Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Choosing a name for your California business isn't as straightforward as you might think. And the name you choose may not be the only name you'll use. That's when you might need a DBA, or "Doing Business As." A DBA is a legal filing that, once approved, allows you to operate your business under a different name.

You'll sometimes see it referred to as a "fictitious business name" or an "assumed business name." In the state of California, you may also hear it called a "trade name." If you're preparing to start a business in California, you'll need to know when to file a DBA and how to do so. Fortunately, we've got you covered with all the info you need on California DBAs.

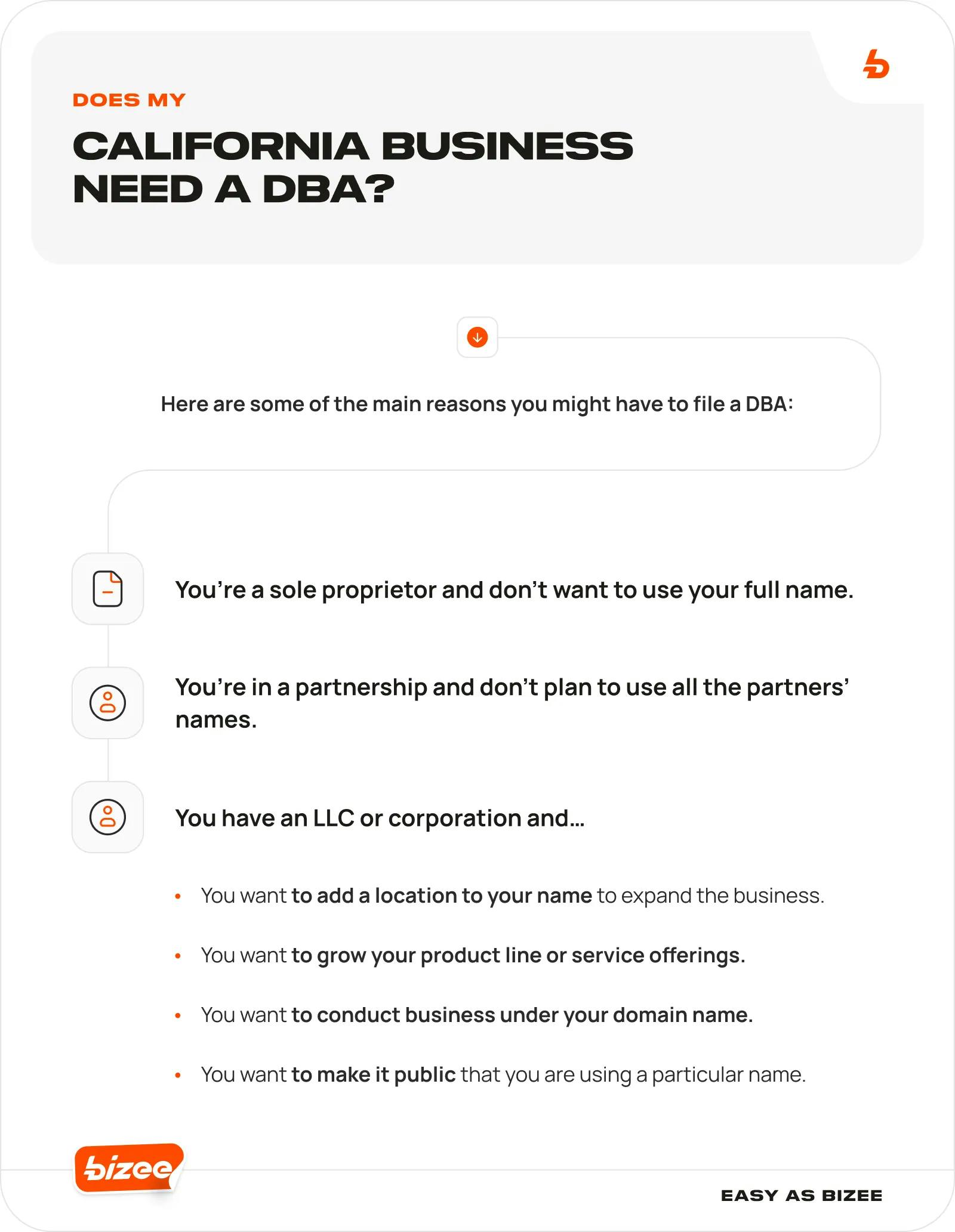

When You Need a DBA in California

There are a few instances in which a DBA is a requirement for operating your California business. Most commonly, this is when you decide to run a business as a sole proprietorship or general partnership without forming a legal business entity.

In this case, you have two options:

A. Use your full legal name — or the last names of all partners — to transact all business.

B. File a DBA to protect your privacy and that of your partners and adopt a different name.

Unless you're an individual freelancer and not planning on doing any marketing or branding, B. is really your best choice.

But there are plenty of other reasons you may decide to file a DBA for your California business:

DBAs offer a lot of opportunities for businesses both with and without a legal structure, including:

- The ability to open a business bank account under the assumed name

- The flexibility to expand the business to new markets

- The opportunity to grow the business via new product offerings or service lines

- The benefit of being seen as a more reputable and legitimate business

- The privacy afforded by not having to use your legal name in business operations

If you decide that a DBA is the right move for your Cali biz, what's next? Let's find out:

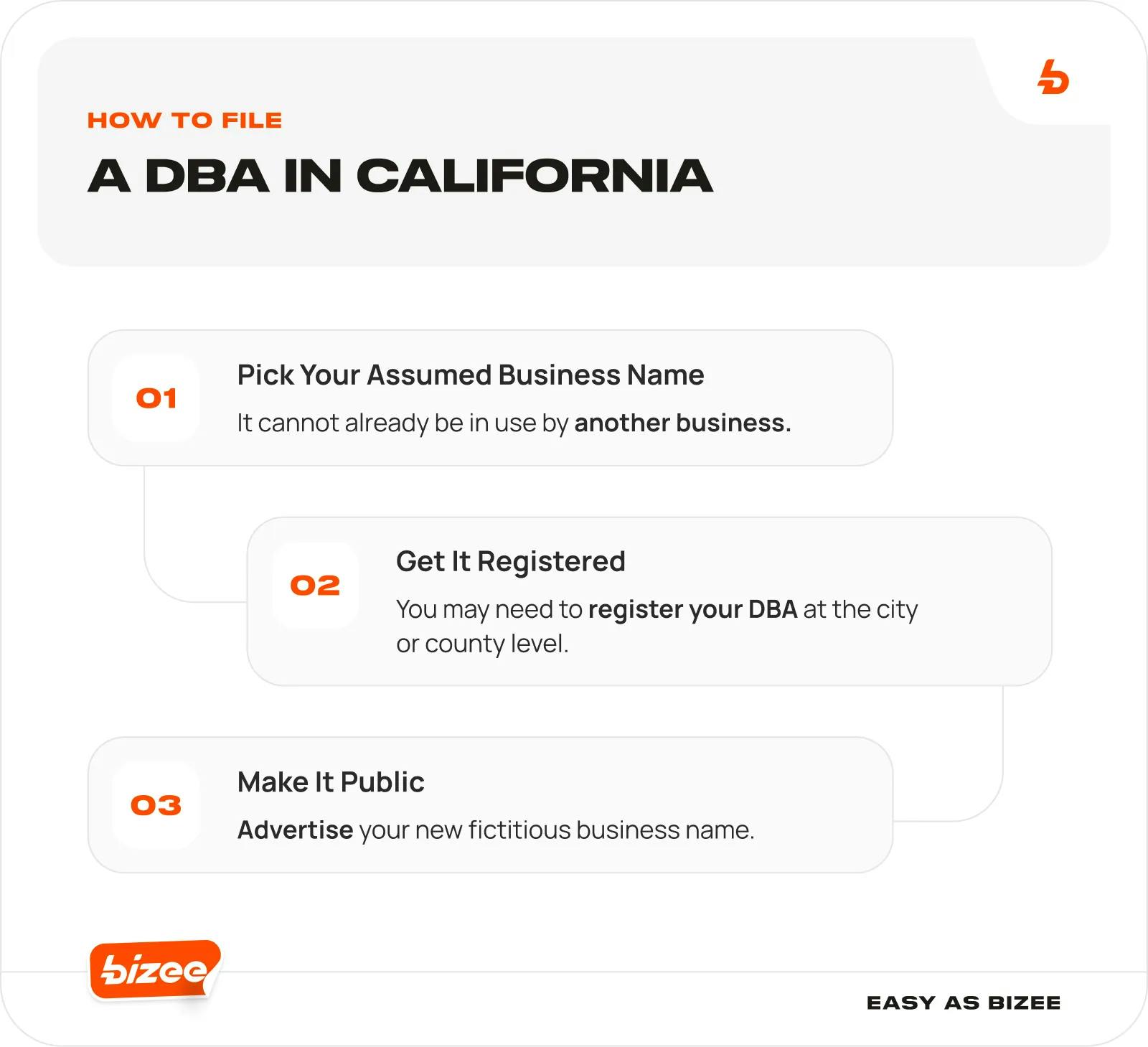

How to File for a California DBA

The first tip you need to know about filing a fictitious business name in California is this: You do not file it with the Secretary of State. CA DBAs are typically filed with your city or county. You can check with your County Clerk's office to find out where to apply. From there, there are a few additional steps you'll need to take.

Choose a Name

Picking a trade name can be a strenuous process. You want to make sure, first and foremost, that the name you choose for your DBA isn't already being used by another business or doesn't sound too similar to that of an existing business.

You can find registered business names (those belonging to LLCs, corporations, and limited partnerships) on the California SOS website. But the Secretary of State doesn't track DBAs, so you'll need to dig a bit deeper on those. In that case, you can check the CalGold site, which offers links to most city/county offices, many of which provide a DBA or fictitious business name (FBN) search.

To make it easier, you can use Bizee's free Business Name Search Tool to see if your selected name is available in California. And if you still need a little nudge to get started, check our Business Name Generator to kickstart your creativity.

Get It Registered

As we mentioned, you can't go through the California Secretary of State to file a DBA. Instead, you'll need to work with your local County Clerk to get the forms required. In some locations, you can download the form, print, and mail it in, but some County Clerks will require you to come into the office.

Remember that you'll need to file your DBA(s) in every location you intend to operate under that name. So if you're using DBAs to expand to new geographic regions, you'll need to file those wherever they're going to be used. If you're planning to expand outside of California, you'll need to check out the DBA or fictitious business name requirements in the new state.

Pro Tip: DBAs in California are valid for five years, so remember to renew them before they expire. If you're growing to other states, their term length may vary, so be sure you double check.

If this registration process sounds like a big hassle, you might need some support from a trusted partner. At Bizee, we offer a DBA service that takes care of all the paperwork and registration and will have you operating under your new name in no time.

Advertise Your DBA

California law requires that you publish notification of your new DBA in a local newspaper within 30 days of filing your FBN statement. This notification must appear once per week for four weeks after filing.

You can check with your County Clerk to see if they have any recommendations for local publications in which to post your notice.

The final requirement is that within 30 days of the last notification, an affidavit is filed with the County Clerk's Office. This may be done by the publication itself, but you'll need to check with them to be sure it's a service they provide. If not, you can also file the affidavit yourself.

This requirement is the same for all businesses filing for a DBA, whether it's a California LLC, a California corporation, a sole proprietorship, or general partnership.

Frequently Asked Questions for DBAs

Still looking for more information on getting a DBA in California? We've got the answers to your most pressing questions:

How Much Does It Cost to Get a DBA in California?

The cost of a DBA will vary depending on your location. You'll pay the registration fee, which is usually $25-50, to the County Clerk or Registrar's Office. If you're filing multiple DBAs, you'll pay a fee for each additional name. If your business is located outside of California, but you're acquiring a DBA or FBN to operate within the state, there will likely be other fees involved. And, of course, if you're operating in California but expanding to another state, you'll need to check the fees in the new state.

You may also choose to go with a third-party provider that can take care of filing your DBA for you. In this case, you will pay the same local registration fee, plus their filing fee, and often a fee to cover the cost of them taking care of the publication and affidavit filing.

Bizee provides this service to LLCs, corporations, and nonprofits. It is available in select California counties. Our fees include local registration, a variable charge to publish the notification and affidavit, and a $99 processing fee.

How Long Does It Take to Get a DBA in California?

This, too, varies based on location. The counties that offer online registration will reduce the time it takes for the DBA to become "official." But keep in mind you'll need to go through the entire process of choosing a name, registering it, publishing it, and filing the affidavit before you can actually start using your fictitious business name.

Generally speaking, you'll probably want to allow a minimum of five weeks from the time of registration before you can begin operating under your DBA.

Is a DBA Required in California?

At times, yes. If you are a sole proprietor or general partner without a business entity and you do not wish to operate under your legal name, you will be required to file for a DBA.

For legal business entities like LLCs and corporations, if you're planning to operate under any name that is different from what you originally filed with the California Secretary of State, you'll need to file a DBA in your local area.

Remember that a DBA is not an LLC, a corporation, or any form of legal business entity. It does not offer liability protection for your business. And while you can certainly run a business without a legal structure and a DBA will help protect your privacy, it won't protect your assets should a customer, vendor, or partner decide to take legal action against you.

California has numerous requirements for businesses, like filing the Form LLC-12, so you'll always want to check to make sure you're staying on top of compliance. Also, remember that when it comes to starting a new business, the requirement in California is that your DBA is filed within the first 40 days. So, if you're forming a business entity with the California SOS and need a DBA, you'll have to do it within that timeframe. And if you're planning to operate as a sole prop or general partnership, you'll need your DBA within 40 days of when you begin running the business.

Why Choose Bizee for DBA Services?

It's a lot to keep track of, and it's not as black and white as you might expect. That's why we recommended seeking support from a trusted expert in business formation. We can take care of filing, registering, and advertising your DBA to get you in business as quickly and efficiently as possible. All you have to do is complete the form with your information, and we'll handle the rest with our DBA service.

Wendi Williams

Wendi is a freelance writer based in Indianapolis, IN, with over a decade of experience writing for a variety of industries from healthcare to manufacturing to nonprofit. When she isn't working on solutions for her clients, she can be found spending time with her kids and husband, working in the garden or doing more writing (of the fiction variety).

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC