Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Who run the world? Women. According to the National Association of Women Business Owners, there are 12.3 million women-owned businesses in the United States today. Current women in business statistics show that not only are women-led small businesses on the rise, but women are also four times more inclined to don the boss hat.

However, women who run small businesses continue to face challenges when acquiring funds for startups. According to a PitchBook study in 2022, only 2% of venture capital funds went to women-led ventures.

We've rounded up a list of small business grants available to women that can help you get your business off the ground or expand the one you currently run.

How Do I Get Money to Start My Own Business?

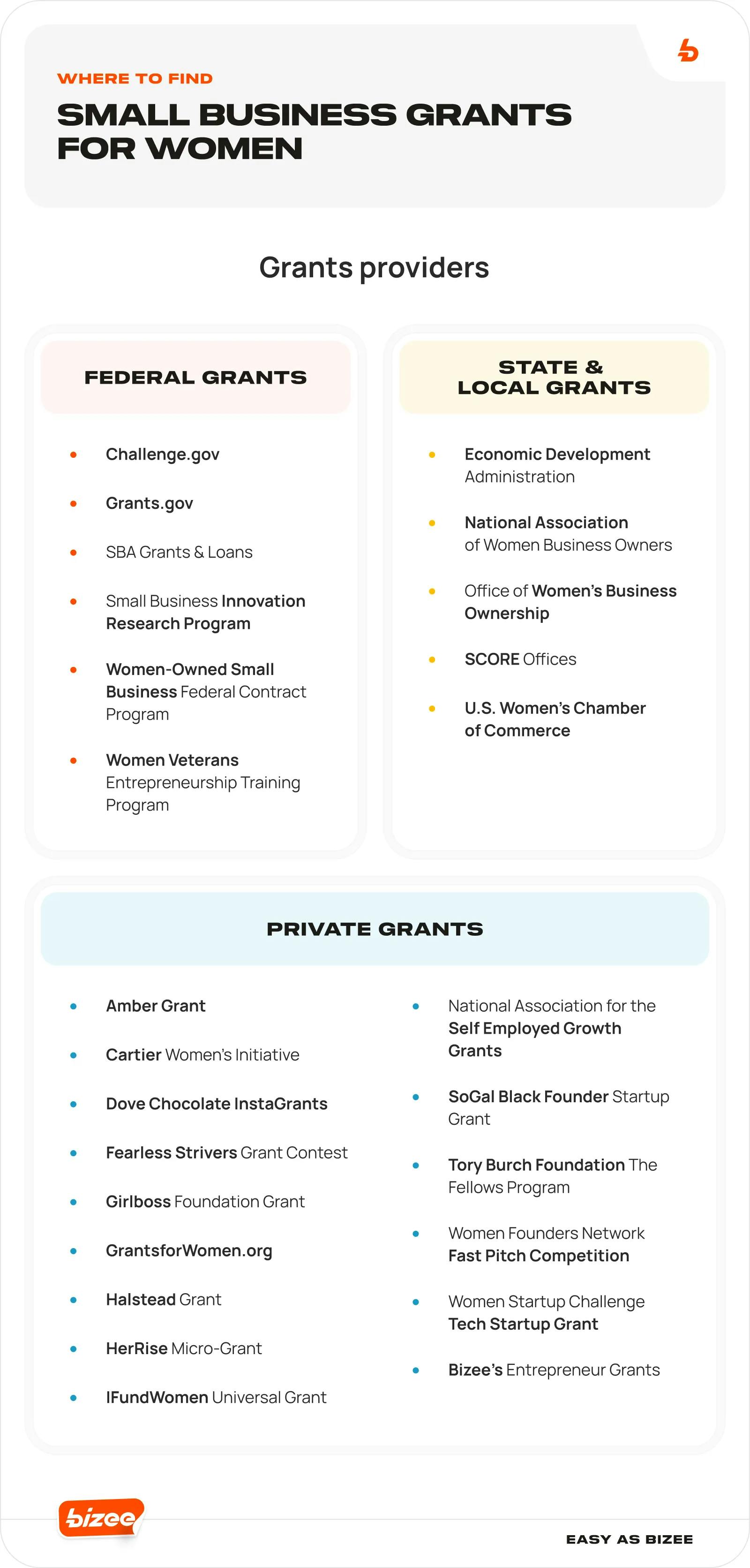

Grants are great for obtaining the required funds to launch or expand your business. A grant is a one-time, lump-sum financial reward given to an individual or organization for a specific purpose. Grants, as opposed to loans, don't have to be repaid. There are federal, state, and private grant providers.

Federal Grants and Loans

The U.S. federal government has over 900 grant programs, some of which are specific to women's causes.

Below, you can find more information about federal government grants for women business owners:

Grants.gov

This is the largest federally sponsored database of government grants in the U.S. and an excellent starting point for researching small business grants for women. In 2002, Grants.gov was established as part of the President's Management Agenda.

To apply, you’ll need to visit the website and check out its section on grant applicants to see if you are eligible. You may need to sort through different options to find the most relevant grants for your small business.

Keep in mind that most government grant applications require you to obtain a Unique Entity Identifier (UEI) and register on the System for Award Management (SAM) portal.

Challenge.gov

Operated by General Services Administration, Challenge.gov uses the spirit of competition to spur innovation and solve critical problems. Since the program's inception in 2010, over 1,200 prize competitions have taken place. Prize amounts vary, and you can reference the Prize & Challenge Toolkit to understand the process.

SBA Loan Program

The Small Business Administration (SBA) provides a variety of loans — such as micro-loans and 504 loans — to make it easier for small businesses to secure much-needed funding. You can discover SBA grants and loans for women that work best for your business through the Lender Match portal.

Women-Owned Small Business Federal Contract Program

This SBA grants for women program allows women-led businesses to compete for specific federal contracts. Out of the 759 eligible industries for this program, 646 are designated for WOSB (women-owned small businesses).

An updated list of qualifying industries is maintained by the SBA.

To become part of this program, your business needs to adhere to the following requirements:

- Be a certified WOSB that meets SBA size standards.

- Be a U.S. citizen and have 51% of business ownership.

- Have a woman managing day-to-day operations and making long-term, strategic decisions.

Women Veterans Entrepreneurship Training Program (WVETP)

Offered by the SBA's Office of Veterans Business Development, this entrepreneurship training is exclusively for women veterans, service members, or spouses of veterans. The Veteran Women Igniting the Spirit of Entrepreneurship (V-WISE) program is an inspiring example of this SBA-sponsored training grant for women.

Small Business Innovation Research and Small Business Technology Transfer Programs

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs are two competitive grants encouraging small businesses to engage in federal research projects. The majority of the grants are from the Department of Agriculture, Defense, Transportation, and Health and Human Services.

To apply, your business needs to meet eligibility requirements, which require you to be a U.S. citizen running a for-profit business with no more than 500 employees.

State and Local Grants

State and local grants are sometimes harder to find because all the data isn't in a centralized directory. Here's a list of offices that can connect you with local and state-based funders:

Office of Women's Business Ownership

This division of SBA supports women's entrepreneurial goals by providing mentorship, training, and access to capital. The OWBO is responsible for over 100 local Women's Business Centers (WBC). To find local grants, contact your nearest WBC to understand the scope of available financing opportunities.

National Association of Women Business Owners

This membership-based organization provides support for women in small businesses and aspiring entrepreneurs in a variety of ways. Since its inception in 1975, the group has championed women business owners by offering access to mentoring, training, and funding opportunities. The group operates at the state and local levels, and you can find your local chapter through its online directory.

U.S. Women's Chamber of Commerce

The U.S. Women's Chamber of Commerce (USWCC) is a platform built to promote, grow, and support women business owners. The membership-based network provides exclusive access to networking events, conferences, and funding opportunities aiming to level the playing field for women in business. Memberships start at $199/year.

SCORE

SCORE is the U.S.'s largest network of volunteer business mentors and experts. You can connect with mentors online or through face-to-face meetings at local chapters for free. These mentors include experienced business owners who can assist you in navigating the process of securing funds (typically a mix of loans, grants, and crowdfunding portals).

Economic Development Administration (EDA)

Every state has its own Economic Development Administration or center that works to achieve economic prosperity. Through its network of regional offices, the EDA provides access to resources and grants that foster innovation and growth. For example, Texas Economic Development has dedicated resources and available finance opportunities. You can contact your local or state office through the EDA's online directory.

Private Funding Opportunities

Over the past few years, numerous private companies and foundations have stepped up financial support for women-led businesses:

Amber Grant

WomensNet sponsors the Amber Grant program, which offers $30,000 in funding to women-owned businesses every month. The application process requires a short video explaining the business and what you'd like to do with the funds. Since its inception in 1998, the program has expanded its grant offerings to include special prizes like “Marketing Grants," "Business Category Grants," and two “$25,000 Year End Grants.”

Cartier Women's Initiative Awards

Probably one of the most recognizable and prestigious awards for women entrepreneurs is Cartier Women's Initiative Award. This global award provides finalists with grants and a plethora of other benefits, including personalized coaching, training, networking opportunities, and media visibility. Grants range from $30,000 to $100,000 and are open to for-profit, women-led businesses that have been in existence for at least one to three years.

Dove Chocolate InstaGrants

Dove Chocolate is making it easier and sweeter for women entrepreneurs to start a business. Each year, the company offers three $10,000 #DoveInstaGrants. To win a grant, you need to share a 30-second video describing why your business is innovative. This initiative builds on Dove's longstanding partnership with the international organization CARE. Dove isn't accepting applications right now, but you can view last year's winners and follow its page to see when applications reopen.

Fearless Strivers Grant Contest

This skill-based competition is the initiative of a partnership between Fearless Fund and Mastercard. The grant provides $20,000 in capital and mentorship to four businesses led by Black women. To apply for this small-business grant, you must be a U.S.-based business with less than 50 employees and annual revenues of under $3 million. You can find the full list of official rules on their application page.

Girlboss Foundation Grant

Since 2014, the Girlboss Foundation has supported women business leaders in the fields of fashion, music, design, and arts. The grant awards $15,000 to selected participants bi-annually. These women also get featured in the Girlboss newsletter and are given two free tickets to the upcoming Girlboss Rally.

GrantsforWomen.org

Grants for Women is a comprehensive resource with an alphabetical directory of all the organizations and foundations that offer grant funding to women. This one-stop site makes it easy for you to browse and find the best opportunities out there. It provides a quick overview of each grant, a link for direct access, and the funding amount.

Halstead Grant

This $7,500 cash grant is for entrepreneurs pursuing a business in the silver jewelry industry. In addition to the cash prize, grant winners receive business mentorship, assistance promoting their businesses, and visibility within the industry. The application deadline is May 1. The process involves submitting a portfolio alongside written essays about your business goals and strategy.

HerRise Micro-Grant

Marsha Guerrier, the founder of HerSuiteSpot, is passionate about getting women of color to take their businesses to the next level. To ease the burden of securing funds, her company partners with corporate sponsors and private donors to provide micro-grants. The HerRise Micro-Grant is a monthly $500 micro-grant awarded to a business run by a woman of color. These funds can be used to build a social media presence, design a website, or purchase equipment.

IFundWomen Universal Grant

IFundWomen Universal is a marketplace perfect for discovering new small business grants for women. First, you have to fill out one universal application. Then, when IFundWomen receives a grant from an institution, it will filter applications in the database against grant criteria. Previous partners of this program include VISA, Adidas, and Unilever. They even provide guidelines to help you build a solid case for your business.

National Association for the Self-Employed Growth Grants

The National Association for the Self-Employeed (NASE) has been giving $4,000 cash awards to small business owners every quarter. This cash grant can be used for a few purposes:

- Startup costs

- Expansion plans

- Advertising and marketing expenses

The only drawback of this grant is that it's restricted to the association's members.

SoGal Black Founder Startup Grant

SoGal Foundation, in association with bluemercury, TwelveNYC, Winky Lux, and Walmart.org's Center for Racial Equity, provides several grants to Black women and nonbinary entrepreneurs. These cash grants range from $5,000-$10,000.

To qualify, you need to have a majority stake in a business that can scale, be a Black woman or Black nonbinary entrepreneur, and have intentions of seeking an investor for future expansion. Applications are accepted on a rolling basis.

Tory Burch Foundation

The Tory Burch Foundation is committed to creating more funding avenues for women entrepreneurs. Its Fellows Program awards 50 grants of $5,000 each to upcoming women entrepreneurs. In addition to financial assistance, grant recipients are given access to 0% interest loans through Kiva, business mentoring, and access to digital resources for a year. The prize includes an all-expenses-paid trip to Tory Burch headquarters in New York.

Women Founders Network Fast Pitch Competition

The Women Founders Network's Fast Pitch Competition — now in its 11th consecutive year — provides up to $55,000 in cash grants to its winners. Women business owners can apply under either of two categories: tech-enabled businesses or CPG (consumer packaged goods)/non-tech businesses. Female founders can submit their pitches from April 1 through May 31, 2023.

Women Startup Challenge Tech Startup Grant

Women Who Tech is encouraging women to make their mark in the world of technology. The organization provides equity-free grants of $20,000 to women-led tech startups. This annual contest is open to women business owners anywhere in the world. In addition to funding, five finalists receive assistance in drafting a pitch to investors. Read up on the grant's eligibility requirements and apply if your business fits the criteria.

Bizee's Entrepreneur Grants

Here at Bizee, we offer two $2,500 grants for all small business owners. These include our Young Entrepreneur Scholarship Grant for current students and our Fresh Start Business Grant for adults looking to start or grow their businesses. The 2023 deadlines for both grants are March 31, June 30, and September 30.

Where Can I Find Local Business Grants?

SBA's Office of Women's Business Ownership, the National Association of Women Business Owners, and the U.S. Women's Chamber of Commerce are all good places to start your research.

You can also visit your Secretary of State, the department of economic development, and other official government websites in your area to inquire about state and local funding opportunities. Type "women's foundation/fund in (state)" into a Google search and filter the results that pop up.

The majority of states have their own state-sponsored women's foundation or fund offering networking opportunities, training, and local grants for women entrepreneurs. A couple of prominent program examples are in Vermont and California:

Lastly, don't forget to consult with female professionals in your industry. They may be aware of local grants specific to your business.

How to Find the Right Funding for Your Business Type

If you're wondering what the best funding option is for you, there are a few points to consider:

- First, understand what you require funding for. Are you investing in capital equipment? Do you have ongoing expenses?

- Next, know the amount of capital you require and how soon you need it.

- Consider your industry and any niche skills you have. Many grants are industry-specific or focus on diversity.

- Finally, ask yourself if you meet the program's eligibility requirements.

Once you've nailed down these points, you'll be equipped to find the best funding option for your startup. Consult a startup business professional to help you assess your options.

Funding Alternatives for Your Women-Owned Business

Grants come with stringent requirements and are fiercely competitive, and the turnaround time can be quite long. If you are keen on exploring other startup funding options, take a look at these:

- Crowdfunding: This funding method taps into the power of people and numbers. Crowdfunding works if you have a physical product you can offer to supporters in exchange for funds. Well-known crowdfunding portals are GoFundMe and Kickstarter.

- Angel Investors: Angel investors are individuals with high net worth who are looking to diversify their interests and increase their earnings. Angel investors are more inclined to invest in early-stage startups than venture capitalist (VC) firms. Angel investors often make great mentors, as the majority are experienced business veterans. 37 Angels is a prominent angel investor for women-owned businesses.

- Peer-to-Peer (P2P) Lending: This is a direct form of lending where there is no financial institution or bank acting as the middleman. The benefits of P2P lending include the ability to borrow from multiple investors, competitive interest rates, and quick financing.

- Small Business Credit Cards: This is a quick and short-term way of securing cash for your business. It's ideal if you aren't looking for a significant amount. Use a business credit card to cover common startup expenses like paying for your formation fees or building your website.

Ready, Set, Fund Your Women-Owned Business

Whether you're a first-time business owner or an experienced one, applying for financial aid as a woman can be daunting. Bizee wants to help all entrepreneurs succeed.

Our Entrepreneurial Grants offer $2,500 towards education expenses and/or startup costs. Apply now and get one step closer to turning your brilliant idea into a thriving business.

Swara Ahluwalia

Swara Ahluwalia is a freelance content writer with experience in the technical, B2B and SaaS domain. She also has curated content for various lifestyle brands. In her downtime, you will most likely find Swara training for her next marathon or spending time with her two daughters.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC