Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

If you've been bitten by the entrepreneurship bug, you might have your sights set on any number of new business opportunities.

And why not? Operating multiple businesses may increase your workload, but it's also a great way to diversify your income pool. Plus, it gives you the opportunity to keep learning and gain a new perspective on business in general.

If you are thinking about starting multiple businesses simultaneously, here are all the details you need.

Try Our Free Business Name Search Tool.

Check the Availability of Your Business Name.

Get Started TodayConsiderations for Running Multiple Businesses

Statistics state that the average number of businesses started by an entrepreneur is two. You might be wanting to launch several ideas, but how do you know if you’re ready? Here are a few points to consider.

New Business Idea Viability and Growth

Assess all of your ideas and their ability to turn a profit and the amount of time and resources required to launch and manage them. You'll need to perform market research to understand who your competitors are, the potential market size, any risk factors and the financials needed to get off the ground.

Speak to members of your local Small Business Group or a SCORE mentor to get a grasp on idea viability, market prospects and costs.

Do consider the scalability of the businesses. Can the ideas be spurred into a franchise?

Where’s the Money? How Will You Fund Multiple Businesses?

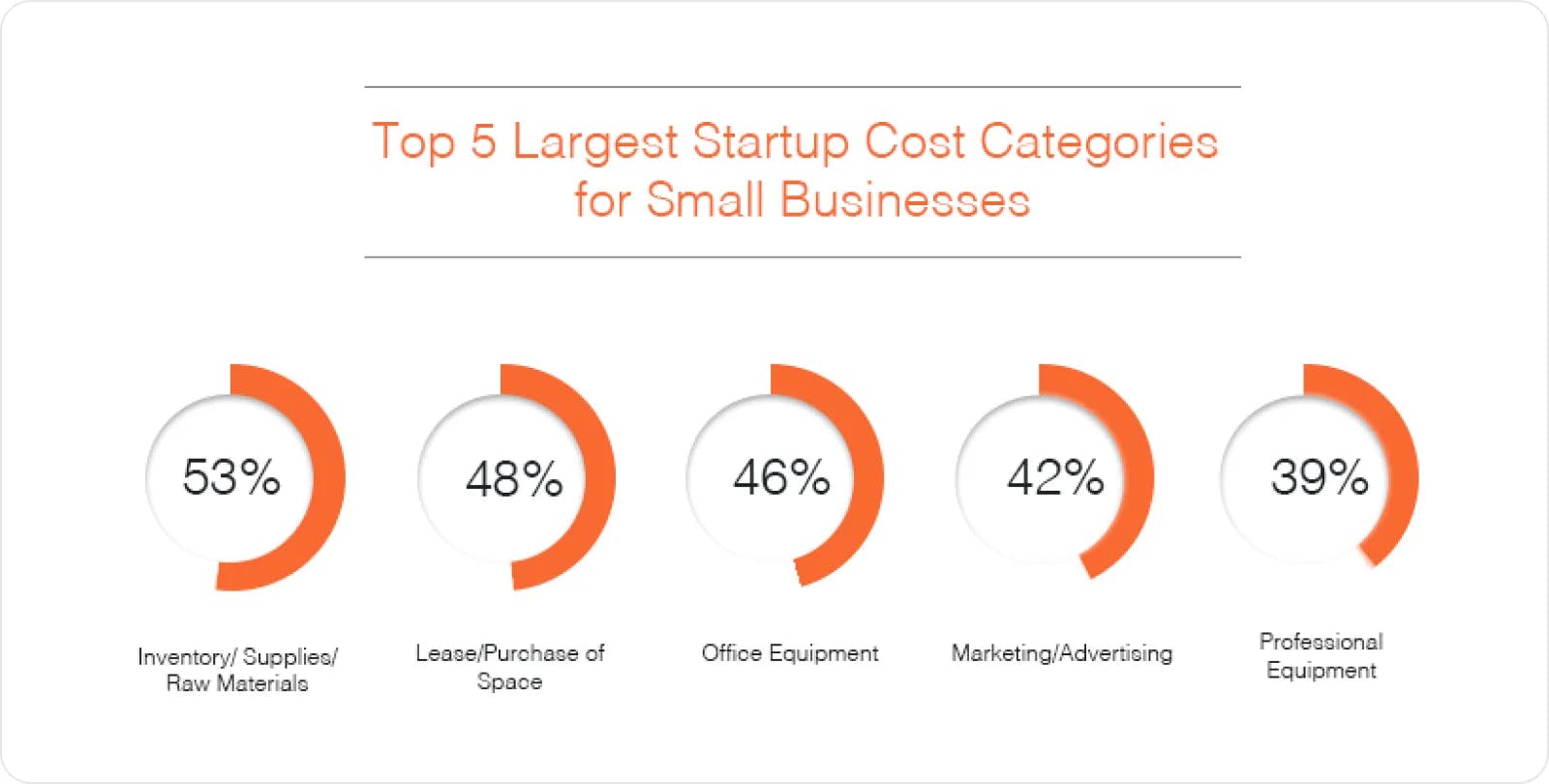

Thirty-eight percent of small businesses fail due to a lack of capital, and starting multiple businesses is a whole lot more costly than just one.

According to the U.S. Small Business Administration, most small businesses require around $3,000 to start. So, if you want to start three businesses, you'd roughly need $9,000 to get things going. Use this worksheet to identify your startup costs and then iron out your funding.

Do you have enough funds aside or would you require a loan? Will you target angel investors or family/friends to raise capital?

If the new businesses involve products, you could explore crowdfunding. Crowdfunding is a popular and unconventional way of raising funds where you don’t lose any ownership percentage. Fundable and Indiegogo are two popular crowdfunding portals (fees are 3-5 percent of the amount raised).

Once you’ve got the above pieces sorted, the next decision to make is regarding the legal structure of your multiple businesses.

Bookkeeping for Multiple Businesses

Staying on top of the finances can get complicated, especially when you've multiple startups. Prepare yourself by speaking to an accountant to gain an understanding of your accounting and bookkeeping options. Questions to ask are:

- Do you need a different business account for each startup?

- Does your legal structure require you to provide consolidated or separate financial statements?

- Are there accounting processes you can automate and streamline across businesses?

QuickBooks, FreshBooks and Sunrise are cloud-based tools that allow to you manage the financials, across your businesses, on your own, under a single login. A word of caution though, check the pricing structure as some platforms may require you to shell out a new subscription fee for each company.

How to Start Multiple Businesses

You feel you have what it takes to start multiple businesses, but how do you start and how do you structure them? Common questions asked are, “Can I start one business and put multiple businesses underneath it?” or “Do I need to register a DBA for each business?”

There're three ways to legally structure your businesses. Let’s examine each option closely as it impacts the way you’ll be taxed.

1. Create Individual LLCs for Each Business

There is no legal limit on how many businesses you can start or file for, so you can create a separate LLC for each venture. The advantage is that each business is protected from the risks of another. This path is definitely more time-consuming and costly. As each business will be treated as its own legal entity, you’ll deal with more tax forms.

2. File All Your DBAs under One LLC

The second option is running multiple companies under one LLC by filing a DBA for each company. Let’s cover the basics — a DBA stands for “doing business as”, can be filed online and is used in circumstances when a business is operating under a different name.

The benefit of having different DBAs and then incorporating them under one LLC is that each company has its unique name and branding. A lot of time and money will be saved by the filing of only one LLC. The flip side is that each business takes on the risk and liability of another as they are considered a single legal entity. For instance, if you have legal issues with your landscaping business, the risk can transfer to the plumbing business.

When it comes to filing taxes, using an umbrella LLC to run multiple DBAs makes things easier as only one EIN is required. The IRS sees the holding LLC as one business for tax filing purposes, no matter how many DBAs operate under it; therefore, you can accumulate the income earned from each DBA and report it under the LLC's tax form.

3. Create a Holding Company

The last way to structure multiple businesses is to create different LLCs for each business and then put them all under one LLC or corp, which serves as a holding company.

From a tax standpoint, each business will file its own taxes; the losses and profits from each will be added up and placed under the holding company's taxes. The benefit of this is that the losses of one company can be used to offset profits in another.

There are pros and cons to each structure, so it's advisable to consult a lawyer before deciding which legal structure is best for you.

Is It Smart to Start Multiple Businesses?

As an entrepreneur, we’re sure you have a drawer full of ideas waiting to take flight, that too simultaneously. The fact is that there’s no reason, legal or otherwise, why you can’t start multiple businesses at once.

However, starting several ventures together requires you to be well planned, organized and efficient. Bizee has helped over 1,000,000 small business owners get the right business structure and tools in place. A great place to start is with our free Business Name Search Tool — you can find out if your desired business names are available in your state and even get started on forming your businesses.

Try Our Free Business Name Search Tool.

Check the Availability of Your Business Name.

Get Started Today

Swara Ahluwalia

Swara Ahluwalia is a freelance content writer with experience in the technical, B2B and SaaS domain. She also has curated content for various lifestyle brands. In her downtime, you will most likely find Swara training for her next marathon or spending time with her two daughters.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC