Why Start an ID

Corporation?

The state of Idaho offers a range of business financing and incentives, giving businesses in Idaho a competitive edge. Your corporation may be able to take advantage of these incentives, provided it meets qualifying criteria.

For example, if you meet the requirements, your business may be able to qualify for the Idaho Business Advantage. The Idaho Business Advantage gives your business access to several tax credits and rebates if your business has invested at least $500,000 in new facilities and created at least 10 jobs paying at least $40,000 annually.

For a lot of entrepreneurs looking to start a larger business, ID incorporation may be the best choice. As a corporation, your business is able to buy and trade stock, and when it comes to excess profits, corporations offer more flexibility than a limited liability company (LLC). A corporation is allowed to pass income and losses to its shareholders, who report taxes on an individual tax return at ordinary levels.

Is an LLC Better Than a Corporation?

It all depends on your goals. For smaller businesses, limited liability companies are usually a better option. An LLC is easier to set up and receives many of the same benefits as corporations, but with less regulation.

Learn more about forming an Idaho LLC so you can decide which business entity is right for you.

Benefits of

Forming an

Idaho C

Corporation

The strongest form of liability protection possible by insulating your personal assets and finances from business debts, obligations, damages, bankruptcy or other liabilities

Several options to create, buy, sell or transfer stock, including publicly

The ability to issue more than one type of stock

The ability to raise more funds by issuing more stock

The ability to sell stock to investors inside and outside the U.S.

Benefits of

Forming an

Idaho S

Corporation

It offers several advantages similar to those provided by a C Corp including, but not limited to:

Options for creating, transferring and selling stock, though not as many as a C Corp

The capacity for up to 100 shareholders

Simpler rules than those that apply to C Corporations

Easy transfer of ownership simply by selling your stock

The possibility of saving money by allowing you to pay less self-employment tax

In this guide, you’ll find information on naming your corporation, getting a Registered Agent, the fees you’ll need to pay, business taxes and much more. We also cover what you'll need to register your corporation and how you'll interact with the Secretary of State in Idaho.

Start a

Business in

Idaho Checklist

Start a Business in Idaho Checklist

To help you along the way, use our Starting a Business checklist to keep track of everything you need to do to get your business up and running.

How to Form an ID Corporation Yourself in 6 Steps

On this page

How To Guide

Step 1: Choose a Unique Business Name and Complete a State Business Search

Every Idaho business must have a unique name that isn't already claimed by another business in the state. If you’re having difficulty coming up with a name, try using our Business Name Generator to gather ideas. You'll need to follow a few naming rules, which you can read about in detail on the Idaho Corporation Names page.

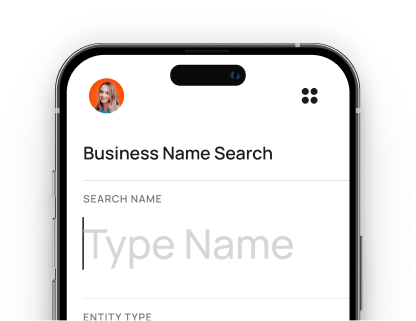

Once you’ve picked a name, you’ll need to make sure it’s available in Idaho. To see whether another company in the state is using your desired business name, use our tool to do an Idaho entity search. Or you can carry out a name search on the state's website.

We can check Idaho corporation name availability for you

Use Bizee's Business Name Search Tool

Step 2: Provide an Official Business Address for Your Corporation

All ID corporations must have a designated address. It could be the address of your home (if you’re running the company from your residence), a building where your office is located or any physical address of your choice. The address can be outside the state of Idaho and can be a P.O. Box.

You may also be able to use a virtual mailbox for your business address. Bizee can provide you with an Idaho virtual mailbox where we'll receive your mail, scan it and upload it for your online review. This can be especially helpful if you run a home-based business and don't want your residential address published as part of your business public record.

Step 3: Assign a Registered Agent

Someone who receives official correspondence and is responsible for filing documentation with the ID Secretary of State is known as a Registered Agent. Every Idaho corporation is required to have a Registered Agent.

You can fill this position yourself, assign another manager in your business or use a Registered Agent service. If your Registered Agent in Idaho is a person, they must have a physical street address in Idaho and must be available during business hours to receive important documents on behalf of your company. You'll appoint your Registered Agent when you file your Articles of Incorporation with the Secretary of State and formally create your corporation.

All of Bizee’s business formation packages include Registered Agent service. It’s free for the first year and just $119 per year after that. You can also access a digital dashboard to view any document we've received on your behalf.

Step 4: File Your Articles of Incorporation with the Idaho Secretary of State

Once you've gathered all the information for your corporation, you’ll need to file your Articles of Incorporation with the State Corporation Commission. This will officially create your business.

Here’s what is typically included:

- Your corporation's name

- The corporation’s capital structure (number of shares to be issued)

- Registered Agent's name and address

- Incorporator(s) name(s) and address(es)

- The mailing address of the corporation

- Name and signature of at least one incorporator

- Contact information

- Name of the organizer

Your Articles of Incorporation can be filed online via the state's digital portal, and if you do so you'll save the $20 manual processing fee associated with paper form filing. You can also mail or deliver the form to the Office of the Secretary of State, or Bizee can file it on your behalf. The ID Corporation filing fee is $100.

Mail or Deliver to

Office of the Secretary of State

450 N 4th Street

PO Box 83720

Boise ID 83720-0080

You only need to file your Articles of Incorporation in Idaho once, but once a year thereafter, you'll also need to file an annual report with the Secretary of State in ID. Bizee can remind you about this every year, or we can do it for you if you have us handle the paperwork.

Let Bizee Handle All the ID Incorporation Paperwork for You for $0 + the State Fee

Incorporate Now for Free

What are the fees and requirements to incorporate in Idaho?

State Fee

$100

State Filling Time

6 Weeks

Expedited Filing Time

5 Business Days

Annual Report

Frequency

Annually

Due Date

Within 60 days immediately preceding first day of anniversary month.

Filing Fee

$0

Step 5: Get an Employer Identification Number (EIN) from the Internal Revenue Service

You'll need an EIN to identify your business to the IRS. You use this number for filing and paying taxes, submitting payroll information and payments for your employees and opening a business bank account. You can obtain one directly from the IRS, or Bizee can get one for you as part of the ID corporation creation process.

Step 6: Write Bylaws

A set of rules that govern how a corporation will be run, bylaws detail how many directors the corporation will have, whether the board of directors will have annual meetings and what the voting requirements will be, among other things.

Some states legally require companies to create bylaws, and the state of Idaho is one of them. You don't however need to file your bylaws with the State. Simply keep them with your other business records.

It's always a good idea to write and follow bylaws to protect your business from any future changes and events.

Types of ID Corporations

C Corporation

When you file to start a corporation, by default, it's a C Corp. This is the choice for large businesses that will trade shares in the stock market. An Idaho C Corporation will offer you several liability protections, but it will also be required to adhere to numerous strict rules and regulations. It will also likely have a substantial amount of administrative overhead, and won't enjoy as many tax advantages as other corporation types.

Learn more about C Corporations.

S Corporation

Technically, an S Corporation isn't a business entity the way LLCs and C Corporations are. It's a tax filing status. An LLC or a C Corporation can be an S Corporation. It's just a matter of filing a form with the IRS.

The main reason to file as an S Corp is to save money on self-employment taxes. To get an idea of how much money you might save, use our S Corp Tax Calculator.

If you want your Idaho C Corporation to be treated as an Idaho S Corporation, file the IRS Election by a Small Business Corporation form, also known as Form 2553 or an S Corp Election form.

Consult with your tax advisor or accountant to determine whether this is your best option.

Learn more about S Corporations.

Compare S Corp vs. C Corp to learn the benefits and drawbacks of both, and decide which one will best suit your needs.

Professional Corporation

Some states, including Idaho, allow certain occupations to form Professional Corporations where they deliver professional services. Idaho Code, Title 30, Chapter 21, Part 9, § 30-21-901 defines allied professional services in Idaho as:

"...professional services that are so related in substance that they are frequently offered in conjunction with one another as parts of the same service package to the consumer."

Title 30, Chapter 21, Part 9, § 30-21-901 also specifies a few of the professions permitted to form a Professional Corporation in Idaho, which includes, but may not be limited to:

- Architects

- Chiropractors

- Dentists

- Engineers

- Landscape Architects

- Lawyers

- Nurses

- Occupational Therapists

- Optometrists

- Physical Therapists

- Podiatrists

- Professional Geologists

- Psychologists

- Certified or Licensed Public Accountants

- Social Workers

- Surveyors

- Veterinarians

Check with the Secretary of State to confirm whether your business should and can be a Professional Corporation.

Foreign Corporation

If your business operates in another state and you want to expand into Idaho — or vice versa — you’ll need to form a Foreign Corporation.

Learn more about Idaho Foreign Corporation registration.

Nonprofit Corporation

Charitable organizations can incorporate as nonprofit corporations. This means all the profits they generate are donated to the organization supported by the charity, minus administrative costs.

A nonprofit corporation is also exempt from federal and state taxes, allowing more of the profit to benefit the charity.

Note: Everything in this guide applies to for-profit corporations, and mostly to C Corps and S Corps. Items listed as requirements for forming a corporation may or may not also apply to nonprofits.

Limited Liability Company

Depending on the type of business you want to start, or your personal circumstances and goals, an LLC may be a better option. For example, you may only want to build a small business that you yourself will run with just a few employees and you may not need the options to buy and sell stock.

An Idaho LLC is usually a better option for a smaller business. It's easier to set up, but it still offers you certain advantages you'd get from a corporation. You can even have your LLC treated as an S Corporation for tax purposes to save you money.

Regardless of which way you choose to go, we can help you with your Idaho business registration.

Learn more about limited liability companies.

Sole Proprietorship or Partnership

These are the simplest types of businesses to set up. That's because there's no real setup to do. If you don't choose to form a separate business entity, by default, you'll have either a sole proprietorship (just you) or a partnership (you and one or more other people).

Neither of these options provide you with any special benefits or liability protections and can leave your personal assets vulnerable. For these reasons, we don't recommend them.

Compare business entity types to decide which one is best for you.

Helpful Resources from the State of Idaho

More Information in This Guide

You’ll find plenty more insight and guidance on the other pages of this guide, including:

Idaho Corporation Names

How to search the state business registry and find the right name. Includes information on naming rules, assumed names, reserving names for ID corporations and more.

Idaho Registered Agents

How to appoint, change and search for Registered Agents. Also includes the duties they fulfill and the rules they’re required to follow.

Idaho Incorporation Fees and Requirements

Details the various fees you’ll need to pay and the state and federal requirements you’ll need to meet. Includes details about Employer Identification Numbers (EINs), state and federal business licenses, annual reports and more.

Idaho Corporation Taxes

Covers the various taxes you’ll have to pay to the state and federal governments. Includes details about state taxes such as income and sales, and federal taxes such as income and self-employment.

Incorporate Now

Launch Your Business With Bizee

No Contracts. No Surprises. Only $0 + State Fee to Launch Your Business.