Join 1,000,000+ Entrepreneurs like you

Entrepreneurship is booming – and we're happy to be one of America's fastest growing companies.

How to Get a Tax ID Number

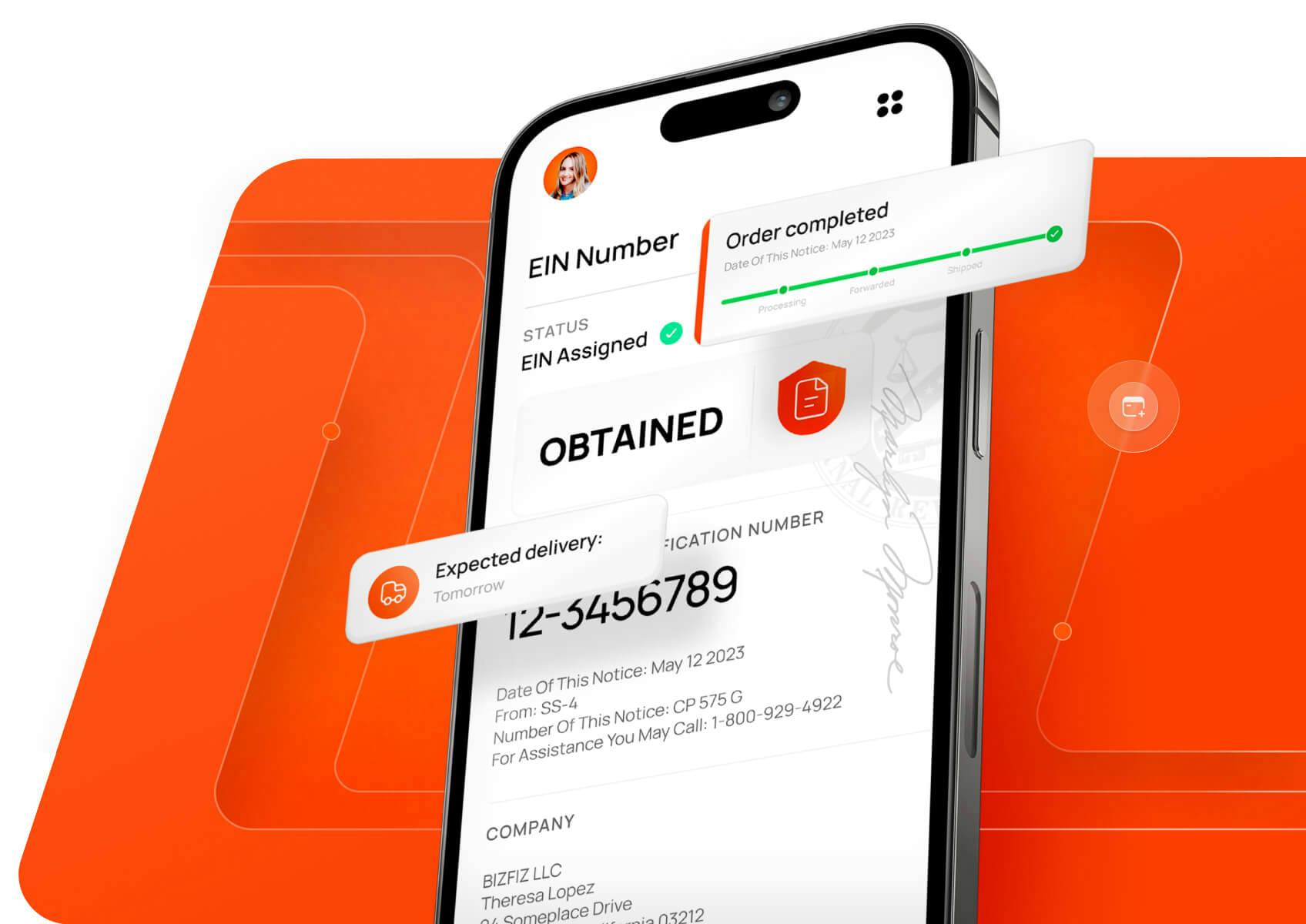

The SS4 is the IRS form required to obtain an EIN (Employer Identification Number, frequently called a Tax ID number). The EIN/Tax ID number can be thought of as a Social Security Number for your business. It is usually required to open a bank account in the name of the business and to properly pay and account for any wage/payroll employees of your company. Bizee will obtain your federal EIN electronically and have it back to you via email within one business day.

What is an Employer Identification Number (EIN)?

Also known as a “Tax ID number,” the EIN is a business federal tax ID that works like a Social Security Number for your business. Your EIN helps you file tax returns for your business, is typically required to open a business bank account under the name of your business, helps you properly pay and account for wages and payroll for your company’s employees, and otherwise helps establish credit for your business and maintain your business’s official standing as a legal business entity.

Do You Need a Federal EIN for Your Business Entity?

In general, unless your business is a sole proprietorship with no employees and no separate legal entity for your business, you need to get an EIN. Sometimes if you own an LLC and it is a single-member LLC with simple accounting, you can get by just using your personal Social Security Number for tax purposes and for receiving payments from clients. But even the simplest businesses can generally benefit from using an EIN – the EIN serves as a tax ID for your LLC or other corporate entity.

The following business entities should get an EIN:

Where & When You'll Use an EIN

Your EIN is necessary for several situations in running your business. You will need to use your EIN for certain tax forms, such as filing your tax returns for your business, and filling out W9 forms for clients (if you run a service business), and other forms related to managing payroll for your employees. Your EIN is also necessary to set up a business bank account and apply for business loans. The same types of reasons for needing a Social Security Number in your personal life are also the reasons to use an EIN in managing your business.

How Do You Get an EIN? Apply for an EIN Online

Business owners can get an EIN by filing IRS Form SS-4. Bizee offers a convenient service to help you apply for an EIN online to obtain your EIN number quickly and efficiently. If you're looking for a way to get an EIN, whether in Texas, Florida, Michigan or anywhere in the United States, Bizee can provide one for you in one day. Apply for an EIN online with Bizee, and we'll obtain your federal tax ID electronically and have your new EIN back to you via email within one business day.

Apply for an EIN online to obtain your EIN number quicklyHelp Obtain a EIN / Tax ID Number

Save your time. We'll handle the paperwork.

If you would like to use our services to facilitate the filing of your Tax ID / EIN please place the order and a representative from Bizee will contact you to obtain specific information required to complete and file the Tax ID / EIN in your state of formation.

Common questions about obtaining an EIN / Tax ID Number

Will I need an EIN in order to obtain a business account with a bank?

Yes, under most circumstances business entities other than DBAs must present an EIN along with the filed Articles of Organization or Incorporation in order for an account to be opened.

What circumstances require me to change my EIN?

If you already have an EIN, and the organization or ownership of your business changes, you may need to apply for a new number. Some of the circumstances under which a new number is required are as follows:

- An existing business is purchased or inherited by an individual who will operate it as a sole proprietorship.

- A sole proprietorship changes to an LLC, corporation, or partnership.

- A partnership changes to an LLC, corporation, or sole proprietorship.

- A corporation changes to an LLC, partnership, or sole proprietorship.

- An LLC changes to a corporation, partnership, or sole proprietorship.

- An individual owner dies, and the estate takes over the business.

When will I receive my Federal Employer Identification Number?

If it is a stand-alone order for an existing entity we can obtain and email the EIN within one business day.

What is the SS4/EIN/Tax ID Number?

The SS4 is the IRS form required to obtain an EIN (Employer Identification Number, frequently called a Tax ID number). The EIN/Tax ID number can be thought of as a Social Security Number for your business. It is usually required to open a bank account in the name of the business and to properly pay and account for any payroll employees of your company.

Providing Everything

You Need When You Need It

As your business grows, we'll be there every step of the way to make sure that you have the resources at hand to service your companies ongoing needs.

Dissolution

Used to formally terminate the existence of a entity.

Learn More

Business Formation

Start an LLC, S Corp, C Corp, or nonprofit here.

Learn More

Foreign Qualification

Filed when you need to expand your entity to new states.

Learn More

Get Reinstated

Get your business back up and running after dissolution.

Learn More

Virtual Address

Protect your privacy, secure a street address for your biz, and check your mail from anywhere.

Learn More

Amendment

File if a company requires changes to membership, addresses, or company name.

Learn More