On this page

Filing Fees & Requirements

How Much Does It Cost to Incorporate in California?

Legal business registration — and keeping your business in good standing — involves necessary expenses and investment. Some of these costs are payable to the Secretary of State, while others are due to additional state entities or the federal government. Here are some common requirements and fees.

Please note that fees for a permit or business license in California may be due when you first form your business, on an ongoing schedule or on an ad hoc basis. Find more details below.

Initial California Incorporation Fee

When forming a corporation in California, you’ll need to file a form and pay a filing fee. Here are the current California incorporation fees and filing times:

State Fee

$105*

State Filling Time

4 Weeks

Expedited Filing Time

6 Business Days

*includes a $5 certified copy fee

When you use Bizee to start a corporation in California, we charge you the state filing fee and forward it to the Secretary of State when we file your incorporation paperwork.

Bizee Can File Your Incorporation Paperwork for You for Free

Just pay the required California corporation filing fee.

Incorporate Through Bizee Today

California Allows You to Incorporate More Quickly by Paying a Rush Fee

View Expedited Fees for California

Employer Identification Number

Every corporation in the country should have a unique EIN (Employer Identification Number) from the Internal Revenue Service. You'll use it when you open a business bank account, file taxes and pay employees. You can get one directly from the IRS, or Bizee can get one for you.

Get an EIN Through BizeeForeign Corporations

If you want to do business in a state other than the one where your business is based, you must create a Foreign Corporation.

California Foreign Corporation Registration

Before you can bring an arm of your business from another state into California, you must request Foreign Qualification in California. This means the state gives you permission to conduct business there.To request registration of a California Foreign Corporation, you must file a Statement and Designation by Foreign Corporation with the Secretary of State and pay a processing fee of $100.

The state may have additional registration requirements, so contact the Secretary of State directly for more information and to ensure you're in compliance with state law.

Foreign Qualification to Operate in Another State

If you plan to expand your California corporation into another state, you’ll first need Foreign Qualification or a Certificate of Authority from that state. This is necessary before you can create a physical presence, hire employees or bank in that state.

You'll likely have to complete at least one application and pay a filing fee, but each state has its own requirements. Before you start the process, compare state filing times and state filing fees so you can plan accordingly.

Above all, contact the state government entity that administers business (usually the Secretary of State) to confirm their requirements and for specific instructions.If you need assistance, Bizee provides a complete Foreign Qualification service for all states.

Get Foreign Qualification or Certificate of Authority Through BizeeCalifornia Annual Report Requirements

Most states require business entities to file an annual (or other periodic) report. California requires an annual Statement of Information to be filed with the Secretary of State initially within 90 days of incorporation and every year thereafter.

When your CA Statement of Information form is complete, you may file it online accompanied with a filing fee of $25.

Statement of Information

Frequency

Annually

Due Date

During six-month period ending on last day of anniversary month of incorporation or qualification.

Filing Fee

$25

Important

The initial Statement of Information filing is due within 90 days of the entity formation date.

Bizee Can Complete and File Your Annual Report on Your Behalf

Bizee’s Annual Report Filing Service

California Business License and Permit Requirements

Before you start doing business, you must secure the necessary state, federal or local business licenses and permits to operate your corporation. Some of the fees will only need to be paid once, while others may be ongoing charges.

Permits and licenses vary based on:

- The type of business you run (e.g., attorneys must pass the state bar exam)

- The industry your corporation operates in (e.g., restaurants will need health permits)

- The location of your corporation (state, county or city) (e.g., a license to conduct business in San Diego)

Operating your corporation without the required business license in California can leave you vulnerable to risks, such as fines from local, state and federal governments.:

You can research these permits and licenses yourself, or use Bizee’s Business License Research Package, which includes:

- A complete report on all the licenses, permits and tax registrations your corporation will need

- The applications you'll need to file with the local, state and federal licensing authorities

California Corporation Bylaws

You're not legally required to have California corporate bylaws unless the Articles of Incorporation don't specify the number of directors in the corporation. You're also not required to file them with the Secretary of State.

Bylaws are essentially rules for carrying out tasks related to managing your corporation, including but not limited to:

- the number of directors the corporation has

- how they'll be elected, their qualifications and the lengths of their terms

- when, where and how your board of directors can call and conduct meetings

- voting requirements

The bylaws must then be adopted (and amended, if necessary) by the board of directors and shareholders.

Despite their not being legally required, a set of bylaws can be extremely helpful in making sure you’re organized and can help protect your business from any future changes and events that may affect your business.

Other California Corporation Filing Requirements and Fees

The State of California requires you to complete a few more tasks before you can begin conducting business.

Appoint a Director

Some states — including California — require corporations to appoint a full board of directors. California requires corporations to have a minimum of three directors.

In addition, as of 2019, per the state's Corporations Code, Title 1, Division 1, Chapter 3, § 301.3, corporations must have at least one female director on their boards. That minimum requirement increases if and when the number of directors increases. These same requirements apply to directors from underrepresented communities.

Appoint Officers

California Corporations Code Title 1, Division 1, Chapter 3, § 312 requires corporations to have a chairperson of the board (or president or both), a secretary, a chief financial officer and to appoint other officers (CEO, COO, etc.) whose titles and duties are spelled out in the bylaws.

Issue Stock to Shareholders

To raise business capital and keep it separate from company owners' money, every California corporation must sell stock to its shareholders. The Articles of Incorporation must authorize the sale of at least one share, and the corporation cannot sell more shares than are authorized.

Hold Annual General Meetings

California requires corporations to hold annual shareholder's meetings. California Corporations Code Title 1, Division 1, Chapter 6, § 600 states:

"If there is a failure to hold the annual meeting for a period of 60 days after the date designated therefor or, if no date has been designated, for a period of 15 months after the organization of the corporation or after its last annual meeting, the superior court of the proper county may summarily order a meeting to be held upon the application of any shareholder after notice to the corporation giving it an opportunity to be heard."

Get a Fictitious Name or DBA

If you want to register a California fictitious business name (DBA), you must file with the clerk of the county where your business is located. Fees may vary.

Contact your County Clerk for more information.

Bizee Can File Your Fictitious Name or DBA Forms on Your Behalf

Bizee’s DBA Service

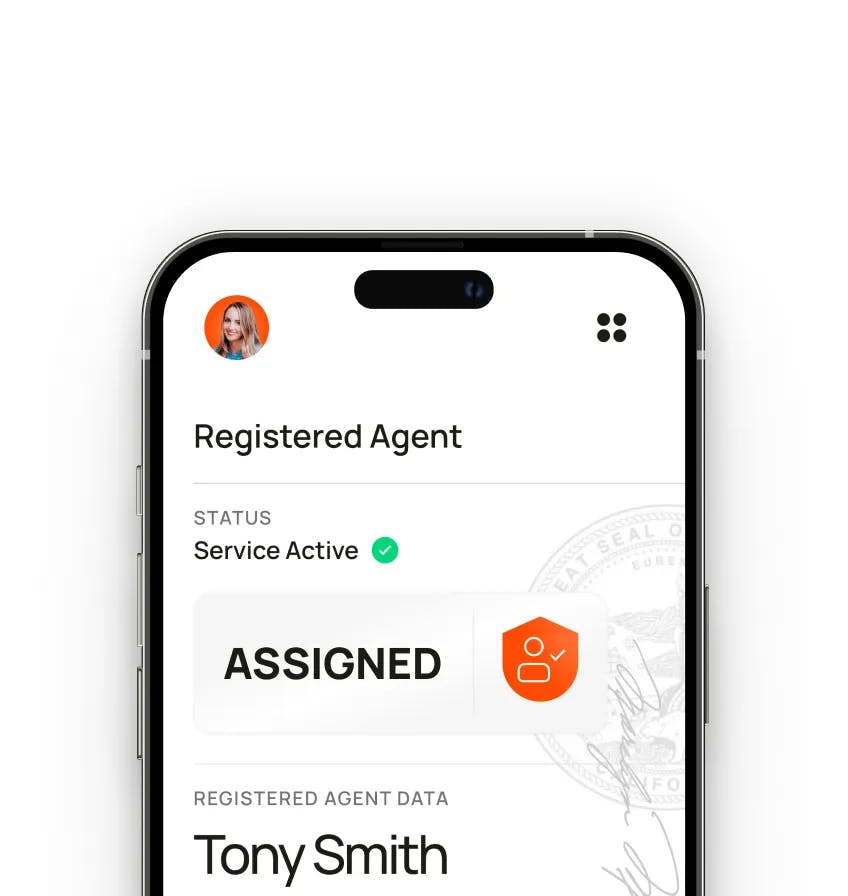

Changing the Registered Agent

If your corporation is based in California, then you must have a Registered Agent in the state. You'll need to appoint one when you file your Articles of Incorporation. You can also change to a new Agent for Service of Process (Registered Agent) later when you file your annual Statement of Information. There is no fee for this if the change is filed between regular Statement of Information due dates.

Let Bizee Serve as Your Registered Agent.

It’s free for the first year if you form your CA corporation with us and $119 a year after.

Use Our Trusted Registered Agent Service

Reserving a Name for Your Corporation

If you're not quite ready to start your business, you can reserve a name for 60 days with the Secretary of State by filing a name reservation request and paying a fee of $10. First, conduct a California corporation search and learn the state's business naming rules to ensure you choose a name that meets legal requirements.

Amending Facts About Your Corporation

When you incorporate, the California Secretary of State forms you fill out include certain facts about your business at that time. Through the years, some or all of this information may change. If it does, you'll need to file a Certificate of Amendment with the Secretary of State, along with a filing fee of $30. You can do this yourself or Bizee can do it for you.

You'll need to file Articles of Amendment when you:

- Change the company's name

- Add, remove or change a director

- Change the Registered Agent

- Change the number of shares your corporation is authorized to issue

- Change any other facet of your business that was listed on the original Certificate of Formation

Getting a Certificate of Good Standing in Texas

Some organizations may request that you prove your corporation's compliance with laws and tax requirements. In most states, this proof is provided with a Certificate of Good Standing or Certificate of Existence. In California, it's called a Certificate of Status.

If you need to prove you have met your commitments, you can request a CA Certificate of Status from the Secretary of State. You'll find instructions for ordering a Certificate of Status on the Secretary of State's website. The fee for this service is $5.

Bizee Can Obtain a CA Certificate of Status on Your Behalf

Bizee’s Certificate of Good Standing Service

The information listed above details many of the fees a standard corporation will be required to pay in California. In some circumstances, there may be other one-off, periodic or ad hoc fees not listed above.

Of course, your corporation will also probably need to pay federal, state, self-employment (if it's an S Corp) and other taxes. You'll find more information on the California taxes page.

FAQs About California Incorporation Fees

What Happens to the State Fees I'm Charged When I Incorporate?

We charge you this fee at cost and then pay it to the Secretary of State on your behalf when forming your California business.

Where Do I Get a Permit or Business License in California?

It depends on various factors, including:

- governing organizations in your industry;

- federal, state and local regulations;

- where you're located; and

- the type of business you run.

Many new businesses need a business license, and you may be required to obtain additional licenses and permits. Our Business License Research Package can take the guesswork out of it for you and help you learn what your corporation needs to be compliant.

incorporate now

Launch your business with bizee

No Contracts. No Surprises. Only $0 + State Fee to Launch Your Business.

.jpg&w=3840&q=75)