Paul R.

“Was able to create my business in less than 30 minutes! Incredibly easy, intuitive and straight forward. Amazing!”

Business accounting and bookkeeping services at a low monthly cost — so you can focus on what matters.

Join 1,000,000+ Entrepreneurs like you

Entrepreneurship is booming – and we're happy to be one of America's fastest growing companies.

Understanding the tax requirements of your business entity is complex and requires a lot of dedicated time. Trying to do everything yourself can be mentally draining — and financially draining, too when it comes to taxes and bookkeeping!

Get accountant services and solutions tailored to suit your business's needs. With Bizee, there are no high fees, mountains of paperwork, or administrative headaches. Get expert knowledge, hands-on support, and peace of mind to make your life easier.

Our business bookkeeping and accounting service take the worry out of managing your tax and finances while saving you up to 50 hours and $2,500+ per year! Check out the host of other great benefits below.

Stress-Free Tax Filing — Yes, It Is Possible!

Get your business and personal taxes filed for you and get advice on enhancing your potential yearly savings.

Compliance Assistance Keeps the IRS at Bay

Entrust your bookkeeping, taxes, and accounting to dedicated specialists. Minimize chances of IRS audits and fees.

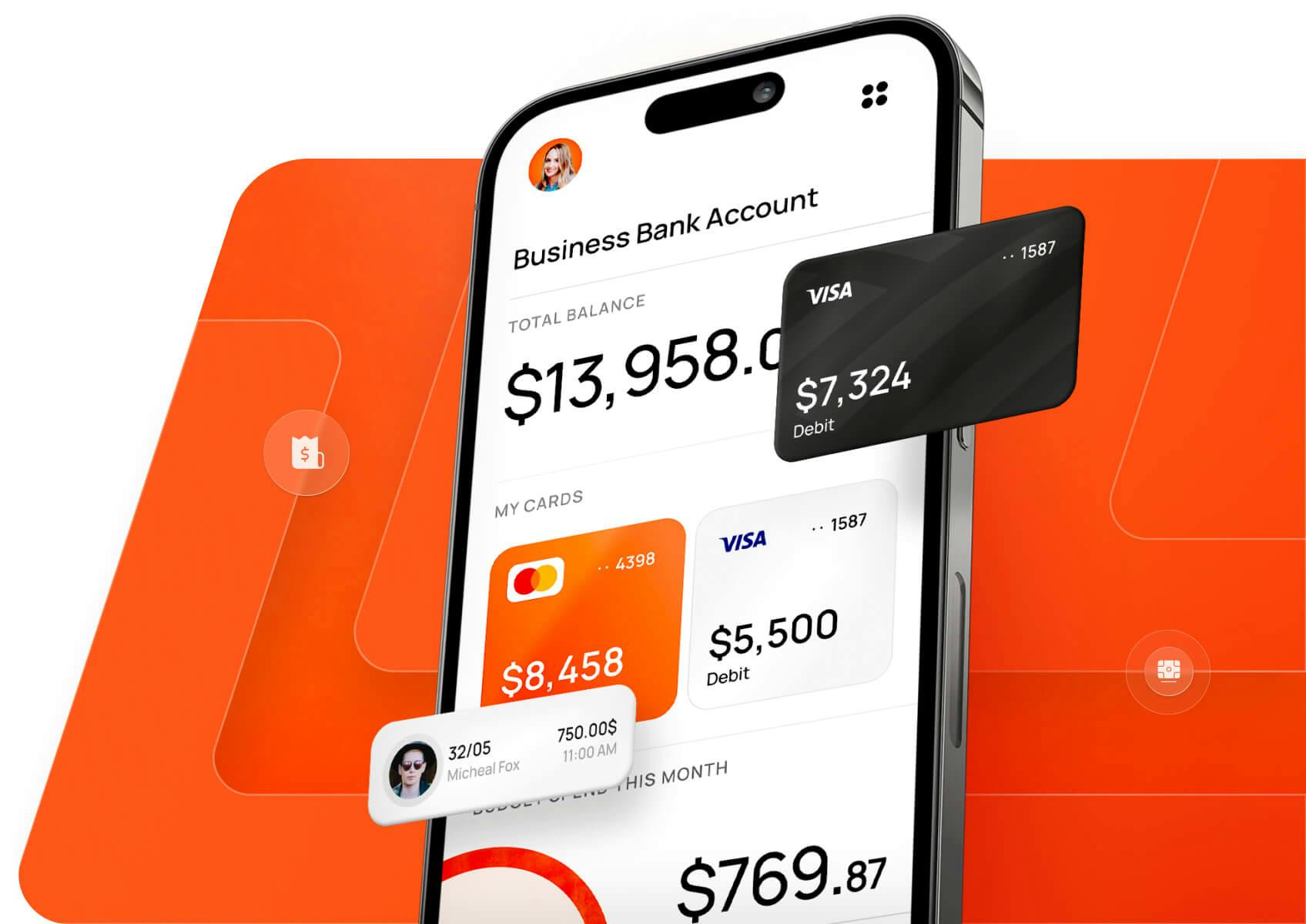

Financial Reporting, Online Tools,

& Resources

Access your mobile-friendly financial reports and tools or easily contact your accountant or bookkeeper anytime, anywhere.

Monthly or Quarterly Bookkeeping

Monitor business performance. Turn accounting figures into actionable information via your modern, intuitive dashboard.

Link Up to Four Bank Accounts

Upload receipts to your dashboard to unlock essential business insights and visual profit and loss statements.

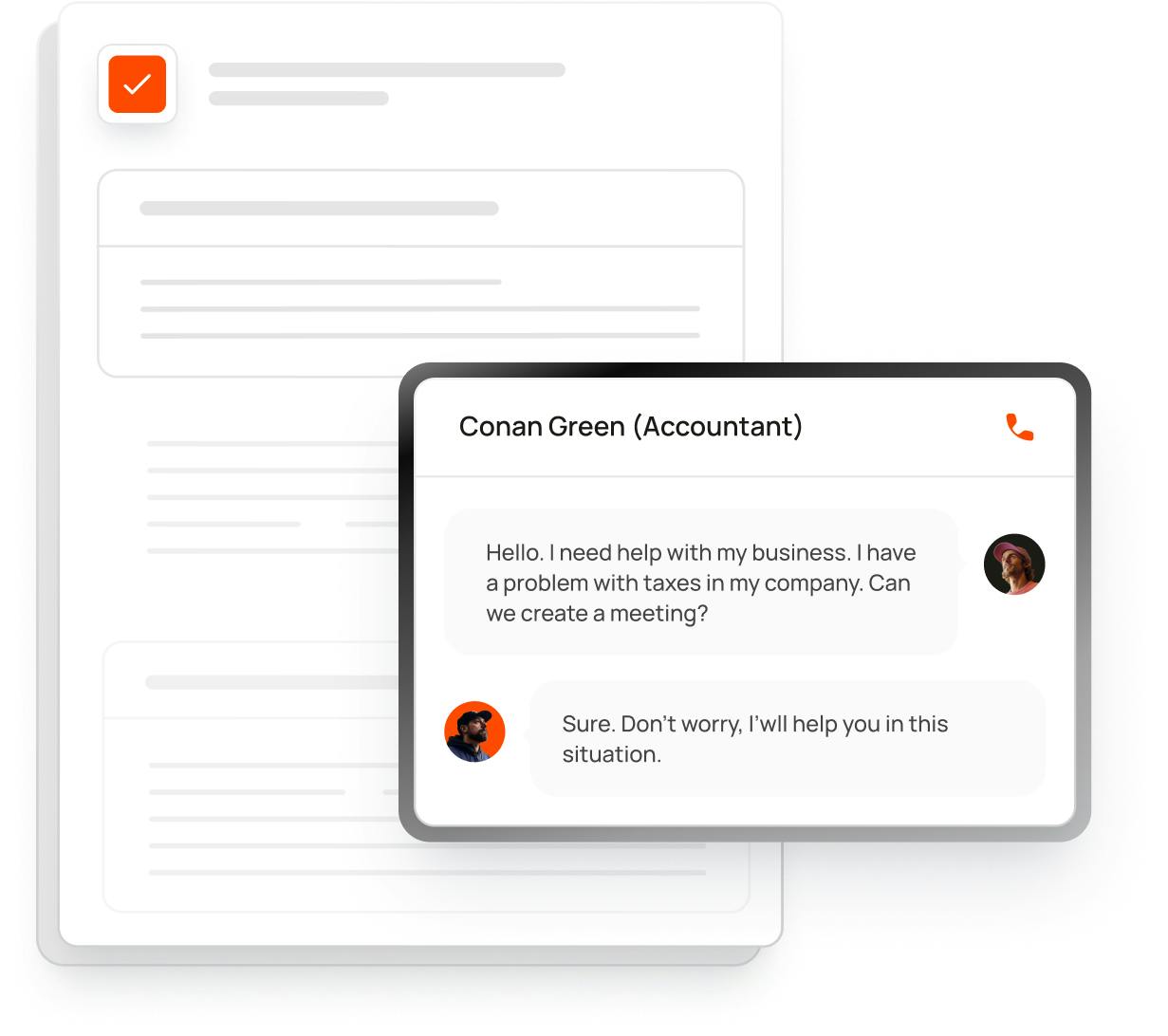

Get Advice from Bookkeeping & Tax Pros

Get advice or one-on-one support from dedicated specialists via email, phone, or online chat in your personalized dashboard.

In your free 30-minute consult, a specialist accountant will review your finances with you to highlight where you can save money and offer practical advice.

During your consultation, your accountant will help you determine which package (Starter or Plus) best meets your business's needs.

Your accountant will then guide you through the initial stages of populating your dashboard. Then you'll receive your login details so you can complete the setup.

“One of the things I really appreciated with Bizee is that it took care of everything for me.”

Khadijah Suleman, Aloaye Clothing LLC

“Was able to create my business in less than 30 minutes! Incredibly easy, intuitive and straight forward. Amazing!”

“Been using Bizee for years. Love how easy it is to file and stay current with my LLC filings.”

“They literally do almost everything for you, including state annual filing. SO easy to use for first-time business owners.”

Join the 1,000,000+ businesses

That trust Bizee to start, manage, and grow their business

The Starter Package costs $90 per month and includes:

The Plus package costs $180 per month. It's a more personalized service and includes the following: Monthly bookkeeping

Never! We're all about transparency, and there are no hidden costs associated with our business accounting and bookkeeping service.

Your free 30-minute tax consultation will help you choose the right package and get set up within your dashboard. After the consult, you're ready to go as soon as you receive your username and password via email.

Yes! Get detailed information on filing your business taxes and finding the right small business accountant. Learn all about the differences between bookkeeping and accounting and what forms you need for LLC taxes.

Absolutely! If you have questions about our business accounting services or need other support, contact us via your personalized dashboard or use our contact form. We also recommend checking out our top tax filing tips and what forms you'll need to file your LLC taxes.

Once you've signed up for our accounting services, contact your accounting team within your personalized dashboard if you need support regarding your accounting and bookkeeping tools, dashboard, or any financial or tax-related advice.

For a low monthly cost so you can focus on what matters.