Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

The battle is on! LLC vs. S Corp? What is better? Both LLC and S Corps are business structures offering limited liability protections and allowing pass-through taxation. However, there are advantages and drawbacks to both models.

In this guide, we'll explain the difference between LLC and S Corp and provide crucial information to help you decide what's best for your business.

Ready to Legally Form Your S-Corp or C-Corp?

Get Started With Our Corporation Formation Packages Today.

ORDER NOWWhat Is an LLC?

An LLC, or Limited Liability Company, is one of the simplest and quickest legal entity structures a business can assume. Forming an LLC creates a distinctive legal separation between the business and the person. This separation keeps one's personal assets, such as a car, house, or personal savings, protected from any business liabilities or debts.

LLCs are extremely popular because they are easy to form, build business credibility, offer more structure and protection than sole proprietorships, and in some cases, also provide tax benefits.

To form an LLC, you have to fill out the Articles of Organization paperwork and pay a stipulated fee to the Secretary of State in your state of business.

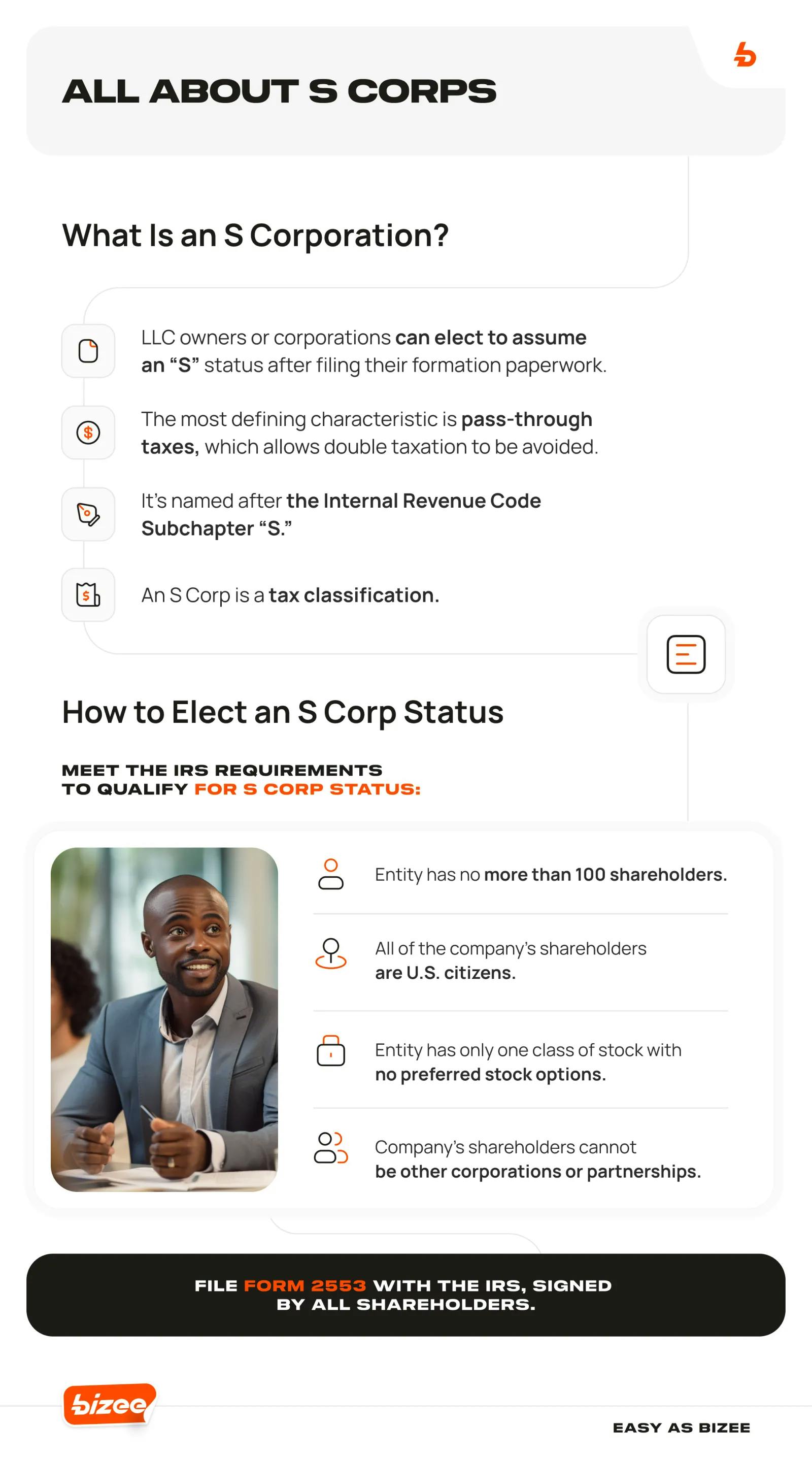

What Is an S Corp?

An S Corporation, or "S Corp," as it's popularly known, is a type of tax classification that allows a business's taxable income, debt, credits, deductions, and losses to be passed directly to its owner or shareholders. Therefore, no separate corporate taxes have to be paid.

The S Corp name is derived from the Internal Revenue Code Subchapter "S," and the IRS (Internal Revenue Service) has many requirements in order for a business to qualify as an S Corp.

It's helpful to think of an S Corp as a "lite" or smaller version of a corporation. An S Corp is a for-profit company incorporated under and governed by state corporation laws. Much like a C Corp, an S Corp must adhere to strict internal practices and formalities like having a board of directors, writing corporate bylaws, and conducting shareholders’ meetings.

S Corp and LLC Similarities

Here are a few ways an S Corp and LLC are similar:

Provides a clear distinction between business and individual

Offers limited liability protection

Pass-through entities (no double tax like corporations, and profits go directly to members)

Subject to ongoing state requirements (like annual reports, fees, and Registered Agent)

LLCs and S Corps: What Sets Them Apart

Ownership (members and shareholders)

Anyone can serve as a member — it could be another individual, LLC, or corporation

No cap on the number of owners

Limits shareholders to 100

Shareholders must be U.S. citizens or permanent U.S. residents

Can't be another LLC, trust, partnership, or corporation

Management

Made up of company members or managers

They can run daily operations or choose to appoint officers

Needs a board of directors and officers

Officers (president, vice president, and treasurer) will run the company

Choice of Taxation

Can opt to file as LLC or S Corp or corporation

S Corp will be taxed as per subchapter S of the IRS Code

Tax Liability

Must pay 15.3% of self-employment taxes on net profits

Can reduce self-employment tax by withdrawing an owner's salary

Have to pay payroll taxes on salary

Board/ Shareholder Meetings

Not mandatory

Mandatory

Paperwork & Records

Annual reports are required

Annual reports are required

Meeting minutes have to be kept as official records

Stock Rules

Cannot issue stock or have shareholders

Only one class of stock is permitted with shareholder voting rights

Salary Payout

LLC owners or members aren't required to pay salaries to themselves

Required if ownership is more than 2% and owners are providing services to the company

Salary needs to be at market rate

Business Name

Need to have "LLC" or a version of it — rules can differ with each state

Can be designated as Inc, Corp, or Corporation

Legal Agreements

Beneficial to have an operating agreement, but not required

Corporate bylaws are required

Formation Fees

Averages between $100-$200, but varies per state

Averages between $45-$100, but varies per state

LLC Benefits

What advantage does an LLC have over an S Corp? We've highlighted some of the benefits an LLC brings to the table:

- Liability: The limited liability protection of LLCs is integral to its usefulness. After all, it’s right there in the name. An LLC creates a separation between the business and the owner. It keeps all your personal assets like home, savings, and car shielded from business liabilities.

- Taxation: All businesses have to report taxes, and it can be difficult. In the case of an LLC, your company isn't responsible for its own taxes. Rather, it's taxed as part of your personal income.

- Ownership: Whereas other business entities must face ownership restrictions that might prohibit foreign or corporate entities from becoming a member of your company, an LLC has no such limitations. You can decide who runs the company — you as an owner or other members.

- Membership: With an LLC, there is a lot of flexibility around who can be a member. An individual, corporation, trust, or even a partnership can serve as an LLC member, and there is no limit on how many members you have.

- Profit distribution: Much like ownership, this is another area in which LLCs enjoy more freedom. In this case, the profit shares may be broken down and distributed however you see fit, even if they differ from the percentage of ownership.

- Easy start and compliance: Perhaps the greatest appeal for LLCs — aside from the liability protection — is that this business entity requires minimal effort to start and remain compliant with regulations. Unlike corporations, the initial registration fees and paperwork are relatively light, and you control your own meetings and documentation.

LLC Drawbacks

While LLCs can be formed quickly and offer a plethora of benefits for small business owners, they do pose some limitations:

- Taxation: Taxes can be a double-edged sword. With an LLC, you can opt for how you wish to be taxed, but in some cases, the pass-through taxation can also create problems when it comes to your self-employment taxes. You might wind up with higher taxes as a result of how much income your LLC earns.

- Record-keeping: While limited liability protection goes a long way toward simplifying your finances, you do have to devote a bit more time to ensure that your personal finances are separate from those of your business.

- Banking: To keep the books organized, you’ll want to use separate credit cards and checking accounts for your business and personal assets. This will reinforce the distinction between the two and make it that much easier to retain your liability protection.

- Termination: Although corporations persist regardless of the shareholders that may depart, an LLC's longevity is dependent on how many members it has and what the operating agreement or state laws say regarding member termination.

- State Laws: LLCs are primarily subjected to state laws, and this can greatly impact how a company responds in a situation. For instance, when an LLC doesn't have an operating agreement, state bylaws decide what happens if there's a members' dispute.

S Corp Benefits

- Limited liability: Keeping your personal and business assets separate is still very much a benefit for owners of an S Corp. Shareholders are not personally liable for company finances, and personal assets cannot be sought after by creditors.

- Taxation: Except for certain capital gains and passive income, your S Corp would be exempt from federal income tax. The pass-through nature prevents you from facing the dreaded double taxation.

- Income: In keeping with the tax theme, an S Corp retains the ability to characterize income in a number of different ways. You may choose to pay yourself a salary and/or dividends, a tactic that can reduce self-employment tax liability altogether.

- Ownership transfer: You can transfer shares of your S Corp much more easily than most other business entities. You can even shift ownership without significant tax consequences or early termination of the business, all while remaining compliant.

S Corp Drawbacks

- Ownership: Although ownership can be transferred with ease, you must meet a number of different requirements when it comes to the actual ownership structure. Owners of an S Corp have to be U.S. citizens or permanent residents. Ownership is gained through the purchase of stock and is largely restricted to individuals, certain domestic trusts, and tax-exempt organizations.

- Wages and dividends: The ability to designate income as wages/dividends is certainly useful, but it could also draw the ire of the IRS if abused. If your salary and dividend payouts appear to be too low, you might be asked to recharacterize your income and pay higher taxes.

- Tax qualification: If you make any errors while qualifying your business as an S Corp, you could face the disastrous fate of losing your company’s S Corp status. Also, because the calculation of taxes can be complicated with an S Corp, you can expect to pay higher accounting fees.

- Paperwork Requirements: Your S Corp will have to adhere to more legal and compliance paperwork, as S Corps are mandated to have corporate bylaws and file annual reports. Yearly meetings with shareholders and the board of directors must be held, and minutes have to be carefully documented.

Which Business Entity Is Right for Me?

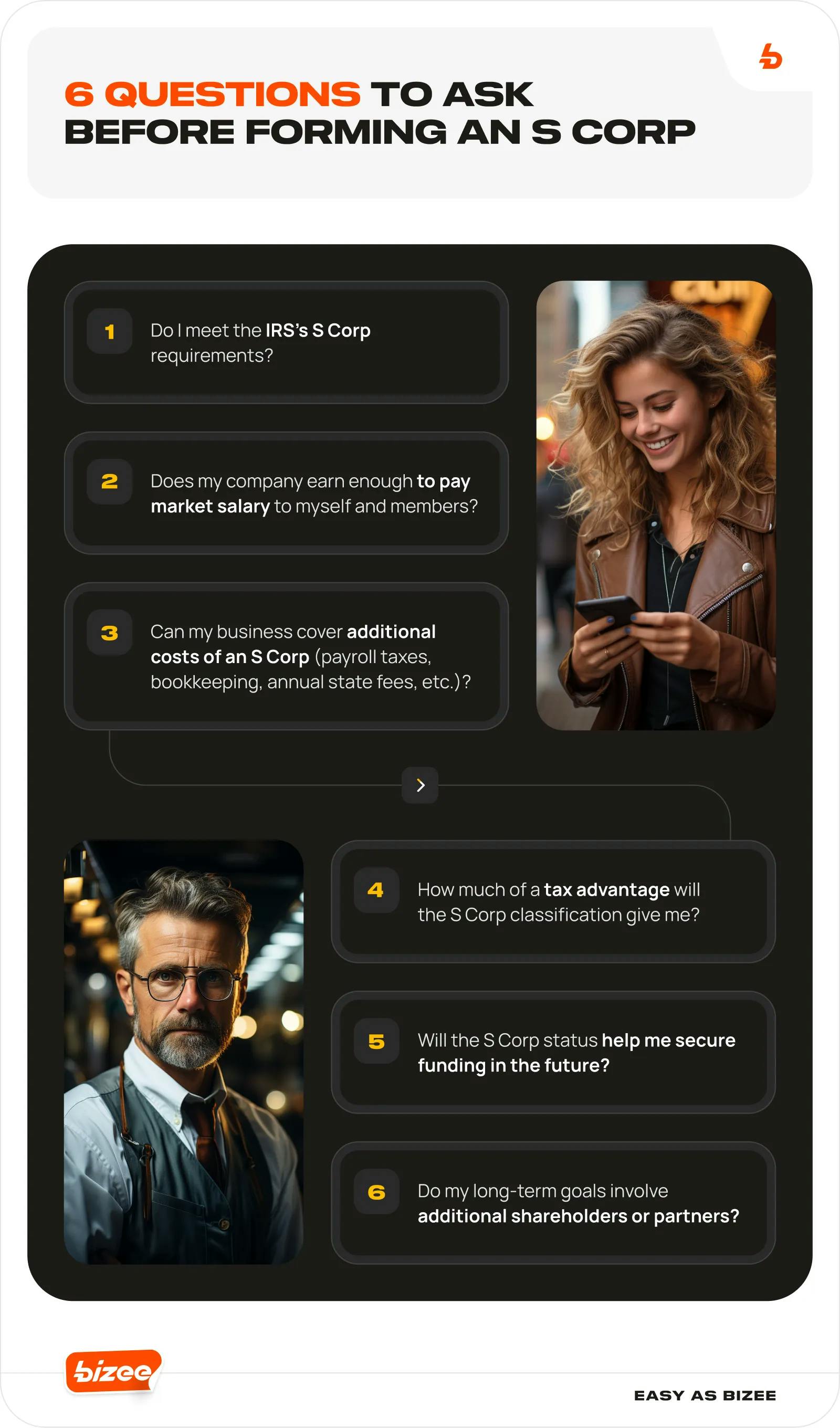

Is it better to be a single-member LLC or an S Corp? Determining which structure is right for you comes down to what your business really needs. You must ask some hard questions to identify the right fit for you.

As S Corp status could work well for you if you have robust plans for scaling and if your business is already making decent profit margins. If you have achieved a consistent level of growth where you can draw out reasonable salaries for yourself and other owners, then the tax break could be ideal for you.

By default, single-member LLCs are considered sole proprietorships for tax purposes by the IRS. All LLC owners, including you, have to pay self-employment taxes and declare business net profits on their personal tax returns.

An LLC works well in cases where you are concerned about prioritizing the protection of personal assets but don't want to be involved in a lot of upkeep and compliance measures. LLC reporting requirements are typically much simpler — most LLCs are just required to file an annual report.

Using the services of a financial advisor can also help you make an informed decision as to which entity is best for you and whether the tax benefit of an S Corp is worth the additional paperwork.

Do S Corps Pay More Taxes Than LLCs?

Actually, no. In most cases, the taxes on S Corps are lower than on LLCs. As an LLC, you can be subjected to hefty self-employment taxes of 15.3% on all net earnings from your business. An S Corp tax status allows you to withdraw a salary and only pay taxes on that salary.

For example: If your LLC's income is $65,000, you'd be obligated to pay a 15.3% self-employment tax. This amounts to $9,945. In contrast, if your S Corp has the same earnings and you have withdrawn a salary of $42,000, your employment tax amount would be $6,426, saving you $3,519.

It's important to note that LLCs have itemized tax deductions that can lower the amount you owe to the IRS.

When Should I Convert From an LLC to an S Corp?

LLCs can elect to apply for an S Corp status once they're growing in profitability. This will allow the profits to pass through to the shareholders without incurring hefty taxation. Another good rule of thumb to follow is that you should be able to pay yourself and your members a salary at the market rate to convert to an S Corp.

Again, we recommend consulting a startup business expert or tax professional to accurately weigh your options.

To form an S Corp, you need to first meet IRS's requirements and file Form 2553 by March 1 to ensure tax classification is applied to the current fiscal year.

LLC vs. S Corp — Final Verdict

Deciding the structure of your small business is one of many important decisions you'll need to make, as it can impact your exposure to liabilities, ownership structure, potential funding avenues, and imposed tax rates.

There is no right or wrong between the two options — it all comes down to what is required for your business.

Bizee's Corporation Formation team can help you weigh your options and decide which entity structure suits your current — and future — business needs. We've supported over 1,000,000 small business owners in kickstarting their LLCs, S Corps, and beyond. Tell us when you're ready, and we'll get you started on the right foot.

Ready to Legally Form Your S-Corp or C-Corp?

Get Started With Our Corporation Formation Packages Today.

Order Now

Swara Ahluwalia

Swara Ahluwalia is a freelance content writer with experience in the technical, B2B and SaaS domain. She also has curated content for various lifestyle brands. In her downtime, you will most likely find Swara training for her next marathon or spending time with her two daughters.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC