On this page

Filing Fees & Requirements

How Much Does It Cost to Start an LLC in Washington, D.C.?

Legal business registration — and making sure your business remains compliant — involves some necessary expenses. Some of these costs are payable to the Washington, D.C., Department of Consumer and Regulatory Affairs, while others are due to additional state entities or the federal government. Here are some of the most common requirements and fees.

Please note that Washington, D.C., business license and permit fees may need to be paid when you first form your business, on an ongoing schedule or on an ad hoc basis. Find more details below.

Initial Washington, D.C., LLC Fees

You’ll need to file as an LLC with the Washington, D.C., Department of Consumer and Regulatory Affairs and pay a filing fee when you first formally form your business. Here are the current Washington, D.C., LLC fees and filing times:

State Fee

$99

State Filling Time

3 Weeks

Expedited Filing Time

4 Business Days

When you form your LLC with us, Bizee will charge you this fee and forward it to the DC Department of Consumer and Regulatory Affairs when we file your formation paperwork.

Bizee Can File Your Formation Paperwork for You for Free — Just Pay the Required Washington DC LLC Filing Fee

Form Your LLC Through Bizee Today

The District of Columbia Allows You to Form Your LLC More Quickly by Paying an Expedited Fee

View Expedited Fees for Washington DC

Employer Identification Number

Every LLC in the U.S. should obtain a unique Employer Identification Number (EIN) from the Internal Revenue Service. You'll use it when you open a business bank account, file taxes and pay employees. It's available at no cost from the IRS, or have Bizee obtain one for you.

Foreign LLCs

When you want to do business in a state other than the one where your business is based, you must create a foreign LLC.

Washington, D.C., Foreign LLC Registration

Foreign companies are those which are formed in another state or country. In order to transact business in the District of Columbia these entities must file a Foreign Registration Statement with the Washington, D.C., Department of Consumer and Regulatory Affairs for a Foreign LLC.

The registration statement must be accompanied by a certificate of good standing or a certificate of existence from the domestic state of formation. Register your out-of-state foreign company online by filing your Foreign Registration Statement with the Washington, D.C., DCRA. The filing fee for a Washington, D.C., Foreign LLC is $220. The state may have additional requirements so contact the Department of Consumer and Regulatory Affairs for more information.

Foreign Qualification to Operate in Another State

If you plan to expand your Washington, D.C., LLC into another state, you’ll first need Foreign Qualification or a Certificate of Authority or Compliance from that state. This is necessary if you'll have a physical presence, employees or banking in that state.

This process will likely require you to complete an application and pay a filing fee. Each state typically has its own requirements, so you’ll want to contact the state government entity that administers business (usually the Secretary of State) for specific instructions.

If you need assistance, Bizee provides complete Foreign Qualification service for all states.

Annual Report Requirements

Most states require businesses to file an annual (or other periodic) report with the Secretary of State. For the District of Columbia, the Department of Consumer and Regulatory Affairs requires a biennial report to be filed once every other year. When you file your biennial report, you’ll need to pay a fee of $300. Here are the Washington, D.C., biennial report filing requirements:

Annual Report

Frequency

Biennially

Due Date

April 1st

Filing Fee

$300

Filing Fee

There is no charge for the Public Information Report. The Franchise Tax Fee is based on the revenue of the LLC.

Note

Starts with year after incorporation or qualification: then each second year thereafter.

Bizee Can Also Complete and File Your Washington DC Biennial Report on Your Behalf

Bizee’s Annual Report Filing Service

Washington, D.C., Business License and Permit Requirements

As a business owner, it’s your responsibility to make sure you have the proper state, federal or local business licenses, to operate your Washington, D.C., LLC. Some of the associated fees only need to be paid once, while others are ongoing charges.

Permits and licenses vary based on:

- The industry your LLC operates in (e.g., restaurants will need health permits)

- The type of business you run (e.g., healthcare providers must meet HIPAA requirements)

- The location of your LLC (state, county or city) (e.g., a license to conduct business from the District of Columbia)

Running your business without the required licenses may expose you to risks and fines from federal, state and local governments.

You can research these permits and licenses yourself, or use Bizee’s Business License Research package, which includes:

- A complete report on all the licenses, permits and tax registrations your LLC will need

- The applications you'll need to file with the local, state and federal licensing authorities

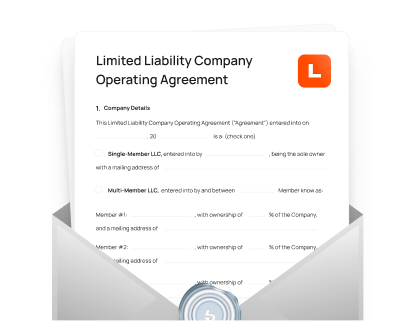

Operating Agreements

The District of Columbia doesn't require you to have an LLC Operating Agreement in place.

An Operating Agreement is a document that covers the rights and duties of the business members, how the business will be run, how managers and members are chosen and several other key areas. It's usually filed with your Articles of Organization at the time that you formally form your business.

This document can be extremely helpful in making sure you’re organized and prepared for any future events that may affect your business.

Bizee Can Draft a General Operating Agreement Template When You Form Your Washington DC Business.

If you have any unique requirements, you can make the necessary changes to accommodate them.

Learn About Operating Agreements

Other Potential Washington, D.C., LLC Fees or Requirements

It is normal for your business to pay and meet several other fees and requirements during the life of your LLC. These ad hoc fees will only be payable in specific circumstances, as listed below.

Obtaining a Trade Name or DBA

If you wish to establish a Washington, D.C., DBA or trade name, you must register your trade name with the Washington, D.C., Department of Consumer and Regulatory Affairs and pay a filing fee of $55.

Bizee Can File Your Trade Name or DBA Forms on Your Behalf

Bizee’s DBA Name Service

Changing the Registered Agent

Your LLC needs a Washington, D.C., Registered Agent, which you must appoint when you file your Articles of Organization. You can also switch to a new Registered Agent later - for a fee of $50 - by filing a change of agent form with the Washington, D.C., DCRA.

Have Bizee Serve as Your Registered Agent.

It’s free for the first year if you form your LLC with us and $119 a year after.

Bizee's Registered Agent Service

Reserving a Name for Your LLC

If you don’t want to form your LLC right away, you can reserve a business name for 120 days with the Washington, D.C., Department of Consumer and Regulatory Affairs. Simply reserve your name by filing a form with the Washington, D.C., DCRA, and pay a filing fee of $50. First, perform a Washington, D.C., business search and learn about business name rules to ensure you choose a name that meets state requirements.

Amending Certain Facts About Your LLC

Your business formation documents state certain facts about your Washington, D.C., business at the time it's formed. Over time, these facts may change. If they do, you'll need to file a form for a Certificate of Amendment with the Washington, D.C., Department of Consumer and Regulatory Affairs for a filing fee of $220. You can do this yourself or have Bizee file the amendments on your behalf.

You may want to file for a Certificate of Amendment when you:

- Add, remove or change an LLC member or manager

- Alter the stated purpose and activities of your LLC

- Change the business address of your LLC

Getting a Washington, D.C., Certificate of Compliance

Some organizations will request that you prove your LLC’s compliance with laws and tax requirements. If you need to prove you have met your commitments, you’ll need a Certificate of Good Standing from the Washington, D.C., Department of Consumer and Regulatory Affairs. You can obtain one by requesting a Certificate of Good Standing from the Washington, D.C., DCRA, and paying a fee of $50.

Bizee Can Obtain a Delaware Certificate of Existence (or Good Standing) on Your Behalf

Certificate of Good Standing Service

The fees listed above detail many of the charges a standard LLC will be required to pay in Washington, D.C. In some unusual circumstances, there may be other one-off, periodic or ad hoc fees not listed above.

Of course, your LLC will also probably need to pay self-employment, payroll, federal, state and sales taxes. More information about taxes can be found on the Washington, D.C., Business Tax page.

FAQs About Washington, D.C., LLC Fees

What Happens to the State Fees I'm Charged When Forming My LLC?

We will charge you this fee at cost and then pay the fee to the DC Department of Consumer and Regulatory Affairs on your behalf when forming your Washington, D.C., business.

Where Do I Get Business Licenses and Permits for My LLC?

It depends on various factors, including:

- The type of business you run

- Where your business is located

- Governing bodies in your industry

- Federal, state and local regulations

Many new businesses need a business license, and you may be required to obtain additional licenses and permits. Our Business License Research package can take the guesswork out of it for you and help you learn what your LLC needs to be compliant.

incorporate now

Launch your business with bizee

No Contracts. No Surprises. Only $0 + State Fee to Launch Your Business.