Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Business is booming, but there are only so many hours in the day. You could really use some help managing, operating, and furthering the core functions of your business activities. Once you've found someone who values what you do and is ready to take on the challenge, you'll need to make it official.

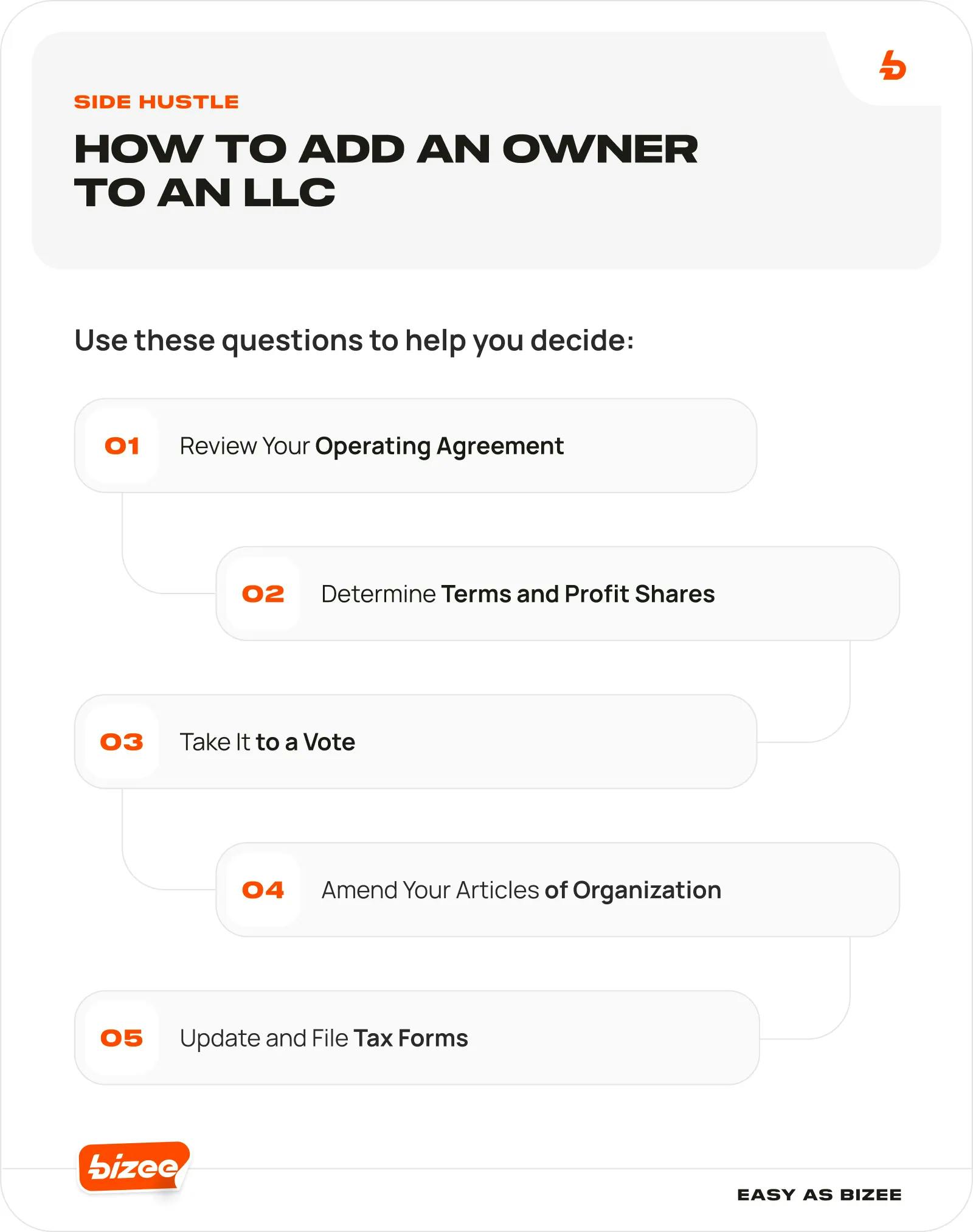

Let's learn how to add new members to your LLC in five simple steps. Then, we'll go over the pros and cons and answer some common questions.

1. Review Your Operating Agreement

Your operating agreement is designed to outline how your business can run most efficiently, and it should also include information on how to add a member to your LLC. Not all states require your LLC to have an operating agreement, but you can get started easily if the guidelines are in place. If you do have this document, give it a thorough inspection to see if the procedure for adding members has been outlined.

If so, there may be some initial actions to take. Do you need a unanimous vote from existing members to add members to LLC? What percentage of the company can be sold to a new member? It's important to follow whichever procedures are outlined in your operating agreement — first of all, because it functions as a legally binding document, but also because it shows that your business is capable of following its own rules and adhering to its own terms.

Now…what if you don't have an operating agreement? Or, what if your agreement doesn't list any specific terms pertaining to the addition of new members? In most cases, you'll need to instead follow the rules set out by your state's limited liability laws. In some states, this could mean dissolving your current LLC and forming a new one to legally change the ownership structure.

Referencing your operating agreement is the best way to start the process and determine exactly how to add new members or owners. If your business doesn't have an agreement, Bizee provides access to a lawyer-approved template for our Gold and Platinum Package members that will cover all of these important terms and details. It might also be beneficial to refresh your memory on the specific workings of LLCs as you move through the process.

Order Platinum Package - $299 + State Fee (Includes Free Registered Agent Service & Domain Name + Email)

2. Determine Terms and Profit Shares

If you're asking, "how do I add a partner to my existing business?" you should be considering the terms of your new arrangement as well. While we're laying out each step of the process, this particular step is crucial for adding members to LLC entities. Adding a new partner or member to your business means giving them direct access to your business, and as such, there must be legal terms that all parties agree to.

In most scenarios, adding members to LLC entities involves having the new member bring a capital contribution to your business. This may be a cash investment, or it could be in the form of property or specific services that enable your business to expand into new markets. Whatever the contribution, setting terms and defining how profit will be shared amongst each member is essential.

LLCs use percentages to reflect ownership interest. Perhaps you've heard of agreements where one partner's ownership interest or percentage share is 51%, while the other partner is allocated the remaining 49%. This is done to give one owner a controlling stake or final say regarding business decisions.

You can also change an LLC member's percentage share at a later date if needed. When adding members to LLC entities, you might find that a similar arrangement works, such as allocating a percentage stake in the company that determines profit share. Or, you might need to define alternative terms depending on the level of involvement or capital contribution your new members bring to the table.

All of these terms should be outlined in your operating agreement, which will need to be revamped after altering the ownership structure.

3. Take It to a Vote

The third step in adding a new owner or member to an LLC is having current members vote on an amendment to the operating agreement. This vote must be recorded in the company's official minutes. Most LLC operating agreements (and most states) require the vote to be unanimous; all parties must agree to add the new member to the company.

But what if it's just you? If you're the sole owner of your LLC, you'll still need to formally cast your vote and record it — this documentation will need to be kept with your formation documents and pertinent records for future reference.

If you already have other members in your LLC and the vote to add a new member is discordant, you might find yourself in a tricky situation. However, if your operating agreement and formation state accept a majority vote, it's acceptable to move forward with the addition. Whichever way you proceed, making an effort to understand why the decision is not unanimous amongst your LLC members is highly encouraged. Transparency within an organization enables better discussion and a higher degree of trust between members, which isn't something to be taken for granted.

In the case of a discordant vote, it may be beneficial to reexamine the terms set forth for adding the new member. The proposed profit percentage or ownership percentage could be the issue, and it's worth noting that these two numbers don't have to be equal.

4. Amend Your Articles of Organization

Once all members have voted and a decision has been reached, you'll need to amend your Articles of Organization. This may also be a good time to determine whether you want your LLC to be member-managed vs. manager-managed.

Some states don't require this amendment since their Articles of Organization don't require LLC member information. If you aren't sure about your state's policy, contact your Secretary of State or whoever is responsible for business filings.

This amendment, known as a Certificate of Amendment or Articles of Amendment, must include specific information about your business, such as:

- Name of the business (as it appears in your existing Articles of Organization).

- Date when the business was legally formed.

- Information about the proposed change in the ownership structure (terms of the amendment).

- Name and address of your LLC's Registered Agent (you may have chosen Bizee to act as your Registered Agent if you formed your business with us).

- Signatures of the authorized signee(s) for the company.

Once the Articles of Amendment have been filed, there's one last step to take before your new members can be considered official.

5. Update and File Tax Forms

Part of navigating how to add an owner to an LLC is understanding the changes to your taxes. If you used to be the sole owner, it's likely you've been using your own Social Security number as your federal tax identification number. With more than one owner or member, your LLC will be required to obtain an Employer Identification Number (EIN).

Your EIN is your LLC's tax identification for filing business tax returns and completing W9 forms, and it's often required when opening business bank accounts. You must have an EIN in order for your LLC to pay employees and manage payroll.

You'll also need to take a good look at your tax structure. Understanding how to add a member to an LLC is one thing, but you'll also need to understand how your business should be taxed. An LLC without members is taxed as a sole proprietorship, so if you wish to add a new member and be taxed as a corporation, there are additional forms and filings that the Internal Revenue Service (IRS) will need in order to provide you with corporate status.

If you aren't sure how your business should be taxed with the addition of a new member (or members), Bizee's tax accountants can help you navigate the process and determine the best tax status for your LLC. You can sign up for a free tax consultation to get more information.

Adding Partners to Your Business: Pros and Cons

Now that you know how to add an owner to an LLC, you must consider the pros and cons of making such a big change. Adding a partner can be a great boon, but sharing opposing views on business operations can quickly lead to problems. Let's take a look at the benefits and disadvantages of adding members to LLC entities.

Pros of Adding Members to LLC

- Shared workload. You'll be able to split the workload between two people instead of carrying the burden of daily activities alone. Many business owners run ragged trying to get everything done. As they say, more hands make light work.

- New ideas. You may already be an "ideas" kind of person, but a partner can bring new ideas to the table and help transform your business for the better. Having another pair of eyes can lead to better solutions that help you grow and scale.

- Decreased cost burden. If you rent office space or equipment, have inventory costs, or face other financial obligations necessary to business activity, splitting the cost between two partners makes a huge difference. Cash flow is often the biggest stumbling block for business owners, and having someone else to shoulder the burden can ease your stress and enable you to focus on more important tasks.

- Less paperwork. When you're the sole owner, tedious paperwork can feel endless — and it all falls on your shoulders. Adding an additional partner means sharing those responsibilities and lightening your load of paperwork.

- Ability to pursue new ventures. With two or more strong minds working together, your options are virtually endless. Adding a business partner to your LLC can open up opportunities to dive deep into competition research and industry trends, enabling you to harness a better understanding of your ideal audience. If your partner has experience in something you don't, you can leverage their knowledge to pursue new ventures and enter new markets.

Cons of Adding Members to LLC

- Navigating disagreements. Unfortunately, business partners don't always agree on how things should be done, and this can create stress and tension within your LLC. This is why most business partners don't opt for a 50/50 split of the ownership interest, instead giving one partner (usually the original owner) a controlling stake. Still, even if you have the final say when a disagreement arises, it's important to try and work out your differences to achieve peace in your business.

- Making joint decisions. When you add a business partner, you seldom get to call the shots without informing your partner and hearing their input. If you're patient, you can use this as an opportunity to build trust within your partnership. However, decisions could end up taking longer to make, leading to missed opportunities along the way.

- Sharing profits. Adding members to LLC entities means sharing all of the business profits. Instead of pocketing it all for yourself, you'll have to adhere to the terms outlined in your operating agreement. That said, the goal of adding a business partner is to increase profits overall, so this may only be a disadvantage in the beginning.

- Managing informal arrangements. As you go through the process of adding an owner to your LLC, it's important to know that the government doesn't have any requirements about the nature of your partnership. In other words, adding a new member is a legal agreement, but how you work, interact, and share the workload is considered an informal agreement. As such, it can be stressful if there are challenges, disagreements, or tension when one partner isn't pulling their own weight.

How Do I Add Multiple Members to My LLC?

To add multiple members to your LLC at the same time, follow the same steps listed above. When you draft your Articles of Amendment, include all information relevant to each new member.

What happens if one or more of the proposed members is a non-U.S. citizen or non-U.S. resident? Can non-U.S. residents still be added to your LLC? The answer is yes — U.S. citizens, U.S. residents, non-U.S. citizens, non-resident aliens, U.S. business entities, and non-U.S. business entities can all become members of your LLC.

How Do I Change Ownership of an LLC With the IRS?

At some point, you may wish to change the ownership of your LLC or transfer partial or full ownership of your LLC to another member — or buyer, if you've elected to sell your LLC entirely. No matter the situation, you must notify the IRS, which will update its records based on your submitted Form 8822-B. Then, you'll need to determine tax regulations and IRS requirements, which involve either a short-term or long-term tax rate on any profit generated by the sale of your LLC.

Want to Add a Member to Your LLC? Start by Creating Your Operating Agreement With Bizee

Now that you know how to add a member to an LLC, it's time to create your operating agreement so it supports your new member addition. Bizee can help you do this by focusing on and addressing the most important and relevant aspects of your specific business.

Our team of legal experts knows which questions to ask to get the right information, and they can help you avoid lost time and money compared to completing the agreement on your own. You want to run your business, and we want to help you run it with ease. Order our Gold or Platinum package today and receive a lawyer-approved operating agreement template for your LLC.

Join the 1m+ businesses that trust Bizee

GET STARTED

Chad Ruppert

Chad is a freelance writer and former project manager focused on presenting information on SaaS, technology and business formation.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC