Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

Affiliate Disclosure: Please note this post includes affiliate links, While using our affiliate links may earn us a commission, we only collaborate with affiliate partners who excel in service and are dedicated to helping you save time and money. Quality is our standard when selecting partners.

Once you’ve formed an LLC, one essential step you'll need to follow is to keep your personal and business finances separate. Different accounts help to protect your personal assets from any potential business liabilities, and the best way to do that is by opening a dedicated business account for your LLC.

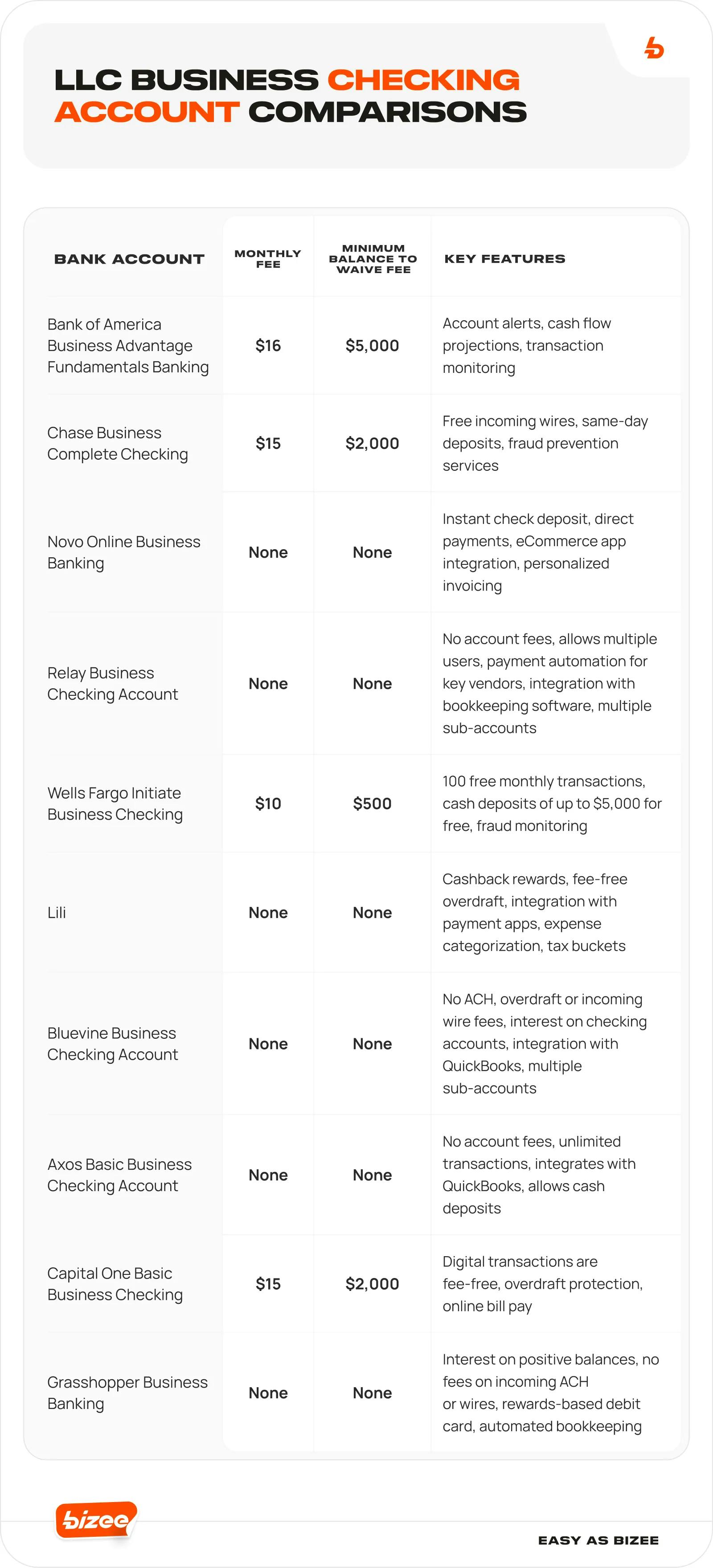

We’ve put together a list of the best business checking accounts for LLCs in 2023.

1. Bank of America Business Advantage Fundamentals Banking

Bank of America is a large and well-known bank with wide access across the country. It does come with a monthly fee, which is waived if your business is doing well and you can keep $5,000 in the account or spend $250 a month on a debit card.

Opening a Business Advantage Fundamentals Banking account provides access to useful digital tools, including the Cash Flow Monitor and Bank of America mobile app, which will allow you to access your account from anywhere, make mobile deposits, transfer funds, monitor pending transactions and pay bills directly from your smartphone.

Key facts about Bank of America’s LLC business checking account:

- BoA is a big bank with locations across the U.S.

- There is a $16 monthly fee, waived if you maintain a balance of $5,000 or spend $250 a month on a linked debit card.

- You get access to helpful digital tools to get account alerts, project cash flow and monitor transactions.

- Business Advantage Fundamental accounts can be accessed via a web portal or mobile app.

In addition to a business checking account, Bank of America will also help you track your expenses and provide online statements 24/7 so you can monitor how your money is coming in and how it’s being spent. Bizee has partnered with Bank of America to offer a bonus when you set up a new small business account.

Join the 1m+ businesses that trust Bizee

Get Started2. Chase Business Complete Checking

If you’re looking into opening up a new business account and do not already have an account with JPMorgan Chase, this offer will pay you $300 just to get you started. Business banking with Chase combines online banking, mobile app and brick-and-mortar service with close to 5,000 branches and access to 16,000 ATMs across the country.

Key facts about Chase’s LLC business checking account:

- Chase is a huge bank with locations across the U.S.

- There is a $15 monthly fee, waived if you maintain a balance of $2,000, make $2,000 of purchases on a linked debit card or via a couple of other methods.

- You get quick access to your money with same-day deposits.

- You can accept incoming wire payments for free.

- You can accept card payments into the account and also have access to fraud prevention services.

- Chase Business Complete Checking accounts can be accessed via Chase Business Online and Chase Mobile Banking.

To qualify for the $300 bonus, business banking customers will need to deposit $2,000 in their new business account within 30 days and maintain an average balance of that amount for 60 days. The final step is to make five transactions using your account within 90 days of opening.

Depending on how your business accepts transactions, you may incur some fees with this account. There is a transaction fee of 2.6 percent plus $0.10 for all tap, dip and swipe card transactions and a fee of 3.5 percent plus $0.10 for manual card transactions.

3. Relay Business Checking Account

The Relay business checking account is well-suited to LLC's of all sizes. The account allows LLC owners to assign permissions and debit cards to team members for greater control of expenses and transactions. It also allows both U.S. and non-U.S. citizens the ability to open a U.S. based bank account.

Key facts about the Relay Business Checking account:

- No account fees, overdraft fees or account minimums.

- In-depth team permissions for multiple account users.

- Payment automation for key vendors.

- Issue physical and virtual debit cards for detailed expense tracking.

- Integration with bookkeeping and accounting software.

- Sub-accounts for financial planning.

- Integration with payment providers like PayPal and Stripe.

Relay accounts are FDIC insured and integrate with bookkeeping software, payment providers and other third-party systems. The account also allows for payment automation with your favorite vendors.

4. Wells Fargo Initiate Business Checking

Another addition to our list of the best business checking accounts for LLCs is the Wells Fargo Initiate Business Checking account. This account provides support through online and mobile banking, including bill pay and mobile deposit, access to over 13,000 ATMs and access through its dedicated small business customer service center.

Key facts about Wells Fargo Initiate Business Checking accounts:

- Wells Fargo is a huge bank with locations across the U.S.

- You can get email and text alerts for account activity.

- There are no account fees if you maintain a balance of $500.

- Wells Fargo provides continuous fraud monitoring and zero liability debit card protection.

- You can access your account via Wells Fargo online and mobile banking.

Fees associated with the account are:

- 100 monthly transactions free. There is a fee of $0.50 if you go over 100 per month.

- No fee for the first $5,000 in cash deposits processed each month. After $5,000, there is a fee of $0.30 for every $100.

- A monthly service fee of only $10 and the monthly fee is waived as long as you keep a $500 minimum daily balance.

5. Lili

Our next business checking account for LLCs is not a major, nationally recognized bank, but a growing online financial resource specifically tailored to meet the needs of freelancers and solopreneurs. Lili is ideal for small businesses looking to simplify their banking needs, manage their business finances and save on any potential expenses.

Key facts about the Lili account:

- No fees and no minimum balance requirements.

- Business cashback rewards when shopping from certain merchants.

- Fee-free overdraft of up to $200.

- Deep integration with payment apps and online platforms.

- Helpful tools, including expense categorization, detailed reports and tax buckets.

- Free ATM cash withdrawals.

Lili offers its customers an online business checking account that also includes a Visa business debit card and a network of 38,000 ATMs. There are no added fees, no minimum balance requirements and no overdraft fees.

This banking option is also ideal for tax purposes, as it can track spending and money flow and generate quarterly or yearly reports when it comes time to report or file for taxes. It even sets aside money in “tax buckets” to make sure that you save enough.

Another perk offered by Lili is that money paid via direct deposit is available in a Lili account two days earlier than if you were banking with a traditional bank. Your funds are also FDIC insured through Choice Financial Group.

6. Bluevine Business Checking Account

Bluevine is part of a new breed of checking accounts, providing a wide range of convenient services for small business owners. Bluevine accounts are FDIC insured and include two-factor authentication for greater security. Unlike many other business checking accounts, it also offers interest on your account balance.

Key facts about the Bluevine Business Checking account:

- No monthly fees and no minimum balance requirements.

- No ACH, overdraft or incoming wire fees.

- Unlimited deposit, payment and withdrawal transactions.

- Interest on the checking account.

- Integration with QuickBooks online.

- Multiple sub-accounts for better money management.

If you use QuickBooks online, Bluevine has built-in integration for easy importing of transactions and fast reconciliation. Bluevine also offers completely fee-free banking, with no monthly, ACH, overdraft, incoming wire or similar fees. The sub-account feature can be very useful for financial planning in your LLC.

7. Novo Online Business Banking

Novo is an online bank that’s ideal for ecommerce businesses. It is known for integrating third-party programs like Xero, Slack, Stripe and Shopify, and Novo makes it simple to get paid through money transfers, wires and card purchases. If you’re working with cash, Novo may not be the best option for you.

Key facts about Novo Online Business Checking accounts:

- No monthly service charges or fees.

- Deposit checks instantly.

- Send payments directly from Novo.

- Integrate with many apps across popular e-commerce marketplaces.

- Set aside money with a “Reserves” function.

- Create and send personalized invoices.

- Accept ACH and check payments and avoid transaction fees.

Novo aims its services at e-commerce businesses that rely primarily on customers making online purchases. If you do want to make cash withdrawals, all you’ll need is a Novo debit card.

8. Axos Basic Business Checking Account

The Axos business account has an attractive offer for LLCs. If you incorporated after June 2020, Axos will provide a $200 welcome bonus. Even if you formed your LLC before then, you can get a $100 bonus.

Key facts about the Axos Basic Business Checking Account:

- No monthly maintenance fees or minimum balance requirements.

- Unlimited reimbursements on domestic ATM fees.

- Unlimited payments, transactions, deposits and credits.

- Compatible with QuickBooks bookkeeping software.

- Cash deposits are available via various banking networks.

There’s more to love, too, including no monthly fees, unlimited transactions and integration with QuickBooks. You can easily access your account, too, through online and mobile banking apps.

9. Capital One Basic Business Checking

Capital One might be better known for its credit cards, but it also offers a robust banking solution for LLCs. In addition to free debit cards and fee-free digital transactions, you can waive the monthly account maintenance fee for keeping $2,000 or more in the account.

Key facts about the Capital One Basic Business Checking Account:

- Capital One is a huge bank with locations across the U.S.

- $15 monthly fee, waived if you maintain an average balance of at least $2,000.

- Deposit up to $5,000 in cash each month with no fee.

- Domestic wires are charged at $15 for incoming and $25 for outgoing.

- There are no limits on fee-free digital transactions.

- Overdraft protection and online bill pay.

- You can access your account via Capital One online and mobile banking.

If you link a Capital One deposit account, you also get free overdraft protection, and it offers complete online bill pay so you can easily pay your main vendors.

10. Grasshopper Business Banking

Grasshopper business banking provides several helpful digital tools to help LLCs easily manage their finances and cash flow. You can make and schedule payments from any device via check or ACH. The app features easy, built-in invoicing for personalized billing and faster payments.

Key facts about Grasshopper business banking:

- No monthly fees.

- Interest on positive balances.

- No fees on ACH transactions or incoming wires.

- Rewards-based debit card with cash back.

- Built-in bill payment and digital invoicing.

- Automated bookkeeping and cash flow management.

You also get a fee-free debit card that features rewards and cash back, and there are no monthly fees and no fees on incoming wire transfers or ACH receipts. The bank account integrates with Quickbooks and Auto books for fast reconciliation.

Business Checking Account Tips + Tricks

To make the most out of your business checking account, check out these tips and tricks straight from the business experts at Bizee:

- Look for a business bank account that does not charge a monthly maintenance fee or where you can avoid the fee by keeping a minimum balance.

- Make sure you have the right paperwork in place to open your business account and avoid these common mistakes.

- Explore the various digital tools that your LLC may need to stay on top of your finances, and choose an account with those features.

- Seek out accounts that do not charge you to receive wire transfers or ACH.

- Take advantage of accounts that will easily integrate with your bookkeeping software, as that will make financial reporting, reconciliation, and tax preparation much easier.

Do I Need a Business Checking Account or Can I Use a Separate Personal Checking Account?

If you run an LLC, you must have a separate business checking account that is only used by your business. That’s because your LLC is considered to be a “separate legal entity,” and as a result, it needs its own bank account. This separation of your personal and business assets also helps to limit your personal liability if anything happens to your company.

LLC Bank Account Promotions and Offers May Change

Whichever business checking account you choose, it’s always helpful to do additional research, as offers may change and new promotions may be offered. Above all, make sure that you are comfortable with the services offered and that you’ll be happy with the customer support that your bank will provide.

Take advantage of Bizee’s partnership with Bank of America, and be eligible for a $100-$500 bonus when you sign up.

Get Up to a $500 Bonus When You Set Up a New Small Business Account with Bank of America.

Learn More

Paul Maplesden

Paul is a freelance writer, small business owner, and British expat exploring the U.S. When he’s not politely apologizing, he enjoys hats, hockey, Earl Grey Tea, mountains, and dogs.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC