What Are Articles of Amendment?

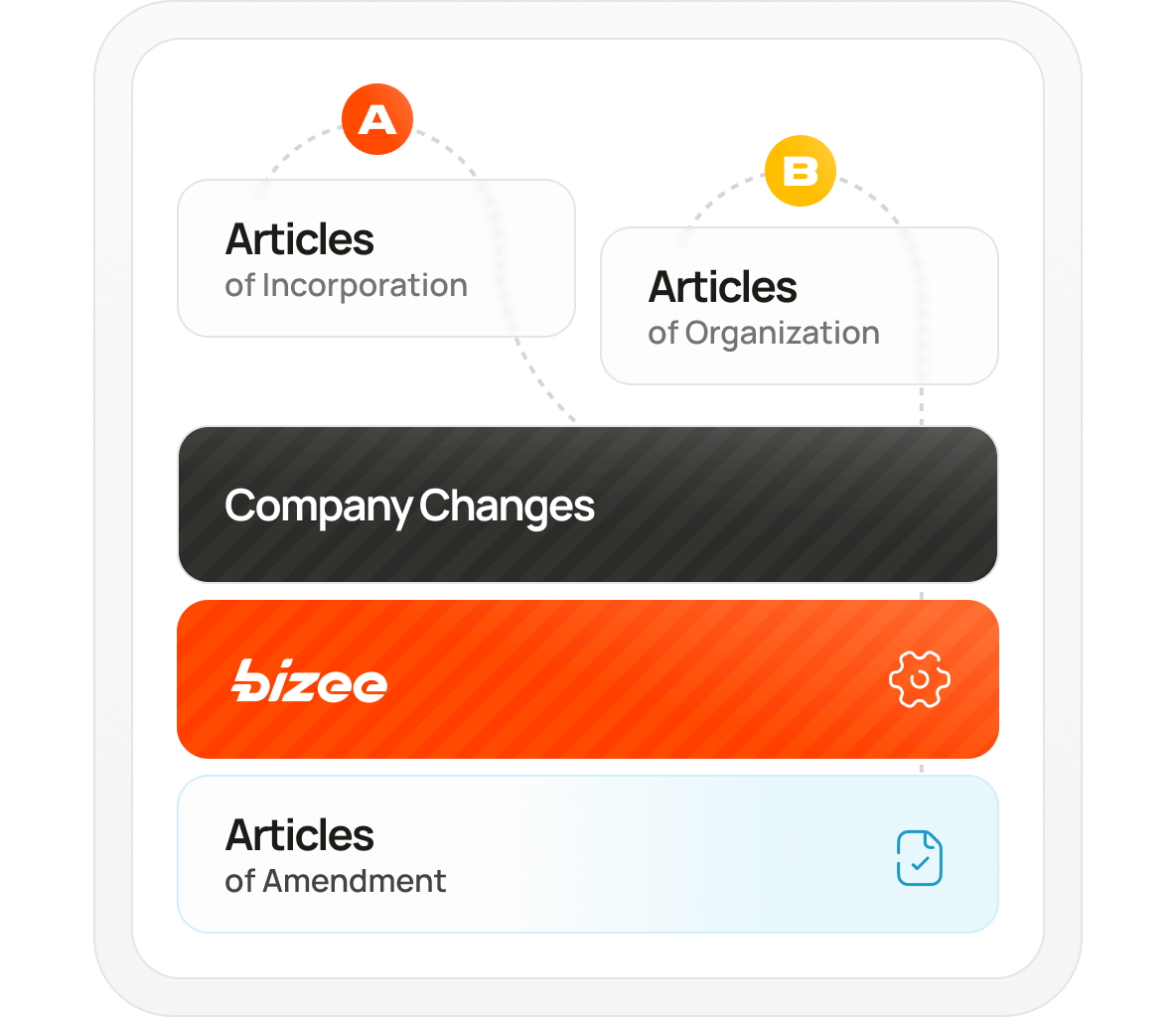

Articles of Amendment are filed when a company makes a significant change to their Articles of Incorporation or Articles of Organization that were created when the business first formed.

As an organization, you’re always evolving, shifting and improving. This means you’ll inevitably need to change some of the important parameters of your business. That’s where Articles of Amendment come in.

When Do I Need to File Articles of Amendment?

You need to file Articles of Amendment with your Secretary of State when your LLC, C Corp, S Corp or nonprofit changes or modifies its:

- Business address

- Business name

- Stated business activities

- Member information

- Number of authorized shares

Why Is It Important to File?

Not keeping your business’s information up-to-date may result in fines and penalties.

You need to let the state know things have changed so that you remain in good standing. Otherwise, you risk being seen as negligent, damaging your reputation.

For practical purposes, the state needs to know who to send official correspondence and legal notices to. For this reason, keeping information updated, such as your Registered Agent, is key.

New era of privacy

how to file

articles of amendment

determine the correct form needed

This is typically provided by your state. Make sure you can’t file a cheaper or simpler form. For example, some states have a separate form solely for changing your Registered Agent that often requires a lower fee than Articles of Amendment. Research your state’s requirements before beginning.

fill out the amendment form

A standard form includes your business name, state, date, article number(s) being amended, a written statement that the article is being amended, the amendment itself and a statement that all other articles remain in effect. You’ll also need signatures from members. Failing to provide all the necessary info could mean your amendment is denied.

submit the form to the state and pay the filling fee

Depending on the state, this may be done online or delivered in person. It typically costs $100-$200 — but if you’re a nonprofit corporation, the fee is often lower.

file restated articles of organization or incorporation

Once the Articles of Amendment are submitted, you may want to file restated Articles of Organization that reflect these new changes. While it’s not a requirement, it helps consolidate your documents so everything’s streamlined.

We Make Filing Easy

We get it. Running a business takes time, money and lots of mental energy.

Bizee offers fast and affordable professional filing services so your Articles of Amendment will be out of sight and out of mind. Life is short — why spend it doing paperwork?

Use our form to enter your business type and state, and place an order. The rest is up to us.

Common Questions About Filing Articles of Amendment

How Long Does It Take to Change a Company Name?

The filing time for Articles of Amendment typically takes four to six weeks, depending on the governing state agency. For example, in California, the process takes over eight weeks. In Texas, it may take just three to five business days. Many states offer expedited service for an additional fee.

For the purpose of federal taxes, the IRS typically takes about six to eight weeks to register a change of business name.

How Do I File Out-of-State Articles of Amendment?

If you’re filing an amendment for a business that’s not in your home state, you’ll need to file a Foreign Amendment. These will require additional documentation by your state, including a Certificate of Good Standing.

How Much Does It Cost to File Articles of Amendment?

Our service fee to file Articles of Amendment is $99, so your cost will be $99 + the fee in your state. State feels typically are around $100-$200, but if you're a nonprofit, the fee is often lower.

To review the fee in your state, select the state and entity type above.

Some states also offer expedited filing, which is an additional fee.

Do I Need to Consult a Lawyer When Filing?

An attorney isn’t necessary to file an amendment. That said, if you’re ever faced with a confusing business situation, it’s never a bad idea to consult a trusted legal professional to ensure you’re making the most educated decision you can.

What Will I Receive When the Articles Are Filed?

You’ll receive a copy of the articles once they’re filed. If you file with us, the governing state agency will return a copy to us. Then we’ll mail it to you for your records.

ready to

make a change?

Save the hassle. Let us file your LLC’s Articles of Amendment on your behalf.