Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

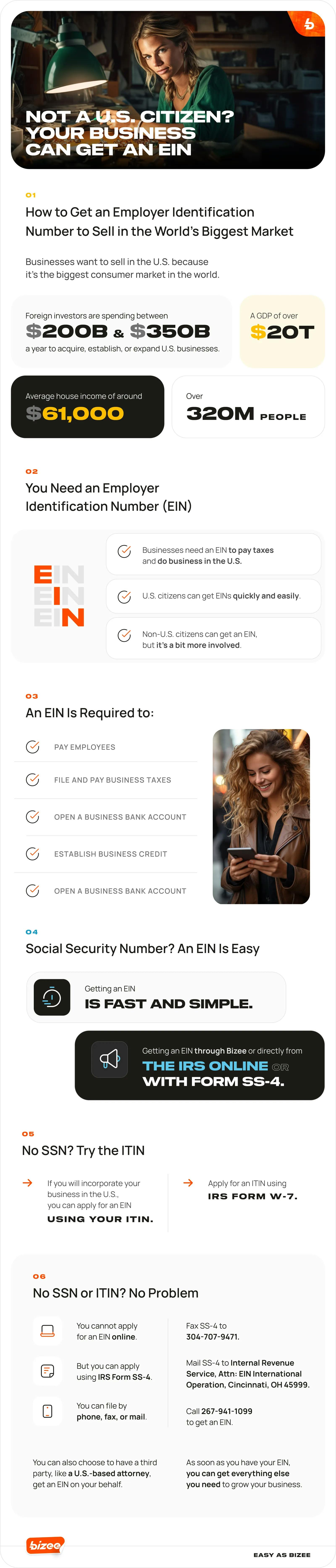

Historically, America has been seen as a leader in business and innovation, making it a desirable hub for budding entrepreneurs to start their businesses. In 2021, U.S. business profits were higher than ever, showing that America can be a strategic and equitable country to start a business.

The American dream is one that provides people with the opportunity to be successful and draws even non-citizens to consider starting their business here. However, can non-U.S. citizens even start a business in the U.S.? And if so, what do they need in order to do so successfully?

Order Gold Package - $199 + State Fee (Includes Free Registered Agent Service & EIN)

Tax IDs for Foreigners

When an entrepreneur forms a business, they need to acquire a federal Employer Identification Number (EIN), also known as a “Tax ID number.” An EIN is a nine-digit business federal tax ID that works like a Social Security number for your business. Your EIN helps you with the following:

- Filing tax returns for your business

- Opening a business bank account under the name of your business

- Properly paying and accounting for wages and payroll for your company’s employees

- Establishing credit for your business and maintaining your business’s official standing as a legal business entity

Non-U.S. citizens can also get an EIN. However, the process for foreign business entities to apply for and receive a business EIN is a bit different than the process for U.S. citizens.

Join the 1m+ businesses that trust Bizee

GET STARTEDApplying for an Individual Taxpayer ID Number (ITIN)

Many people think that you must have a Social Security number (SSN) to get a business EIN, but this is a misconception. Non-U.S. citizens who own businesses can still get a business EIN even if they do not have an SSN. Social Security numbers are for individual persons, whereas business EINs are for business entities; these two types of tax IDs are handled differently by the IRS.

While you don’t need to have an SSN to register a foreign EIN, it does make the process simpler. This is because getting an EIN online requires users to have a valid Taxpayer ID Number. Non-U.S. citizens or “foreign persons” typically cannot get a U.S. SSN, but there is another option of taxpayer identification called the Individual Taxpayer Identification Number, or ITIN.

If you are not eligible to get an SSN, you can apply for an ITIN using IRS Form W-7. Getting an ITIN can be helpful in the overall process of obtaining a business EIN since it will allow you to use the online IRS form to fill out the application for your business EIN.

However, the ITIN only allows you to apply for your EIN online if your business is going to be incorporated in the U.S. According to the IRS, “If you were incorporated outside of the United States or the U.S. territories, you cannot apply for an EIN online.”

So, if your business is already incorporated outside of the U.S., you likely do not need to bother with getting an ITIN. Instead, you will need to use a different process for applying for a business EIN, which is outlined below.

Applying for an EIN Without an SSN or ITIN

If you have no SSN, no ITIN and your business is or will be located in the U.S., you can still apply for a business EIN. However, the process is more complicated because you are not allowed to apply for the EIN online. To get your business EIN as a foreign person, you need to fill out IRS Form SS-4, Application for Employer Identification Number (EIN). We have an entire blog post that provides step-by-step instructions for filling out Form SS-4.

You cannot file this form online (unless you have an ITIN, as discussed above). This means you’ll need to choose whether you want to file the SS-4 form by phone, fax or mail. According to the IRS Form SS-4 instructions, you have to choose only one application method, and you cannot file the form by multiple methods.

Since each method is slightly different, you have to decide whether to apply by phone, fax or mail based on what will work for your situation.

- Phone: Only international EIN applicants can receive a business EIN by phone. According to the IRS instructions for Form SS-4: “If you have NO legal residence, principal place of business, or principal office or agency in the U.S. or U.S. possessions, you may call 267-941-1099 (not a toll-free number), 6:00 a.m. to 11:00 p.m. (Eastern Time), Monday through Friday, to obtain an EIN.”

- Fax: There is a special fax number to use if you want to apply for your business EIN by fax. Send the relevant IRS form to this fax number: 304-707-9471. If you apply by fax, you will generally receive your business EIN within four business days.

- Mail: If you prefer to file the IRS Form SS-4 by mail, use this address for international applicants (who do not have any legal residence, principal office or principal agency in any state or international U.S. territory):

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

If you apply by mail, it might take several weeks for your business EIN to arrive. You also have another option when it comes to obtaining an EIN as a foreign entity. Working with the IRS can be complicated, especially if you are based outside the U.S. This is why the IRS lets you have the option to work with a third-party designee on your behalf.

If you want a third-party designee (like an attorney) to be allowed to talk to the IRS on your behalf, you can designate this on the IRS SS-4 form. Your third-party designee will be allowed to receive your new business EIN on your behalf, which can be helpful in working through the IRS application process to avoid any errors or delays.

Getting an EIN with Bizee

If you're a non-U.S. citizen looking to get an EIN, Bizee can get one for you on your behalf. Our EIN service can save you time and hassle. We'll take care of the paperwork and have your new EIN back to you via email in three months. Also, if you decide to form your business with Bizee using our Gold or Platinum packages, receiving an EIN will be included as part of the incredible service you'll get from Bizee.

While the process of getting a foreign EIN can be time-consuming and difficult to navigate, it is a necessary part of starting a business in the U.S. Bizee is here to help you be on your way to achieving the American dream.

Please note: Bizee's entire customer support team is fluent in both English and Spanish.

Join the 1m+ businesses that trust Bizee

GET STARTED

Lisa Crocco

Lisa Crocco is a marketer for an international food manufacturer by day and a freelance writer/marketer for startups and small businesses by night. She's written for outlets like USA Today College, Career Contessa, CloudPeeps and Fairygodboss.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC