Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

If you're in the process of starting a Limited Liability Company (LLC), a written operating agreement can help lay the groundwork for how your business will be structured, managed, and operated. Though not required by most states, this legal document establishes the guidelines for how your LLC will be governed, the roles of its members, their ownership stakes and compensation, day-to-day operations, and other important provisions. All these factors will need to be agreed on for your business to operate effectively without internal strife, discord, or confusion.

What Is an Operating Agreement?

A written LLC operating agreement is your business’s rule book, constitution, and roadmap all in one. Even though your state may not require it, having one will ensure all your LLC members have protection from personal liability should the LLC get sued or owe money to creditors.

This critical legal document defines the roles of LLC members, establishes the bylaws they'll need to follow, governs how the business will be managed, and uses conflict resolution practices to settle disputes or disagreements. This document cannot take effect until all LLC members have signed and approved its contents.

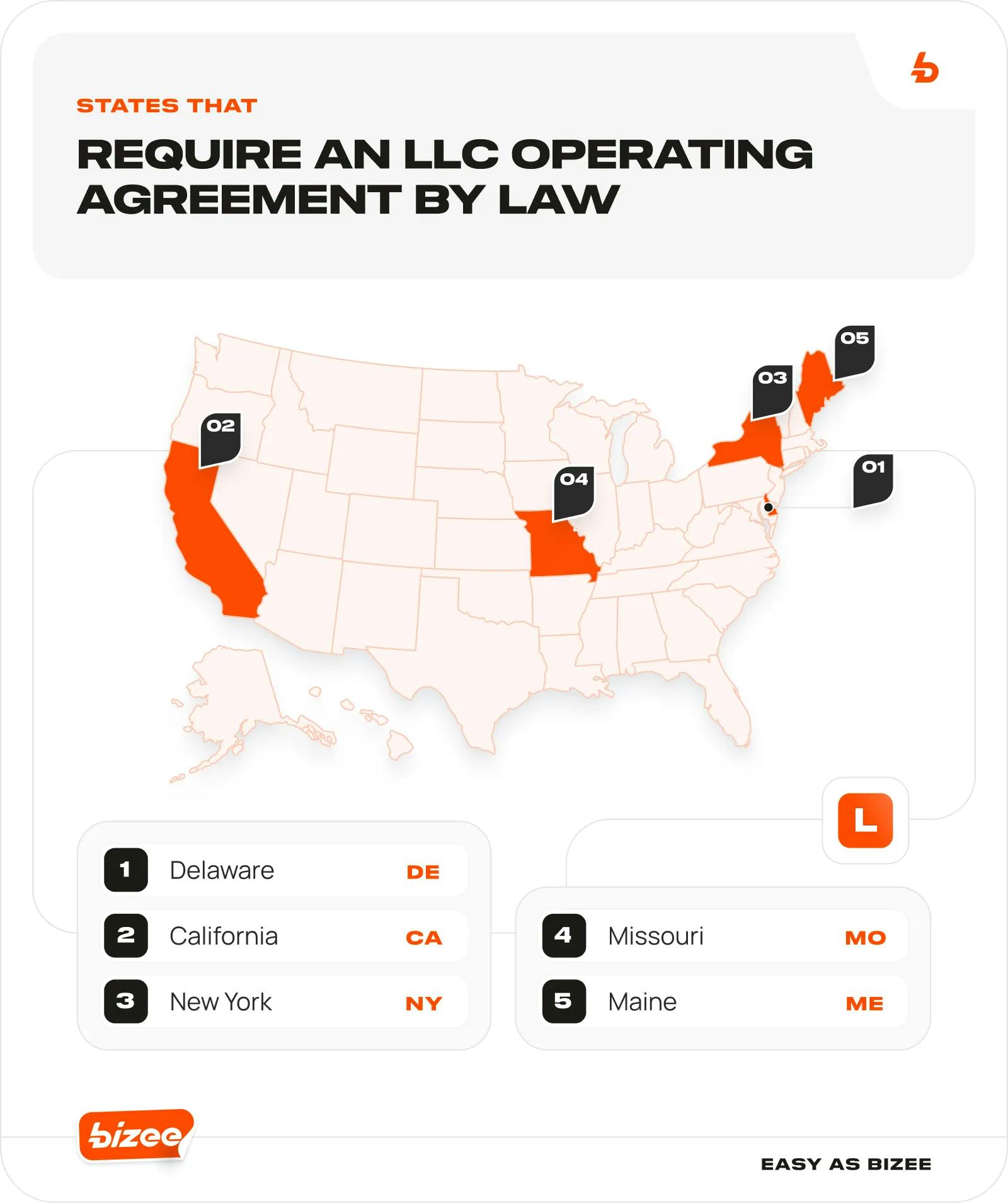

States that require you to have an operating agreement include California, Delaware, Maine, Missouri, and New York. But even if your state doesn't require one, it's a smart document to have.

What Should an Operation Agreement Include?

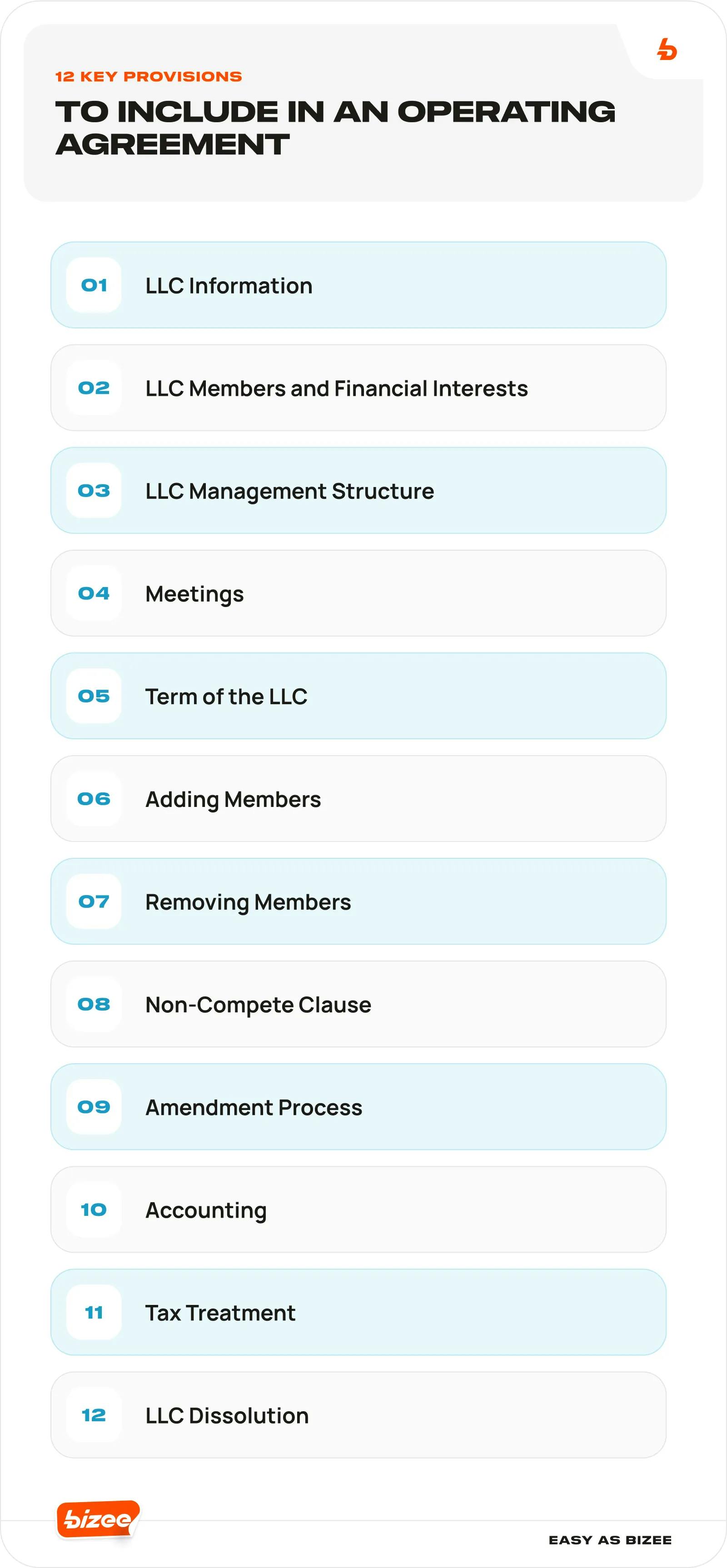

LLC operating agreements can vary in length and the details they cover. It will all depend on your business and the needs of the LLC. But most LLC operating agreements will contain a dozen or so key provisions, which we will outline and explain in further detail.

Ownership Determination

If you are operating a single-member LLC and are therefore taxed as a sole proprietorship, then ownership determination is straightforward: You own 100% of the LLC.

However, determining the percentage of ownership for a multi-member LLC is a bit more complicated. Assets that contribute to starting up a business may vary by member. These assets may also range from monetary contributions to others, such as properties, vehicles, or equipment. Each member's interests in a business will need to be recorded and formalized through the operating agreement. This includes monetizing non-capital contributions.

Once the value of a member’s contribution is recorded, assessing the percentage of ownership is fairly clear-cut. If a business’s starting costs are $100,000, and five LLC members contribute the same amount of $20,000 each, then each member has a 20% stake in the business. These numbers depend on the contributions and stakes of each individual LLC member.

Much like a partnership agreement, an LLC operating agreement is meant to clearly define the interest and contributions made by each owner and to have this information recorded in a legally binding document.

An Outline of Rights, Tasks, and Payments

Being an LLC member may or may not come with a distinct set of responsibilities. These can include managing the LLC, attending meetings, and playing an active role in the organization. Each member's duties will be determined by the terms set within the operating agreement.

For the most part, LLC members play an active role in the management of the business. They vote in chief officers, participate in meetings, and may even decide to change and amend the bylaws created when the business was first established. This is known as a “member-managed” structure, which gives each member a say in the decision-making process.

Another option is to opt for a “manager-managed” structure, which, unlike member-managed, will give the decision-making rights of the business to one person or entity, often hired for a salary as opposed to an equity stake in the LLC. This might happen if the LLC members want anonymity or to act as “silent” partners, taking a hands-off approach to running the LLC. This structure might also be a good option if the LLC members do not have the proper skill set to run a business, which would necessitate bringing in a professional manager.

Member Managed

Pros:

- Shared responsibility in running the business

- All members have a say

- Members may focus on or manage areas where they possess a special skill, such as marketing, production, sales, etc.

Cons:

- Voting may lead to disputes and rifts within the organization

- Future investors and members might not want to play an active role in the business

Manager Managed

Pros:

- Management of the LLC is delegated to one person

- Can attract passive investors

- Decisions can be made quickly

Cons:

- Added expense to LLC, which will now need to pay a salary to the manager

- Removes LLC members from the decision-making process

- Must find a candidate that all LLC members will approve

For an LLC that chooses to be member-managed, each member will take on a role and responsibility within the business. LLC members are the owners of the business, and though they do not own shares as owners of a corporation would, they all have a vested interest in the LLC and its success. The benefit of operating a business as a multi-member LLC is sharing in the profits of the business, as outlined in the operating agreement. This would include quarterly or annual distributions, as well as the allocation of assets, should the business dissolve.

Exit and Entry Rules

New Members

Admitting a new member to the LLC can help add capital and a level of expertise that was missing from the business. It can also ignite drive and passion within the company, reinvigorating other members with new ideas. At the very least, it can help spread out the risks and responsibilities of the business.

When adding new members, the provisions of the LLC’s operating agreement play a key role. These provisions may require the unanimous vote of existing members or simply the majority’s consent. Either way, the terms need to be clearly laid out in the operating agreement.

Exiting Members

The same goes for an LLC member leaving the company or intending to break from the agreement. Your operating agreement should provide guidance on what to do if and when a member passes away, no longer wants to be part of the business, or is no longer operating in the best interests of the company, resulting in their removal.

No matter the cause for the removal of a member, an LLC operating agreement must provide guidance. This may involve allocating the departing member's interest to surviving family or determining other ways their interest should be distributed, such as selling their share to another member or multiple members.

A Dissolution Plan

As much as we would like to think that our business dreams will lead us down a path of growth and success in perpetuity, that’s not always a possibility. Whether due to market and economic factors, a flawed business plan, strife within the organization, or a number of other factors, some LLCs shut down, close their doors, or, to use the technical term, dissolve.

Should that be the case, your operating agreement should have a plan in place on how to dissolve your LLC step by step. This may include some or all of the following provisions:

- A vote with unanimous or majority consent from LLC members to liquidate the business

- A plan to pay off outstanding debts

- Distribution of the remaining assets to the LLC members

- A wrap-up of the LLC’s tax responsibility and the filing of its last tax return

A Severability Provision

If you're familiar with the expression “don’t throw out the baby with the bathwater,” you're likely to understand the severability provision.

It all boils down to “severing" or removing a clause from the operating agreement that may not be enforceable and rewriting it in a way that doesn't invalidate the entire contract. Perhaps a law has changed, making the clause unenforceable. Since we don’t have a crystal ball to see if, when, or how state and federal laws might change, it is important to add a severability provision at the end of the contract to accommodate such an event.

Operating Agreement Provisions

While operating agreements can vary on the types of clauses and number of provisions, there are several major provisions that should be considered "must haves" in any operating agreement.

1. LLC Information

- Name of business

- Address

- Business purpose/type of business

- Registered Agent

2. LLC Members and Financial Interests

- Names of the LLC members

- Percentage of ownership

- Financial contributions

- Distribution of profits and losses

3. LLC Management Structure

- Member-managed?

- Manager-managed?

- Board member selection/appointment

4. Meetings

- How often? Quarterly? Annually?

- Select corporate officers

- Bylaw and amendments

- Dispute resolution

5. Term of the LLC

- How long the LLC will last, which is essentially until the LLC members decide to dissolve the business or the state shuts it down

6. Adding Members

- How to bring in a new member and the requirements for joining

7. Removing Members

- Actions leading to removal/expulsion

- Deciding what happens to a member’s interest upon death

- Transferring ownership or member interest

8. Non-Compete Clause

- Ensuring that members do not work for or invest in competing companies or share company information

9. Amendment Process

- At certain points in a business’s life, bylaws created at the formation of a business may need to be changed.

- Articles of Amendment allow LLC members to incorporate changes to the LLC’s governance

10. Accounting

- Recordkeeping

11. Tax Treatment

- Tax treatment: Partnership? Corporation? Sole proprietorship? S Corp?

12. LLC Dissolution

- When can you dissolve/liquidate

- Plan of allocation of business assets and debts

Can I Create My Own Operating Agreement?

The short answer is yes. But the real question is: Should you create your own operating agreement? You can indeed create your own operating agreement, but you should consider the important role it plays in the operation of your business. Have a lawyer review your draft before any LLC members sign off.

There’s a lot to consider when creating an operating agreement. Overlooking a provision or not providing enough clarity can lead to confusion and misunderstanding among members. Even though free templates are available online, each business will have its own unique considerations regarding the organization, management, member duties, transfer of interest, succession, and potential liquidation of the company.

What Is the Difference Between an LLC and an Operating Agreement?

An LLC is a legal business structure formed to help protect the owner(s) and members’ personal assets should the business be sued or default. An operating agreement is a legal document that outlines the structure and organization of the business. The operating agreement reinforces this protection and helps shield its members from creditors and legal liabilities that would threaten their personal finances.

Does an LLC Need an Operating Agreement?

While it's not a requirement to have an operating agreement in most states, without one, an LLC defaults to the state’s rules. Unlike an operating agreement created for your unique business, state rules may not take into consideration your company’s specific needs.

Creating your own customized operating agreement can prevent your business from being subject to the state's guidelines.

Creating an Operating Agreement for Your LLC

Your operating agreement will not only help organize and manage your business, but it will also ensure all members are in agreement. It’s a “living” document that can be amended to reflect changes in the business's rules, requirements, and regulations or any changes made to state laws. Bizee provides a lawyer-approved operating agreement template for our Gold and Platinum members to help you create a document that works for your business.

Peter Mavrikis

Peter Mavrikis is an author and editor with over 25 years of experience in publishing. He has worked as the Editorial Director for Barron’s Educational Series, as well as Kaplan Test Prep, where he ran the test prep, foreign language, and study guide.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC