Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

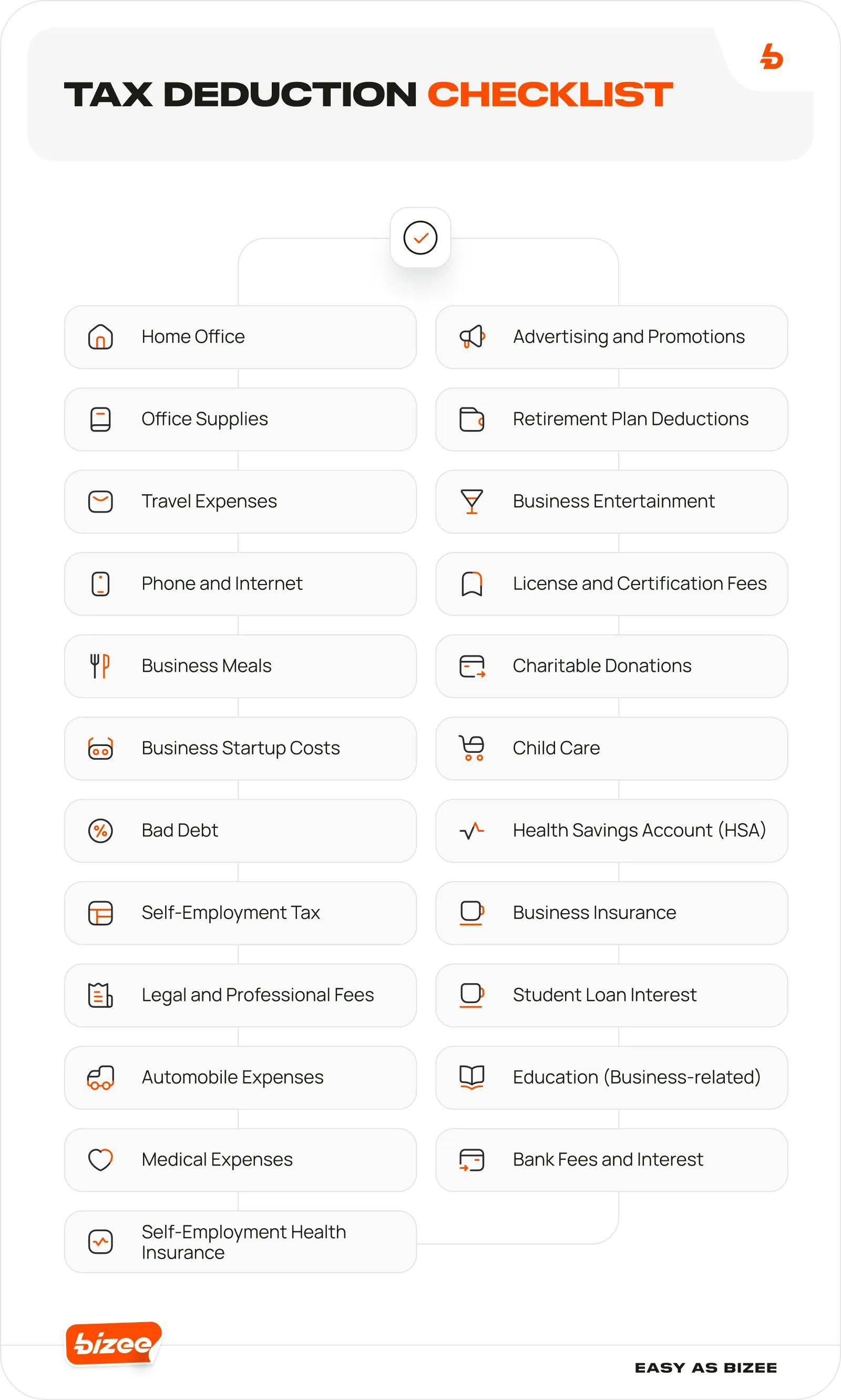

Not only can preparing taxes for your startup or LLC can be complicated, but it can also be costly. You could be overlooking thousands of dollars in deductions a year if you file without assistance. This essential tax deduction cheat sheet gets you started with the most eligible tax breaks you could be missing out on.

15 Tax Deductions for Your LLC or Startup

You might be a business owner wondering, "How can I legally reduce my taxes?" There are several legitimate ways a business can utilize deductions to lessen its tax liability and keep more profits. Most of these tax deductions can apply whether you're a startup or have been in business for a number of years.

Use this tax deduction cheat sheet of 15 ways to shave money off your tax bill:

1. Home Office

If you work from home, you can apply this deduction toward your taxes. This deduction will allow you to claim expenses associated with the upkeep of your home office, including a portion of your home utilities, Wi-Fi, repairs, home insurance, etc. A standard deduction of $5 per square foot of the portion of your home used for business or actual expenses based on a percentage of your home used for business can be claimed. Make sure to keep all receipts and documents related to working in your home office.

2. Office Supplies

All the equipment, tools, and supplies needed to run your business are deductible. These can include:

- Stationary

- Computer

- Printer

- Office furniture (desk, chair, shelving, drawers, etc.)

- Ink cartridges

- Thumb drives

- Business-related subscriptions and computer programs

- Postage and packaging material

- Cleaning supplies

3. Travel Expenses

You can deduct 100% of your business and travel expenses. These can include air travel, business lodging, meals, entertainment, parking fees, car rentals, and gas.

4. Phone and Internet

You can write off your cell phone or landline use as long as you use your phone for business purposes. This can include everything from your monthly cell phone bill to the cost of your new smartphone.

5. Business Meals

Prior to 2021, business meals were capped at 50%. Luckily, this has changed since the COVID pandemic. For the 2022 year, you can deduct 100% of business meals when "talking shop" with employees, but keep your receipts. In 2022, business meals were 100% deductible when conducting business meetings at a restaurant with employees. However, as of 2023, the business meals deduction rules reverted back to pre-2021 rules of 50% deductibility.

6. Business Startup Costs

This deduction is ideal for new businesses that have invested money to form and start their LLCs. New businesses can deduct up to $5,000 in taxes for startup costs and an additional $5,000 in organizational costs, but only if startup costs are $50,000 or less. If startup costs exceed $50,000, the allowable deduction amount is reduced by the overage. The deduction is eliminated if those costs exceed $55,000 and must be amortized over 15 years.

7. Bad Debt

If you have a vendor or customer that has not paid their bill, has gone out of business, or has not responded to any attempt to pay off their balance, business owners can claim a deduction from this "bad" and uncollected debt.

8. Self-Employment Tax

Sole proprietors and LLCs with only one owner pay the full amount of self-employment tax, which is 12.4% for Social Security and 2.9% for Medicare (15.3% total). The IRS allows you to deduct half of the self-employment tax (7.65%) on your income taxes, therefore reducing your tax liability.

9. Legal and Professional Fees

Whether it's for a consultation, to draft a contract, or to prevent or defend against a lawsuit, lawyer fees can add up quickly. The good news is that legal fees related to the operation of a business are tax deductible. The same applies to professional fees, including tax preparation services.

10. Automobile Expenses

If you use your vehicle for business purposes, you can deduct your auto expenses, including miles driven. You can also count your vehicle as a business asset and deduct the depreciation value.

11. Medical Expenses

Medical expenses are going up every year. One way to save is by tallying up the cost of your health plan, co-pays, deductibles, and any other fees related to medical needs, including medicines. (Worth repeating: Keep good records.)

If medical expenses add up to more than 7.5% of your adjusted gross income, then you can deduct anything over that amount.

12. Bank Fees and Interest

Interest payments and bank fees can take a huge chunk of a business's revenue. This is especially true when dealing with a high-interest rate environment.

If your business uses credit to finance purchases, the interest charges are fully tax deductible. The same applies if you take out a loan to help fund your company.

13. Advertising and Promotions

If you're a startup ready to print your first batch of business cards, announce a promotion, or launch an advertising campaign, all your expenses are tax deductible.

In addition, the fees associated with maintaining and running your website, advertising yourself online, or even sponsoring your local middle school softball team are all tax deductible since they're considered the "cost" of advertising your goods and services.

14. Retirement Plan Deductions

A SEP IRA is an ideal way for business owners to sock away money in a retirement account and deduct the contribution from their taxable income.

15. Business Entertainment

Showing your clients a good time can be part of your job, especially if you're looking to build relationships and discuss business prospects. As of the Tax Cuts and Jobs Act introduced in 2017, most entertainment expenses are no longer deductible; however, entertainment-related meals are 50% deductible if the charges are separate from the cost of entertainment.

Bonus Tax Deductions

Additional tax deductions for 2023 can include the following:

- Cost of licenses and certification fees

- Self-Employment Health Insurance

- Charitable donations

- Health Savings Account (HSA)

- Child care

- Business insurance

- Student loan interest

- Business-related education

Tax Workarounds for LLCs

Unlike a C Corporation, an LLC does not pay corporate income tax. That doesn't mean you don't need to file a business tax return, but this does offer a big benefit by allowing you to treat the LLC as a "pass-through" entity for tax purposes. Simply stated, the income earned by the LLC "passes through" the business owner's personal taxes. Here's how this and other tax loopholes for LLCs will help save you money:

- Filing as an S Corp. To gain the maximum tax benefit, your LLC will need to file taxes as an S Corp. This will help you reduce your self-employment taxes by paying yourself a salary from a portion of the revenue and distributing the rest of the money earned by the business as a dividend.

- Capital expenditure deductions. Money used to buy physical assets for a business, such as property, vehicles, buildings, equipment, or technology, is a big investment many small businesses make. Payments for these assets and their upkeep can be deducted incrementally throughout the year.

- Qualified Business Income Deduction. This deduction, also commonly called QBI, is worth up to 20% and can be taken in addition to standard and itemized deductions. This applies to net income (minus business expenses). Instruction can be found in IRS Form 8995 or through a tax professional.

Tax Terms to Add to Your Repertoire

When working on your business taxes, it's important to know the terms used in the tax filing process. To help, we've put together a list of the most common tax terms and their definitions:

Above-the-Line Deductions

Amounts that are subtracted from the gross income include contributions to a retirement account, health saving account, student loan interest, etc.

Adjusted Gross Income (AGI)

All income received during the year, including wages, dividends, capital gains, and interest, minus all qualified deductions and expenses. The AGI is used to calculate tax liability.

Amortization

Method of writing off the cost of an asset, such as equipment, vehicles, or buildings over a number of years.

Capital Expenditure

Funds used to improve a business, particularly when it comes to growing income capacity.

Capital Gain

Money gained from the sale of an asset such as shares, property, or land. This amount is above the cost of the asset.

Capital Loss

Money lost from the sale of an asset such as shares, property, or land. To calculate capital loss, subtract the purchase price from the lower selling price.

Carryover

When credits or deductions cannot be used and must be transferred to the following year's tax filing.

Credit

The amount that can be applied to reduce the total tax bill. A $1,000 tax liability with a $100 credit will reduce the federal income tax bill to $900.

Charitable Contribution

A deduction earned for donating to a charity, qualifying non-profit, or foundation. Charitable gifts can include money, clothing, real estate, or household items.

Deduction

A monetary amount that can be subtracted from the taxable income and used to reduce a filer's taxable income.

Dependents

Someone who depends on a taxpayer for support. This can include a spouse or child.

Earned Income Tax Credit (EITC)

A refundable tax credit for low and moderate-income families with children.

Estimated Tax Payments

The estimated amount deducted from income throughout the year. This method is an option used by business owners to submit estimated taxes in four equal amounts dispersed on a quarterly basis. Any overpayments will result in a refund after annual taxes are filed.

Exemption

The amount that can be deducted from the AGI reflecting all the people dependent on your income. An exemption can include yourself, your spouse, or your children.

Filing Status

The classification used by the IRS to calculate the standard deduction and other tax breaks. There are five filing statuses:

- Single

- Married (filing jointly)

- Married (filing separately)

- Head of household

- Widow or widower (qualifying)

Income Tax

The tax imposed on businesses and individuals (or families) by the federal government based on income received.

Itemized Deduction

An item-by-item list of the deductions that can be claimed including medical expenses, mortgage interest, real estate tax, charitable contributions, etc.

Pass-Through Entity

Structured entities that allow business owners to avoid double taxation. In many cases, this lets business owners pay taxes on personal income earned through the business.

Self-Employment Income

Income received for services provided and paid to a sole proprietor, freelancer, or independent contractor.

Standard Deduction

The fixed amount that taxpayers can deduct from their income. The number is adjusted every year and varies whether taxes are filed as single, married, or head of household.

Tax Deductions

Also called tax write-offs, these are the expenses that can be deducted from your AGI to calculate your final tax liability. The tax deduction can fall into the following categories:

- Above-the-line deductions

- Itemized deductions

- Standard deductions

Tax Liability

The amount owed to the IRS calculated in a tax filing.

Taxable Income

The amount used to calculate how much is owed in taxes.

Voluntary Compliance

Fulfilling tax obligations and honestly reporting all income and tax activity related to filing with the IRS.

W-2

Tax paid by the employer for a full-time, salaried employee.

Withholding

The amount deducted from wages or other income to pay toward taxes.

7 Tax Mistakes to Avoid This Tax Season

Are you preparing your taxes for your startup or LLC on your own? Be cautious when filing business taxes without the help of a tax-deductible service — there are penalties and fines you could end up facing. Plus, the rules to file are always changing. Read on to learn some of the most common mistakes to avoid:

- Making "avoidable" errors on your tax form: Spell your name correctly, include the correct Social Security or EIN, and make sure all the boxes you check are intended to be selected.

- Overlooking or forgetting to add information that the IRS is already aware of: As we get closer to tax reporting time, you'll begin to receive documents showing how much you earned. These may include bank interest, dividends from stock that you own, or direct income earned. Make sure you enter all these amounts accurately, as the IRS already has this information. Failure to match the records collected from your bank, brokerage firm, or employer will raise a huge red flag with the IRS.

- Neglecting to add business deductions: Go back to the beginning of this article and review the deductions you can legally claim for your business. Neglecting to add these deductions will make your tax bill much higher.

- Keeping inaccurate records: It's important to keep your bills, receipts, invoices, and other documents related to your business in case you get audited by the IRS. Having this paperwork will prove that the deduction and credits claimed are valid. Keep these records for at least three years.

- Missing your tax payment date: If you owe money to the IRS, make sure you pay it by or before the cut-off date. Generally, the due date is April 15, but this can vary if the date falls on a weekend. For 2023, the date is April 18. Failure to pay will result in a penalty of 5% of the amount owed per each passing month.

- Missing your tax filing date: The tax filing date for 2023 is April 18. Forgetting to file your taxes by the due date will lead to fines and penalties. If you really need more time, make the effort to file for an extension by submitting Form 4868. This will give you four more months to gather your documents and information. Just make sure you file by October 16.

- Submitting your return unsigned or undated: This happens more often than you'd think. Unsigned or undated tax returns cannot get processed, so if you followed all of the advice in this article but neglected to sign your form, you will need to refile completely.

What Can I Claim Without Receipts?

Having receipts is the best and safest way to claim deductions. If you're audited, you'll need to show them. If you make a claim and don't have a receipt, a bank statement, invoice, or bill may also work as a record. Some items that may fall into this category include vehicle expenses, retirement plan contributions, health insurance premiums, and cell phone expenses. Most of these items will have a record in your bank statement or a bill statement.

What Is the Best Write-Off for Taxes?

The answer depends heavily on your business and the types of expenses it incurs. However, for the lowest tax bill possible, you should be taking full advantage of all the write-offs listed above.

How Much Can an LLC Write Off?

For the most part, there is no limit to the amount that an LLC can claim as a deduction for the business. When it comes to write-offs, it's important to reiterate that the documentation and receipts are kept to validate the deduction. Some deductions, however, do have set limits. The deductions limit for starting a business is $5,000 for startup expenses and $5,000 for organizational expenses. If startup costs exceed $55,000, they can be amortized over a maximum 15-year period.

Contributions to a self-employment pension (SEP) fund also have a limit and are capped at 25% of the company's revenue or $66,000 for 2023 ($61,000 in 2022). For a Simple IRA or Simple 401(k), the maximum contribution is $15,500 in 2023 ($14,000 in 2022). This can increase to $19,000 (2023) or $17,000 (2022) if you are 50 or over.

Maximize Your Deductions With a Tax Specialist

Filing taxes can be complicated and time-consuming if you're running your own business, especially if you undergo an audit. Avoid missing crucial information or deductions by hiring a tax-deductible professional. Bizee offers a business Accounting and Bookkeeping service to make your business filing a breeze.

Peter Mavrikis

Peter Mavrikis is an author and editor with over 25 years of experience in publishing. He has worked as the Editorial Director for Barron’s Educational Series, as well as Kaplan Test Prep, where he ran the test prep, foreign language, and study guide.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC