Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Determining whether to launch your LLC in Delaware or California involves taking a look at the pros and cons of each state so you can make the right decision for your business. Overall, Delaware is a better choice for most business owners due to its business-friendly court system and lower taxes. California may be a good fit for business owners who want access to a strong economy and lots of startup funding.

Form your LLC @ $0 + State Fee.

Includes Free Registered Agent Service for a Full Year.

Get Started TodayForming an LLC in Delaware

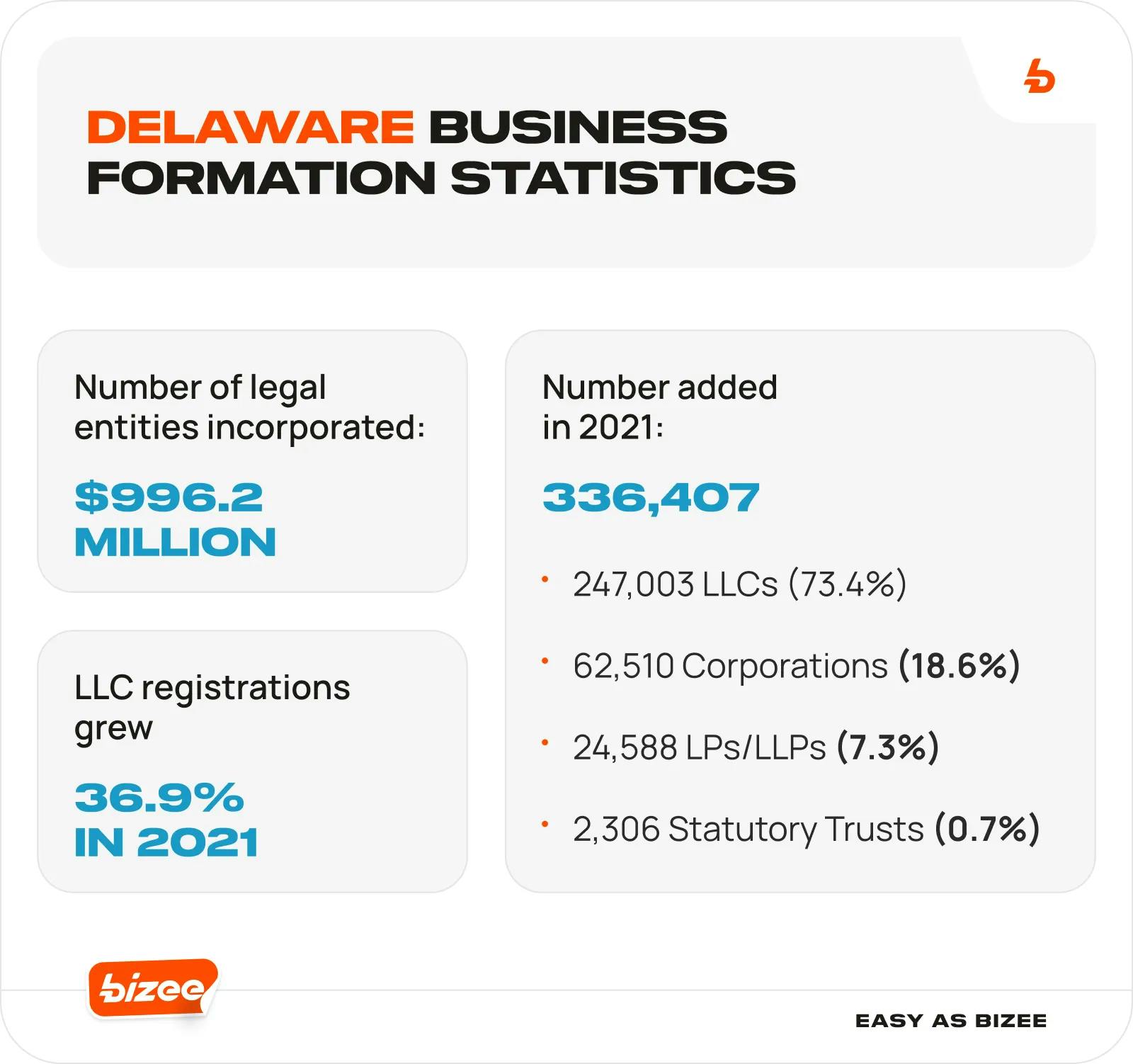

Known as “the First State,” Delaware has a long history of forming businesses. Though small in size (it’s the second smallest state in the country after Rhode Island), Delaware has formed over 1.8 million businesses. This is in part due to its flexibility in LLC formation and the beneficial tax treatment offered by the state.

Delaware LLC Pros

Delaware has long been considered the preferred state to form a Limited Liability Company (LLC). In 2021, 72.3% of all businesses were formed in Delaware. Here’s why:

- The courts in Delaware are efficient and quick when it comes to cases involving business entities.

- Delaware has no state or local sales tax for consumers.

- If you do not conduct business within the state, you will not have to pay income tax.

- Unlike most other states, LLCs formed in Delaware are not required to file annual reports.

- The names and addresses of LLC members are not required to be a part of the public record, keeping your name private.

- The yearly franchise fee is a flat rate that's not dependent on earned income like other states.

Delaware LLC Cons

Although the advantages of forming a business entity in Delaware are enticing, there are also some drawbacks to consider. Cons include the following:

- Domestic and foreign LLCs must pay an annual franchise tax of $300.

- Despite having no sales tax, Delaware has a gross receipts tax for sellers of goods and services. This is based on the business's total gross revenue and ranges from 0.0945% to 0.7468%.

- Legal disputes will need to be heard in a Delaware court, so if you do not live in Delaware, you’ll need to travel to the state for the duration of any proceedings.

- All LLCs require a business license.

- Delaware is one of the few states that require an operating agreement.

Delaware LLC Costs

Compared to other states, the filing costs for forming an LLC in Delaware are higher than average. And even though you may not be conducting business in the state, which can save you from paying income tax, there are still costs in maintaining your business status in Delaware.

Here are the costs associated with forming a business in Delaware:

- $90 Certificate of Formation filing fee

- $75 120-day reserve of LLC name

- $25 fee to operate under a DBA (by county)

- $200 Foreign LLC registration

- $100-$300 per year to hire a Registered Agent service

- $100 same-day expedited filing; $50 24-hour expedited filing

- $300 franchise tax

Forming an LLC in California

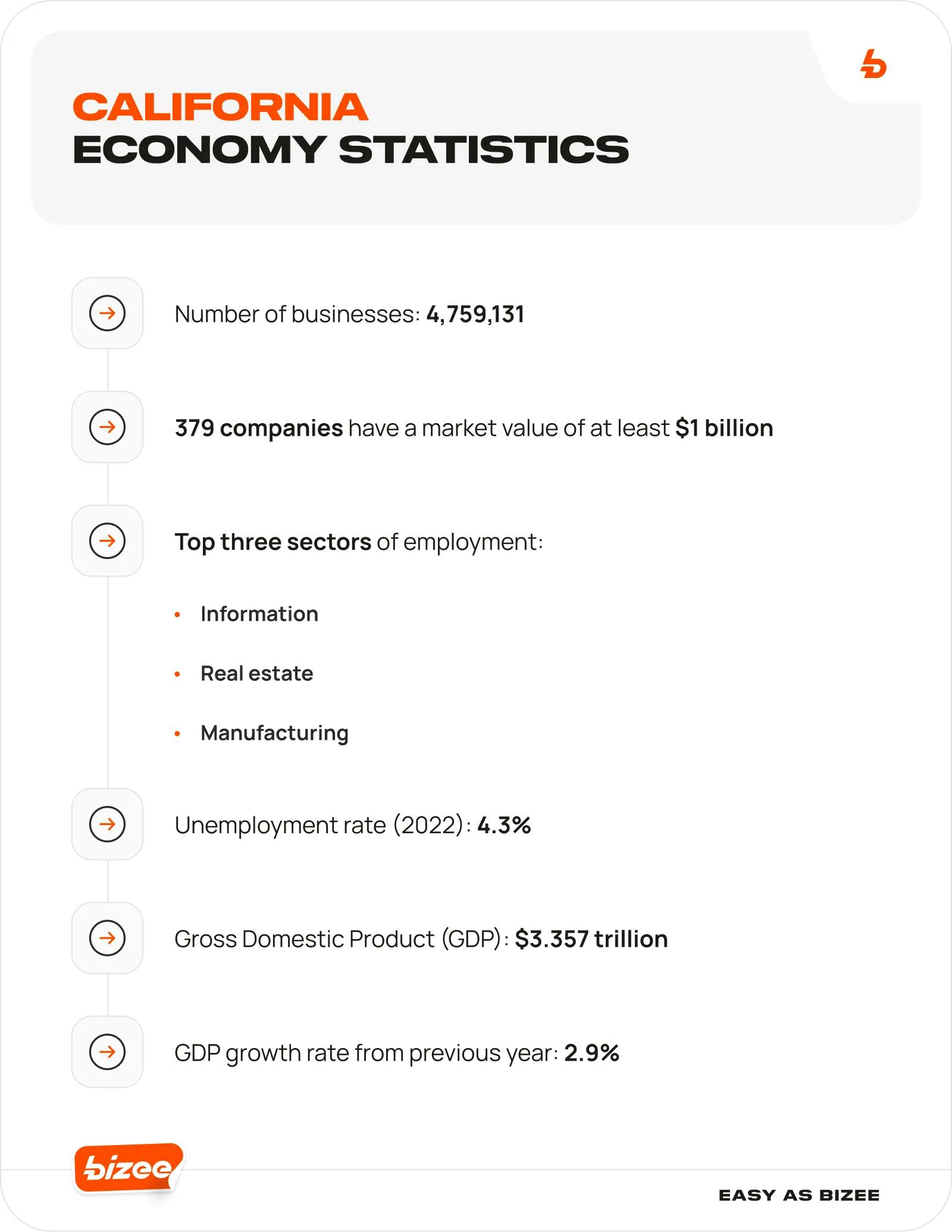

With over 40 million residents, California is one of the country’s wealthiest states with a GDP of over $3.5 trillion. If California was its own country, it would be considered the world’s fifth-largest economy after the United States, China, Japan, and Germany.

Other reasons why the Golden State is a top state for businesses include a growing economy with continuing economic expansion and job gains, as well as access to investors and capital for growth opportunities.

California LLC Pros

Here are some of the main reasons why small business owners in California are opting to form an LLC in the state:

- California has a growing (if not booming) economy and is home to some of the biggest industries in the country, including tech, the entertainment industry, travel and tourism, and agriculture.

- The California Office of the Small Business Advocate (CalOSBA) serves as a support for business owners, offering local advisors you can talk to.

- California is a focal point and nexus when it comes to large trade shows and conferences that can help your business grow.

- Forming a business in California can open up networking opportunities. You’ll be closer to potential investors who may help fund and support your business aspirations. Many investors are attracted by California's incentivize investment and economic development policies and the tax benefits provided to investors.

- It’s a wealthy state with lots of people and a popular tourist destination. In 2022, tourists spent close to $138 billion dollars in the Golden State, translating to more customers and sales to California-based businesses.

California LLC Cons

We’ve highlighted some of the reasons why starting a business in California could be a good idea for your business. Now, let’s look at the cons:

- California has the highest state income tax rate in the country of up to 12.3% for high earners.

- It also has a high sales and use tax rate of 7.25%.

- California requires all LLCs to pay an annual franchise tax of at least $800.

- If your business reports revenue over $250,000, you will pay a gross receipts tax of $900-$11,790, depending on revenue.

- Unlike Delaware, which has a favorable treatment toward small businesses and is considered “pro-business,” treatment by the courts in California can be viewed as more unpredictable.

- You cannot form a Series LLC in California.

- Though it's a recommended step no matter where your LLC is, California is one of the few states that requires LLCs to create an operating agreement.

Costs

Forming an LLC in California will involve a number of different fees covering various aspects of the entity formation process, which can include the following:

- $75 LLC filing fee (which includes $70 state fee and a $5 certified copy fee)

- $10 business name reservation fee for 60 days

- $20 fee to file a Statement of Information (annual report)

- $15 handling fee for form submissions

- $100-$300 per year to hire a Registered Agent service

- $350-$750 for expedited filing

- $800 franchise tax

If the LLC earns more than $250,000, an gross receipts tax will need to be paid. The amount due will depend on the LLC’s income. Here’s an estimate of this fee payment structure:

$250,000-$499,999

$500,000-$999,999

$1,000,000-$4,999,999

$5,000,000 and up

Is It Better to Incorporate in California or Delaware?

Although California is booming with a growing economy, diverse industrial base, and expanding population, Delaware has proven to be a favorite when it comes to forming an LLC. It has an established reputation for being business-friendly and 66.8% of Fortune 500 companies have incorporated in Delaware. Add to that the fact that 93% of initial public offerings based in the United States have designated Delaware as their corporate base.

Why incorporate in Delaware vs. California? Here are some more key factors that make Delaware the best state for forming an LLC:

- It's a business-friendly state with years of expertise in dealing with business law.

- The state has a dedicated court to work with cases dealing with businesses called the Court of Chancery.

- The Delaware Division of Corporations makes filing easy and acts efficiently when it comes to providing prompt service.

- Unless you operate in the state, there is no income or sales tax.

Foreign Qualification in California and Delaware

Businesses can operate as foreign LLCs in both states, but to do so, they must meet the specific foreign qualification filing requirements designated by the state that is not their “home” state. So you can file for an LLC in Delaware if you live in California and vice versa or if you live anywhere else.

For Delaware, requirements include the following:

For California, these requirements include the following:

California vs. Delaware LLC FAQs

Can I Do Business in California With a Delaware LLC?

If you plan on doing business in California and have an LLC in Delaware, you'll need to get a foreign LLC in California. This will allow you to operate in California. The process involves submitting a Certificate of Qualification to the Secretary of State. This is basically a license to legally operate in California.

Will Your Delaware LLC Have to Pay Taxes to Both California and Delaware?

If you plan on doing business in both states, you will need to pay the franchise tax in both Delaware and California. For Delaware, the franchise tax is $300. For California, the fee is $800. Both Delaware and California have a gross receipts tax on products or services sold.

Conducting business in both states means you will also be liable to pay income taxes on the business revenue received during the tax year. If you have a Delaware LLC and do not do any business in Delaware during the year, then you will not have to pay income tax to Delaware.

Form Your Free LLC With Bizee

Whether you're planning to form an LLC in Delaware or California, or anywhere in between, Bizee can navigate you through the process. Since 2004, we’ve assisted over 1 million small business owners as they embark on their entrepreneurial adventures. Register your business for $0 (plus state fee) and streamline your LLC formation.

Form your LLC @ $0 + State Fee.

Includes Free Registered Agent Service for a Full Year.

Get Started Today

Peter Mavrikis

Peter Mavrikis is an author and editor with over 25 years of experience in publishing. He has worked as the Editorial Director for Barron’s Educational Series, as well as Kaplan Test Prep, where he ran the test prep, foreign language, and study guide.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC