Why Create a Washington, D.C., LLC?

Within the District of Columbia, business owners can take advantage of various incentives, provided your LLC meets the specific criteria. For example, Washington, D.C., offers new businesses the opportunity to apply for funding provided by the Washington Area Community Investment Fund. The Washington Area Community Investment Fund (Wacif) is a nonprofit community loan fund based in Washington, D.C. providing access to capital and expertise to entrepreneurs and community organizations.

For entrepreneurs wanting to start a business in Washington, D.C.,, creating a Washington, D.C., limited liability company (LLC) is generally the fastest and easiest way. With more simplified rules and regulations, an LLC is an ideal business entity for startups and small to medium-sized businesses, granting you the advantages and protections that larger District of Columbia corporations benefit from.

Benefits of Starting a Washington, D.C., LLC:

Protect your personal assets from your business liability and debts

Create, manage, regulate, administer, and stay in compliance easily

Easily file your taxes and discover potential advantages for tax treatment

Learn more about the benefits of the LLC business structure.

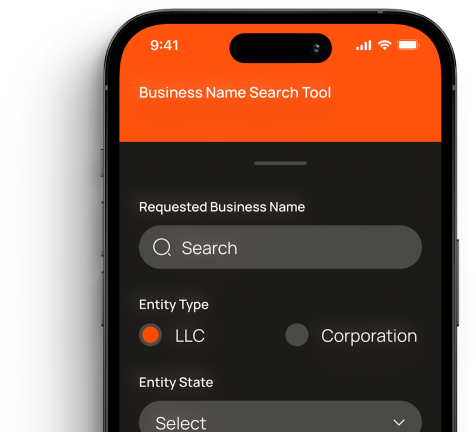

In this detailed guide, you’ll find information on naming your LLC, getting a Registered Agent, the fees you’ll need to pay, Washington, D.C., business taxes, and much more. We also cover your registration needs, filing your Washington, D.C., LLC, and how you'll correspond with the Washington, D.C., Department of Consumer and Regulatory Affairs.

How to Form an LLC in Washington, D.C., Yourself in Six Steps

On this page

How To Guide

incorporate now

Launch your business with bizee

No Contracts. No Surprises. Only $0 + State Fee to Launch Your Business.