Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

What’s the difference between a traditional LLC and a Series LLC? Is one business entity better than the other?

Here, we'll compare Series LLC vs. LLC and discuss where and how a Series LLC functions and which type of LLC might be beneficial for your company.

What Is a Standard LLC?

A standard LLC is a business entity that provides small business owners with protection by separating their business and personal assets. This means that a business owner can only lose the money invested in the business and will not personally be required to pay back debts or cover damages when facing a lawsuit.

Other key factors contributing to LLCs' popularity include their flexibility, low cost, and less complicated tax preparation, especially when it comes to single-business tax reporting.

Join the 1M+ businesses that trust Bizee

Get StartedWhat Is a Series LLC?

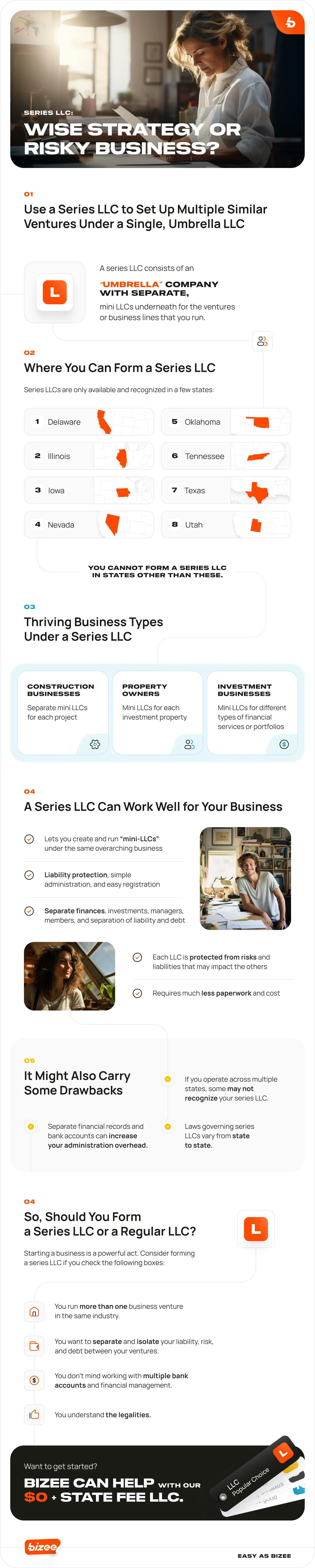

A Series LLC gives you all the same benefits as a regular LLC, but it serves as a sort of "umbrella company" with additional flexibility and protections for multiple companies or lines of business within your overall operation.

But who uses a Series LLC? One example is rental property owners. A Series LLC can give rental property owners a way to separate their real estate investments from one another. Businesses that operate multiple channels of revenue (or have separate teams or divisions in different states) may determine that a Series LLC is the best fit for their company as well.

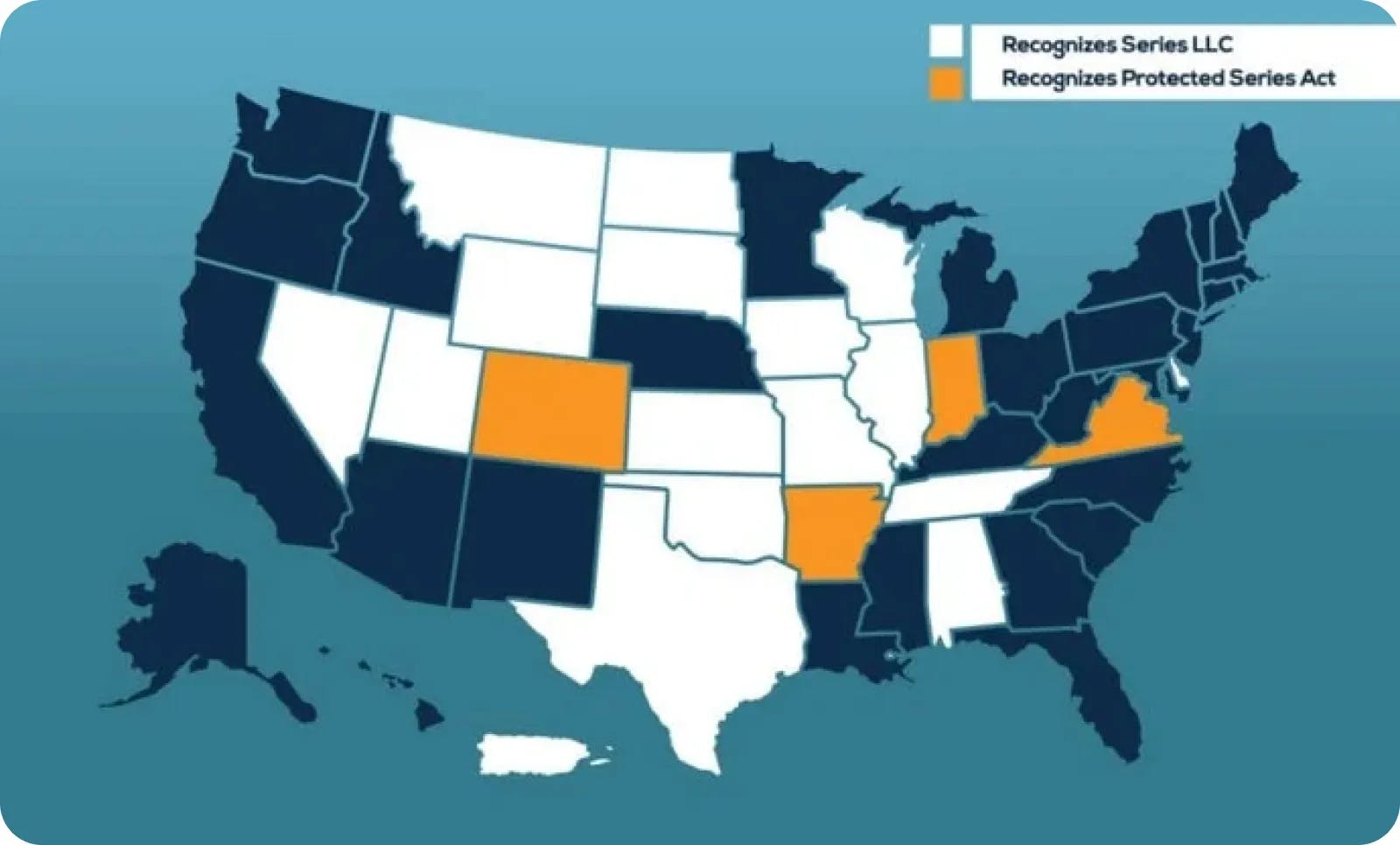

Even though Series LLCs (sometimes called an LLC with the ability to establish a series) were created to simplify investment portfolio management, this type of business structure is still a relatively new approach to LLCs. And Series LLCs are currently available in 22 states, including Delaware, Nevada, Texas, Virginia, and Wyoming.

So, depending on the state in which you reside, the Series LLC option may not be available. If it is available, each "Series" of the LLC should be added and listed in the operating agreement.

It's also important to understand the distinction between a Series LLC vs. a holding company. If you start a holding company, you will not be actively operating any of the businesses underneath you. With a holding company, you will strictly own stock in another company, enough stock to have sway over its management but not direct operations.

Standard LLC vs. Series LLC

One key feature of an LLC common in both types of LLCs is asset protection. Do you plan to form your business as a standard Limited Liability Company, which is what millions of business owners do every year in an effort to protect — and separate — their personal assets from their business assets, or are you planning on forming multiple LLCs under a parent company — also called a Series LLC?

Two examples where the latter would work include multiple real estate properties or separate investments. If you fall under these two examples, you would want protection from liability and risk between the individual companies.

To help you determine what type of LLC is right for your business, here are the pros and cons of each option.

Standard LLC: Pros and Cons

Many business owners form one LLC or create a DBA (Doing Business As) in lieu of forming multiple LLCs. Learn the pros and cons of standard LLCs below.

Pros:

- You can have one LLC with multiple DBAs that fall under the same company.

- A DBA can help identify your company with the business, as well as provide product and service branding.

Cons:

- A DBA is not a formal business structure or even a separate business entity but rather an extension of your company.

- Since it’s not a separate LLC, there is a risk that each DBA will be liable for damages since they all fall under the same LLC.

Series LLC: Pros and Cons

If your state allows a Series LLC, consider these pros and cons before deciding what entity is best for your business.

Pros:

- It limits the risk between each business by providing separate liability.

- A Series LLC may make loan and bank approvals easier.

- You can secure legal entities with different names with a Series LLC, something a DBA cannot accomplish.

Cons:

- Compared to a single LLC, accounting and tax filing becomes more complex and costly.

- Depending on the state, you may have to pay annual fees and costs for each LLC and also meet compliance requirements for each, which can become more complicated and costly.

Benefits of Forming a Series LLC Over a Standard LLC

A Series LLC can be a great way to separate your business assets and divide the responsibilities for investment and debt into different areas or divisions of your company.

A Series LLC allows you to form multiple “mini-LLCs,” so to speak, and operate them all under a single umbrella company. Each LLC in your series would have its own members, bank accounts, debt, and other unique qualities that make up a typical LLC.

Operating in this fashion can also help you disperse and minimize any risk and liability that could be shared if you operated all your businesses under one single LLC.

Benefits of Forming a Standard LLC Over a Series LLC

The main benefit of forming a standard LLC over a Series LLC is the ease of formation and management. A standard LLC is not only simpler to set up, but you won't have to deal with the inconsistencies of Series LLCs as your business grows.

For example, if you wanted to expand your business to a new state that doesn't accept Series LLCs, you'd be in a pickle if you didn't choose a standard LLC business entity. And because the rules vary in the states a Series LLC is legal in, you might also run into issues when it comes to what you are held liable for in each state.

You'll also have to deal with multiple bank accounts and Registered Agents if you have a Series LLC, which, if you don't have several business partners, can get confusing — fast. That's why we recommend filing a standard (and free) LLC for most business owners.

Getting the Right Advice

Whether a Series LLC or standard LLC is the best choice for you, it's good to be cautious and seek professional advice before making any major business decision. So if you have a complex business that you want to simplify and operate as efficiently as possible, you might want to meet one-on-one with a local CPA or seek the advice of a company like Bizee that specializes in LLC formation with state-specific expertise. The right decision could save you money, time, and years of legal headaches.

Peter Mavrikis

Peter Mavrikis is an author and editor with over 25 years of experience in publishing. He has worked as the Editorial Director for Barron’s Educational Series, as well as Kaplan Test Prep, where he ran the test prep, foreign language, and study guide.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC