On this page

Naming Your Business

Whether you’re searching for the right business name or registering your LLC with the Oregon Secretary of State (SOS), we can help. We’ve got all the information you need on how to conduct an Oregon business search, plus LLC naming rules, assumed names, and registering your business.

General Rules for LLC Names

These rules typically apply to all LLCs, regardless of what state they’re formed in.

Your LLC Name Must Be Unique

The business name you choose cannot be used by any other LLC or corporation in the State of Oregon. This is why it's imperative to perform an Oregon SOS business search before you begin the filing process.

Your LLC Name Must Not Be Confusable with Another Business Name

It’s not enough for your LLC name to be unique. It also cannot be similar to the name of a corporation or LLC in Oregon. For example, you cannot use the following factors to say your name is different from the name of another business:

- Suffixes, such as Corporation, Company, Incorporated, Incorporation, Limited, Corp., Co., Inc., Ltd., LLC, etc.

- Definite articles, such as “A,” “An,” or “The.”

- The conjunction "And," or “&."

- The singular, plural, or possessive forms of words.

- Abbreviations, punctuation, symbols, fonts, typefaces, etc.

Your LLC Name Must Contain Certain Words

All LLCs must have the words “Limited Liability Company,” “L.L.C.,” or “LLC” in their names, normally at the end of the name.

Your LLC Name May Be Subject to Other General Restrictions

Most states will not allow you to form LLCs with names that:

- Are very similar to the name of a federal or state agency or organization (e.g., FBI, FDA, Oregon Comptroller, Oregon Police, Treasury, etc.)

- Suggest affiliation with a federal or state agency or organization.

- Use the term “Olympic” or any terms that are trademarks of the International Olympic Committee.

- Imply a purpose that would be illegal for your business to carry out.

Specific Rules for Oregon Business Names

In addition to the general rules listed above, Oregon has some specific business naming statutes. You’ll need to follow these rules to name your business appropriately. Here is an excerpt from Oregon Administrative Rule 160-010-0011, sections 5–6:

(5) Names submitted for registration must be composed of the English letters “a” through “z,” and the Arabic and Roman numerals 0 through 9, in integers or spelled out.

(6) The following special characters and punctuation marks will also be allowed in the name, however, they will not, by themselves, make a name distinguishable:

(a) Special Characters — asterisk (*); “at” sign (@); backslash (\); left brace ( { ); right brace ( } ); caret (^); dollar sign ($); “equal to” sign (=); “greater than” sign (>); “less than” sign (<); number sign (#); percentage sign (%); plus sign (+); tilde (~); and underscore (_).

(b) Punctuation Marks — apostrophe ( ‘ ); left bracket ([ ); right bracket( ]); colon (:); comma (,); dash or hyphen (-); exclamation point (!); left parenthesis (( ); right parenthesis ( ) ); period (.); question mark (? ); single quote mark (“ ); double quote mark ( “ ” ); semicolon (;); and slash ( / ).

How to Come Up With a Business Name

Finding the perfect business name can be tricky. We have a complete guide to choosing the right business name, but basically, you'll want to choose a name that will:

- Best represent your product or services

- Appeal to your customers

- Be memorable enough to stand out

- Not be used by any other business in Oregon

Need help coming up with a business name? Try our free Business Name Generator.

Oregon Business Search

Once you have an idea of the business name you’d like to use, you’ll need to perform an Oregon business name search to make sure another business doesn’t already have that name.

Bizee offers a fast, simple, and convenient tool to look up your proposed business name. The Oregon SOS also has a tool that lets you search the State of Oregon business registry to see whether someone already has your desired business name.

Find Out Whether Your Preferred Business Name is Available in Oregon With Bizee’s Free Tool

Check Your LLC Name

Trademarks and Service Marks

You must be careful that your Oregon LLC name doesn’t infringe on the trademark or service mark of another business. The easiest way to make sure your proposed business name doesn’t do that is to complete a trademark search through Bizee. If no one else is using it, you can even register it as a trademark yourself.

Make Sure Your Business is Starting Off on the Right Foot When It Comes to Intellectual Property.

Let Bizee run a trademark search for you.

Bizee’s Trademark and Registration Service

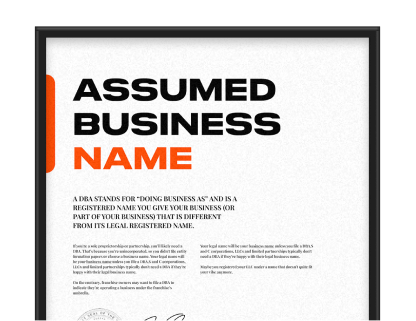

Oregon DBA or Assumed Name

You may do business under a different name from your legal LLC name. In some states, this is called a DBA (doing business as), fictitious name, or trade name. In Oregon, it's called an assumed name. You may decide to use an Oregon assumed name for a variety of reasons.

For example, your business might be called PNW Marketing Solutions, LLC, and under that company, you have an event planning business called PNW Excellent Events. You could file for an assumed name just for that brand. You'll do that with the Assumed Business Name — New Registration form, or you can have Bizee do it on your behalf through our DBA service.

Note: A trade name is not the same as a trademark. Learn more about trademark vs. DBA.

Register and Manage a DBA or Assumed Name Through Our Easy-To-Use Service

Get a DBA or Assumed Name

Register Your Business Name With the Oregon SOS

Once you’ve completed an Oregon business entity search, checked availability, followed the naming rules, and decided whether you need an assumed name, you can register your LLC name. There are a couple of ways to do this.

- If you don’t want to form your LLC right now, you can reserve the business name. You’ll need to complete an Application for Name Reservation form and file it with the Oregon SOS. Once you do so, your name will be reserved for 120 days. You don’t need to reserve a name if you’re forming your business right away.

- If you’re ready to start your LLC now, you can file your Articles of Organization with the Oregon SOS or have Bizee do it for you.

Bizee Can Handle All Your Formation Paperwork With the State of Oregon for You — and We’ll Do It for Free!

Form an LLC in Oregon for $0 + State Fee ($100)

Start Your LLC Now

FAQs About Oregon Business Names

How Do I Search for My Oregon Business Name?

Use our free Business Name Search tool and enter your desired business name. You can also perform an Oregon business search of the state's registry, which will tell you whether there are any corporations or LLCs in the state with that name.

Are There Any Rules for Naming My Business in Oregon?

Yes. Most LLCs will be bound by general rules (applicable to all LLCs) and specific rules (applicable in the State of Oregon). You'll find more information above.

Can I Do Business Under a Different Name Than My LLC Name in Oregon?

Yes. You can conduct business under an assumed name. Details are above.

Can I Reserve a Name for My LLC in Oregon?

Yes. The Oregon SOS allows you to reserve a name if you don’t want to start your business immediately. Details are above. If you’re ready to start your business now, you don’t need to reserve a name.

incorporate now

Launch your business with bizee

No Contracts. No Surprises. Only $0 + State Fee to Launch Your Business.

.jpg&w=3840&q=75)