Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Starting a nonprofit organization is certainly commendable and it can be an extremely rewarding journey. In some cases, you might even get “superhero” status from fellow friends, family members and the local business community. But the process isn’t all sunshine and roses.

Starting a nonprofit requires some thorough research. As an emerging entrepreneur, you’ll need to 1) find a cause that brings value, 2) understand startup costs, 3) find a state that is best for your nonprofit and 4) register for tax exemption with the IRS and your state. Phew! It’s a lot of work.

Is it a good time to start a nonprofit? What qualifies as a nonprofit? Let's understand the nonprofit landscape in the U.S. and the best places to start one.

A Close Look at Nonprofits in the U.S.

Here's an overview of how nonprofits are faring in the U.S.

There are 1.8 million nonprofit organizations in the United States, including 501(c)(3) charities, private foundations and professional organizations.

According to the National Center of Charitable Statistics, between 2006 and 2016, the number of nonprofit organizations registered with the IRS rose by 5.4 percent, from 1.48 million to 1.54 million. These 1.54 million organizations consist of a diverse range of nonprofits, ranging from art and health to education, advocation and professional associations.

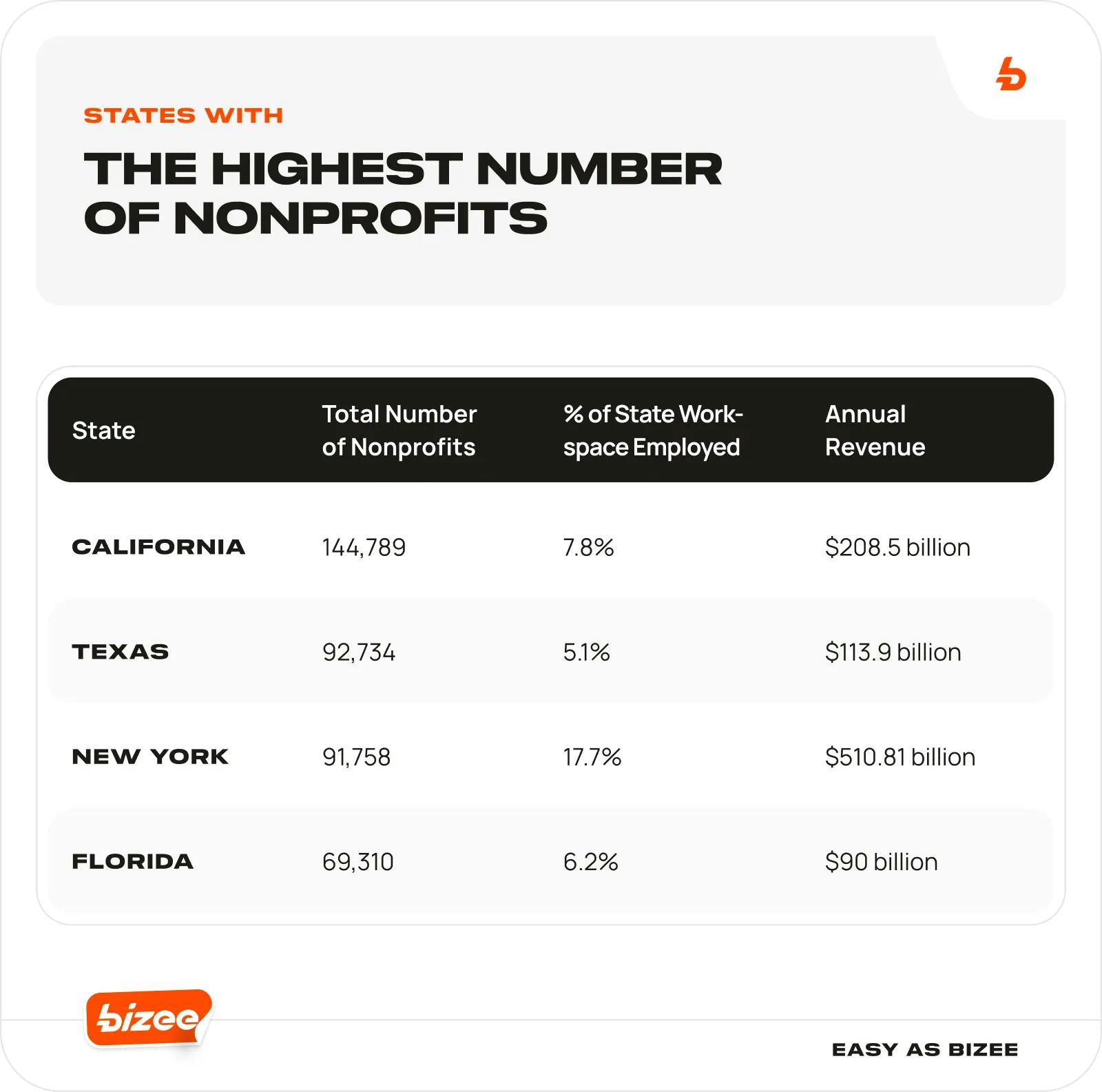

Nonprofits tend to exist in areas that have lots of legacy and established industries and communities. Boston registers the highest rate of locally focused nonprofits, followed by San Francisco and Washington, D.C.

What can we conclude from the above? Starting a nonprofit is common, the type of nonprofit can vary across multiple industries and, most importantly, Americans are passionate about giving back!

Top 5 States to Start a Nonprofit

One of the key decisions you need to make while contemplating a nonprofit is where you are going to incorporate and register your nonprofit. Why? Like most things in governance, some states are more receptive to nonprofits and give more tax exemptions. Below is our list of top five states where it’s the easiest and most beneficial to start your nonprofit.

1. Delaware

Home to over 5,500 nonprofits, Delaware is a small but popular state to start a charitable organization (even if they operate from another state). Why? Delaware’s formation laws are quite business-friendly and allow for nonprofits to be formed under the same statutes as other for-profit corporations.

Another formation perk is that Delaware requires a nonprofit to have just one director, whereas a state like New York requires three. The state’s governance and annual reporting requirements in the state are also more flexible and straightforward than in other states. In Delaware, you can incorporate your good cause for $89 and also enjoy operating from a state that doesn’t have many restrictions on a charity's activities.

2. Wisconsin

This Badger State is another happening spot for nonprofits. Wisconsin plays host to approximately 30,854 nonprofits that employ 11.9 percent of the state’s workforce. The state’s incorporation fee is $35, while the business tax registration fee is $20 — one of the lowest amongst all states. The formation process is similar to that of for-profit organizations but requires a nonprofit to have three directors who aren’t related to each other on the board.

Wisconsin also offers lucrative sales and use tax exemptions for nonprofits operating strictly for nonprofit religious, charitable, scientific or educational purposes. However, Wisconsin does have some stringent reporting requirements, such as annual report filings and renewal of charitable solicitation registrations.

3. Arizona

Arizona’s affordable incorporation fees and lenient governance make it a hot state for nonprofits. Arizona has no charitable solicitation laws, so you, as a nonprofit, don’t need to register with the state in order to fundraise or solicit contributions, meaning you can get your good cause up and running quickly. The fee to file Articles of Incorporation is just $40 ($35 optional expedite fee). The state’s expedited processing time is 7-10 business days. You also need to list just one director for formation purposes.

One unique filing requirement for Arizona is a Notice of Incorporation, which needs to be published three times in an authorized newspaper within 60 days of filing incorporation paperwork. The cost for this is based on the local paper.

4. Texas

Everything is bigger in Texas, even the number of nonprofits. What attracts nonprofits to the Lonestar state? The state’s flourishing business scene, coupled with business-friendly laws and ease of formation, is why over 100,000 nonprofits have opted to incorporate there. The nonprofits contribute $113.9 billion in revenue to the state.

Texas’s nonprofit incorporation fee is a mere $25. Although the incorporation process is simple and filing fees are low, Texas does have some stricter requirements for nonprofits. Annual reports have to be filed by the state deadlines and three directors are required to be on the board of your nonprofit.

5. Nevada

Like Delaware, Nevada is a popular state for nonprofits because it doesn’t have strict regulations curtailing the activities of a nonprofit. It’s also considered a tax haven because there is no state income tax — something that’s enjoyed by the 7,000 nonprofits currently in the state.

It takes only $50 to incorporate a nonprofit in the Silver State, and you can expect an approval within seven business days (you can expedite this for an additional fee between $125-$1,000). Lastly, nonprofits formed under NRS Chapter 82 are also exempt from the requirements of the State Business License in Nevada, making it even easier to operate.

Can a Nonprofit Operate in Different States?

Absolutely! Nonprofits can actually operate nationwide even if they are incorporated in a certain state. However, if you decide to expand your operations outside your state, it would be beneficial to check that state’s policy. For example, in some states like California and Illinois, it can be a criminal offense if you fail to register as a solicitor before you go about collecting funds or donations.

Give Your Good Cause a Perfect Start

Starting a nonprofit is a noble deed, but one that can quickly turn exhausting. There are some complicated rulings surrounding nonprofits and getting tax exemptions. If you are ready to champion your good cause, it would be well worth it to download our How to Start Nonprofit Guide that can walk you through the startup process. Bizee can also help you incorporate and gain IRS approval for your nonprofit whenever you wish to do so.

Swara Ahluwalia

Swara Ahluwalia is a freelance content writer with experience in the technical, B2B and SaaS domain. She also has curated content for various lifestyle brands. In her downtime, you will most likely find Swara training for her next marathon or spending time with her two daughters.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC