Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

You want to be your own boss and experience the thrill of being the sole decision-maker while enjoying the flexibility and benefits of running a business. A sole proprietorship may be your calling.

But what's a sole proprietorship? Do you need to register a sole proprietorship? Are you buzzing with these questions?

Let's find out what a sole proprietor is, how to start, the most common sole proprietor businesses and how to truly make your business official — if you so choose.

Join the 1M+ businesses that trust Bizee

Get StartedWhat Is a Sole Proprietorship?

A sole proprietorship is a business that is owned, controlled and managed by just one person. Although it's not a legal business entity, it’s the easiest and most common form of running a small business that allows owners to pocket an average of $45,000-$50,000 in earnings. In addition to being easy to start and manage, it has minimal startup costs, simple tax calculations and entitles you to all the profits.

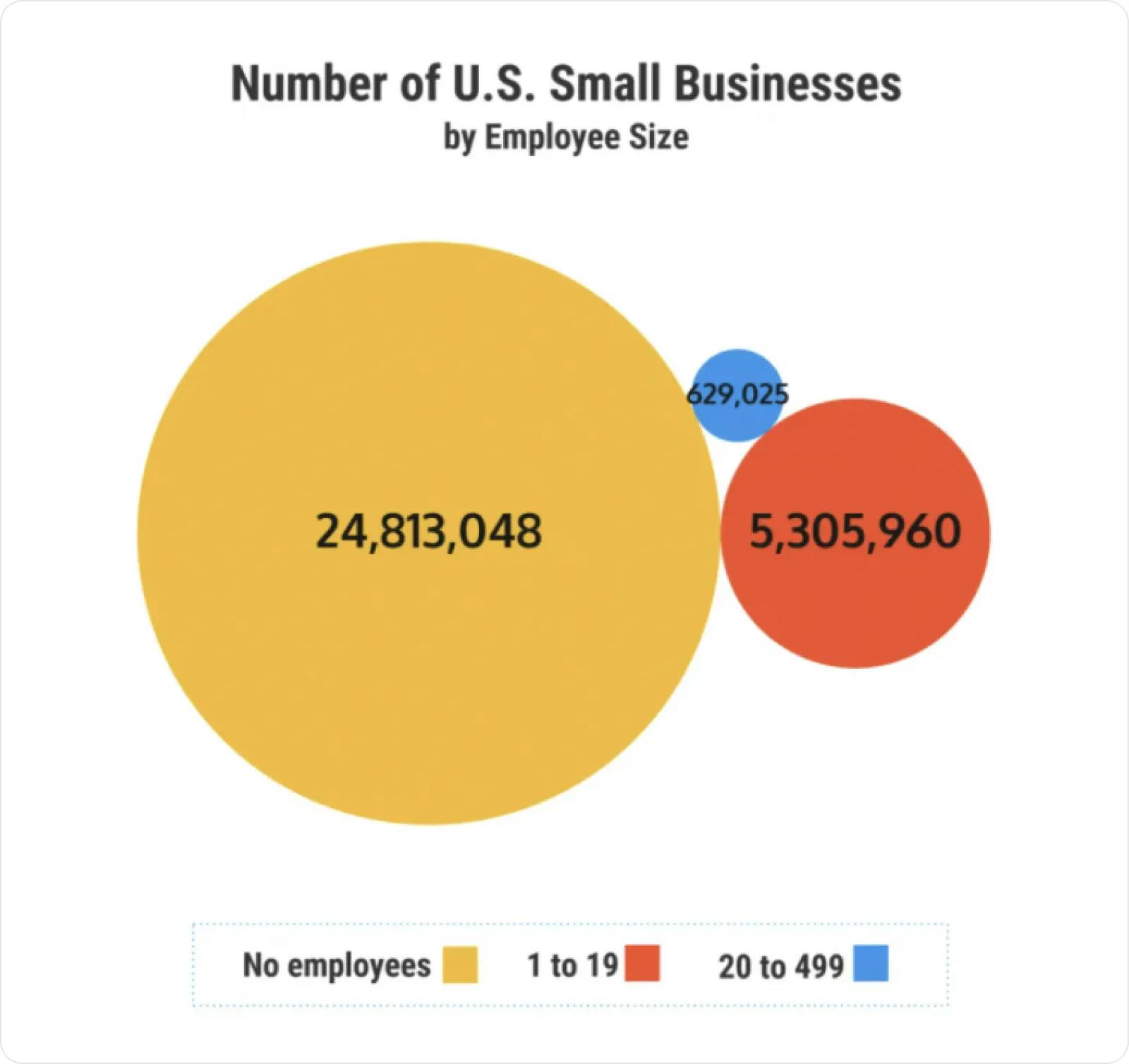

It’s no surprise then that out of the 31.7 million small businesses in the U.S., approximately 23.04 million are sole proprietorships. A UENI study reports that more women are running sole proprietor ventures. Sole proprietors enjoy a great deal of autonomy and independence as there is no distinction between the person and business. But, because it's not a legal entity, it doesn't come along with the same protections that a limited liability company (LLC) or corporation does.

Most Common Sole Proprietorship Business Ideas

Wondering what industries and markets are great for sole proprietors? Here’s the scoop — you can run a sole proprietorship across a variety of industries. It really depends on your skill set and interest. Many side hustles transition well into lucrative sole proprietorship models. Some businesses that are well-suited for a sole proprietorship are:

- Freelance graphic designer

- Virtual assistant

- Web developer

- Freelance writer

- Photographer

- Baker

- Real estate agent

Is a Sole Proprietorship Easy to Start?

Yes, a sole proprietorship is actually one of the easiest types of businesses to start. Why? Well, for starters, it doesn’t require any fees to start, has low tax rates and doesn’t require you to register with the state.

Do you need to do anything to be a sole proprietor? Apart from a solid business idea and minimal finances, there isn't much you need to start a sole proprietorship. You might already be a sole proprietor if you're currently offering services or products.

However, there are some steps and documentation you should get in place so your sole venture is well-positioned for success and growth.

How to Set Up a Sole Proprietorship

If having complete ownership and control of your business excites you, then follow these essential steps to set up a successful sole proprietorship. The entire process can take a few days to a week.

1. Select your Business and Domain Name

Most sole proprietors choose to do business under their legal name as it builds credibility and leverages their reputation. However, you do have the option to operate under a different name by filing for a DBA (short for “doing business as”).

If you want to make sure that no one else, across the entire country, can claim your business name, then you can trademark the name with U.S. Patent and Trademark Office (USPTO).

After picking and registering your business name, we recommend you get a domain name even if you have no immediate plans of building a website. Why? Having the same business and domain name creates an easy client experience and reduces confusion. Also, a website plays a key role in today's digital landscape; therefore, it's best to be prepared and secure a domain name that will be there whenever you're ready to launch your website.

2. Register for the Correct Business Licenses and Permits

No matter what business you start, you want to adhere to state and local licenses and permit requirements. These regulations generally vary by industry, state and locality, so it’s essential you do your due diligence and file for the right ones.

Most cities require sole proprietors to have the correct business licenses that give them legal rights to operate. For example, a real estate business license allows you to officially list, appraise and sell property.

Business permits are different from licenses; permits typically involve some sort of inspection for safety purposes. The most common examples of state and local business permits are:

- A zoning permit for operating a business from home or a particular location.

- A health permit for opening a restaurant or serving food.

- A permit to build/construct in an area.

Check with your nearest licensing department or Small Business Development Center for specifics.

Depending on the type of business, you might need to apply for federal licenses and permits. Industries regulated by the federal government include aviation, agriculture, alcoholic beverages, firearms, mining and nuclear energy.

The costs of these licenses and permits vary and are minuscule if compared to fines you'd pay if you have a run-in with the authorities, so don't skimp on these.

3. Secure an Employer Identification Number (EIN)

As long as you're the only one operating your business, you can use your Social Security number for business operation and tax purposes. However, the moment you think about hiring an employee or setting up a retirement fund, you’d need to get an Employer Identification Number (EIN). An EIN is a federal tax number that the IRS uses to identify a business entity. You can apply for an EIN number online.

4. Start a Business Bank Account

Opening a dedicated business account for your sole proprietorship is one of the best practices you can adopt. It makes it easier and faster to do your accounting and bookkeeping, and you’ll also get an accurate overview of your business's financial health.

A separate business account shows the IRS that your business isn’t a hobby and you’ll be able to write off any losses faced for tax purposes. Lastly, transactions in a business account allow you to build a good credit history, which is vital to securing a loan down the line.

5. Get Insurance and Stay Protected

There’s a high level of personal liability with a sole proprietorship, so we recommend you purchase insurance that provides a layer of protection. Look into getting property, health and liability coverage. You might also want to consider acquiring business auto insurance (around $600-$1,000) as your personal auto insurance won’t cover any driving done for business purposes. This might seem like a lot of upfront costs and investment, but it'll protect your assets.

6. File and Pay your Taxes

As a sole proprietor, there is no separate tax filing — you’ll file and pay income tax using the Schedule C on your Form 1040 on all of your business profits. If you want to lower the taxes subjected to your business, then steer clear of the “hobby business” territory by drawing out a self-payment each month. This proves to the IRS that your business is legit and you are in it to make a profit.

As no income tax or self-employment tax has been withheld from your business income, you'll probably have to pay quarterly self-employment taxes of approximately 15.3 percent.

Protecting Your Business Even Further

There's never a dull moment when it comes to creating and launching your own business, and a sole proprietorship is an easy and quick way of getting your business off the ground.

However, remember that a sole proprietorship is not a legal business entity and therefore exposes you personally for any business obligations. If your business is sued for any reason, your personal accounts and assets could be at risk. And without an official business designation, clients may see your business as less legitimate than others who have filed as an LLC.

If you want to truly make your business official and legal, setting up an LLC is the best way to do so. Your personal income will be separate from your business, you'll have an easier time securing business credit and loans and you can gain credibility in the eyes of your clients and customers. When you're ready to make your sole proprietorship an LLC, Bizee can help you form an LLC in a quick and hassle-free manner.

Form Your LLC $0 + State Fee.

Includes Free Registered Agent Service for a Full Year.

Get Started Today

Swara Ahluwalia

Swara Ahluwalia is a freelance content writer with experience in the technical, B2B and SaaS domain. She also has curated content for various lifestyle brands. In her downtime, you will most likely find Swara training for her next marathon or spending time with her two daughters.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC