Providing Everything

You Need When You Need It

As your business grows we'll be there every step of the way to make sure that you have the resources at hand to service your companies ongoing needs.

Amendment

File if a company requires changes to membership, addresses, or company name.

Learn More

Dissolution

Used to formally terminate the existence of a entity.

Learn More

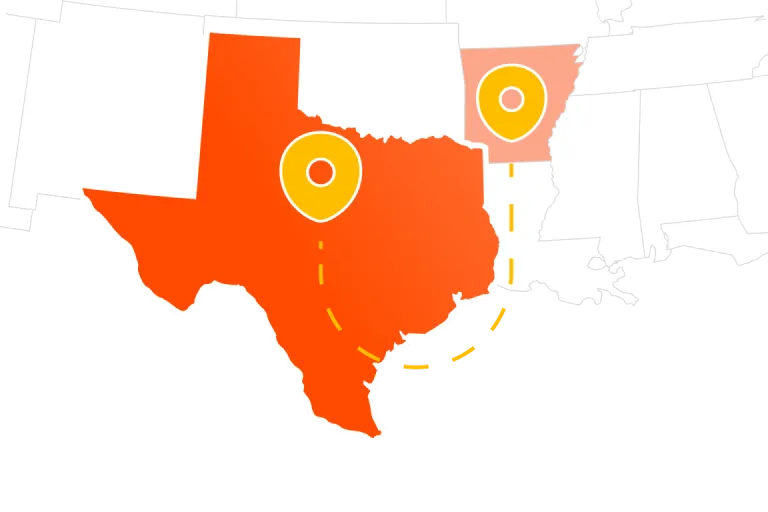

Foreign Qualification

Filed when you need to expand your entity to new states.

Learn More

Fictitious Business Name

Filed if a company requires assumed business/fictitious name.

Learn More

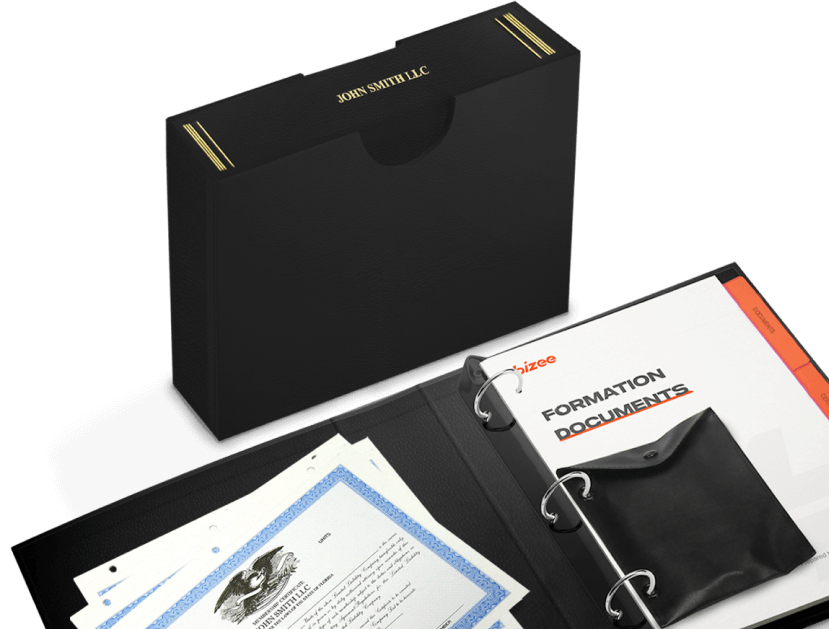

LLC KITSCorporate LLC Kits & Stock Certificates.

Slip Case and Binder

Stock Transfer Ledger

20 Custom Printed Stock Certificates

Metal Die-Cast Embossing Seal

Operating Agreement for LLCs

Minutes and By-Laws for Corporations

We Are Here to Help

We understand that questions come up every turn of your business.

When building a business, seemingly small mistakes can end up costing a lot. Understanding federal tax rates, post-tax deductions, and how to accurately calculate employer payroll taxes can save time and money. Learn the ins-and-outs of employer taxes and much more with our practical start-up guides.