What Is a Nonprofit?

A nonprofit corporation is an organization that has a purpose far beyond making a profit. Instead of owners and shareholders keeping the company’s earnings like they might in a C Corp, a nonprofit typically focuses on a larger mission, donating revenue toward a specific cause or goal that benefits the public.

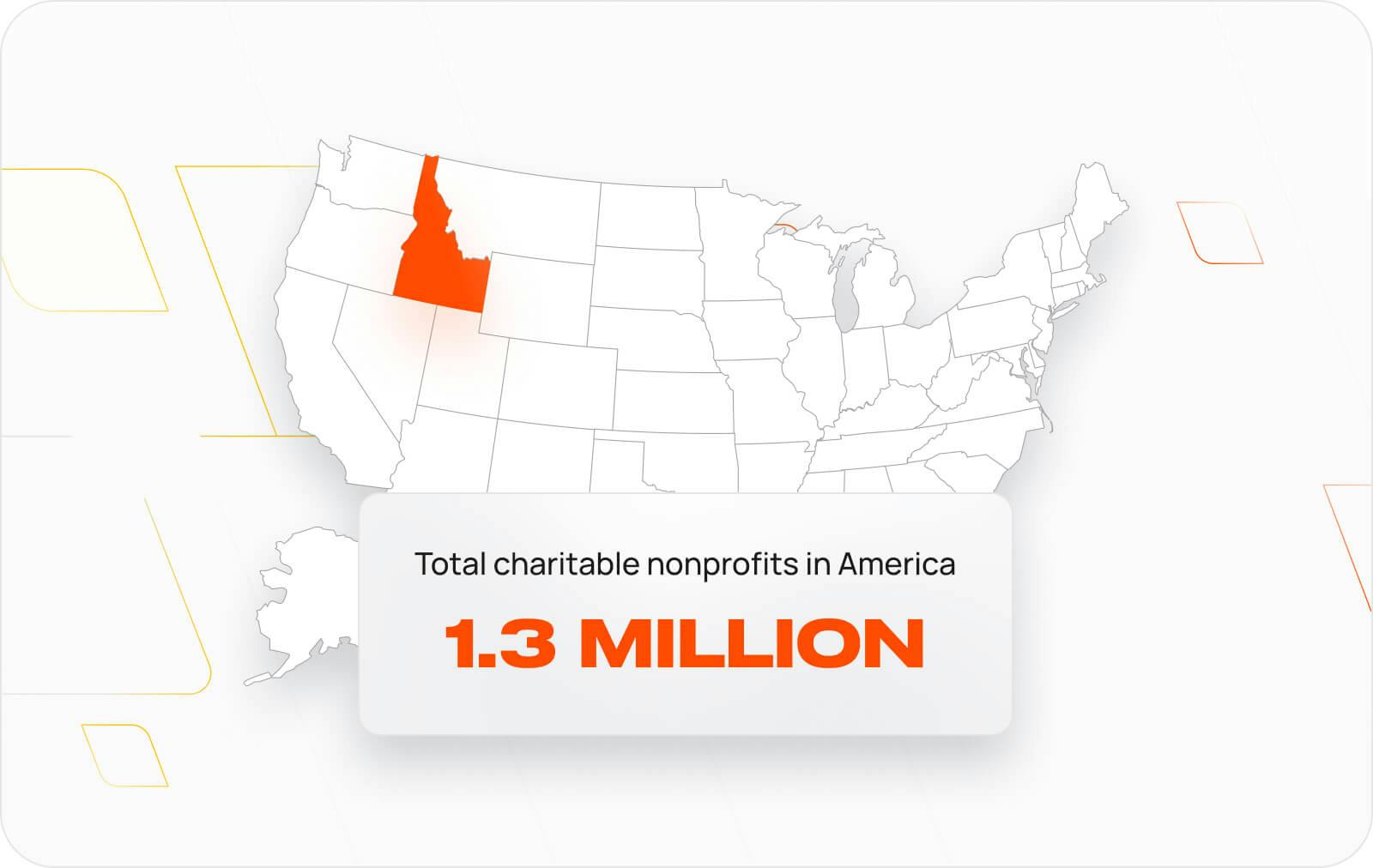

According to the National Council of Nonprofits, there are more than 1.3 million charitable nonprofits in America

However, being a nonprofit doesn’t mean that the company doesn’t make money. It just means that the company must put the money it does make back into the organization to pay for employee salaries, administrative expenses, and other overhead costs.

The Benefits of Starting a Nonprofit

There are four main advantages to becoming a nonprofit:

There are also a few disadvantages of becoming a nonprofit:

Forming a Nonprofit in Your State

Each state has different rules, regulations and fees for forming a nonprofit. For example, it costs $270 to start a nonprofit in Maryland, but in Kentucky, it only costs $8. Use Bizee’s filing fees chart to easily research and compare state fees before starting your business.

Four Types of Nonprofit Organizations

There are four main types of nonprofit in the United States. Each type has slightly different goals and corporate structure (but all are tax-exempt!). They include:

Nonprofit vs. Not-for-Profit: Is There a Difference?

The terms nonprofit and not-for-profit are not interchangeable. Both types of organizations exist to collect and distribute money, but they are treated differently for the purposes of taxes, charters and financial reasons.

The most significant difference between nonprofits and not-for-profits is that a nonprofit is a formal, legal entity for tax, governance and management purposes (similar to an LLC or corporation). A not-for-profit isn’t generally a separate legal entity, and they are less common than nonprofits.

Nonprofit corporations exist for charitable purposes, like offering assistance to socially disadvantaged people, providing education, promoting the arts or running an animal shelter. They typically carry out bigger-scale, organized charitable activities.

Not-for-profit organizations are generally associations formed by groups of people for achieving the organization’s objectives. This could include membership associations, sports clubs, civic leagues and business leagues. While nonprofits can apply for tax-exempt status, not-for-profits do not qualify for tax-exempt status under 501(c)(3). Instead, a not-for-profit needs to meet 501(c)(7) IRS guidelines to be considered for tax-exempt status. The IRS mandates that a not-for-profit must be organized for pleasure, recreation and other similar non-profitable purposes.

Is Starting a Nonprofit Right for You?

Nonprofits are usually established with a higher purpose in mind, like a religious, educational or charitable cause.

If you’re passionate about a particular cause, creating a nonprofit may be right for you. But don’t go it alone — there are complicated rules for establishing a nonprofit and attaining tax-exempt status.

How to Start a Nonprofit Corporation

While the incorporation process is accessible to all nonprofits, only those that meet specific parameters can achieve the 501(c)(3) tax-exempt status and corresponding benefits. Despite how attractive this sounds, you shouldn’t enter into a nonprofit lightly. While tax-exempt status sounds great, for most founders out there, the reason to start a nonprofit goes beyond saving on taxes.