Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

There are certain requirements that all business owners will need to complete before forming their corporation. One of the key requirements is filing for Articles of Incorporation. These important documents are required for business owners in all 50 states. And in order for your corporation to start conducting business, these documents need to be submitted and approved by the Secretary of State before your business formation can be considered complete.

Starting a business can be complicated. You need to make sure that you've selected the right name, have a business plan in place, opened up the right bank account, have the necessary financing, etc. You'll also need to complete and submit all of your business formation filings. When it comes to forming a corporation, this will include your Articles of Incorporation. (For Limited Liability Companies, these documents are known as Articles of Organization.)

If you’re just getting ready to form your business and have questions and concerns about how to do it, you’re in the right place. We will help put things in order and answer your what, how, why and where questions revolving around Articles of Incorporation.

Every Bizee Formation Package Includes Your Articles of Incorporation, Filed with Your State.

Form Your Business TodayWhat Are Articles of Incorporation?

Your Articles of Incorporation will consist of key information required by your state in order to form your C Corp or S Corp. They will be part of the public record and it’s important that the information submitted is accurate and up-to-date.

Official forms can be downloaded from your state’s business filing agency, which in most cases is the Secretary of State. Forms will vary by state, but the requested information is basically the same. On your Articles of Incorporation form, you will need to include:

- Business name

- Business address

- Type of business or purpose

- Name and address of your Registered Agent

- Names and addresses of your board of directors

- The number and types of shares the corporation can issue

- The name of at least one “incorporator” who will sign and submit the articles

- The duration of the corporation (if applicable)

How to File Your Articles of Incorporation

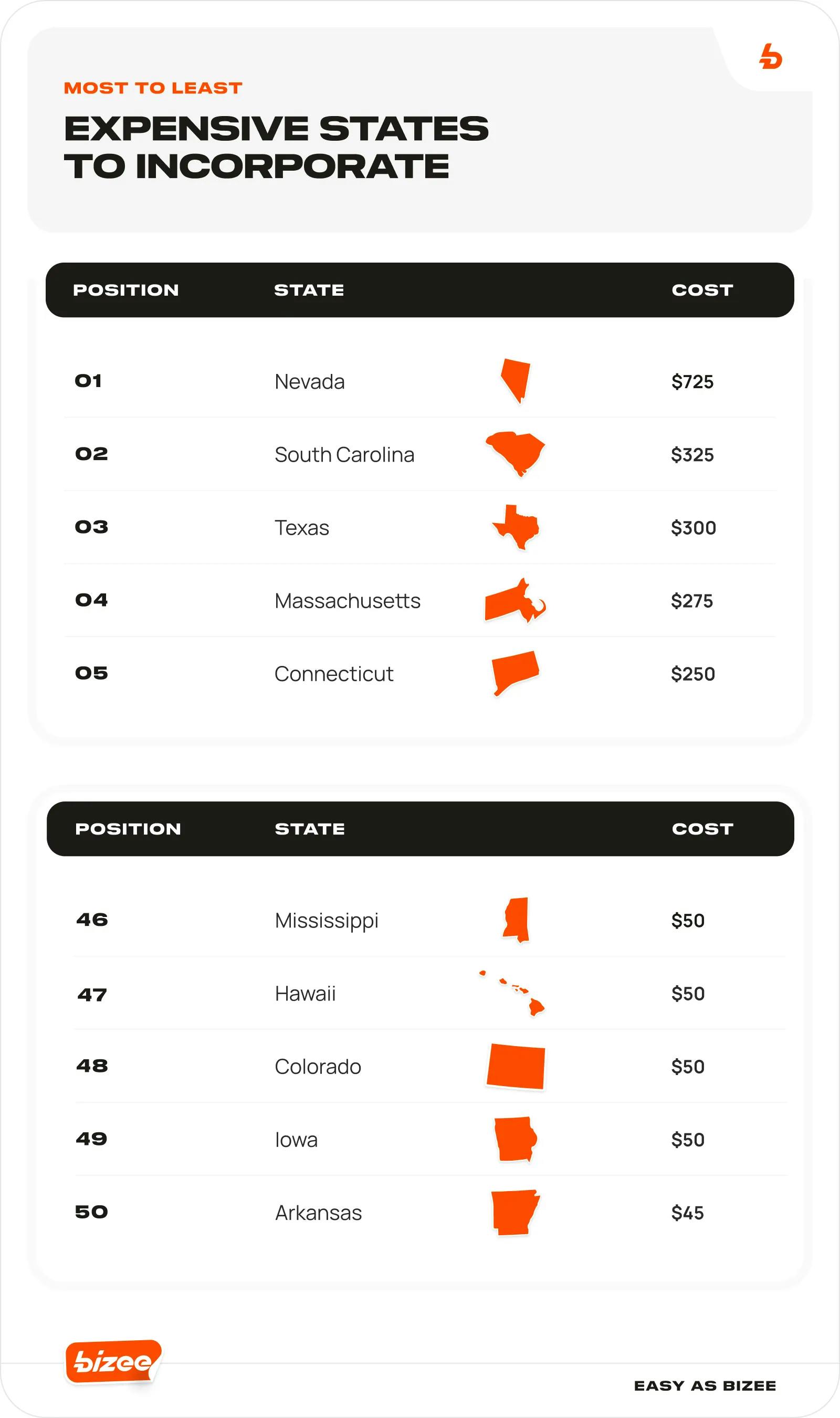

Once the form is completed, the next step is to make sure that the filing fee is also included with your paperwork. Filing fees can range from state to state, with Arkansas coming in at the lower end with a fee of $45 and Nevada proving to be the most expensive with a fee of $725.

From there, you can begin taking the following steps:

Decide How to File

You've got your paperwork and your fee together — now what? Check into the options your state has available for filing. Most states allow you to file online. If that's not the case for your state, then a printer and a visit to your post office will be required. Applying online should be straightforward, but if you need support, professional service providers can help walk you through the process.

Double-Check Everything

Make sure to read the instructions and proofread your form. These are legal documents. Although a process exists for corporations and LLCs to amend a filing, doing this at the initial steps of formation will lead to rejection, loss of time and the added cost of reapplying.

Wait for Confirmation

Once received, the state will review the filing making sure that everything looks good. Stumbling blocks to your application can include an incomplete application, missing or incorrect payment amount and unavailability of your company name. (To avoid the latter, a business name search would be highly recommended.)

Once the application is approved, you will receive a Certificate of Incorporation, setting you on the path the legally conducting business within your state as a corporation.

Although most corporations include bylaws — or at least they should — these are typically not part of the Articles of Incorporation filing requirements. Rather, the bylaws are the rules that govern the day-to-day operation of a business. Articles of Incorporation provide the general details of the business, whereas the bylaws get into the specific procedures and rules for managing the business.

They are helpful in showing how a corporation is run, especially if there is an issue within the board or an internal dispute. And unlike the Articles of Incorporation, which can be viewed by the public, bylaws are kept within the corporation and are not part of the public record.

Why Do You Need Articles of Incorporation?

Having your Articles of Incorporation submitted and approved by your Secretary of State or state governing office formally establishes your business. Now you are legally recognized as a corporation and can participate in the protections and even tax advantages that this designation offers.

Here are five key ways Articles of Incorporation benefit your business:

- Without them, you would not be able to legally operate as a corporation.

- You can now take advantage of favorable tax incentives offered by states, including green energy investments, production incentives, retirement benefits and more.

- Having your business formed as a corporation offers protections from business liabilities against personal assets.

- Your business can exist in perpetuity, making it easy to transfer ownership or to continue operating after the exit or death of key stakeholders in the business.

- An official business entity establishes a public image for your company and adds a level of trust and credibility to your business.

Your Articles of Incorporation are a key requirement to making your business “official” with the state and a part of the overall business environment. Approval of your filing and your Certificate of Incorporation (also called Certificate of Formation) means that you can now move ahead and conduct your business as a corporation.

What Happens After You Receive Your Certificate of Incorporation?

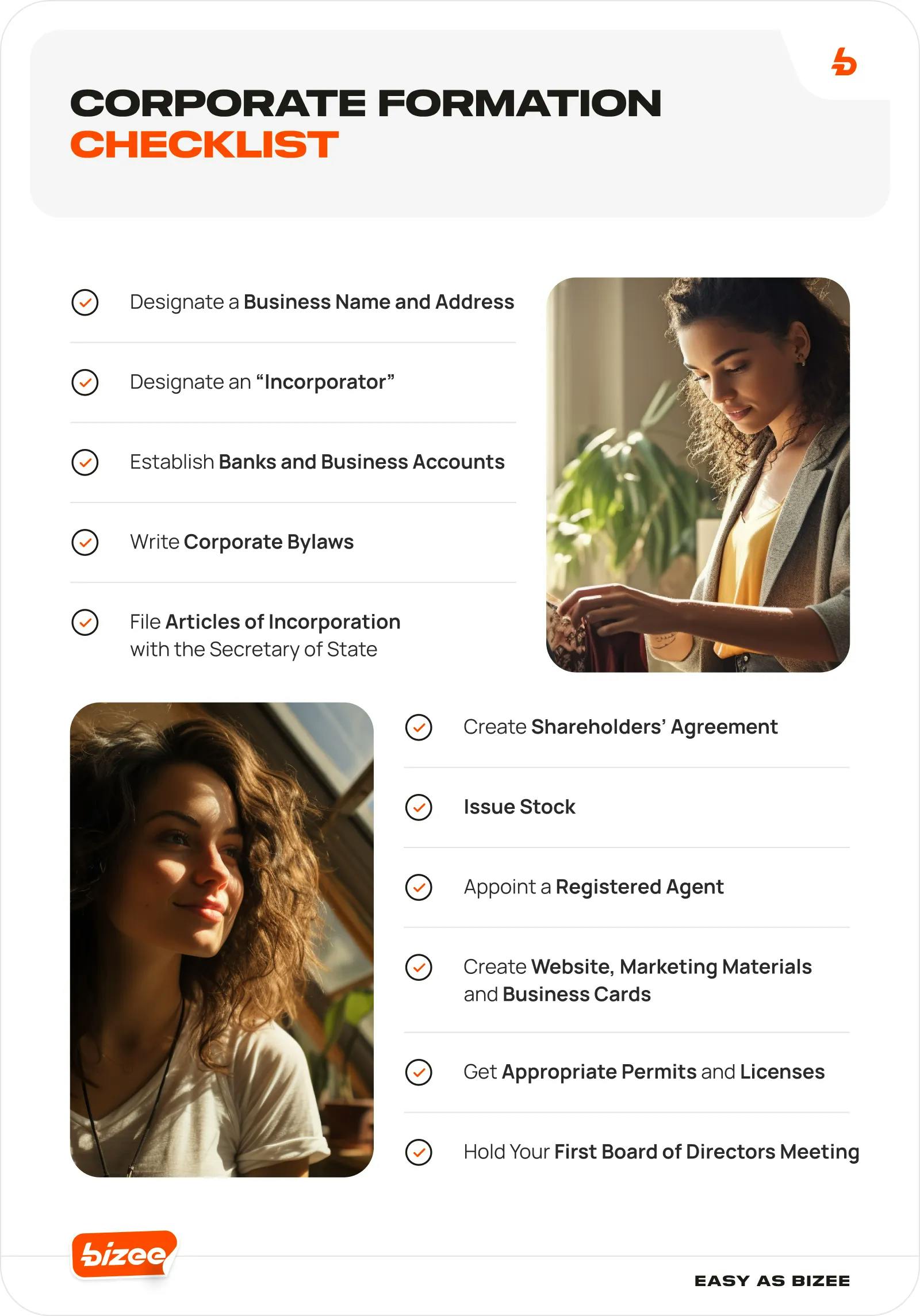

Now that you have your Certificate of Incorporation, you can move on to your next steps of getting your business running. Here's a checklist highlighting more tasks to cover. If you've already received your certificate, skip ahead to the "Write Corporate Bylaws" task.

Bizee’s Articles of Incorporation Service

Since 2004, Bizee has helped 1,000,000 business owners start, run and grow their businesses. Whether it’s establishing your corporation or setting up a Limited Liability Company (LLC), the professional staff at Bizee can find a Registered Agent, submit your state filing and make sure that your Articles of Incorporation (or Organization) are ready to go out for the state's review. If and when the time comes, we can also assist you with your Articles of Amendment and even prepare and file your annual report.

Every Bizee Formation Package Includes Your Articles of Incorporation, Filed with Your State.

Form Your Business Today

Peter Mavrikis

Peter Mavrikis is an author and editor with over 25 years of experience in publishing. He has worked as the Editorial Director for Barron’s Educational Series, as well as Kaplan Test Prep, where he ran the test prep, foreign language, and study guide.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC