Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

If you've bought a house or a car, rented an apartment or taken out a personal loan, you know how important it is to have solid credit. The same is true for your business, but in this case, it's not just your personal credit history that matters.

Having good credit is just as critical to your business's success as it is to yours. Of course, you've been building credit with every financial decision since you became an adult. Is it possible to establish business credit in less time? And can you get business credit with an EIN? To help, we've put together some of our best answers to your business credit questions.

Maximize Your Business Expenses and Save Money on Interest.

Learn More With Our Credit Card Partner.

Learn moreWhy Is Establishing Business Credit Important?

One of the best reasons to build business credit is that it gives you access to much larger financial capacity than personal credit. If you want to invest more significant sums of money into your growing business, the amount available to you as a personal loan or personal credit limit might not be sufficient.

However, by tapping into the resources that are available for an incorporated business, you can dramatically increase the total amount of funds available to your company. If you own multiple businesses, you can even treat each one as a distinct entity when dealing with lenders. Ultimately, this affords you greater volume and flexibility when financing your various enterprises.

How Do I Apply for Business Credit?

That's sort of the catch: You can't actually apply for business credit — you have to earn it. That comes with time and with excellent management of your business finances.

But first things first: if you haven't done so yet, open a dedicated business bank account. This is your first, crucial step to separating your business and personal finances and establishing a credit history for your business.

From there, you have many other ways to continue strengthening your business's credit:

Can You Apply for a Business Credit Card with Just Your EIN?

The answer to this isn't black and white, but what it boils down to is...sort of. Your EIN is your business's personal identification, much like a Social Security number is an individual's personal identification. It might seem like a no-brainer to apply for business credit using only your EIN. After all, that will help keep your business finances separate from your personal finances and will help protect your privacy. It might also increase your chances of receiving funding if using your own SSN and credit score would be a hindrance.

However, it's not likely that you'll find a small business credit card that will accept only your EIN. Lenders want to have a guarantee that you're good for the amount they're lending, and if the worst happens and your business goes under, they want to be sure you're still on the hook.

Most of the time, to qualify for a card that accepts only an EIN, you'll need a long and strong credit history for your business. This is usually only the case for large, well-established corporations.

If your ultimate goal is to keep your finances separate, you'll want a card that will report to business credit agencies but doesn't report to consumer agencies. Bank of America is a good option in that case.

Ultimately, there is no silver bullet when it comes to getting your business credit built up fast and easy. But if you follow the steps we outline below, you'll be well on your way in no time.

How Do I Get High Business Credit?

Remember that there is no "set it and forget it" option for building your business credit. It's an ongoing process that takes time and requires your involvement. However, to make it as quick and painless as possible, make sure to follow the steps above and also educate yourself on what constitutes "good" business credit.

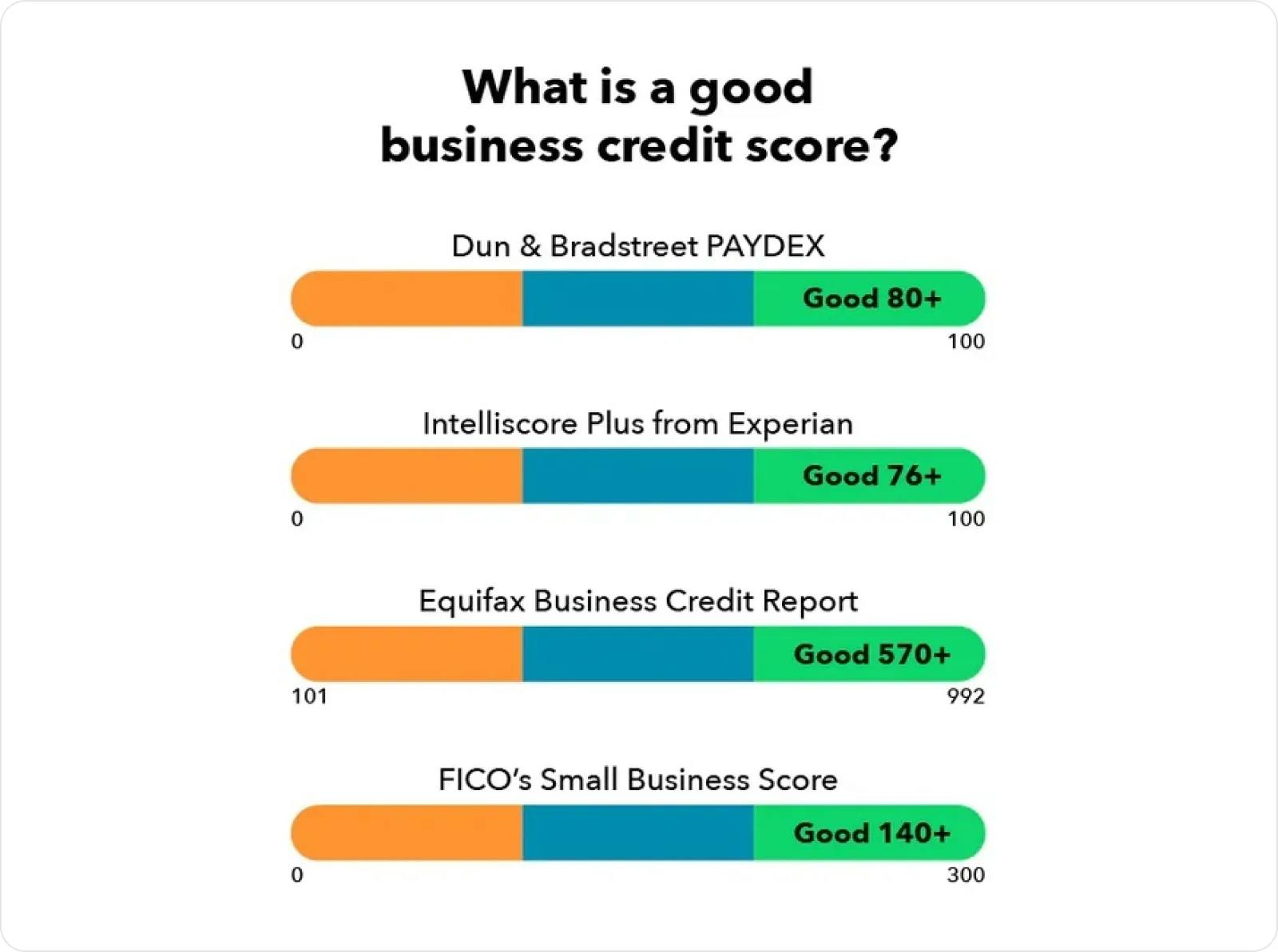

Each of the major agencies that report on business credit maintain their own scoring rubric. It's helpful for you to know the differences between each and understand where your business falls.

Remember that these scores are different from those measuring personal credit. So, a 740 might be a great credit score for an individual based on that single reporting agency...but it might be a terrible (or even impossible) score for a business.

Is There a Checklist to Build My Business Credit?

You asked, and we answered. Here's your complete list of to-dos so you can boost your business credit score:

1. Incorporate Your Business

In order to start building business credit, the owner must first incorporate the business by forming an LLC or other legal business entity. Incorporating your business legally separates your personal finances from your business.

2. Get Your EIN

Once incorporated, a business will need to apply for a unique nine-digit Employer Identification Number (EIN) from the Internal Revenue Service. It's used by government agencies, as well as any vendors and credit bureaus your business deals with.

3. Open a Business Bank Account

As mentioned above, make sure you open a business bank account for your LLC, including a checking and savings account, in the name of your business so you can make payments and deposits.

4. Make Payments from Your Business Accounts

Now that you’re an incorporated business, pay for all of your operating expenses — rent, supplies, utility bills, inventory, etc. — with your business bank account.

Making payments under the name of your business will help to build a business credit history, as there will be a proven track record of your business making payments on time.

5. Get a Business Credit Card

As part of setting up your business bank account, you should also apply for a business credit card through your bank. Just like with a personal credit card, paying off the balance of your business credit card each month builds positive payment history, increases your business credit score and lets potential lenders know that your business is reliable and trustworthy.

6. Apply for a DUNS Number

Dun & Bradstreet is a business credit reporting agency; you can help build business credit fast by applying for a DUNS (Data Universal Number System) number for your business. This will get your company connected to the business credit reporting system.

And having a DUNS number is also required if you want to apply for federal government contracts, grants or Small Business Association (SBA) loans.

7. Apply for a Business Line of Credit

If your business has just been launched, it might be prudent to “think small” in terms of building business credit. In the first 30 days after you’ve incorporated, try to arrange a small trade line of credit with a supplier or vendor. Consider applying for a small business line of credit from your bank. Even if you cannot qualify for a larger loan or credit limit, just getting a line of credit can help with establishing business credit.

Make Smart Financial Choices for Your Business

Just like with personal credit, making small but sound financial steps for your business increases its creditworthiness. Over time, as your business grows, your ability to borrow additional money will grow right along with it.

Once you’ve established good business credit, your company will be able to qualify for lower loan interest rates and get better payment terms from suppliers and vendors.

If you aren't sure where to start, Bizee can be your trusted ally in building your business credit and establishing solid financial footing. We're here to support you and offer the resources you need to succeed, like our comprehensive list of the top business credit cards.

Maximize Your Business Expenses and Save Money on Interest.

Learn More With Our Credit Card Partner.

Learn more

Wendi Williams

Wendi is a freelance writer based in Indianapolis, IN, with over a decade of experience writing for a variety of industries from healthcare to manufacturing to nonprofit. When she isn't working on solutions for her clients, she can be found spending time with her kids and husband, working in the garden or doing more writing (of the fiction variety).

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC