Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

If you’re a business owner who is deciding to close your business and stop business operations for your LLC, you might wonder what happens to your 401(k), SEP IRA or other retirement savings accounts that you might have through the business. The good news to know up front is that, even if your LLC is closing, your 401(k) investments are most likely to remain safe, separate and unaffected by the business’s closing.

If you have a company 401(k) or other retirement savings plan, that money is generally considered to be separate from the business’s funds. You have a variety of options to keep your retirement investments safe, and with most of these options, you can continue contributing to your retirement account.

Get Ready For Your Next Adventure.

Let Us Handle Your Business Dissolution Paperwork — So You Can Get Started On Your Next Great Idea.

File DissolutionIf your company is closing, you have a few options for what to do with your 401(k):

- Keep your money in your current 401(k) account and continue to let your current third-party retirement savings plan or investment manager administer it. Even if your LLC closes, your 401(k) can keep working for you.

- If you will be going to work for a new company, you can look into transferring your 401(k) balance to their plan.

Roll over your 401(k) into a Rollover IRA. You can choose two options:

- Traditional IRA: Traditional 401(k) to traditional IRA is a tax-free rollover. In this case, your money continues to grow tax-deferred, and putting the money into your new rollover IRA account is not a taxable event.

- Roth IRA: Traditional 401(k) to Roth IRA is not a tax-free rollover and you’ll have to pay taxes to convert the pre-tax money from your 401(k) to post-tax retirement savings in a Roth IRA. Consult with a professional tax adviser or financial adviser to make sure you understand the possible tax obligations and overall long-term implications for your retirement savings.

- Withdraw the funds as a cash distribution; this is not a recommended option as you will both have to pay federal taxes on the entire amount and potentially have to pay penalties for an early withdrawal (generally dependent upon your age). Unless you’re in a financial emergency and have no other choices, try to leave your 401(k) money in your retirement savings account. Leave that retirement money alone, and let it grow for the future.

Let’s take a deeper dive into the options available to you with regard to your 401(k) when your LLC closes.

Keep It in Your Current 401(k)

This is an easy option to choose if your funds are already invested with a third-party retirement plan administrator, such as Fidelity Investments, AIG, Principal Financial Group, Mutual of Omaha, Vanguard or others on the market. While you won’t be able to continue making contributions to your 401(k) once your business closes, your investments will stay invested, your account will still exist under your name and your retirement savings can continue to grow while you deal with the other facets of closing down your business.

Once you are prepared to begin making retirement contributions again, you can decide on your next steps of getting your 401(k) transferred or rolled over, or you can start a new retirement savings account depending on your new employer and overall financial planning circumstances.

Transfer 401(k) to New Company Plan

If you plan to start a new job with a different company once your LLC closes, you can transfer your balance to a new account with your new employer’s 401(k) plan administrator.

However, before you transfer to the new company’s plan, do some research:

- Do you like the investment options available with the new company's plan?

- Are the plan’s investment management fees lower or higher than your old plan?

- Is the retirement plan administrator a reputable company?

- Are you confident that this plan can give you a better overall mix of investments and low fees to reach your retirement goals?

Transferring your 401(k) to a new employer’s plan can be a convenient option as it will consolidate your old and new 401(k) balances into a single account, making it easy for you to keep track of where your investments are.

There are two ways to transfer your balance to the new 401(k):

- Request a direct transfer from your current 401(k) administrator to the new plan administrator. You will need to fill out some paperwork with your current plan administrator and they will handle the transfer to the new account.

- If the direct transfer is not an option, you can request to have the distribution in the form of a check. Your plan administrator will distribute the balance of your old account directly to you, and then you will have 60 days to deposit the funds into your new 401(k) account. If the funds are not deposited in a timely manner, you could end up having to pay income tax on the entirety of your balance, so if you choose this option, make sure to deposit that check quickly.

Traditional IRA Rollover vs. Roth IRA Rollover

Once your LLC has closed, you can transfer your 401(k) retirement account from the plan administrator to a traditional or Roth IRA account. Making this kind of transfer is called a rollover. Since you are doing a direct transfer from one retirement account to another, no taxes are due at the time of transfer as long as you don’t take a cash disbursement or withdrawal along with the transfer.

You might want to choose to roll over into a traditional IRA account if your 401(k) account contains pre-tax contributions. Or if your retirement savings are already in a Roth 401(k) (with post-tax dollars), a Roth IRA transfer might be a better fit as future Roth IRA contributions will also be after-tax.

Or if you’re willing to owe extra taxes this year in exchange for tax-free income in the future, you can convert your pre-tax retirement savings into post-tax Roth IRA savings. Unlike traditional IRA or traditional 401(k) funds that are taxable income in retirement, Roth IRA accounts provide tax-free income in retirement. So for some people, it can be a better deal in the long run to convert 401(k) or traditional IRA funds to a Roth. However, the Roth conversion can be complicated, and it is not the right answer for everyone; consult with a financial adviser or tax professional before you decide to do this.

Similar to transferring your 401(k) to a new plan, the rollover option will also be performed as either a direct transfer or by the plan administrator mailing you a check that must be deposited with the new custodian within 60 days. Again, make sure to deposit the check promptly! If the check is not deposited within the 60-day timeframe, this will be treated as a taxable distribution from your retirement account, and you will be subject to any taxes and penalties that come along with it.

Rules and Tax Implications of Traditional and Roth IRAs

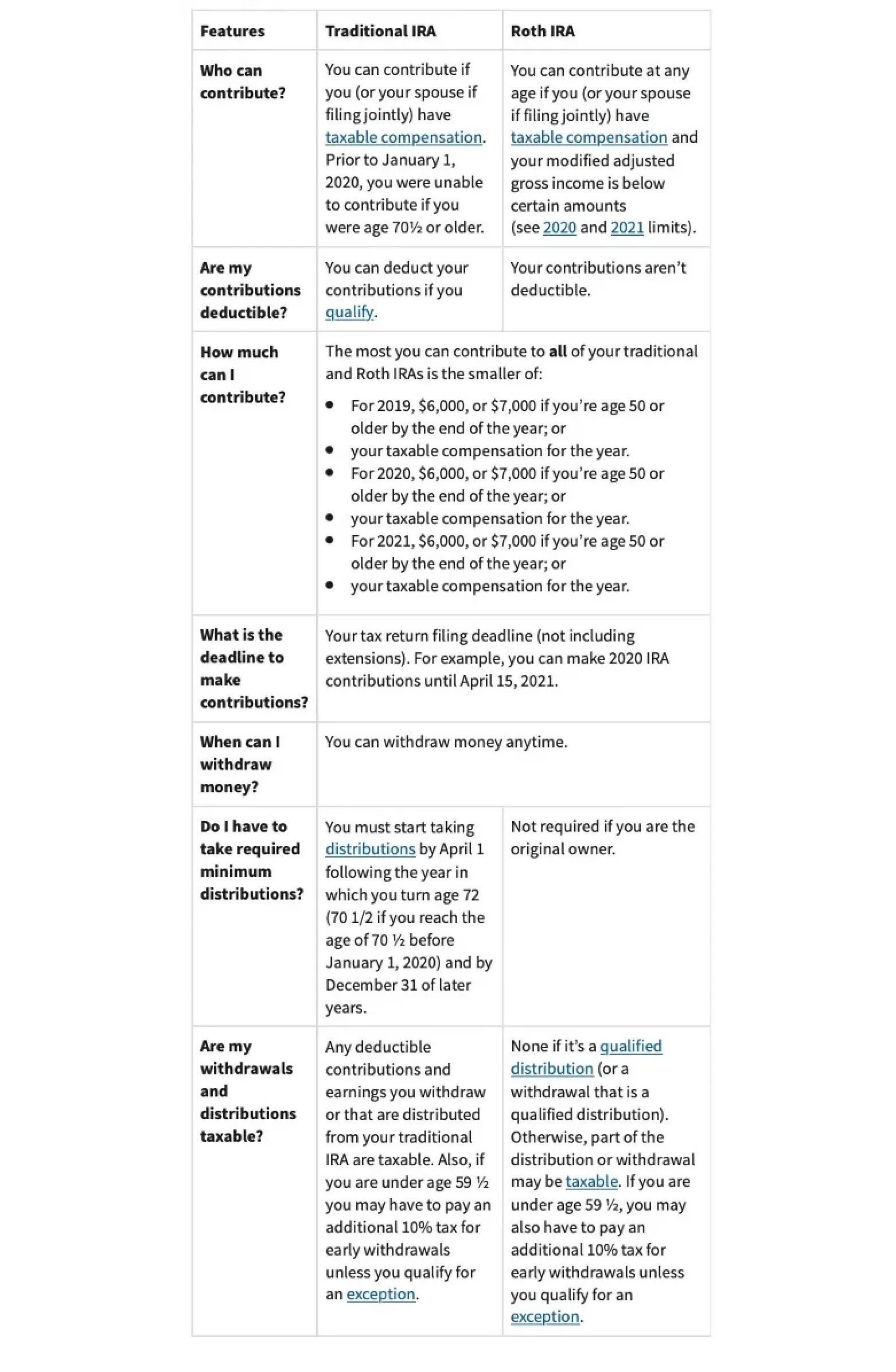

Both traditional and Roth IRA accounts allow you to save for retirement, but in different ways when it comes to where you find the tax advantage. This chart highlights how traditional and Roth IRAs are similar and how they differ:

Source

Closing your LLC can be a stressful time both logistically and mentally. Having a plan for your retirement account will take some of the financial burden off of your shoulders. Keep in mind that if you just aren’t sure what to do with your retirement funds right now, you can absolutely keep your 401(k) account as-is with the current plan administrator as long as they are open to maintaining your account.

This will give you a little time to deal with other needs before attending to your retirement account plans. Before deciding between a rollover or cash disbursement, consider tax and penalty implications. Whatever comes next in your career, hopefully you can leave your retirement money invested and let it keep growing for the future. Closing an LLC is one chapter of your life, but there are many more to come.

Get Ready For Your Next Adventure.

Let Us Handle Your Business Dissolution Paperwork — So You Can Get Started On Your Next Great Idea.

File Dissolution

Ben Gran

Ben Gran is a freelance writer from Des Moines, Iowa. Ben has written for Fortune 500 companies, the Governor of Iowa (who now serves as U.S. Secretary of Agriculture), the U.S. Secretary of the Navy, and many corporate clients. He writes about entrepreneurship, technology, food and other areas of great personal interest.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC