Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

If you’re ready to form a legal business entity and you're thinking that an S Corp or C Corp is the way to go, it’s vital to understand what’s meant by the terms "incorporation" and "corporation." Although the words sound similar, there are fundamental differences in how they’re applied. Let's break it down and give you a better idea of what they mean.

Ready to Legally Form Your S-Corp or C-Corp?

Get Started With Our Corporation Formation Packages Today.

Order NowWhat's the Difference Between Corporation and Incorporation?

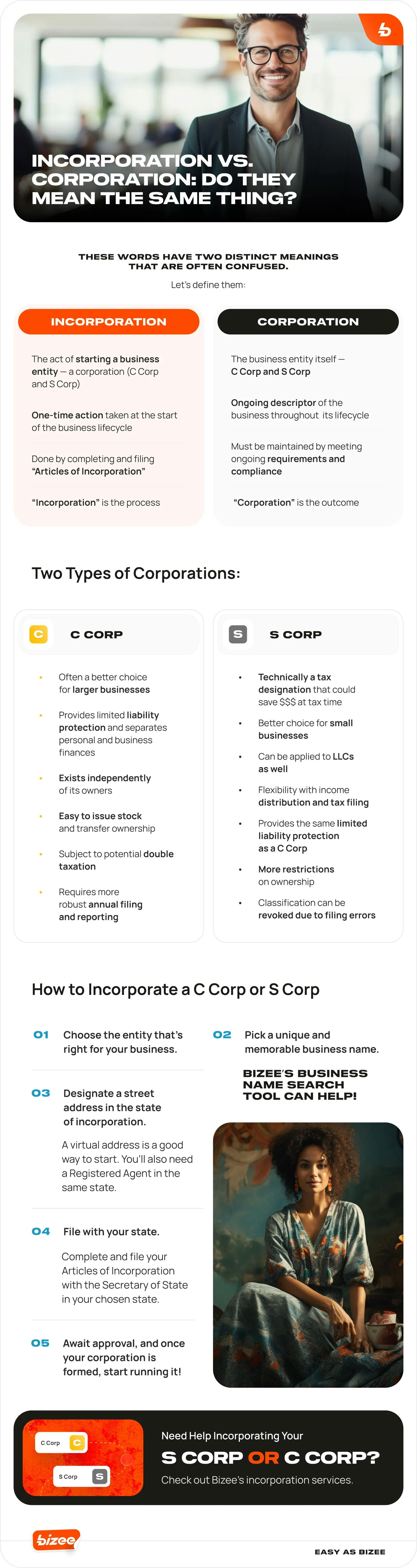

Simply put, "corporation" is a noun that describes a type of business entity, while "incorporation" is a verb that describes the act of forming a — you guessed it — corporation.

A corporation is considered legally separate from its owners, employees and others, and exists as an entity in its own right. Corporations in the U.S. are known as either S Corporations or C Corporations, and each provides different benefits to stakeholders.

The main difference: incorporation is the process you go through to create a corporation, which is a separate legal entity.

Corporations Are Not Your Only Option

S Corporations and C Corporations do provide some advantages to specific types of entrepreneurs, but they also require a lot of overhead to maintain, including:

- Payroll for employees

- Creation of a company charter

- Bylaws and meeting minutes, regularly updated

- Issuance of stock ownership certificates

- The requirement to hold an Annual General Meeting

- The requirement to appoint officers

- The requirement for a board of directors

- Complex tax filings

In most cases, there’s a type of business that provides similar benefits to corporations without the administrative headaches — the limited liability company, or LLC. These types of businesses are quicker, easier and cheaper to create and maintain. It’s important to note that an LLC is not a type of corporation, but in many cases, it will meet your needs and it also offers liability protection.

We have a complete set of state-by-state guides to forming a corporation and other guides for forming an LLC. They’re a great starting point for learning what’s best for your circumstances. We also have a Business Entity Quiz that helps you decide the type of business that’s best for you.

Ready to Legally Form Your S-Corp or C-Corp?

Get Started With Our Corporation Formation Packages Today.

Order Now

Paul Maplesden

Paul is a freelance writer, small business owner, and British expat exploring the U.S. When he’s not politely apologizing, he enjoys hats, hockey, Earl Grey Tea, mountains, and dogs.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC