Why

Incorporate

in Illinois?

Just like many states in the country, Illinois offers several tax-based incentives to help businesses create jobs and investments in Illinois.

For example, the Illinois Enterprise Zone Program was designed to stimulate economic growth and neighborhood revitalization in economically depressed areas of the state through state and local tax incentives, regulatory relief and improved governmental services. Businesses located or expanding in an Illinois enterprise zone may be eligible for state and local tax incentives.

For many entrepreneurs looking to start a larger business, creating an Illinois corporation may be the best choice. As a corporation, your business is able to buy and trade stock, and when it comes to excess profits, corporations offer more flexibility than an LLC. A corporation is allowed to pass income and losses to its shareholders, who report taxes on an individual tax return at ordinary levels.

Is an LLC Better

Than a

Corporation?

It all depends on your goals. Limited liability companies are usually better for smaller businesses. An LLC is easier to set up, and you receive many of the same benefits as a corporation, but with less regulation.

Learn more about forming an Illinois LLC so you can decide which business entity is right for you.

Benefits of

Forming an

Illinois C Corp

The strongest form of liability protection possible by insulating your personal assets and finances from business debts, obligations, damages, bankruptcy or other liabilities

The ability to issue more than one type of stock

The ability to raise more funds by issuing more stock

Several options to create, buy, sell or transfer stock, including publicly

The ability to sell stock to investors inside and outside the U.S.

Benefits of

Forming an

Illinois S Corp

It offers several advantages similar to those provided by a C Corp including, but not limited to:

Options for creating, transferring and selling stock, though not as many as a C Corp

Simpler rules than those applicable to C Corporations

The possibility of saving money by allowing you to pay less self-employment tax

The capacity for up to 100 shareholders

Easy transfer of ownership simply by selling your stock

In this guide, you’ll find information on naming your corporation, getting a Registered Agent, the fees you’ll need to pay, business taxes and much more. We also cover what you'll need to register your corporation and how you'll interact with the Illinois Secretary of State.

Starting a

Business in

Illinois

Checklist

To help you along the way, use our Starting a Business checklist to keep track of everything you need to do to get your business up and running.

How to Form an Illinois Corporation Yourself in 6 Steps

On this page

How To Guide

Step 1: Choose a Unique Business Name and Complete a State Business Search

Every Illinois business must have a unique name that isn't already being used by another business in the state. If you’re having a tough time coming up with a name, try using our Business Name Generator to gather ideas. You'll need to follow a few naming rules, which you can read about in detail on the Illinois Corporation Names page.

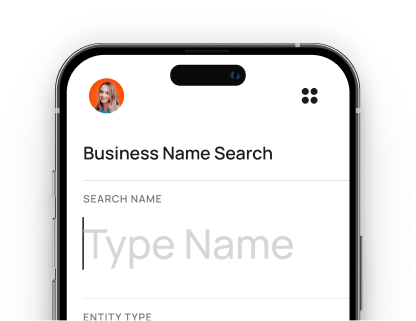

Once you’ve selected a name, you’ll need to make sure it’s available in Illinois. To learn whether another company in the state is using your desired business name, use our tool to do an Illinois entity search.

You can also search for your desired name on the IL Secretary of State website.

We Can Check Illinois Corporation Name Availability for You

Use Bizee's Business Name Search Tool

Step 2: Provide an Official Address for Your Corporation

Every Illinois corporation must have a designated primary address. That could be your home address (if you’re running the company from your house), a building where your office is located or any physical address of your preference. The address can be outside the state of Illinois and can be a P.O. Box.

You may also be able to use a virtual mailbox for your business address. Bizee can provide you with an Illinois virtual mailbox where we'll receive your mail, scan it, and upload it for your online review. This can be especially convenient if you run a home-based business and don't want your home address published as part of your business public record.

Step 3: Assign an Registered Agent

Someone who receives official correspondence and is responsible for filing reports with the Illinois Secretary of State is known as a Registered Agent.

Every Illinois corporation is required to have a Registered Agent.

You may fill this position yourself, assign another manager in your business or use a Registered Agent service. If your Registered Agent in Illinois is a natural person, they must have a physical street address in Illinois and must be present during business hours to receive important documents on behalf of your company.

You'll appoint your Registered Agent when you file your Illinois Articles of Incorporation to create your business with the Secretary of State.

All of Bizee’s business formation packages include Registered Agent service. It’s free for the first year and just $119 per year after that. You can also access a digital dashboard to view any document we've received on your behalf.

Step 4: File Your Articles of Incorporation with the Illinois Secretary of State

Once you've gathered all the information for your corporation, you’ll need to file a form with the Secretary of State to create your Articles of Incorporation. This will officially create your business.

Here’s what you're typically required to provide:

- Your corporation name

- Registered Agent's name and address

- The purpose of your corporation

- The corporation’s capital structure (number of shares to be issued, who owns them, pricing, etc.)

- Names and addresses of directors

- The incorporators' names, addresses and signatures

Your Articles of Incorporation can be filed online via the Secretary of State website. You can also mail or file the form in person to the Office of the Secretary of State, or Bizee can file it on your behalf. The Illinois corporation filing fee is $175 (this includes the initial minimum franchise tax fee of $25).

Springfield Office

Secretary of State Department of Business Services 501 S. Second St., Rm. 350 Springfield, IL 62756

Chicago Office

Secretary of State Department of Business Services 69 W. Washington St., Ste. 1240 Chicago, IL 60602

You only need to file your Certificate of Formation once, but every year after, you'll also need to report and pay IL franchise tax (if applicable to your business) and file a public information report. Bizee can remind you about this every year, or we can do it for you if you have us handle the paperwork.

Let Bizee Handle All the Illinois Corporation Formation Paperwork for You for $0 + the State Fee

Incorporate Now for Free

What are the Fees and Requirements to Incorporate in Illinois?

State Fee

$179

State Filling Time

3 Weeks

Expedited Filing Time

2 Business Days

Annual Report

Frequency

Annually

Due Date

Within 60 days immediately preceding first day of anniversary month.

Filing Fee

$77

Step 5: Get an Employer Identification Number (EIN) from the Internal Revenue Service

You'll need an EIN to identify your business to the IRS. You use this number when filing and paying taxes, when submitting payroll information and payments for your employees and opening a business bank account. You can obtain one directly from the IRS, or Bizee can get one for you as part of the Illinois corporation formation process.

Step 6: Write Bylaws

Bylaws are a set of rules that govern how a corporation will be run. They may detail how many directors the corporation will have, whether the board of directors will have annual meetings and what the voting requirements are, among other things.

Some states require companies to create bylaws. Although you're not legally required to file your bylaws with the state of Illinois, you are required to have them at your principal place of business. Regardless of whether or not your state requires them, it’s always a good idea to write bylaws to protect your business from any future changes and events.

Illinois Corporation Types

C Corporation

When you file to start a corporation, by default, it's a C Corp. This is the choice for large businesses that will trade shares in the stock market.

An Illinois C Corp will offer you several liability protections, but it will also be required to adhere to numerous strict rules and regulations. It will also likely have a substantial amount of administrative overhead and won't enjoy as many tax advantages as other corporation types.

Learn more about C Corporations.

S Corporation

Technically, an S Corporation isn't a business entity the way LLCs and C Corporations are. It's a tax filing status. An LLC or a C Corporation can be an S Corporation. It's just a matter of filing a form with the IRS.

The main reason to file as an S Corp is to save money on self-employment taxes. To get an idea of how much money you might save, use our S Corp Tax Calculator.

If you want your Illinois C Corp to be treated as an Illinois S Corp, file the IRS Election by a Small Business Corporation form, also known as Form 2553 or an S Corp Election form.

Consult with your tax advisor or accountant to determine whether this is your best option.

Learn more about S Corporations.

Compare S Corp vs. C Corp to learn the benefits and drawbacks of both, and decide which one will best suit your needs.

Professional Corporation

Some states, including Illinois, allow certain occupations to form Professional Corporations. The state's Professional Service Corporation Act defines this as:

"... a corporation organized under this Act that is organized solely for the purpose of rendering one category of professional service or related professional services and which has as its shareholders, directors, officers, agents and employees (other than ancillary personnel) only individuals who are duly licensed by this State or by the United States Patent Office or the Internal Revenue Service of the United States Treasury Department to render that particular category of professional service or related professional services..."

The Professional Service Corporation Act 805 ILCS 10/3.6 permits several professions to form an Illinois Professional Corporation including, but not limited to:

- Architects

- Professional engineers

- Dentists

- Psychiatrists

Check with the IL Secretary of State to confirm whether your business should and can be a Professional Corporation.

Close Corporation

Put simply, a Close Corporation is one that has a limited number of shareholders, and isn't publicly traded.

Usually, Close Corporations are exempt from corporate requirements, such as having a board of directors and holding annual meetings. Per Illinois Business Corporations Act 805 ILCS 5/2A.40, an Illinois Close Corporation can be managed according to a shareholders' agreement rather than by a board of directors or bylaws.

This entity is often chosen by family-owned businesses to prevent non-family members from establishing or claiming any ownership of the company.

Nonprofit Corporation

Charitable organizations can incorporate as nonprofit corporations. This means all the profits they generate are donated to the organization supported by the charity, minus administrative costs.

A nonprofit corporation is also exempt from federal and state taxes, allowing more of the profit to benefit the charity.

Note: Everything in this guide applies to for-profit corporations, and mostly to C Corps and S Corps. Items listed as requirements for forming a corporation may or may not also apply to nonprofits.

Limited Liability Company

Depending on the kind of business you want to form, or your personal circumstances and goals, a limited liability company (LLC) may be a better option. For example, you may not need the options to buy and sell stock. Or you may simply want to build a small business with a few employees or even just yourself.

An Illinois LLC is usually a better option for a smaller business. It's easier to set up, but it still offers you certain advantages you'd get from a corporation. You can even have your LLC treated as an S Corporation for tax purposes to save you money.

Regardless of which direction you decide to go, we can help you with your Illinois business registration.

Learn more about limited liability companies.

Sole Proprietorship or Partnership

These are the simplest types of businesses to set up. That's because there's no real setup to do. If you don't choose to form a separate business entity, by default, you'll have either a sole proprietorship (just you) or a partnership (you and one or more other people).

Neither of these options provide you with any special benefits or liability protections and can leave your personal assets vulnerable. For these reasons, we don't recommend them.

Compare business entity types to decide which one is best for you.

Helpful Resources from the State of Illinois

General Assembly

You’ll find plenty more insight and guidance on the other pages of this guide, including:

Illinois Corporation Names

How to search the state business registry and find the right name. Includes information on naming rules, assumed names, reserving a corporation name and more.

Illinois Registered Agents

How to appoint, change and search for Registered Agents. Also includes the duties they fulfill and the rules they’re required to follow.

Illinois Incorporation Fees and Requirements

Details the various fees you’ll need to pay and the state and federal requirements you’ll need to meet. Includes details about Employer Identification Numbers (EINs), state and federal business licenses, annual reports and more.

Illinois Corporation Taxes

Covers the various taxes you’ll have to pay to the state and federal governments. Includes details about state taxes such as income, sales and franchise, and federal taxes such as income and self-employment.

incorporate now

Launch your business with bizee

No Contracts. No Surprises. Only $0 + State Fee to Launch Your Business.

.jpg&w=3840&q=75)