This page contains affiliate links and we may receive a commission if you make a purchase using these links.

LLC Filing Requirements

Haven't formed your LLC yet? Learn more about how to start an LLC in your state.

You filed your Articles of Organization and started your LLC — now what? Here are the most important next steps to ensuring your business is successful.

1. Understand Your Ongoing LLC Filing Requirements

Each state requires different forms, such as your business annual reports and state franchise tax reports, to be filed at different times. Failure to file these reports can lead to the company being revoked or administrative business dissolution. Bizee includes lifetime company alerts with courtesy email reminders to inform clients of an upcoming filing requirement with all of our state filing packages — or you can research filing times yourself.

Business Name Trademark

2. Protect Your Business Name With a Trademark

A trademark is an essential asset for your business because it protects the brand name and identity that you worked so hard to create. When you secure a federal trademark for your business brand, it gives you exclusive rights to use your business name, logo, or slogan once the trademark is approved. Federal Trademark Protection also prevents other businesses from using your brand name and brand identity.

Bizee is happy to help with conducting a trademark name search on your business name. Our partnered attorneys will do the research to make sure the mark isn't already taken, ensure the filing is properly prepared and submitted to the government office, and provide sound legal advice throughout the entire process.

Benefits of Bizee's Trademark service include:

- Legal counsel from an experienced trademark attorney

- A thorough search of existing trademarks

- A registered trademark with the USPTO

- Handling all correspondence with the USPTO until the name is approved.

Finances & Accounting

3. Set Up Finances and Accounting for Your LLC

Once you form your LLC, there are important next steps to ensure your business finances and accounting are organized for tax season and peace of mind, and that your personal and business finances are kept separate to ensure safety of your personal assets. With the right accounting steps, your business will run smoothly and be set up for increased profits and success.

Choose a Bank

The right business checking account for your business should have minimum fees, so that your money goes into the business or your own checking account instead of spending on hidden, tricky bank fees. According to NerdWallet — which looked at the 10 biggest banks in the U.S. and some additional online banks — these are the four best free business checking accounts for your LLC:

Best Free Business Accounts

U.S Bank Silver Business

Allows 150 transactions a month for free. Has 3,000 bank branches in addition to online banking.

Capital One Spark Business

Online banking with no monthly limit on transactions.

Wells Fargo Business Choice

Make 10 debit transactions a month and the $14 monthly free is waived. Offers a total of 200 free monthly transactions and no charge for the first $7.500 in cash deposits each month.

Bank of Internet Federal Bank Basic Business

Online-only bank that offers 200 free transactions a month and unlimited fee reimbursement for ATMs in the U.S.

Separate Business & Personal Expenses

Once you form your LLC, it’s important to keep your business and personal assets separate to protect your personal assets from liability. It also makes tax season a whole lot easier when you have one clear account with all your business expenses, instead of all expenses mixed up within two accounts that need to be sorted.

Once you choose a business checking account for your LLC, make sure you receive a business checking card or apply for a business credit card that you can use for all business expenses. You can also use a tool like Expensify to track and tag business expenses from your mobile phone.

Consider a Small Business Credit Card

After you've established your business as a legal entity, it's smart to consider getting a business credit card. But which one is right for you, and which features should you examine before choosing one? Factors such as 0% intro APR will help your business carry an interest-free balance during the initial period. Similarly, welcome offers are a great way to add free money to your business spending. Not to mention, in the long run, a business credit card can help you save thousands per year from cash-back offers and reward points.

The list of rewards and bonuses for signing up for a credit card is plenty and should be factored in while zeroing down on a credit card suitable for your business. To help you get started, check out our list of the top 10 business credit cards that we highly recommend for small businesses.

Set Up Accounting Software

Choosing the right accounting software will allow you to track your accounts receivable — the money that is flowing in and out of your business. Accounting software will allow you to track bills, invoices, expenses, and customers. This is also another important step in simplifying your year-end tax burden. With a clear, separate business checking account and card and an organized accounting software system, you’ll (barely) dread tax season as a business owner.

Here are some favorite accounting software options for LLC business owners:

QuickBooks

This is a top option for a lot of business owners and starts out at only $10 a month. You can automatically important banking transactions, track your customers and vendors and related bills and expenses, and integrate with a lot of other online finance tools. If you hire an accountant or tax support, they will all likely support QuickBooks. You can even use an online version in addition to a desktop version of their software. The drawback is that the learning curve for QuickBooks can sometimes be a bit steep.

Xero

Xero is online accounting software that is a great option for those who find QuickBooks to be too complicated and difficult to understand. Their plans start out at $20 per month.

FreshBooks

FreshBooks is online accounting software that allows you to also track your time, expenses, collaborate on projects, and view accounting reports. One drawback is that it doesn’t currently have a way to track invoices that your business needs to pay. But, accounts start out at $15 per month.

Determine How You’ll Accept Credit Cards

If you use QuickBooks or FreshBooks, you’ll be able to accept credit cards to pay for invoices. If you have a brick-and-mortar location for your small business, you want to look into offering payments through a service such as Shopify or Square.

Look Into Business Funding Options

In case your business runs out of cash flow, you want to have a backup option so your business doesn’t go under. You can raise capital from investors, ask friends or family for loans, get a business credit card, take an online business loan, or look into government financing using the SBA & Business USA’s financing tools.

Also, it’s important to remember that you can also bootstrap your business, which means only using the funds you have in your bank account and not expanding until you get more business income.

This page contains affiliate links and we may receive a commission if you make a purchase using these links.

Business Operations

4. Set Up Business Operations and Marketing for Your LLC

Having a great online presence for your business is the number one way people will find you. You need to start with buying a domain name. Then you need to choose a service to host your website such as Wix. Finally, design your website using a tool such as SquareSpace or WordPress. Make sure your website includes important business information such as how to contact you and business hours.

Choose a Virtual Phone System

Your business needs a phone number so that your customers, employees and and vendors can reach you. A great option is to look into a tool such as Grasshopper, which allows you to get a business phone that actually forwards to your cell phone, so you never miss an important call.

Design a Business Logo

A logo will reflect your business branding everywhere your customers interact with you — on your website, on your invoices, in your email signature, on business cards, and more. Instead of trying to design a logo yourself, try a logo making service such as Wix or buy some really high-quality pre-made logos you can customize on CreativeMarket.

Get Business Cards Created

Once you have a logo, create nice-looking business cards that you can hand out when you’re out networking or even running errands. You never know when a conversation about your business will come up, and you want to be able to give someone a place to research your business and contact you. A great tool to create inexpensive business cards is Vistaprint.

This page contains affiliate links and we may receive a commission if you make a purchase using these links.

Choose Business Tools

5. Choose the Best Business Tools to Run Your LLC

In addition to accounting software, there is a number of online business software options that will lift a number of menial tasks and burdens off your full business-owner plate. Below are important business functions for your LLC and what we think are the best business tools for your LLC.

Collaboration

Social Media Management

Communication

Email Marketing

Advertising

Customer Relationship Management (CRM)

Customer Support

Human Resources

Website Development

Analytics

Hiring

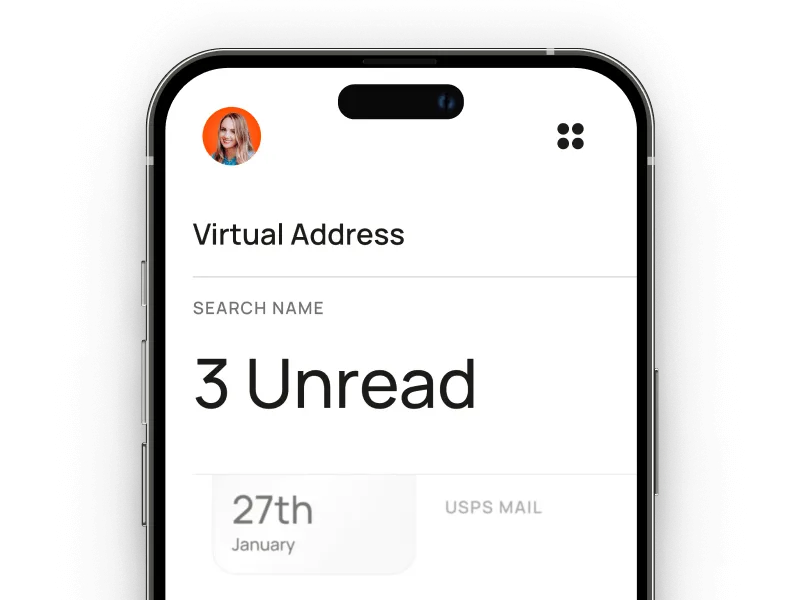

Get a Virtual Address for Your Business

A virtual address gives your LLC a physical address, allowing you to receive and check your mail from a digital dashboard. The virtual mailbox will allow you to work from anywhere and still have a professional address where you can be reached for business. Especially if you're running your business remotely, a virtual address can give you a real street address with the convenience of managing your mail online.