Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Do you run your business as a Limited Liability Corporation (LLC) and are now wondering if it’s time to change your legal entity designation into a corporation? Maybe you’re looking into expanding your business and are exploring ways to raise money. Who knows? Perhaps you have a shot at joining the ranks of the Fortune 500!

If moving to a corporation is a serious consideration, you’ll need to make sure you know what you’re getting into. Understanding the tax implications of making the switch and asking questions like, “Do I need a new EIN if I convert from an LLC to a corporation?” are important considerations to make. Weighing the benefits against the disadvantages of moving from an LLC to a C Corporation — as well as the steps involved in making the change — will also need to be factored into your decision-making process.

Get Ready For Your Next Adventure.

Let Us Handle Your Business Dissolution Paperwork — So You Can Get Started On Your Next Great Idea.

File DissolutionThis is a major move for any business owner to take. The conversion may help open new doors and turbocharge your company’s growth plans...or it may disrupt your current business with complications that you did not intend.

So, if you're wondering...

Should I Change My LLC to a Corporation?

The first consideration is how this change in designation works in your business plan and whether it’s the right move for you.

If you’re looking to find investors for your company with the intent of raising capital for growth, running your business as a C Corporation would make sense. Through your corporation, you can create and sell shares in your company and even entice and reward your employees by making share distribution part of their incentive package. Having a corporation can even give you the opportunity to become a publicly traded company.

Running your business as a corporation, just like an LLC, also offers you the strongest protection against personal liability. That means that there’s no risk to your home, personal savings accounts or other assets should the corporation fail. The business is totally separate from your personal assets.

There are other plenty of other considerations when taking your business to the next level, but before we look into how to make the change, let’s take a deeper look at the pros and cons of making the move to a corporation.

The Pros and Cons of Converting Your LLC into a C Corp

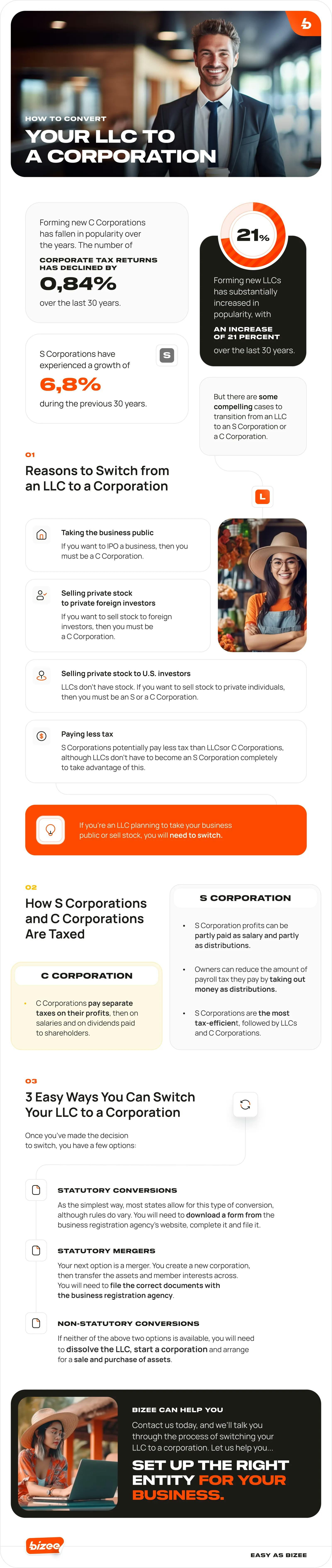

The four major consequences of switching from an LLC to a C Corp can be broken down into management complexity, filing and compliance, the ability to raise capital and taxes. Whether these consequences play a positive role in your business or generate negative implications will all depend on your goals and tolerance for the demands of moving from LLC status to a C Corp designation.

Advantages of a C Corp

1. Management Complexity

Though this may not sound like much of an advantage, the management structure of a C Corp creates a well-established infrastructure that is best suited to meet the goals and demands of your growing business. A strong and stable management structure provides a business with the highest level of organization that is supported by annual board of director and shareholder meetings and the establishment of bylaws that will help guide the business moving forward.

Having a strong board of directors and management team can not only benefit the operation of the business but also instill confidence with shareholders and bring in additional capital from new investors.

2. Selling Company Shares

One of the key benefits of operating as a C Corp is the ability to raise money by selling shares. Attracting investors can help fund expansion plans and grow a business.

3. Distribution of Shares

In addition to using shares as a way to attract investors, they can also be used as a means of attracting and rewarding employees. Offering shares in the company can help entice the right people to join your team as well as motivate and enrich your talent pool. The better the company stock price performs, the more money they make.

4. Flexible Ownership

C Corp ownership belongs to the stockholders. The more stock you own, the higher the percentage of the company belongs to you. There is also no limit to the number of owners of a corporation.

Disadvantages of a C Corp

1. Less Flexibility

Unlike LLCs, which are easier to form and operate, C Corps are more complicated and the rules are bound with added formalities. Such formalities include creating bylaws, electing a board of directors, holding board and shareholder meetings and keeping meeting minutes. There are also a number of rules that need to be followed regarding the issuance or transfer of stock, keeping a stock register and paying out dividends.

2. Complicated Taxes

Corporations are subject to double taxation. This means that the C Corp pays taxes on income and taxes are also deducted from dividend payments made to shareholders. To put it simply, you are paying taxes twice: (1) corporate income tax, which averages 21 percent (2) personal return, which will depend on personal tax rates.

LLCs, on the other hand, can pay taxes as a pass-through entity where the income earned by an LLC is passed along to the owner’s taxes and assessed that way.

3. Higher Costs

Starting up and maintaining a C Corp is costlier than other types of entities, including LLCs, sole proprietorships and S Corps.

4. Reporting Losses

Whereas owners of LLCs and S Corps can deduct losses on their personal taxes, this is not an option for owners and shareholders of a C Corp. These losses can only be deducted on the C Corp's tax return.

Finally, two similarities that both C Corps and LLCs share are that both entities offer limited liability protection and they can be owned by both U.S. and non-resident owners.

How to Convert Your LLC to a C Corp

There are three different ways to change your LLC into a C Corp. Options range from the simplest method supported by most states known as “statutory conversion” to the more complicated method, the “statutory merger.” It is important to look at your individual state's requirements to see if statutory conversion is available by checking with your Secretary of State.

Details and key requirements covering these three options include:

Statutory Conversion

- Create a plan of conversion from your LLC to a C Corp. This will lay out the details of the conversion, such as entity name before and after conversion and any terms and conditions. Your state may provide a template to be filled out.

- Have this plan approved by the members of your LLC.

- File a Certificate of Conversion with your Secretary of State.

- Prepare and submit a Certificate of Formation.

Once your LLC converts to a C Corp, the members of the LLC that signed off and approved the plan of conversion are now shareholders of the corporation.

Statutory Merger

- Form the C Corp.

- Apply for a new EIN.

- Current LLC members must approve a merger of the LLC into the new business.

- A Certificate of Merger must be filed with the Secretary of State.

- Merge the liabilities and assets to the new corporation.

Unlike the statutory conversion, the C Corp must be formed before the assets and liabilities of the LLC "merge" with the new entity.

Non-statutory Conversion

For this final and most complicated and costly option, a business owner must:

- Form a new corporation.

- Transfer the LLC’s assets and liabilities to the corporation.

- Issue corporate shares to the LLC members.

- Dissolve the LLC.

The transferring of assets and liabilities to the newly formed C Corp can be a complicated process that will require expert guidance to avoid any legal implications. Unlike the other two methods, the transfer is not automatic. Additional steps must be taken to complete the transfer and exchange LLC membership to company shares.

Do I Need a New EIN If I Convert from an LLC to a Corporation?

One common question asked during this process is whether a new Employee Identification Number (EIN) is required. According to the Internal Revenue Service, and as noted above, you’ll need a new EIN if a "new corporation is created after a statutory merger.”

Final Steps to Completing the Transition to C Corp

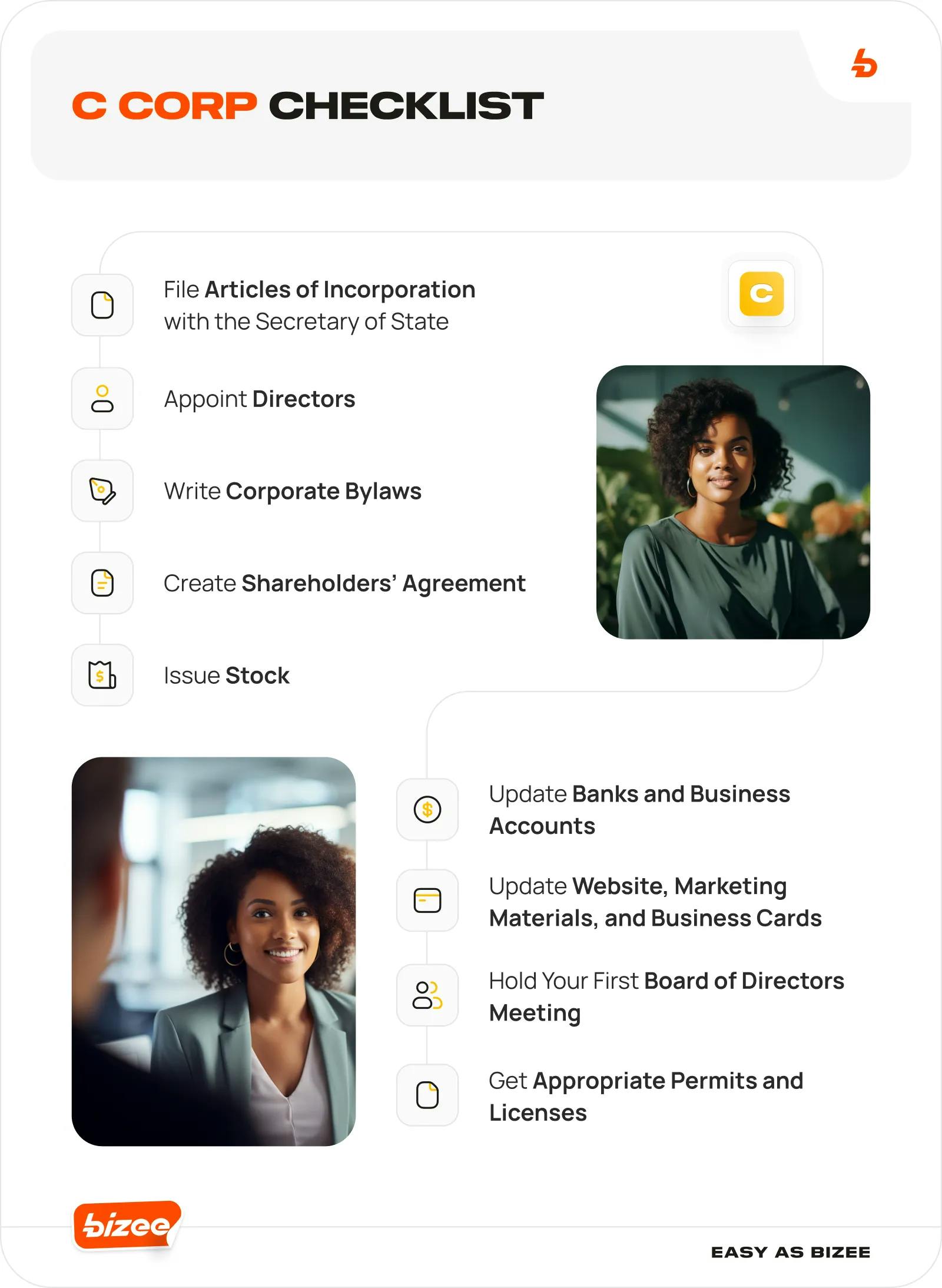

Once you convert your LLC to a C Corp, there are a few final steps to take to complete the process. Assuming that the business name is kept the same, the next items to check off of your list include:

Easy C Corp Formation

LLCs offer flexibility and help simplify taxation and maintenance requirements, but if you are looking to raise money through investors or plan to take your company public, then a C Corp may be the best path to follow.

Changing your LLC to a C Corp is a big step for any business owner. If you want to dissolve your current business first, Bizee can help.

Get Ready For Your Next Adventure.

Let Us Handle Your Business Dissolution Paperwork — So You Can Get Started On Your Next Great Idea.

File Dissolution

Peter Mavrikis

Peter Mavrikis is an author and editor with over 25 years of experience in publishing. He has worked as the Editorial Director for Barron’s Educational Series, as well as Kaplan Test Prep, where he ran the test prep, foreign language, and study guide.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC