If you want to reduce the amount of tax you pay on your LLC earnings, an S Corporation Tax Election (form 2553) is a necessity. This tax election tells the Internal Revenue Service to tax your LLC business as an S Corporation, which could reduce the amount of income on which you need to pay self-employment tax (including Social Security, Medicare and FICA). This can substantially reduce your tax bill with only a slight increase in administrative overhead for you and your accountant.

How LLCs Are Normally Taxed

When it comes to the amount of tax you owe the federal and state government, your income from an LLC is normally taxed similarly to that of sole proprietorship businesses. For a small, one-person LLC, this typically works as follows.

Your business earns revenue

You deduct any allowable business expenses

The amount remaining is your business profit, which you pay to yourself

You pay self-employment tax of around 15 percent on any profits

You pay federal tax at various income bands on any profits

You pay state tax on any profits

An S Corporation Tax Election reduces the amount of tax you pay in step 4, self-employment tax. It has no impact on any other taxes.

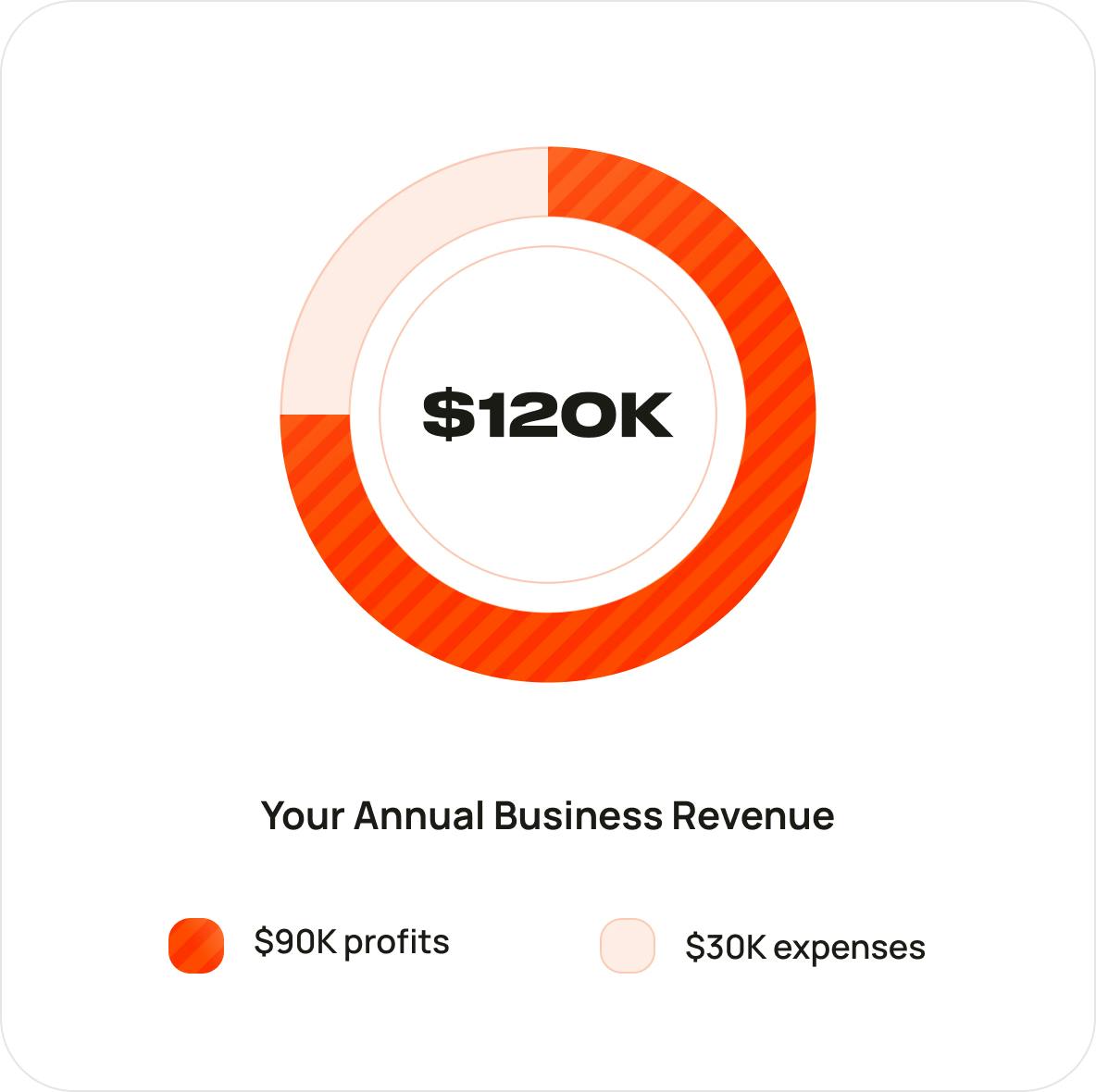

An Example of How an LLC Filing as an S Corporation Can Save Money

Let's illustrate this with an example

Self-Employment Tax as an LLC

Under a standard LLC tax arrangement where the income “flows through” to your 1040 tax return and business schedule C, you would pay self-employment tax on all of that $90,000. At approximately 15%, the tax on that money would be $13,500. You would still pay standard federal and state taxes on any earnings.Payroll Tax as an S Corporation

If you choose to be taxed as an S Corporation, you could say that your salary is $50,000 and take the other $40,000 out of your business as a distribution. You would pay standard payroll tax on that $50,000 for a total of around $7,500. You would not pay any payroll or self-employment tax on the $40,000 distribution, saving you around $6,000. You would still pay standard federal and state taxes on both your salary and your distribution.

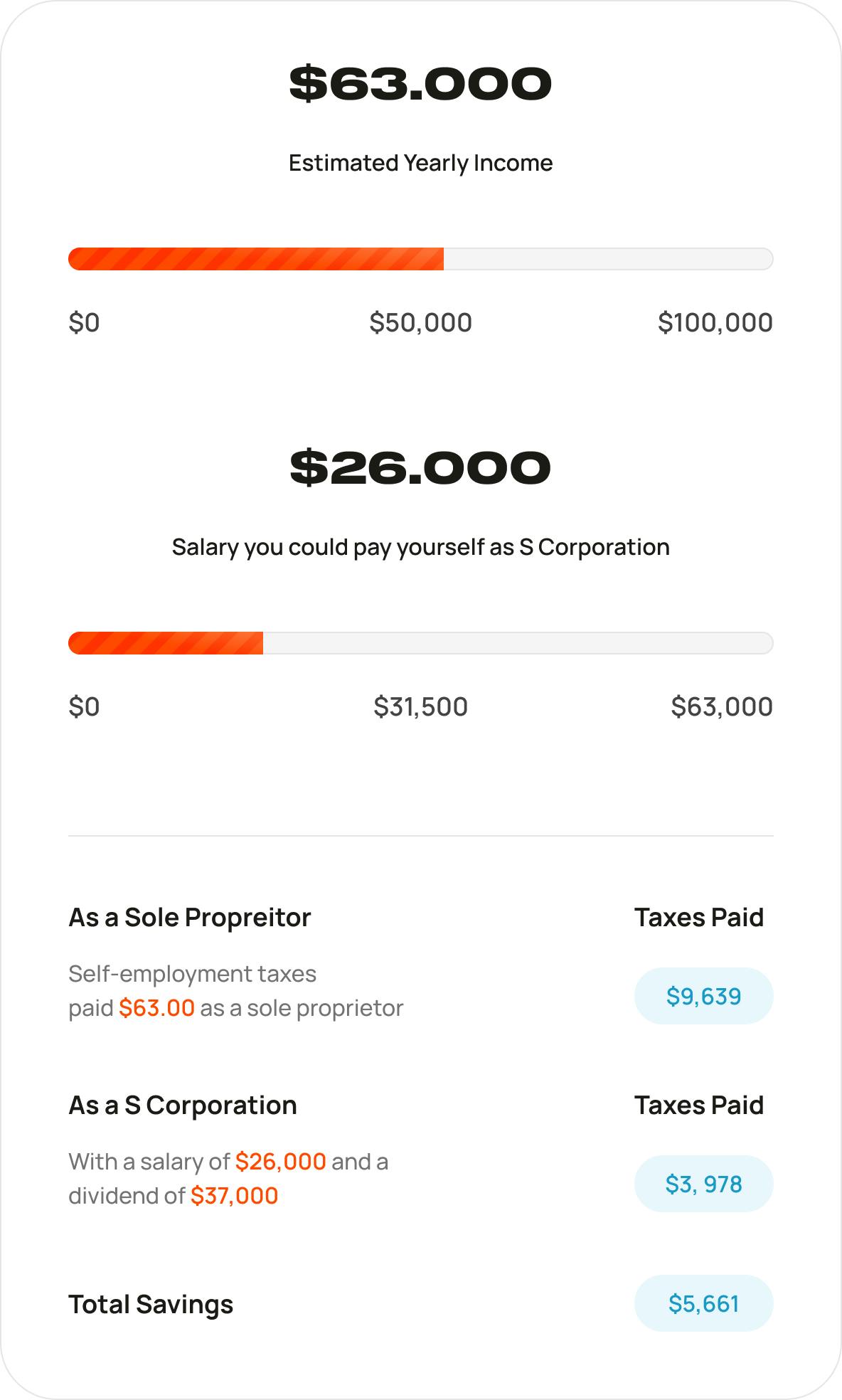

Check the Savings Yourself With Our S Corporation Tax Calculator

The S Corporation tax calculator lets you choose how much to withdraw from your business each year, and how much of it you will take as salary (with the rest being taken as a distribution). It will then show you how much money you can save in taxes.

Use our S Corporation Tax Calculator to view your potential tax savings.

Assigning a Fair Salary

One important part of the S Corporation Tax Election is that you must pay yourself a fair salary, which the IRS defines as “reasonable compensation.” If you do not, the IRS could audit you and levy taxes and penalties. For example, you cannot pay yourself a salary of $10,000 and take $80,000 in distributions.

When it comes to setting a fair salary, look at what full-time roles similar to yours are paying someone with similar expertise and experience, and use that as a baseline. Speak with your accountant or attorney for more information.

Administrative Overhead Of the S Corporation Election

Because it can reduce your tax burden by such a substantial amount, the S Corporation Tax Election is a good idea for most LLC owners. But it’s important to understand the additional overhead this might create for you, your business and your accountant.

Setting up monthly payroll

You will need to set up a monthly payroll where you pay yourself and submit your payroll taxes.

Additional accounting fees

Your accountant will need to file your taxes in a slightly different way, which may increase your accounting fees.

How to File Your S Corp Tax Election

There are a couple of ways you can file form 2553. File Form 2553, S Corporation Tax Election If you want to complete the filing process yourself, here are the steps you need to follow:

Go to the Internal Revenue Service website.

Find the section on S Corporation Tax Elections

Download form 2553

Gather the required information for form 2553 and fill it in

Send the form back to the IRS, typically by mail or fax

Wait for notification of acceptance of your tax election

Help File my LLC s Corporation tax election

No Contracts. No Surprise. Save your time, we’ll handle the paperwork.

We provide a complete S Corporation Tax Election service to register and file your LLC tax status with the IRS on your behalf. Just place an order and we’ll collect the right information to guide you through the process, and the IRS will notify you of your updated tax status.

Common Questions About Filing Your S Corporation Tax Election

Does Filing Form 2553 Remove Any LLC Protections?

No. You still get the same limited liability protections as with a regular limited liability company.

How Much Could I Save by Being Treated as an S Corporation for Tax Purposes?

You could save yourself thousands of dollars a year. We’ve got a handy calculator that shows you exactly how much you could reduce your self-employment tax burden.

Do I Have to File My S Corporation Tax Election at a Certain Time?

Yes. There are certain limitations on when you can file form 2553.

Can I File an S Corporation Tax Election if There Are More Owners in the Business?

Yes. S Corporation Tax Elections are available for most LLCs. For more information, speak to your accountant or attorney.