Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

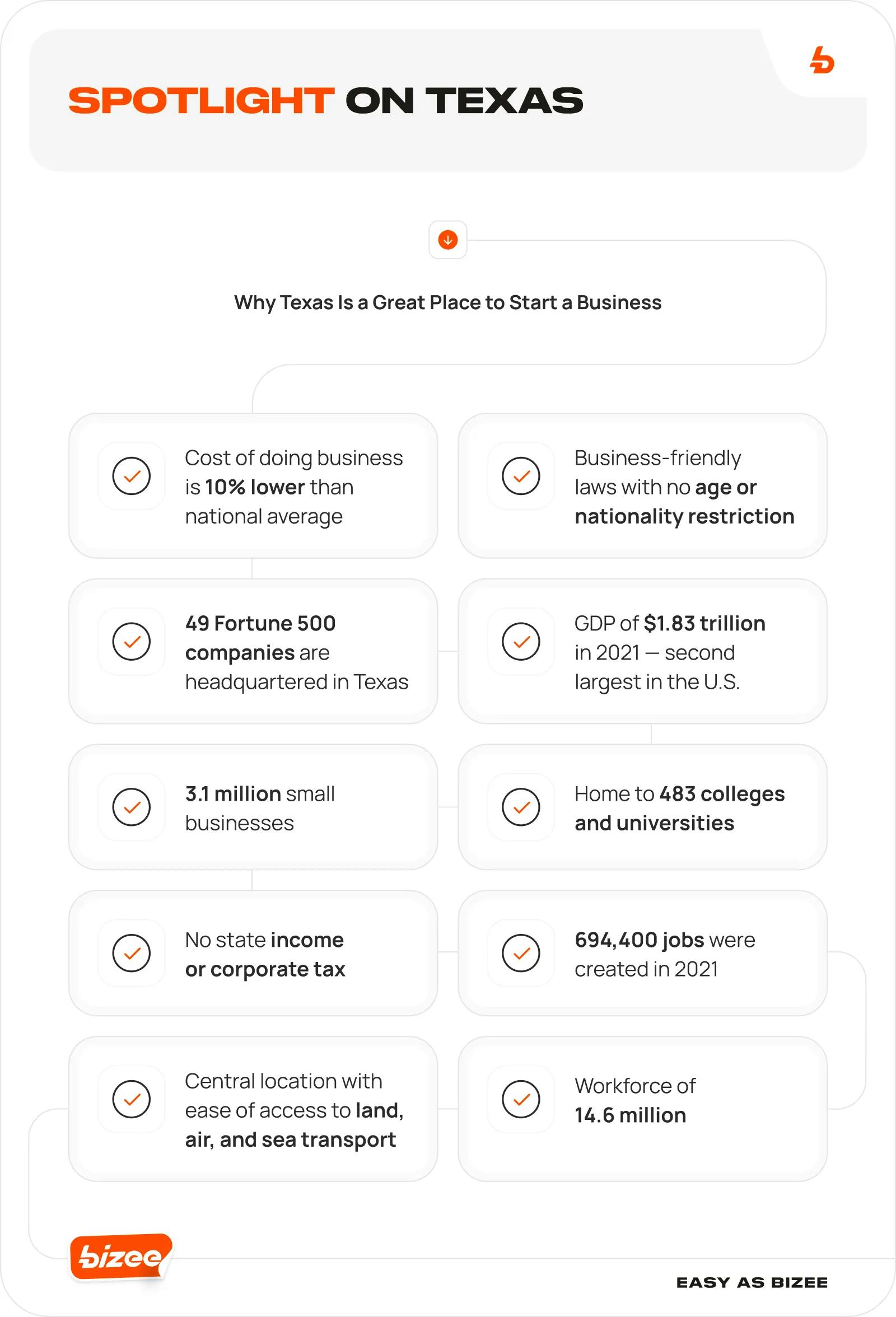

Texas is one of the most popular and profitable states to form a business. If you want to join the 3.1 million small business owners in one of the South's most business-friendly states, we've got you covered. Here's all the information you need to start a business in Texas.

Form Your LLC $0 + State Fee

Includes Free Registered Agent Service for a Full Year.

Get started todayWhat Makes Texas a Great Place to Start a Business?

According to U.S. Census Bureau, Texas saw a 49% increase in new business applications between 2000 and 2022. Here's why so many aspiring business owners are keen to start a business in Texas.

- Business-Friendly Laws: Texas is known to have one of the most favorable business ecosystems in the U.S. Thumbtack's 2021 Business Friendliness Survey placed Texas in the top 10 business states within the country with an overall rating of "B." The state law doesn't have any age or citizenship restrictions on who can start a business or have an ownership interest in a business entity. So, if you're an aspiring teenpreneur or a foreign national, Texas could be the ideal place to form an LLC.

- Lucrative Tax Incentives: The top crowd-puller for businesses is that Texas has no state income or corporate tax, which allows business owners to keep a hefty amount of net profits. The state also offers a wide range of incentives like no property tax, franchise tax exemption, and the Texas Small Business Credit Initiative (TSBCI).

- Low Cost of Living: As of 2021, Texans enjoy the 15th lowest cost of living rate in the country, with the average monthly cost of living being $39,661. The low cost of living benefits a new business in multiple ways. Your customers have more disposable income to spend and your business costs are also lower.

- Access to a Large Labor Force: Texas prides itself on being able to offer a large talent pool of highly skilled labor. The state boasts of a 14 million labor force and is home to some of the nation's top universities and colleges that provide a steady pipeline of resources.

- Multiple Funding Options: Small businesses in the state have access to a wide range of funding opportunities. On top of SBA loans, businesses can connect with angel investors and nonprofit lenders like BCL and PeopleFund. The Product Development Small Business Incubator Fund finances new products from emerging businesses. Venture capitalists are also taking notice of Texas and focusing their efforts on funding entrepreneurs in the state. LiveOak Venture Partners and Silverton Partners are two firms that have recently dedicated funds for Texas businesses.

- Diverse and Supportive Business Community: With so many small businesses already part of the state, you’re automatically joining a wide network of startup communities. You can also attend the Governor's Office of Small Business Assistance events to find mentors and fellow business owners to ask questions and receive guidance from.

- Commitment to Investment in Technology and Innovation: Another reason Texas attracts budding entrepreneurs is that the state government is committed to making investments in technology and innovation, both of which improve the business landscape. In recent years, the state has seen a flurry of investments from tech giants like Google, Apple, Amazon, Wipro, and Microsoft. This, alongside the booming venture capital investments in electronics, make the state a hub for innovation.

- Robust Infrastructure: Texas is easily accessible by air, land, and sea. The government recently announced a 10-year, $83 billion commitment to new roadway project that will further strengthen the state's transportation network. What does this mean for you? Your business can easily reach its customers, suppliers, vendors, and potential employees.

- Thriving Economy: Texas is the second-largest economy in the U.S. And, when compared to other nations, Texas has the 11th largest GDP "gross domestic profit" in the world, making it bigger than Canada, Russia, Korea, and Australia. The state has consistently led the nation in job growth and opportunity creation. In August 2022, Texas broke the job growth record for the 10th consecutive month by adding 16,400 nonfarm jobs. These stats indicate a prospering economy that will support new businesses.

Top Texas Industries

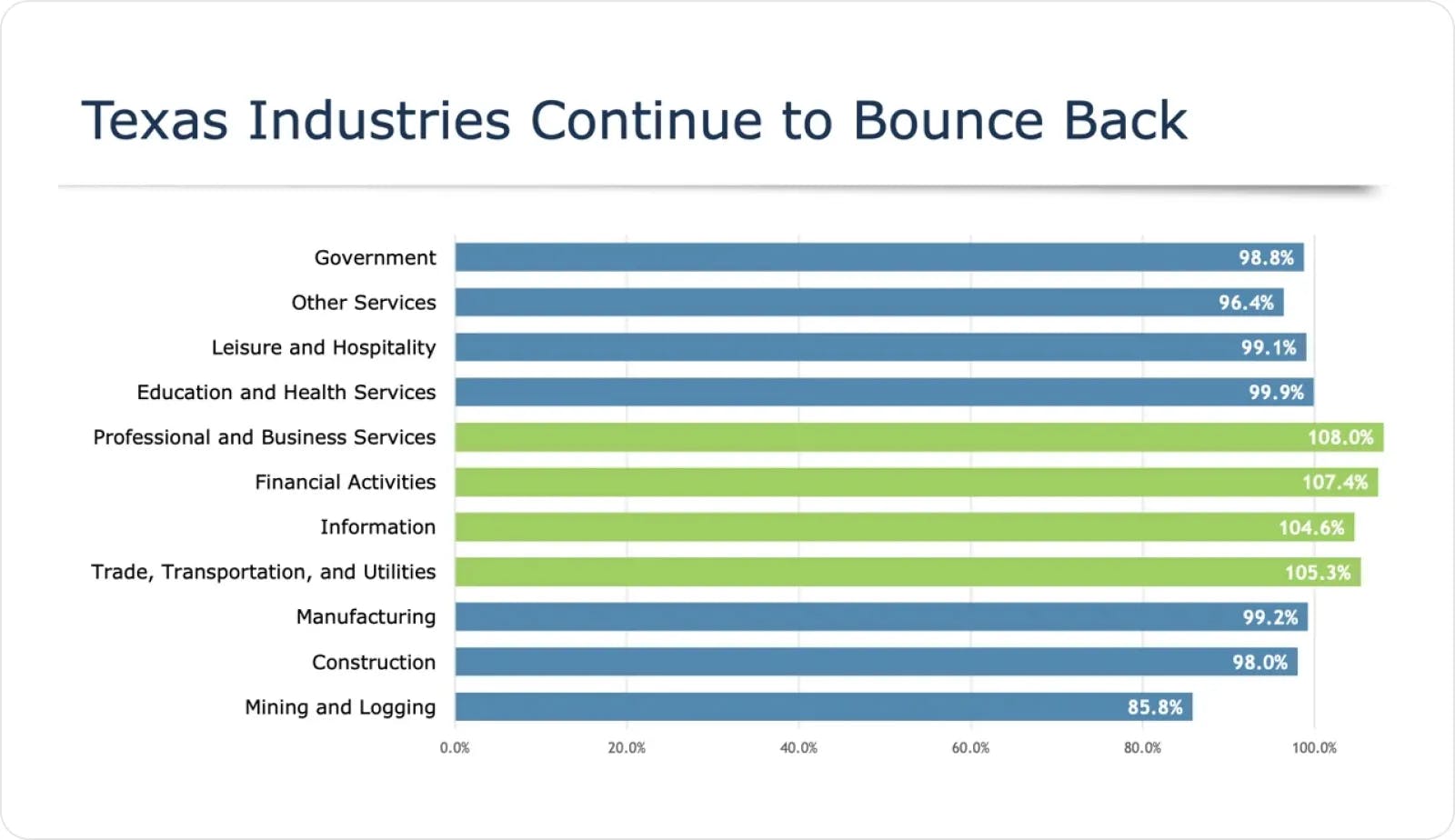

You might think Texas' economy is driven by the oil and gas sector. But, the state is thriving in other sectors as well, such as aerospace, automotive and IT technology, advanced manufacturing, and life sciences.

The majority of the state's small businesses are in construction, technical and professional services, and waste management industries.

According to the Texas Workforce Commission, the industries making a comeback and poised for robust growth include:

- Business and professional services

- Financial sector

- Information Technology

- Trade, transportation, and utilities

- Education and health services

- Manufacturing

If you're ready to go big with your business in Texas, here are the steps you need to follow to get it started.

1. Create a Business Plan

One of the first steps to starting a business in Texas is creating a business plan. Doing so will make it easier to operate a successful, profitable business.

Your business plan will be a blueprint for how your company will run, and it'll help you get organized before investing your money — or someone else’s. Your business plan should include:

- A business mission statement

- Research on who and where your ideal customers are

- Details on how you plan to market to your ideal customer

- Goals for your business

- Finance options

- Competitive research and how it will guide your decision-making

Your business plan is a great tool for guiding your own decisions, but it will also be something you submit to potential financial backers or lenders.

2. Pick a Business Name

Next, it's time to find the perfect business name. Having a difficult-to-pronounce or generic name can undo all the time and effort you put toward getting your business plan in place.

Your business name should be unique, easily distinguishable, memorable, and suited for your business. Bizee's Business Name Generator can help you in generating a creative business name.

Once you have identified a few names to your liking, run a business name search to ensure your desired name is available. A few things to keep in mind while you are doing a business entity search in Texas are:

- Texas state's naming requirements

- Each search costs $1

- A legal business entity like LLC, partnership, or corporation should have the appropriate identifier.

- Use of the following terms is restricted or prohibited:

- Lotto

- Lottery

- Bank, Banc

- Engineer, Engineering

- Olympic

- Cooperative

- Veteran

- Legion

- Trust

- Insurance

Lastly, we recommend thinking ahead and making sure your chosen name is also available as a domain name. Having a coinciding website and business name will make it easier for customers to locate and remember you.

If your preferred business name is available, there are three ways you can register it so no one else can stake their claim on it:

- Reserve the business name: In Texas, you can reserve a business name for up to 120 days for $40.

- File for a DBA: A "doing business as" or "assumed name" certificate allows you to run your business under a name that's not the legal business name. For instance, if you're thinking of running your personal training business as "FitWithShay," but your legal name is Shalene Richards, you'll need to get a DBA in each county your business operates.

- Get a trademark: A state-specific trademark ensures no one else in the state can use the same name. The application for a state-level trademark costs $50.

3. Choose the Right Business Entity

The business structure you opt for can have a significant impact on your operations, income, compliance requirements, and taxes.

A for-profit business in Texas has the following structures to pick from,

Sole Proprietorship

- Most single-owner businesses are automatically considered sole proprietorships

- The owner is personally responsible for debts and liabilities

- It's not a legal entity

Limited Liability Company (LLC)

- The easiest and quickest legal entity to form

- Creates a distinction between the person and business

- Protects personal assets from business liabilities

- Minimal reporting and compliance requirements

Partnership

- Formed by two or more partners

Corporation (Corp)

- Separate legal entity

- Business is owned by "shareholders"

- Daily operations are run by directors: Texas law requires at least a single director. The law allows a single person to hold all three positions of director, president, and secretary

- Stringent reporting and compliance requirements

The Texas Secretary of State will not assist you in finalizing the best entity structure, but Bizee surely can. Tell us about your dream business and we can help you figure out the ideal entity for it.

4. Get Your Company Registered

Depending on which type of business you choose, you may need to register that business with the Texas Secretary of State and pay the associated fees.

How much does it cost to start an LLC in Texas? Here’s a breakdown of costs and registration requirements:

Sole Proprietorship

No

You might need to file a DBA if the business name is different from your legal name.

NA

Partnership

No

You might need to file a DBA if the business name is different from your legal name.

NA

Limited Liability Partnership (LLP)

$200 per partner

Bizee's Business Formation team can assist you with filing the formation paperwork. We'll make sure you've crossed all the Ts and dotted all the Is so your business registration application isn't rejected.

5. Apply for an EIN

An EIN or "Employer Identification Number" is like a Social Security number that the IRS assigns to every business entity. You can apply for your 9-digit EIN for free on the IRS website. Your EIN will make it easier to grow your business in the future, apply for funding, and pay your taxes.

6. Set Up a Business Bank Account

One of the golden rules of running a successful business is to keep your personal accounts separate from those of the business. It keeps the books clean and makes everything easier come tax season.

For Texas, you can use the Governor's Small Business Resource Portal to find information on local banks and other financial resources.

7. Register for Licenses and Permits

Depending on what your proposed business is, you might need to secure other permits, licenses, or approvals at a federal, state, and/or local level. For example, you would require a local health permit in order to run a home bakery.

Check with the Business Permit Office (BPO) and Texas Department of Licensing and Regulation (TDLR) to see what the state-level permit and licensing requirements are for your business. Visit U.S. Small Business Administration website for information about specific federal licenses and permits.

All Texas businesses, even remote ones, selling tangible, taxable goods or services are required to get a seller's permit. You can apply for this permit via the Texas Comptroller website.

8. Build a Website

In today's digital landscape, having a website is one of the keys to small business success. Luckily, you don't need to know any coding to get it in place.

Follow these five steps for building your small business website:

- Find and register a domain name. We recommend you get this done alongside picking your business name. Domain names can be purchased via GoDaddy, Bluehost, Google Domains, and other hosting sites.

- Choose a website builder. Most website builders like Wix, Weebly, and Squarespace are free or have a nominal monthly fee between $3-$27.

- Plan layout, content, and graphics. You can use the templates provided by website builders or work with a graphic designer to create something original.

- Set up a payment system. If you're running an e-commerce business, it would be helpful to have a payment gateway integrated into the website. Most website builders provide this feature at a 3%-5% processing charge.

- Test website. Before officially launching the website, test it. Click on every single picture, icon, and link to make sure everything performs optimally.

- Promote it. Spread the word about your website. Include the link on your social media handles, packaging, GoogleMyBusiness page, and LinkedIn profile.

Texas Business FAQs

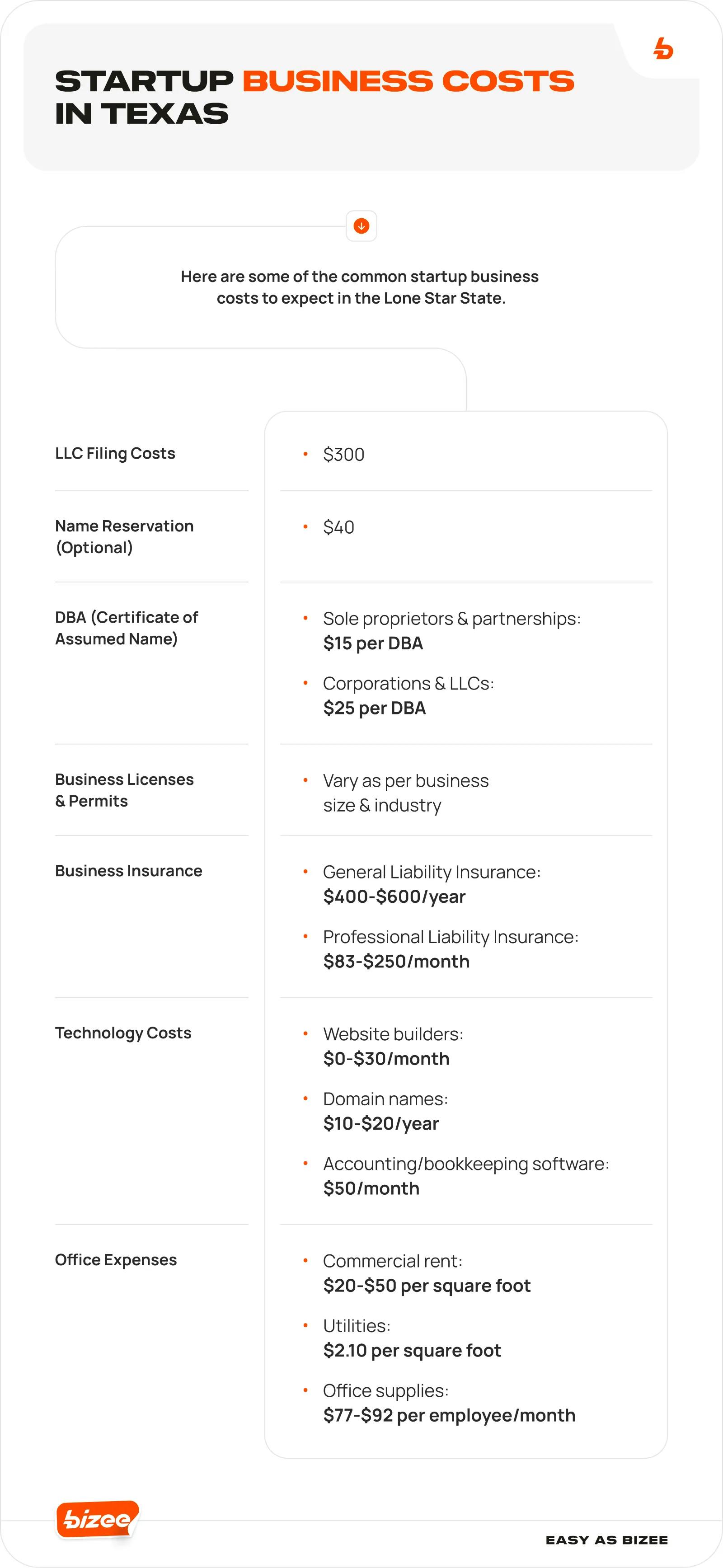

How Much Does It Cost to Start a Business in Texas?

The minimum cost to start an LLC or a corporation in Texas is $300. This is the amount you have to pay to file the Certificate of Formation in order to officially and legally register your business.

If you wish to receive expedited services for your filing, you can expect to pay an additional $25. For hard copies of certified Certificate of Formation or Certificate of Existence, the State of Secretary charges $15.

If you opt to reserve a name before filing for the LLC, the fee would be $40.

We also recommend including the costs of securing the correct licenses and permits in your startup costs checklist. The amount varies according to the business type and size.

Other expenses to be mindful of include technological expenses (website hosting and domain name), equipment, insurance, and yearly compliance costs.

Do You Need a Business License to Operate in Texas?

No, Texas doesn't require a general business license. The Certificate of Formation issued by the Secretary of State or the Assumed Business Name certificate serves as a general business license.

But, as mentioned earlier, your business might require you to get different licenses, permits, or operation certificates at a federal, state, or local level.

How Long Does an LLC Last in Texas?

An LLC in Texas doesn't expire unless a specific termination date is set by the owners on the Certificate of Formation.

If you do set an expiration date on your formation document and wish to change it, you need to inform the Secretary of Texas of the new date by completing a Texas Certificate of Amendment.

How Do I Start My Own Business With No Money in Texas?

The costs of starting a business can certainly add up, with many expenses being non-negotiable. However, don't let that dampen your spirits, as there are ways to minimize the cost.

According to Forbes, the cost of doing business in Texas is 10% lower than the national average. To further reduce your startup costs, do your research before you splurge on high-ticket purchases like equipment or software. You can also reach out to various angel investors and venture capitalists to secure funding.

Go Big in Texas With a New Business

Texas has a lot of factors working in its favor. The thriving economy, business-friendly laws, generous tax breaks, low-startup costs, and large workforce supply are just a few reasons this Southern state continues to be a top choice for aspiring business owners.

If you want a "Made In Texas" stamp for your new business at a nominal cost, Bizee's formation services can turn your entrepreneurship dreams into reality. Our business experts will give you the right information and resources. We can even help you form an LLC for $0 + your state fee.

Form Your LLC $0 + State Fee

Includes Free Registered Agent Service for a Full Year.

Get started today

Swara Ahluwalia

Swara Ahluwalia is a freelance content writer with experience in the technical, B2B and SaaS domain. She also has curated content for various lifestyle brands. In her downtime, you will most likely find Swara training for her next marathon or spending time with her two daughters.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC