Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

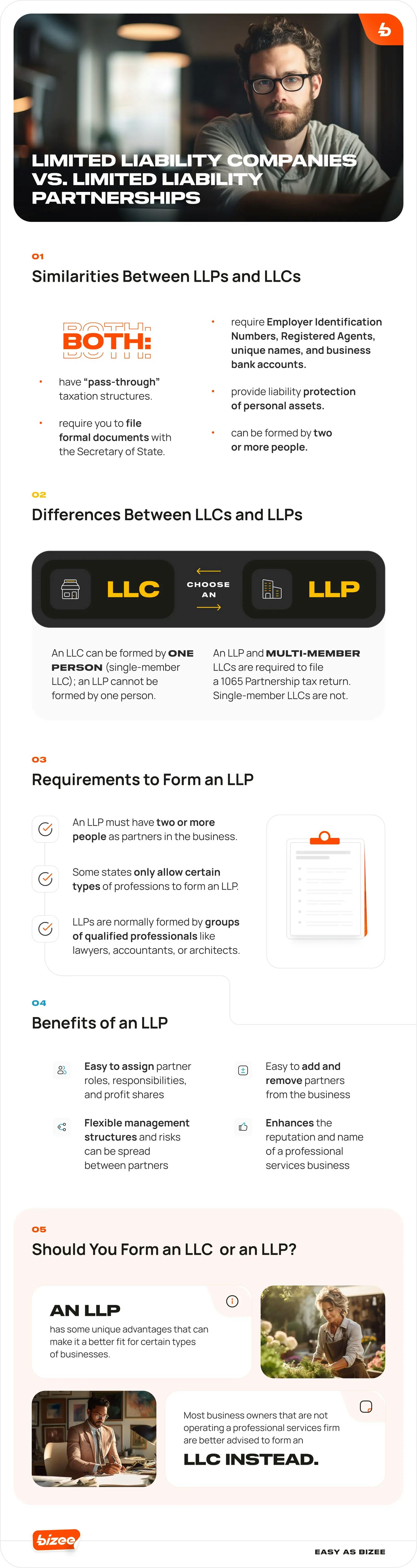

When you start a business, you don’t have to go it alone. Starting a business with partners can be a good strategy to help you maximize your strengths, be more productive, find new opportunities and scale the business faster. When business partners bring their shared talents and energies to a common goal, they can often accomplish more than they could on their own. But what’s the best way to start a business if you want to have partners? Should you form a limited liability company (LLC) or choose a different kind of business entity, like a limited liability partnership (LLP)?

There are a few key points of difference between LLC and LLP entities. Depending on what kind of business you want to create and how you want to operate your business, an LLP might be the right option.

Learn more about the advantages and differences of LLC vs. LLP business entity.

LLC vs. LLP: What Are They?

A limited liability company (LLC) is one of the most popular types of business entities for small business owners. It offers limited liability protection with a “corporate shield” to protect the business owners’ personal assets from lawsuits against the business. The LLC has flexible tax treatment if you choose to file as an S Corporation, and it has pass-through taxation.

A limited liability partnership (LLP) has some of the same benefits as an LLC, but it offers additional flexibility that might be helpful for the specific needs of certain kinds of businesses. While an LLC can have just one member, an LLP must have more than one partner. An LLP is most often used by groups of professionals that are providing a professional services business, such as a law firm or architecture firm.

Rules for LLPs vary by state. Some states only allow certain kinds of professionals to own an LLP. For example, California only allows LLPs to be formed by architects, engineers, lawyers, public accountants or surveyors.

Form Your LLC @ $0 + State Fee.

Includes Free Registered Agent Service for a Full Year.

Get Started TodayDifferences Between an LLC and an LLP

A limited liability partnership (LLP) has some of the same tax advantages and liability protections as an LLC, but with a few key differences on how the business operations are managed, how the partnership structure works and other aspects of running the business.

LLC vs. LLP Taxes

Like an LLC, an LLP is also a pass-through entity for tax purposes. The partnership itself does not owe taxes and does not have to pay corporate income tax. Business income from the LLP “passes through” to the individual tax returns of the partners.

When it comes to tax time, an LLP is required to file a tax return called Form 1065 (“U.S. Return of Partnership Income”). You can deduct your tax-deductible business expenses from your LLP’s income, but the LLP itself does not owe tax. All of the LLP’s business income “passes through” to the partners’ individual tax returns, where the partners are responsible for paying tax.

Liability Protection

A limited liability partnership (LLP) offers a similar style of “corporate shield” protection as the LLC, although it is not a corporation. If partners in an LLP get sued by a dissatisfied customer or competitor, the partnership itself is the target of the lawsuit. The partners’ personal assets (outside of the assets that are kept in the LLP) are generally protected from legal action against the partnership.

A limited liability partnership also protects the assets of each partner from responsibility for the actions or liabilities of other partners. So if your business partner makes a bad mistake and gets sued, it won’t affect your finances.

LLP Flexible Operations

A limited liability partnership (LLP) is a flexible structure that makes it easy for the business partners to assign roles, responsibilities and outline financial stakes. For example, one partner might be responsible for marketing, while the other is responsible for product development. One partner might own 33 percent of the business (and receive 33 percent of the profits), while the other partner owns 67 percent and gets that larger share of the profits. There might be an LLP with four partners who each own 25 percent of the business and are allotted an equal share of the profits. It all depends on what the partners agree to and how much each partner contributes to the business.

LLP Partnership Agreement

Unlike an LLC, where you may be required by your state to create an Operating Agreement, LLP owners write a formal Partnership Agreement. This Partnership Agreement is highly customizable. This agreement is where the partners decide and confirm in writing about who owns what share of the partnership, which partners have responsibility for which aspects of managing the business and more. You can add or remove partners as needed by updating the partnership agreement.

LLC vs. LLP Management Structures

For some types of businesses, a limited liability partnership (LLP) can be more customizable than an LLC. The LLP makes it possible for multiple partners to manage the business in a coordinated way that accommodates multiple people’s skills and goals while spreading out the risk. The types of businesses that are more likely to form an LLP include law firms, accounting firms, wealth management firms and other professional services businesses.

The LLP structure makes it possible for all partners to participate in the business. There are no “silent partners” in an LLP, although partners can choose to be "general partners" who are fully involved in managing the business or "limited partners" who have more limited responsibilities and/or a smaller financial stake in the business. The LLP is also a good fit for professionals who rely on expertise and reputation to attract clients, but who want to pool their resources and lower their risks.

For example, a successful lawyer who has a strong and growing legal practice as a solo practitioner might decide that they want to bring a partner on board or start a firm with two other colleagues. Forming an LLP can help these lawyers build on their strengths and keep their professional trajectories going strong, while banding together to save money on office space and hiring employees.

How to Choose Between an LLC or LLP for Your Business

For most industries, many small business owners are likely better served by forming an LLC instead of setting up an LLP. However, there are a few situations where forming an LLP might be the best fit for your business:

- You are starting a professional services business.

- You want to go into business with other partners in a firm.

- You and your partners will each bring your own individual skills and reputations while managing the business together.

- You want flexibility for how to assign shares of the partnership’s profits.

- You want flexibility for adding or removing partners from the business.

- You want to test a new business idea before creating a more formal business structure.

When choosing between LLC vs. LLP for starting your business, it’s important to keep in mind that both of these options offer the advantages of pass-through taxation and liability protection for your personal assets. While the LLP has some unique advantages that can make it a better fit for certain types of businesses and situations, many business owners that are not operating professional services firms might be better off forming an LLC.

Bizee's LLC Service

Get Lifetime Customer Support, Free Registered Agent for a Full Year, a Dashboard with All Docs + Additional Services and Much More

Get Started Today

Ben Gran

Ben Gran is a freelance writer from Des Moines, Iowa. Ben has written for Fortune 500 companies, the Governor of Iowa (who now serves as U.S. Secretary of Agriculture), the U.S. Secretary of the Navy, and many corporate clients. He writes about entrepreneurship, technology, food and other areas of great personal interest.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC