Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Creating a business plan for real estate investing in today's market might seem exciting, but it can also be a little intimidating for those new to the game who haven't yet experienced the ups and downs of such a volatile industry.

But don't let that stop you — people invest in real estate every day, and those looking to make a career out of their wise investment strategy have to start somewhere.

By developing your real estate investment business plan now, you'll be expertly positioned to take advantage of what this year (and the next) has in store.

Not Sure Which is the Right Entity for Your Business?

Use Our Free Entity Comparison Guide.

Get Started TodayWhy Should You Invest in Real Estate in Today's Climate?

Real estate in the U.S. is hot — really hot.

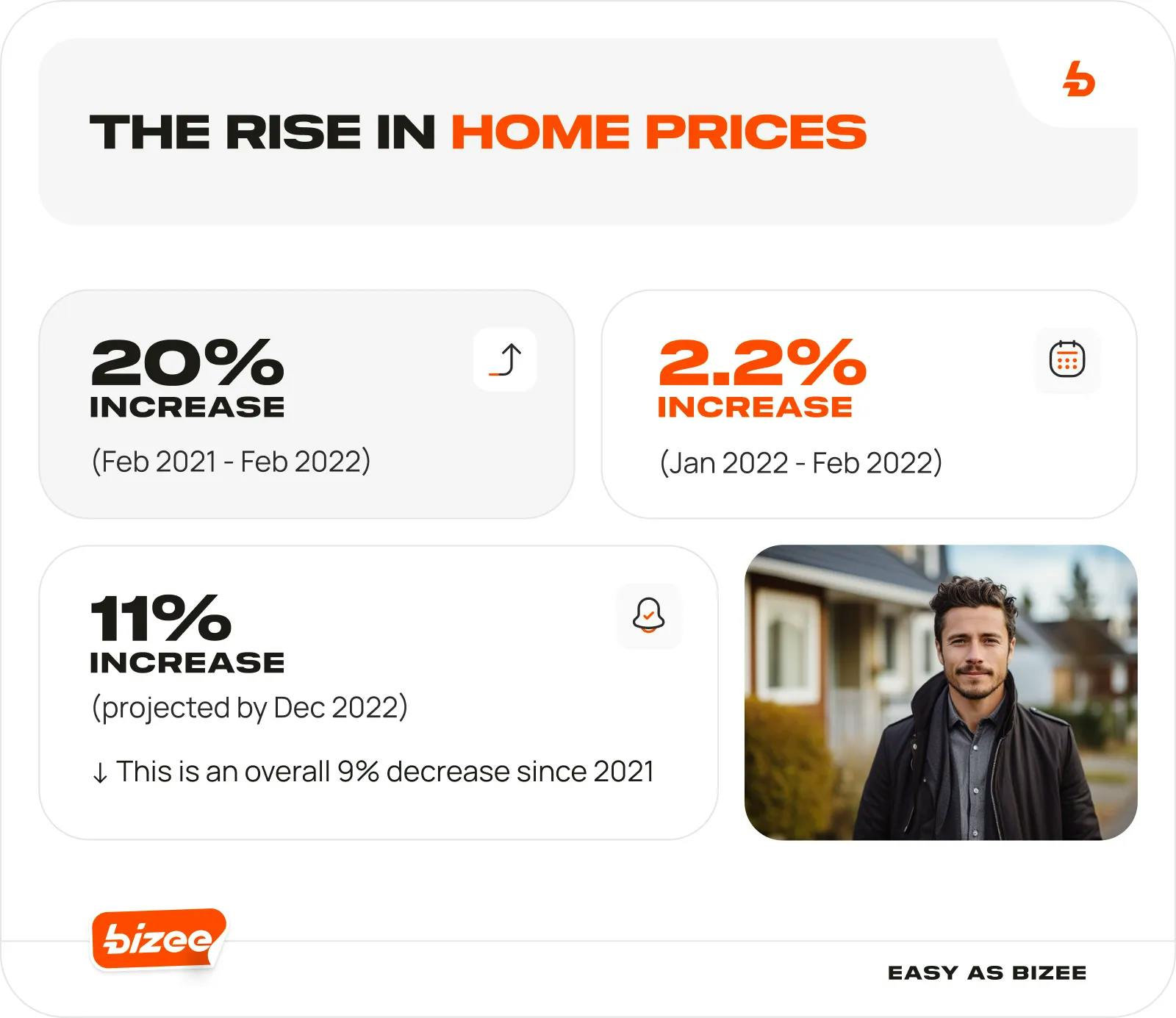

But here's the kicker…these numbers simply aren't sustainable for the long-term.

As we progress through the '20s and beyond, more experts are predicting that the rising interest rates will price many buyers (especially Millennials, who make up the largest share of the current buyer pool) out of the market, which will give the housing supply a chance to breathe with less demand.

As a leading real estate marketplace, Zillow also forecasts that prices will cool off as 2022 sees just a projected 11 percent price increase by the end of the year, down from the 20 percent year-over-year increase that we saw in 2021.

What this means is that despite current conditions, experts predict that more properties will become available with fewer buyers ready to snatch them up. This softens the market for savvy investors who can then leverage their investments to acquire additional properties.

What Is a Real Estate Investment Business Plan and Why Do I Need One?

To get started on your real estate investment journey, you'll need a real estate investment business plan that details all of the components of your business and helps you to strategize for success.

This is because having a business plan for real estate investing is like having a detailed roadmap that tells you how to get to your desired destination. By enabling you to clearly organize your investment goals, your plan can help you define the methods you'll use to achieve them and you'll be viewed as a more legitimate real estate business, as well.

How Do I Assemble a Real Estate Investment Plan?

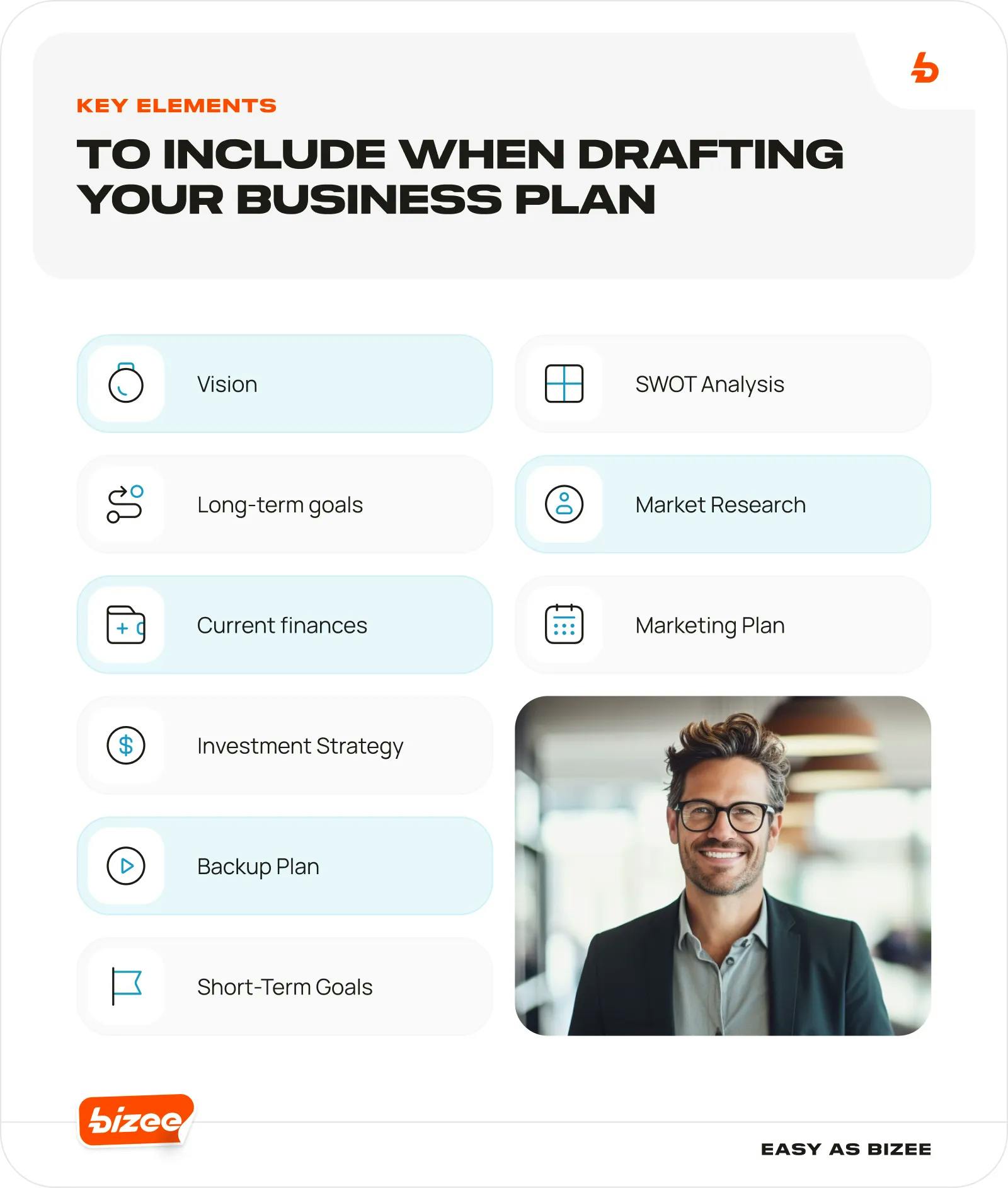

A solid investment plan has nine steps that will enable you to outline your roadmap and begin your new business on the right path. Each of these steps is equally important — remember, the more detail you include, the more robust your plan will be and the more likely you are to avoid distractions en route towards success.

1. Establish Your Vision

Every company needs to have a statement that describes its overall mission, purpose and values. Above all else, this is what will drive your real estate business forward and keep it on course through the thick and thin, the ups and downs, the good times and bad. Your vision establishes the basis from which your company can grow, take on employees and motivate your team to achieve common goals.

A good place to start is by researching the vision of other real estate investment firms that you identify with and might want to emulate. From there, you can tailor your own vision to reflect the personal and business achievements that provoked you to start developing a real estate investing business plan in the first place.

2. Outline Your Short-Term Goals

Consider what you want your business to achieve in the next 1-2 years. Setting short-term goals that are reasonable and realistic — even if they're small — will help you stay motivated and on track towards smashing those long-term goals.

Achievable milestones such as saving for a downpayment, securing your first investment purchase and planning for expenses are good starting points and will help you focus on, and get used to, the concept of checking items off of your list.

3. Record Your Long-Term Goals

Long-term goals are an essential part of a real estate investment business plan and enable you to study the correct metrics to measure your success along the way. These are the sort of goals that are likely to require years of planning and determination, but they're still attainable.

Your long-term goals may be more personal, such as saving for family purchases or expenses (college tuition, for one), or they may be strictly business-related and comprise a large portfolio of investment properties.

4. Identify Your Strengths and Weaknesses (SWOT Analysis)

Understanding where you excel and where you could use improvement is essential for growth. By conducting a strengths, weaknesses, opportunities and threats (SWOT) analysis, you can establish a framework that enables you to evaluate your real estate business and identify ways to increase productivity, performance and efficiency.

Taking an honest approach to this step will uncover any issues or threats with your business which you can then solve or delegate to either your team or third-party service providers. It might also provide some insight into whether starting a real estate business is the right move for you.

5. Take Inventory of Your Current Finances

Are you starting out with a little or a lot? Will your current credit score and debt-to-income ratio be sufficient for achieving your short-term goals? In order to sufficiently assess your financial position, you'll need to take everything into account.

Starting a business with low capital is possible, but there may be challenges that you'll have to face in order to get it off the ground. Investing in real estate brings with it a number of costs — from closing fees, taxes and utilities to property management, repairs and maintenance. Once you fully understand your position, you can create a financing plan that outlines how you'll meet the requirements for each investment.

6. Conduct Market Research

Savvy investors are always watching the market to stay up-to-date on current trends, interest rates, vacancy rates, property prices and more — as well as which geographical areas are hot or cold.

Conducting market research enables you to stay on top of your business and anticipate changes based on outside factors. This will help you make better and more educated decisions with regard to your investments and grow your real estate investing business with more stability.

7. Develop Your Investment Strategy

Maybe you prefer the low-risk, slow-roll strategy of maintaining long-term investments. Or, perhaps you're interested in the fast world of house flipping to cash in on quick profits. You might even feel that investing in multi-family apartment buildings offers your business more than investing in single-family dwellings or commercial properties.

There's no right or wrong way to plan your investment strategy so long as you've done your research and remain committed to serving your short and long-term goals.

8. Draft Your Marketing Plan

Many business owners view marketing as a "nice-to-have" rather than a necessity, but the truth is that marketing can help you build the foundation for your business right from the start.

By investing in your business with strong branding elements, a social media presence and even a basic advertising outline you can increase trust in your business while spreading the word about the services you provide.

Remember, your brand is more than just a logo, and you can use it to determine who your target audience is, how you speak and relate to them and how you build strong relationships that will help you achieve your goals.

9. Compile an Exit Strategy or Backup Plan

A lot of businesses can be simple, but that doesn't mean they'll be easy to manage and grow. Developing a backup plan might seem like preparing for failure, but it's quite the opposite.

Investors have the ability to withstand harsh market conditions, recessions, housing bubbles and more by drafting either a backup plan or exit strategy that will enable them to pivot and reposition themselves if things don't go as planned.

What will you do if a listed property just isn't selling? What if you lose a sale at the last minute, or a seller backs out of a deal? It isn't about the "when" but the "what if" scenarios that you'll want to be prepared for in order to keep your business afloat through tough times.

Writing Your Real Estate Investing Business Plan and Bringing It to Fruition

Keeping up with reputable publications such as Zillow will help you stay on top of market trends as you progress through your business, which can lead to smarter, more educated decisions. But it can also help you create a robust business plan right now.

Once you've considered each of the nine steps above and gathered the appropriate information, it's time to construct your business plan for real estate investing and get to work.

Writing your business plan is an essential process that will boost your legitimacy and help you access any funding required to purchase properties, and there are seven key elements that you'll want to include.

You can also find business plan templates to provide some of the basic structure.

Compose an Executive Summary

Your executive summary provides a "10,000-foot view" of your company and includes your mission statement, any products or services, your goals and your financial and growth strategies.

Consider the executive summary as a place to explore and define the "why" of your business, and be sure to make it clear and concise.

Provide a Description of Your Company

A strong real estate investing business plan will include a company description that outlines which market you operate in, how your services meet the needs of your clients, the nature of those services and the advantages your business has over your competitors.

Essentially, this section should inform others about your business and give them a good snapshot of what you do and how you do it.

Detail Your Organizational Hierarchy and Management Plan

Here, you'll provide details with regards to how your business is structured and organized. If you're a solopreneur, how will you manage and stay on top of everything without sacrificing quality service? If you're building a team, who is responsible for what?

Put yourself in the position of anyone who might read your real estate investment business plan and consider that knowing who is in charge and what their responsibilities entail is a top priority.

Include Your Market Analysis

Compile information that you've gathered for the market in which you plan to operate and invest in and add it to your real estate investing business plan. This will demonstrate your knowledge and understanding of your target market and provide lenders or future business partners with a higher degree of certainty and justification for working with you.

Data that includes market size, shares, pricing and other attributes are important to include here, along with the details of your SWOT analysis.

Summarize Your Financial Projections

It may be impossible to know the future, but researching and compiling data surrounding your market, interest rates, investment capital and more can help you forecast and project revenue and other figures. These numbers are especially important to lenders and others who you plan to work with, as they'll want to know how you'll maintain commitments and achieve your financial goals.

These projections should include annual revenue, cash flow, equity and other calculations that represent attainable goals — shooting for the moon is great, but documenting your projections realistically will help you put actionable plans in motion to achieve them.

Share the Strategies You'll Use to Evaluate Deals

This is the place to showcase your business acumen. Putting in place a method for evaluating deals shows others that you understand what makes a good deal and what should be avoided (and why).

This section should also cover how you plan to find deals in the first place to feed your business right from the get-go. You can learn a lot from other investors who have been around the block and leverage their knowledge and experience to exact success in your own investing business.

Discuss Plans for Managing Multiple Properties

A large part of real estate investing is managing the properties that you acquire. Every investor should include a section describing their management principles and strategies in their real estate investment business plan along with who will take on specific responsibilities. I

f you plan to use a property management company, who are they, and how do they operate? If you plan to hire your own manager instead, how will they keep track of multiple properties as you grow?

These are questions to ask now as opposed to later when you're trying to juggle both sustainable growth and daily activities.

Tips for Success: How to Create a Strong Business Plan for Real Estate Investing

Your real estate investing business plan won't ever be perfect, but that's beside the point. Your goal should be to draft a plan that accurately reflects the passion you've put into your business.

That said, there are a few tips that can help you shape your plan so that it's as thorough and robust as possible.

Be Clear on What You Want to Achieve

- Include details on funding or desired partnerships

- Don't "fake it 'til you make it"

- Be open about the help you need

Prove That You Have a Firm Understanding of Your Market

- Include local market data and statistics

- List average income of tenants and residents in the area

- Point out vacancy rates and final sale prices

Research Your Competition

- Subscribe to their email list to keep tabs on their movements

- Purchase any real estate products they have for sale

- Visit their open houses to get a feel for how they operate

Simulate Deals to Nail Down Your Process

- Practice with example deals to navigate potential obstacles

- Record the process of overcoming roadblocks (method and resources used)

- Show lenders and partners that you're well prepared for whatever comes your way

Launch Your New Business with Bizee

As you work through the creation of your business plan for real estate investing, keep in mind that one day soon you'll want to incorporate in order to take advantage of various business incentives and tax write-offs. Your plan might just tell you which type of structure or business entity is right for the type of business you wish to form, but it isn't always that simple.

To help you choose the best structure that will provide you with correct protection and ease of operation, check out our Business Entity Comparison Guide. We'll help you determine which route to take to establish the real estate investing business that best matches your goals.

Not Sure Which is the Right Entity for Your Business?

Use Our Free Entity Comparison Guide.

Get Started Today

Chad Ruppert

Chad is a freelance writer and former project manager focused on presenting information on SaaS, technology and business formation.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC