Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

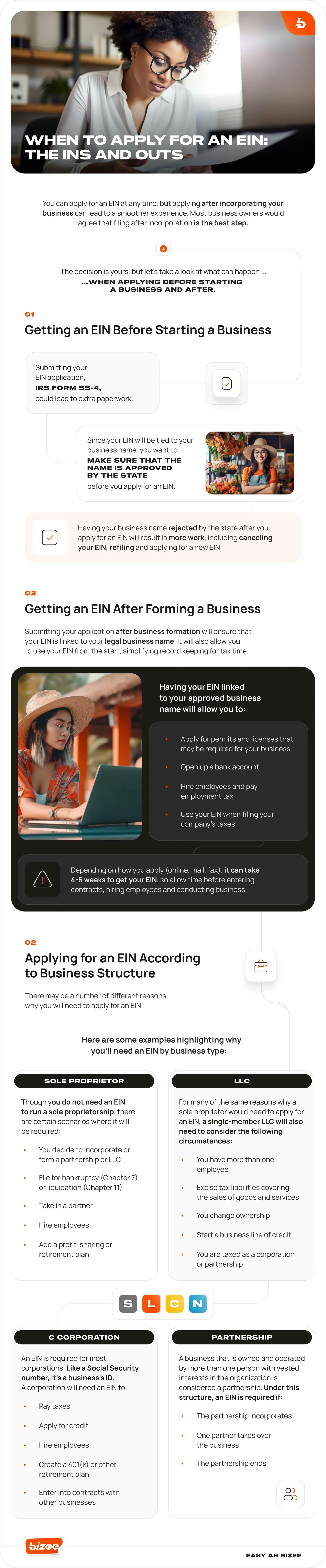

The best time to apply for EIN number is when you form your business entity, though you can obtain an EIN even before officially starting your business.

The decision on when you should apply for an EIN will fall on you and your needs, but it’s important to understand how the process will work and when you should apply for an EIN.

Getting your EIN is a big deal. This is especially true if you are growing your business and have decided to incorporate. So if you fall in this particular category, then congratulations! Your business is “official” in the eyes of the IRS and you are now able to engage in activities that may have been closed to you as a sole proprietor. Having an EIN also adds credibility to your business when it comes to applying for credit and loans, working with vendors and engaging partners.

Since 2004, Bizee has been helping businesses with their business formation needs. Bizee's complete EIN service handles the whole process for you — no matter when you need to apply for your EIN.

Obtain Your Business EIN, Hassle Free.

Get in Touch Today

Peter Mavrikis

Peter Mavrikis is an author and editor with over 25 years of experience in publishing. He has worked as the Editorial Director for Barron’s Educational Series, as well as Kaplan Test Prep, where he ran the test prep, foreign language, and study guide.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC