, Earl Grey Tea, mountains, and dogs.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC