Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Once you start researching how and where to form an LLC for real estate investing, you'll quickly understand how complex of a topic it is. After all, state laws can vary wildly, and there's no shortage of important factors to consider.

To make your decision process easier, we've gathered some of the most crucial considerations and identified the five best states for forming a real estate investment LLC.

Join the 1m+ businesses that trust Bizee

GET STARTEDWhat to Consider When Forming an LLC for Real Estate Investing

Before you decide which state to form your real estate investment LLC in, you'd be wise to take a few key factors into account.

What Are the Advantages of Holding Real Estate in an LLC?

If you're new to the idea of using an LLC to hold real estate investments, then you might be wondering about the benefits of doing so.

For instance, real estate investment LLCs provide:

- Protection from liability: As the name "limited liability company" suggests, an LLC is designed to limit the extent to which its owner is liable. Simply put, if you own a real estate investment LLC that fails, your personal assets won't be at risk.

- Easy transfers: With an LLC, the process of transferring ownership is fairly easy. So if you ever decide to sell your real estate investment LLC, it won't be too much of a headache to do so.

- Simpler than other entity types: Compared to other entity types like C Corporations and S Corporations, LLCs are typically much simpler (and cheaper) to start and operate.

Just remember that forming an LLC for real estate investing will limit your liability but won't eliminate it, so you won't be immune to lawsuits or personal losses (especially if you blur the lines between your and your company's assets) — that's why some entrepreneurs choose to hire a lawyer for their LLC.

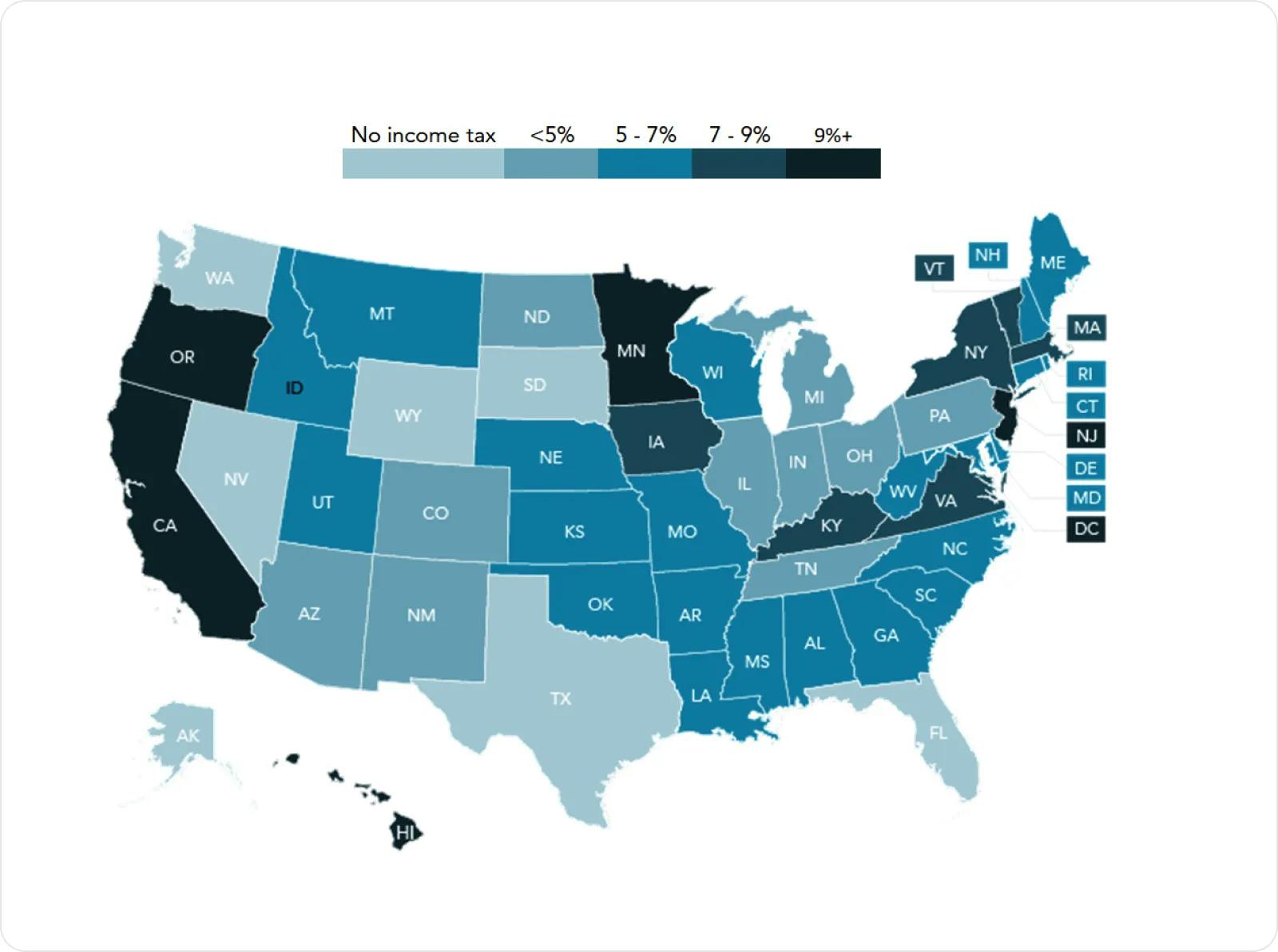

State Taxes and Fees

When choosing a state for your real estate investment LLC, one of the most important elements to consider is each state's taxes and fees and how they apply to businesses like yours.

For instance, some states have little to no income tax, while others tax a significant percentage of individuals' income. Case in point: Oregon had a top income tax rate of over 9 percent in 2020, while its neighbor to the north, Washington, had no income tax at all:

Similarly, some states charge multiple hundreds of dollars to file an LLC, while others charge a grand total of $0.

So when deciding which state to go with, you'll need to think about each one's LLC taxes and fees and how they'll affect you in both the short- and long-term.

Series LLC Availability

For some real estate investors, a series LLC is the way to go. Sometimes abbreviated as an SLLC, a series LLC is a specific type of LLC in which there is one "parent" or "umbrella" LLC with several other LLCs operating beneath it:

Using a Virtual Address for Your Registered Agent Address

This LLC structure is particularly useful for real estate investments. After all, separating your investments into different companies can reduce the risk of one property having a negative effect on all of your properties in the event that something goes wrong.

So why don't all real estate investors use series LLCs? It all comes down to state regulations. As of 2022, a series LLC can only be formed in the following states:

- Alabama

- Arkansas

- Delaware

- District of Columbia

- Illinois

- Indiana

- Iowa

- Kansas

- Minnesota

- Missouri

- Montana

- Nevada

- North Dakota

- Oklahoma

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Wisconsin

- Wyoming

So if you want to use a series LLC to protect your investments, you'll need to form one in a state that allows it.

The Top 5 States to Form a Real Estate Investment LLC

So you know the most important factors to take into account when choosing which state to form your real estate investment LLC, but which are the best overall?

The answer may vary depending on the types of investments you want to make and the type of LLC you want to start, but generally speaking, the following five states come out on top. (Bonus: Every one of our picks recognizes series LLCs.)

1. Wyoming

No matter how you slice it, the Cowboy State is one of the best for real estate investors looking to form an LLC.

There's no income tax (including for LLCs), it costs just $100 to file and you'll only be charged $60 per annual report.

Plus, Wyoming doesn't charge extra for non-residents to form an LLC, so whether you live in Cheyenne or Cape Canaveral, you can enjoy the same low fees.

And the rental market looks good, too, if your real estate business will involve rentals. According to short-term rental data analytics provider AirDNA, Cheyenne, Wyoming, has an overall rental demand score of 93/100. As of April 2022, its short-term rental market is growing by 6 percent per quarter:

And the largest percentage of homes in Wyoming sell for just $124K-$249K, making Wyoming a great place to invest in real estate and set up your LLC.

2. Texas

Have you been asking yourself, "Should I create an LLC for my retail property in Texas?" Depending on the business benefits you're looking for, the answer might just be "yes."

Although LLCs do have to pay franchise tax, the rate is low — as of 2022, it's just 0.75 percent for non-retail or wholesale businesses (like real estate investment companies, for example).

It costs $300 to form an LLC in Texas, but there is no annual fee for most LLC owners. So, the trade-off may be worth it if you're planning to keep your LLC up and running for several years.

When it comes to your investment, Houston, Texas, for example, has an overall rental demand score of 69/100. Its short-term rental market is growing by 15 percent per quarter, according to AirDNA data.

Texas is also known for having affordable homes, and the median home value is $204,185.

3. Nevada

There's a reason many people cite Nevada as one of the best states to form an LLC.

Why? For starters, businesses don't have to pay income tax (unless their gross yearly revenue exceeds $4 million), which is a huge plus for real estate investors who want to put more money into their properties and less into state taxes.

As an added bonus, it only costs $75 to form a Nevada LLC (although you'll also need to pay $200 for a business license and $150 to file an annual list of members).

The rental market in Nevada is good, too. According to AirDNA, Las Vegas, Nevada, has an overall rental demand score of 79/100. Its short-term rental market is growing by 8 percent per quarter.

Homes are a little pricier in Nevada, with a median value of $358,925, but it was awarded the highest score (10) for home appreciation values compared with all of the U.S.

4. Montana

If you're looking to start a real estate investment LLC for a low cost, then Montana certainly lives up to its nickname of the Treasure State.

It costs only $70 to form an LLC (plus $50 for each series if you're filing a series LLC), and each annual report you file comes with a maximum fee of just $35. And unless you choose to have your LLC taxed as a partnership or S Corporation, it won't be subject to income tax (it may, however, be responsible for withholding tax on your behalf).

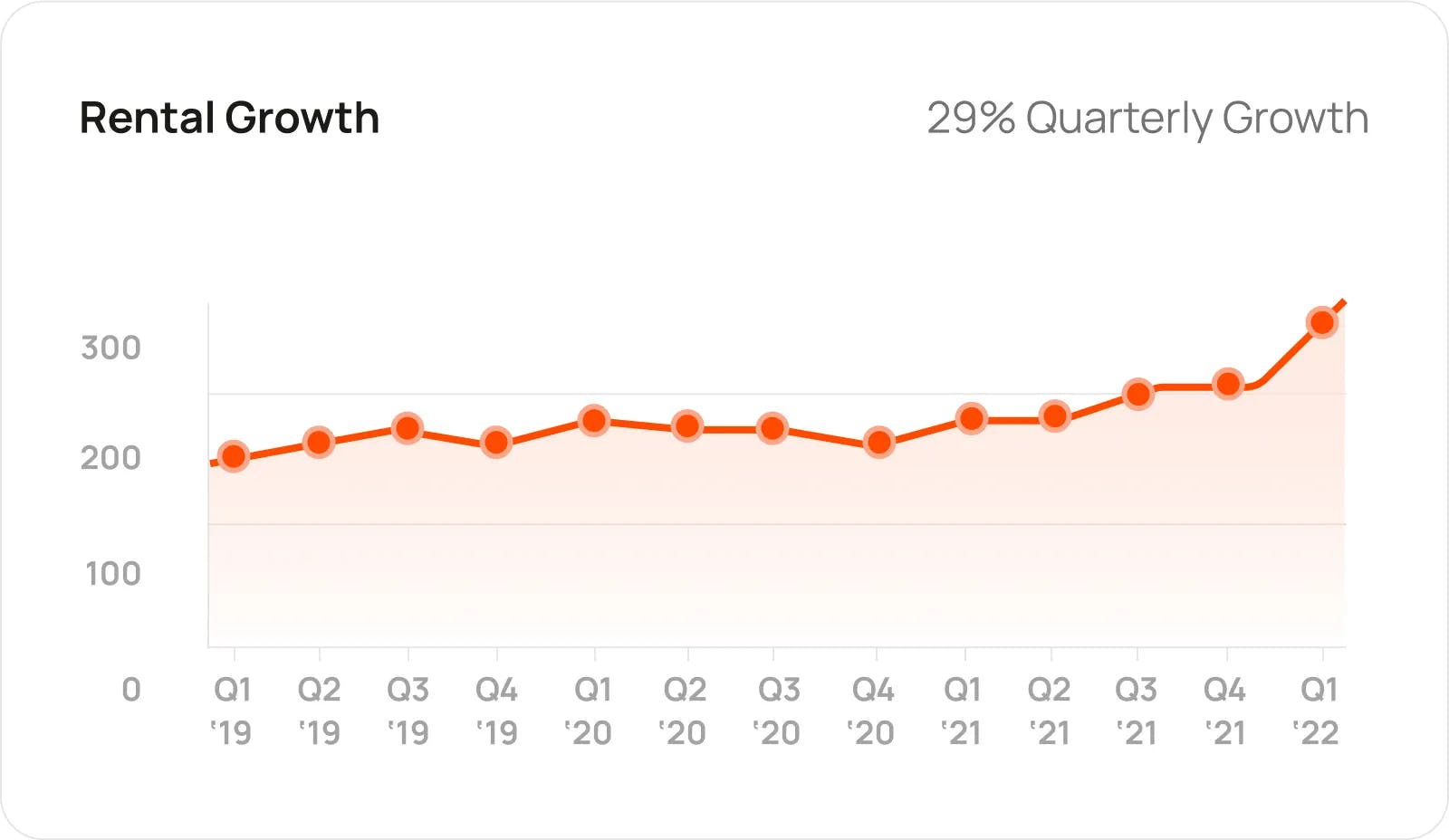

When it comes to investing in a rental, according to AirDNA, Billings, Montana, has a high rental demand score of 97/100. Its short-term rental market is growing by 29 percent per quarter:

The majority of homes in Montana sell for anywhere from $143K-$429K, and the state also received the highest score (10) for home appreciation values when compared with the rest of America.

5. South Dakota

With an LLC formation fee of just $150 whether you live within its borders or not, South Dakota is an extremely LLC-friendly state.

Best of all, there's no income tax for individuals or corporations, LLCs included.

You'll just have to pay $50 per year to file your annual report, but that's likely a much lower cost than what you'd pay in many other states in income tax alone.

Depending on where you're investing, some areas, like Sioux Falls, South Dakota, are growing. According to AirDNA, Sioux Falls has an overall rental demand score of 90/100. Its short-term rental market is growing by 3 percent per quarter.

Investing in real estate in South Dakota is ideal as well, with most homes selling for just $128K-$256K.

Starting Your Real Estate Investment LLC

While there is no one right answer to the question of which state your should choose to file your real estate investment LLC, you're unlikely to be disappointed with any of those five choices.

Want to know more about the fees and regulations associated with filing an LLC in your state? Bizee's LLC state guides can show you exactly what you need to know in seconds.

Form Your LLC $0 + State Fee.

Includes Free Registered Agent Service for a Full Year.

GET STARTED TODAY

Carrie Buchholz-Powers

Carrie Buchholz-Powers is a Colorado-based writer who’s been creating content since 2013. From digital marketing to ecommerce to land conservation, she has experience in a wide range of fields and loves learning about them all. Carrie is fond of history, animals and beauty in equal measure. In her free time, she enjoys knitting, playing video games and exploring Colorado's prairies and mountains with her husband.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC