Dreana A.

Bizee is the best! Professional & always available to answer all my questions. I'm so grateful.

Filing an Annual Report Is Required by Your Secretary of State — For All Business Entities

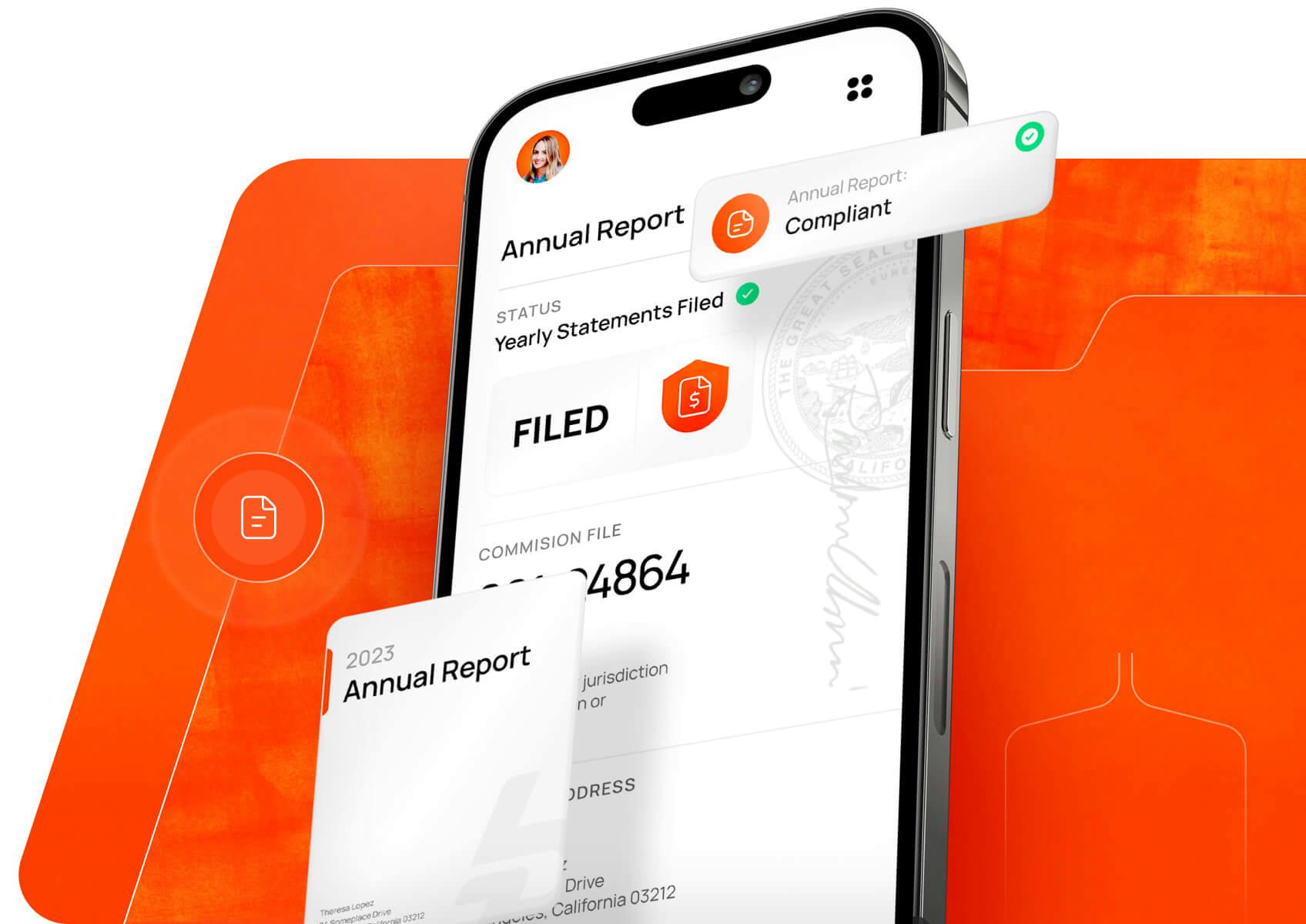

Lighten your workload and ensure your business stays compliant by letting Bizee handle your annual report filing.

Exceptional Value for Your Money, Always

No subscriptions, no recurring fees and no hidden costs. Clear, transparent pricing — every time.

Enjoy a Superior and Modern User Experience

File your annual report effortlessly. A carefully crafted experience makes entrepreneurship easy.

Personalized, Industry-Leading Support

24/7 fast and friendly customer service. Talk to a dedicated specialist, not a salesperson, whenever you need to.

Our service fee to file an annual report is $99.

The fee is the same whether you need to file an LLC annual report or an annual report for your corporation or nonprofit.

The state fee will vary. To review the fee in your state, select your entity type and the entity state at the bottom of the page.

No! We pride ourselves on transparency. There are absolutely no hidden costs associated with filing your annual report.

Yes. Some states proceed to immediate dissolution if your annual report is not filed by the deadline. This means that your company will no longer be registered with the state and the legal and tax benefits of being incorporated will no longer be available to you. States that do this are Florida, Wyoming, Georgia and Virginia.Other states have 20-90 day grace periods.Discover everything you need to know about your state-specific compliance filing requirements.

Business filing deadlines are dependent on the governing state agency and filing times vary by state. It’s important that your business’s annual report is filed well in advance of the due date in order to avoid any potential late filing fees.

Uncover everything you need to know about specific state LLC information and check out our ultimate guide to filing your annual report. You can find all other resources relating to annual reports in our resource center.

If your entity has been administratively revoked, otherwise dissolved or the report is not due within a close proximity to you placing your order, our policy is to contact and inform you then issue a full refund.If your company has been dissolved for any reason, we can assist with reinstatement and then proceed to file the Annual Report.

Once the filing is complete, your governing state agency will typically return a filed copy of your Annual Report which is then mailed to you.

The purpose of filing an annual report is to provide your state with important and up-to-date information about your business and any changes or updated information since the last filing period.

If you don't file your LLC annual report, or don't file it on time, there are several things that can happen:

The state will write to you and could impose a late filing penalty that you’ll be obligated to pay in addition to your regular annual report filing cost.

The state will inform you when you must file by to avoid further action being taken against you or your business.

If you still do not file, your business will lose its “good standing,” which could make it harder to run certain business operations.

If you continue to not file, your state agency will dissolve your business and then strike it off the register.

Having reached this point, you’ll lose your liability protection and you won’t be able to continue as an LLC or corporation.

Bizee is the best! Professional & always available to answer all my questions. I'm so grateful.

Bizee has been great to work with. Their prices are reasonable and they exceed expectations

Easy, smooth, one of the best business decisions I’ve ever made, was to utilize Bizee