Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

There are close to 2 million third-party sellers on Amazon, with thousands more signing up every day. These sellers are most often individuals or small business owners, and almost half make $5,000-$10,000 a month in sales. If you're looking to join the movement, choosing the right Amazon seller business type can dictate how your business runs. We've got all the details you need to make your mark with the largest global retailer right ahead.

Form Your LLC @ $0 + State Fee.

Includes Free Registered Agent Service for a Full Year.

Get Started TodayAmazon LLCs: Pros and Cons

LLCs, or limited liability companies, are a popular choice for Amazon sellers. In fact, Amazon itself is an LLC. So why would you choose an LLC for your Amazon business? Let's address the positives and the negatives of forming one of the most popular entities for small businesses.

Pro: Liability Protection

One of the biggest benefits of forming an LLC is the liability protection you receive. This means that your personal assets won't be jeopardized in the case of legal action. An LLC significantly reduces your risk as a seller and contributes to the longevity of your business.

Pro: Tax Benefits

LLCs are pass-through entities, meaning your business income "passes through" to your personal tax return. This can simplify the process and reduce headaches around managing business taxes, compared to other business structures. LLCs also give you greater tax flexibility, so you can choose to be taxed as an S Corp for potential savings on self-employment tax, while still remaining an LLC.

Pro: Better Branding

With millions of third-party sellers on Amazon, it can be tough to set your business apart. Of course, there's the benefit of having Amazon's name behind you...but so do all the rest. Being an LLC adds to your credibility and builds your reputation so buyers know when they shop your store, they're buying from a legitimate business.

Con: More Involved Setup Than a Sole Proprietorship

LLCs are one of the simplest business structures to set up, but if your other option is to start out as a sole proprietor, it takes a bit more effort. You'll need to go through the business formation process, which involves some paperwork and planning. LLCs require less than C Corps and S Corps though, so it's still a great choice for those looking to get started quickly. As an LLC, you'll have more paperwork in the form of ongoing maintenance.

Con: Ongoing Maintenance

Speaking of ongoing maintenance, LLCs (and all legal business entities) come with some responsibilities for compliance. That means you'll likely need to file an annual or periodical report, file your taxes, and stay on top of various other filing obligations. The requirements for LLCs are often lighter than those for corporations but more than for a sole proprietor. This shouldn't stop you from forming an LLC, but it's always good to know beforehand.

Amazon Sole Proprietors

Another option that's popular among Amazon third-party sellers is a sole proprietorship. Sole proprietors do not form legal business entities but run their businesses as individuals. This is how many Amazon sellers get started. It can be a great way to "test the waters" before selecting your entity. There's no cost in being a sole proprietor (in that there are no filings or registration fees), and there's no paperwork, either.

But while sole proprietorship is how many successful businesses get their start, we always recommend forming a legal entity as soon as possible. Why? Because sole proprietorships offer none of the liability protection or benefits of LLCs or corporations. This means that, should a buyer or another seller take action to sue you, your personal assets could be on the line.

Sole proprietorship is certainly a valid option, but it doesn't come without risks. Make sure, before you choose, you're fully aware of the differences between sole proprietorships and legal business entities, so you make the right decision for your business.

Other Business Entity Types

LLCs and sole proprietorships aren't your only options when setting up your Amazon shop. Though less popular among Amazon sellers, you can also choose to form an S Corp or a C Corp for your business.

S Corps for Amazon

S Corps are similar to LLCs in that they offer pass-through taxation. Additionally, they can also provide benefits that may result in significant tax savings and a reduced tax burden. S Corps come with more regulations than an LLC, so it’s wise to understand them before you get started.

For instance, an S Corp is limited to 100 shareholders, all of whom must be U.S. citizens. It can be a great choice if you want to raise capital but still have the ease of pass-through taxation. You can also have an LLC that you designate as an S Corp for tax purposes.

C Corps for Amazon

C Corps are the least common entity for Amazon third-party sellers, but they are still a valid choice, especially if you’re interested in large-scale, rapid growth, public trading, or raising large amounts of capital.

C Corps are not pass-through entities, but they can be subject to “double taxation,” so you might experience a larger tax burden. C Corps also come with a lengthy and sometimes complicated registration process. If a C Corp is right for you, it’s worth it, but you’ll need to be sure it’s the best pick for your business.

Which Entity Is Right for My Business?

Only you can determine which entity is the best for your Amazon seller business, and the info here should help you decide. You will need to know your entity — and if it's a legal business structure, have it registered — before you set up your seller account.

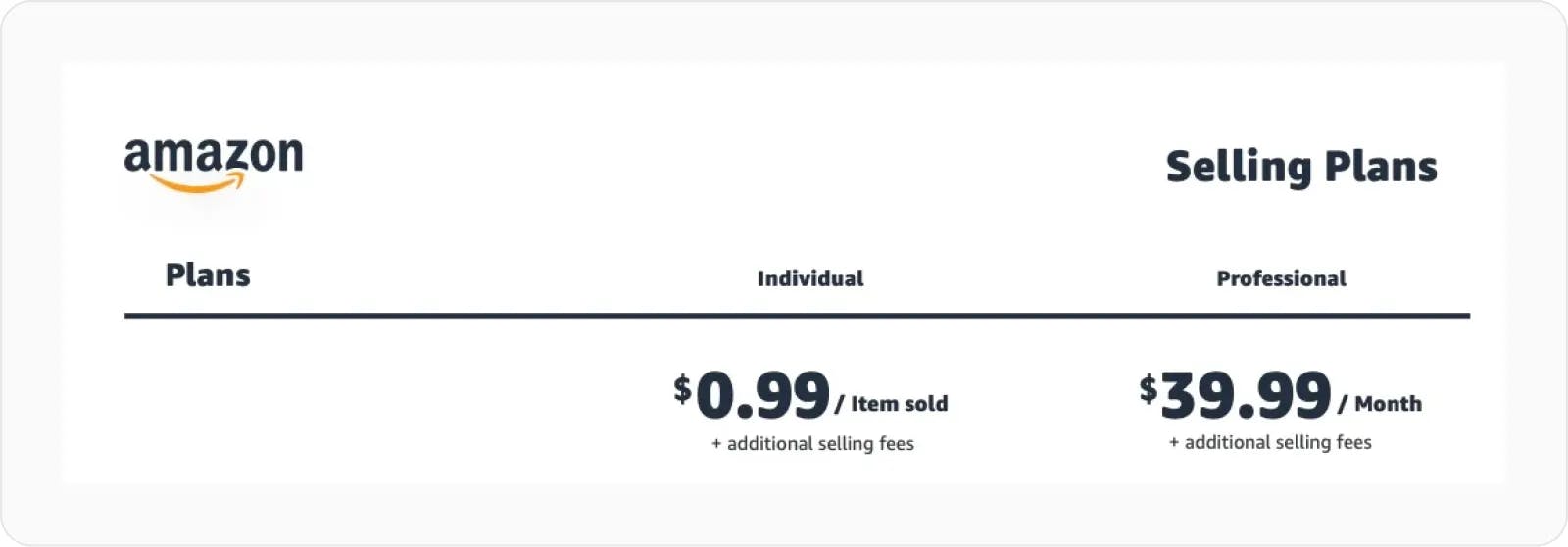

It also helps to decide on the selling plan you're going to select, and this might also influence the entity you choose. Currently, there are two Amazon selling plans — individual and professional.

If you're planning to start slow and only sell a handful of items a month, the individual plan, in which you pay a per-item fee, is probably right for you. It can also be the best option if you're beginning as a sole proprietor. It keeps everything on a small scale and gives you some time to test the waters and decide how and what you want to sell.

The professional plan is for larger businesses intending to sell more than 40 items per month. The monthly fee covers unlimited item sales and allows sellers to advertise and get better placement on product detail pages. This plan is best suited for LLCs, S Corps, and C Corps.

Amazon FBA LLC or Sole Proprietor?

There's another critical choice you'll need to make early on in your journey as an Amazon seller. Will you stock, store, and ship on your own, or will you use Fulfillment by Amazon (FBA)?

FBA is an enormously popular choice for third-party sellers. While it comes with higher fees, it also takes a lot of the workload off your shoulders and can expand your product line, shipping territory, and more.

If you decide to go with Amazon FBA, the question then becomes: LLC or sole proprietorship?

You can choose either, but as mentioned, an LLC will give you liability protection that will reduce your risk and protect your personal assets. An LLC also protects your identity and your privacy — remember that a sole proprietor operates under their own name, so that's what will be seen when buyers find your FBA shop.

Whatever you choose, FBA is a great option to get a successful store launched and running in a short amount of time. It takes care of many of the logistics, so you can stay focused on sourcing products and marketing your brand.

Do You Need an LLC to Sell on Amazon?

The short answer is "No." The long answer is "No, but..."

Then you can insert any of the info from above for why it's a wise decision to form a legal business entity, like an LLC.

Officially, Amazon does not require any seller to have a formal business structure. In fact, individual sellers (sole proprietors) are typically the default when setting up your account on Seller Central. However, we believe it's cost-efficient and worthwhile to seriously consider forming an LLC to protect your Amazon business.

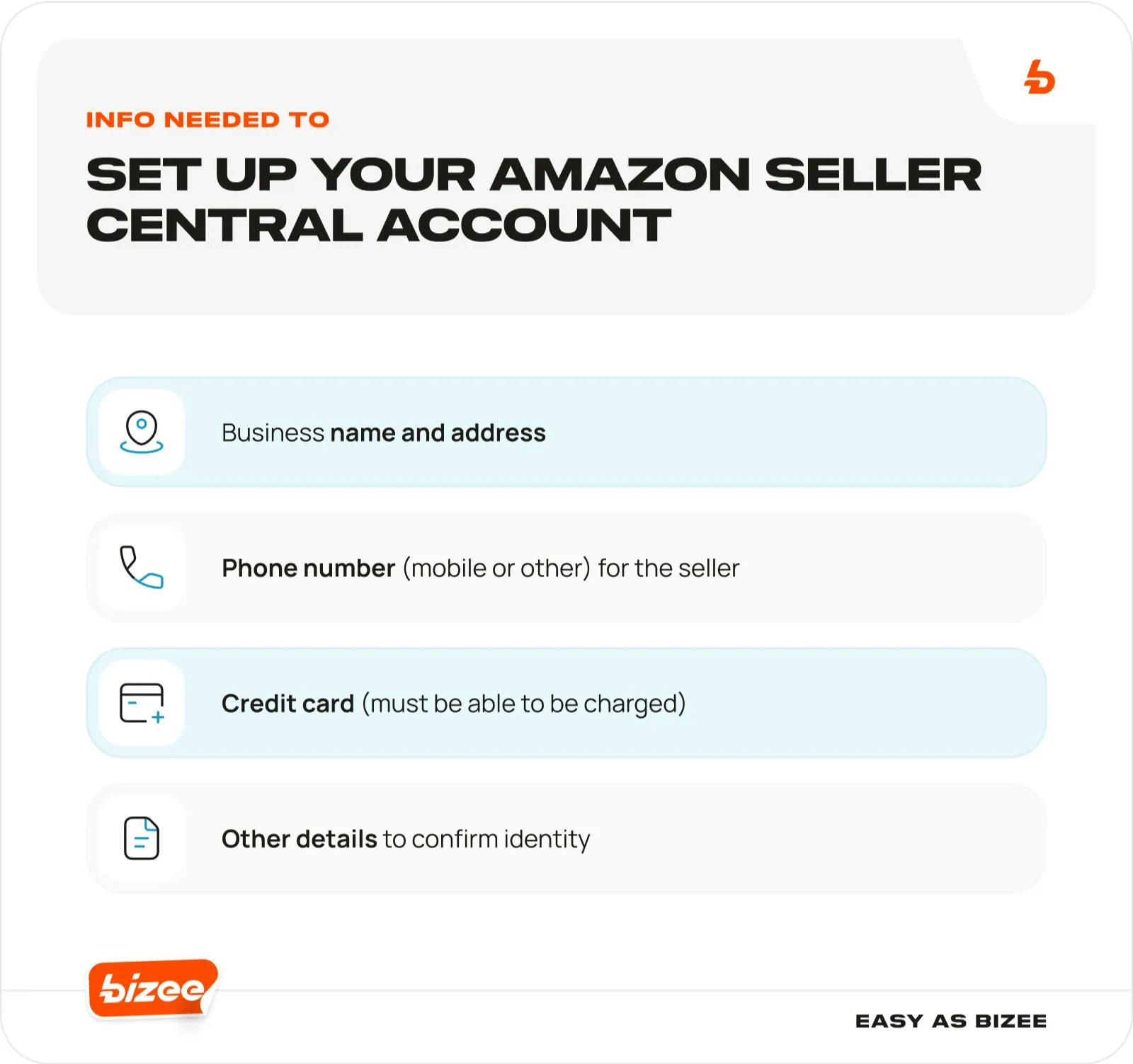

And when you're ready, your first step will be to make things official by creating your Seller Central profile. Before you begin, gather all your information — including your LLC info.

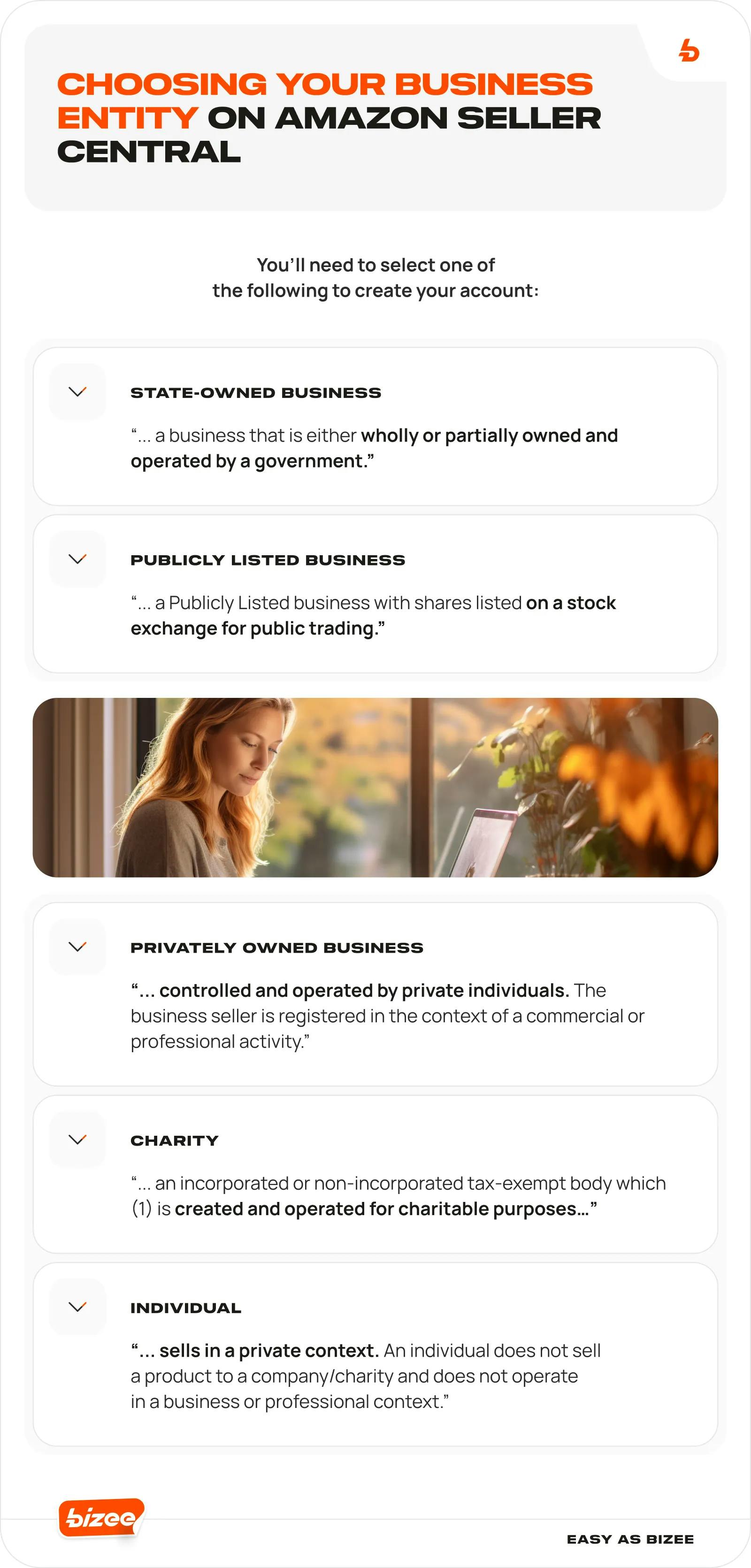

While you aren't required to have an LLC or any other legal business entity to sell on Amazon, you are required to state your entity type during the registration process. The most common types are Public, Private, or Individual, but read through the descriptions carefully, as selecting the wrong one can compromise your account.

How to Incorporate Your Amazon Seller Business

Now that you know what type of Amazon seller you'd like to be, and what entity best suits your needs, you'll want to understand how to incorporate your new business.

If you've decided to operate as a sole proprietor, you can go straight on to setting up your Amazon seller profile on Seller Central.

If you're opting for an LLC or corporation, you have a couple of ways to pursue your goal:

- Handle the paperwork and manage the process yourself through your state's business formation agency

- Rely on a trusted business formation service with the experience and know-how to get your business started on the right foot

Whatever you decide, you'll need to gather some information before you begin, including the following:

- The name and address of all members of the business

- Your chosen business name that's not currently used by any other business in the state

- The name and contact information of your designated Registered Agent

When you're ready, we invite you to check out the business formation packages Bizee has provided for more than 1,000,000 business owners, and join our growing community of successful entrepreneurs.

Amazon Business Resources

Want more in-depth information on starting your Amazon seller business? Here are some detailed, comprehensive resources to get you started.

- Amazon Beginner's Guide: Go straight to the source with Amazon's guide for new sellers.

- Amazon Selling Programs: Get a rundown of all your seller options, incentive programs, financing support, and more.

- How to Start an Amazon Business: This guide from Bizee has everything you need to know to get your Amazon business off the ground.

Frequently Asked Questions

Got more questions on Amazon seller business types? We've got answers!

Which Business Type Is Best on Amazon?

There isn't a "best" business type for Amazon sellers, but your research should point you in the direction of the best business type for your needs. Most of the time, we recommend an LLC for Amazon third-party sellers, but you can also choose to operate as a sole proprietor or register as an S Corp or C Corp.

What Type of LLC Do I Need to Sell on Amazon?

You don't need an LLC to sell as a third-party shop on Amazon, but having an LLC for your business is recommended. You can form your LLC as an individual or with multiple members. Your LLC will provide you with liability protection to ensure your personal assets are covered.

Is an Amazon Seller Considered a Business?

Once you sign up for your seller profile via seller central, you're officially considered a third-party Amazon seller, and you're in business. This is the case whether you form a legal business entity or choose to operate as a sole proprietor.

Do You Need to Be a Registered Business to Sell on Amazon?

You don't need to have a formal business structure, but you do need to be registered as an Amazon seller on the platform's Seller Central. The sign-up process will request additional information if you do have a legal entity, such as business name and address.

Ultimately, starting an Amazon business as a third-party seller is a great way start your entrepreneurship journey, due to the low barrier to entry, cost-efficiency, and earning potential. While you aren't required to form a legal business entity to launch your Amazon shop, there are many benefits in doing so.

Ready to get started with a successful Amazon seller business of your own? The best way to get started is to form your business with Bizee. Our $0 + state fee LLC formation service is a perfect choice for most business owners. You provide your information, and we'll take care of all the rest, so you can jump in and begin running your business right away.

Wendi Williams

Wendi is a freelance writer based in Indianapolis, IN, with over a decade of experience writing for a variety of industries from healthcare to manufacturing to nonprofit. When she isn't working on solutions for her clients, she can be found spending time with her kids and husband, working in the garden or doing more writing (of the fiction variety).

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC