Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

It is an exciting moment in the growth of your business when you decide it’s time to formalize your business structure and convert from a sole proprietorship to an LLC. Particularly if your business originated as a side hustle and has blossomed into your full-time income, it may be time to look at formally organizing your company by forming an LLC.

Doing business as a sole proprietor can be an easy, low-cost way to start a business. You can be successful as a self-employed individual person, even if you don’t have a formal business entity for your company. However, being a sole proprietor can leave you vulnerable to certain risks; you might also get better tax benefits if you form an LLC or other business entity.

Let’s take a closer look at what’s involved with the process when you convert from sole proprietor to LLC.

Join the 1M+ businesses that trust Bizee

Get StartedCan a Sole Proprietor Turn into an LLC?

While there may be some adjustments that need to be made in the conversion, the simple answer is yes, you can convert your sole proprietorship into an LLC. There may be some contractual changes that need to happen with current clients, such as changing the contract language so it is a contract between your client and your business (LLC), not just you as an individual person.

While not a requirement, it can be helpful to check with your legal advisor or tax professional prior to making the move, just to be sure you understand the implications and are ready to make changes such as opening a business bank account or filing a business tax return.

Why Would a Business Choose to Change from a Sole Proprietorship to an LLC?

The primary benefit of converting your sole proprietorship to an LLC is liability protection. An LLC gives you an added “corporate shield” layer of legal protection that can keep your business and personal funds separate, which means your personal assets such as your home, your car and your retirement savings will be protected in case of a lawsuit against your business.

Some other reasons to transition from a sole proprietorship to an LLC include enhancing your business credibility and branding. Some customers might feel that doing business with a registered LLC is more reputable than buying from an unregistered sole proprietorship. With legal rights to the business name, you can advertise and commit to creating your brand.

7 Simple Steps to Convert Your Sole Proprietorship into an LLC

Converting your sole proprietorship to an LLC doesn’t need to be complicated. Follow these seven easy steps to protect your personal assets today:

1. Choose a Business Name

Use Bizee’s free Business Name Search Tool to check name availability to ensure your LLC name is available. If it is not, you will need to get creative and come up with a unique name to register; use Bizee’s free Business Name Generator to experiment with different ideas and word combinations.

2. Update Your Contracts

Review your current business contracts to see if they can be updated to be between your LLC and your clients. Make sure all of your business contracts are entered into by your business, not just by you as an individual person. Make arrangements with clients to update contracts once your LLC is formed.

3. File Articles of Incorporation or Organization

File Articles of Incorporation/Articles of Organization (different states use different names for these documents) with your state’s office of the Secretary of State; these can generally be processed online.

4. Write an LLC Operating Agreement

If you're going to be forming an LLC so you can bring in business partners after being a sole proprietor, be sure to create an LLC Operating Agreement. This document is especially important for multi-member LLCs because it helps to define management and ownership details of your LLC. The Operating Agreement will break down the percentage of ownership between members, distribution of profits and losses, roles of the members/owners of the LLC, how to leave the LLC and other important information.

5. Apply for an EIN

Register with the IRS and apply for an Employer ID Number (EIN) for banking and tax purposes. Bizee offers a convenient service to apply for an EIN for your business.

6. Open a Business Bank Account

Apply for a business bank account with your new LLC name using your LLC EIN. Even if you already have a business bank account for your sole proprietorship, you should make sure that you have a new account under the name of your LLC. This will help you separate your business and personal finances and can help you build business credit apart from your own personal credit history.

7. Update Your Business Permits and Licenses

Update any business permits with the LLC name and changed business structure. It may be necessary to reapply for certain permits and licenses under the name of the LLC; this depends on your state and local laws and regulations, so be sure to check on your local requirements. Check out Bizee’s Business License Research Package if you need support with this.

Once your business has been converted from a sole proprietorship into an LLC, there will be some changes that you will need to deal with in managing your company. You will need to maintain your LLC by keeping it in good standing with state authorities; you can do this by filing an annual report (depending on your state). Keeping your LLC paperwork up to date will help you keep your tax advantages and limited liability protection.

Personal and business finances should be kept separate to ensure there is no confusion and to make tax time easier for you and your tax advisor. You will need to make the decision with your tax advisor as to how you will file your taxes. If your business is going to be a single-member LLC, there are some similarities to a sole proprietorship in how the business is treated for tax purposes, such as pass-through taxation and eligibility for certain business tax deductions.

However, if you choose to set up your LLC to file taxes as an S Corporation, you might be able to reduce your tax bill by paying yourself a salary and protecting some of your business income from self-employment taxes. As the owner of a single-member LLC, you might end up paying a lower effective tax rate than you would as a sole proprietor or employee with the same level of gross income. Talk to your tax advisor to see the best tax filing option for you and your business.

When Should I Turn My Sole Proprietorship into an LLC?

As your business grows, the liability protection an LLC provides is going to be an important consideration for you. Deciding when to turn your sole proprietorship into an LLC is really a personal choice, but if you are committed to running a business full time and you are confident in your future income potential as a business owner, you should not wait to form an LLC.

Forming your LLC today can help you take advantage of potential tax benefits and enjoy the peace of mind of limited liability protection.

Can I Use My Sole Proprietor DBA for My LLC?

If you already are using a sole proprietor DBA name and want to use this same DBA name as the business name for your new LLC, your current sole proprietor DBA will need to be canceled or withdrawn. When you form an LLC, you can register the new LLC's name to be the same name as your (now former) sole proprietor business. Or if necessary, you can file a new DBA to use with your LLC.

But before you try to form an LLC with the same name as your sole proprietor DBA, you will also need to check to see if your DBA name is currently registered as an LLC name by some other business owner; if it is, you will need to choose a different business name for your new LLC.

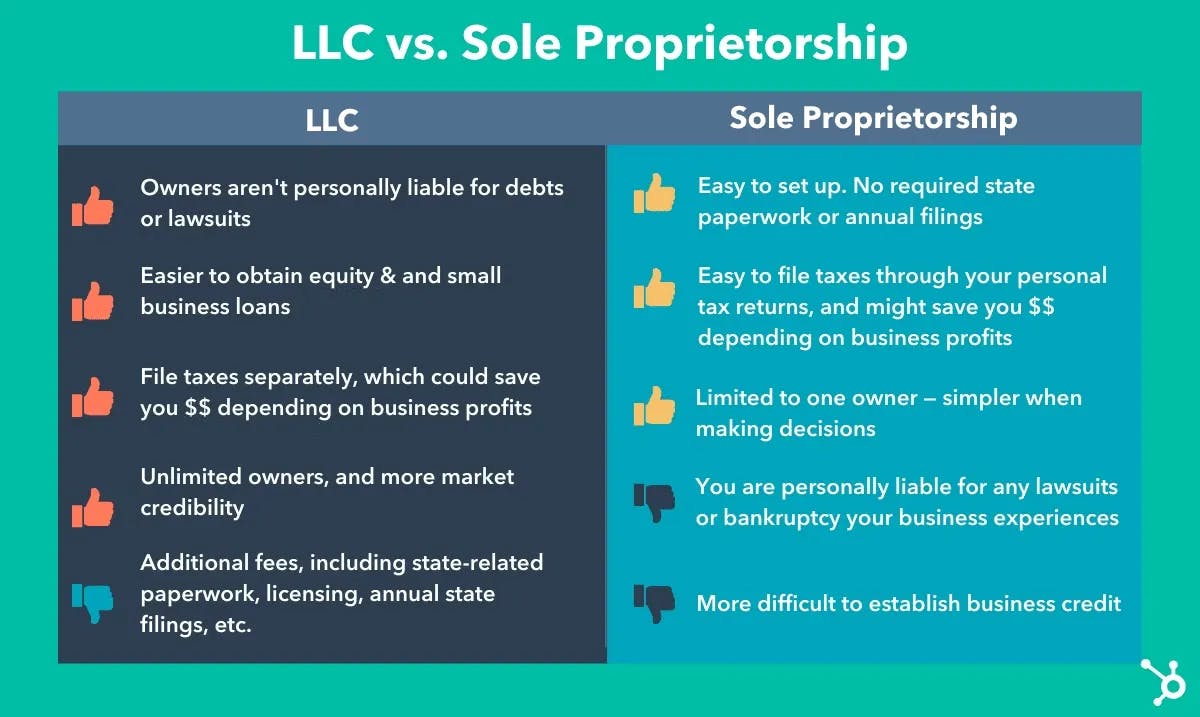

Converting your sole proprietorship to an LLC is a smart choice to make if you’re concerned about protecting your personal assets from the worst-case scenarios of a lawsuit against your business. For a minimal investment of time and money, your business will be a separate legal entity from your personal finances, and you can continue doing business as usual. Other than registering the LLC, filing an annual report and making the changes recommended in the steps above, the day-to-day operations of your business don't have to change much compared to when you were a sole proprietor. Converting your sole proprietorship to an LLC brings many benefits and very few complications or downsides. Learn more about the advantages of forming an LLC vs. a sole proprietorship.

Once you are ready to get started converting your sole proprietorship to an LLC, Bizee will be here to help you with the transition. You can form your LLC with Bizee for $0 + state fee, which makes the entire process of getting your LLC up and running streamlined and incredibly simple. We handle everything for you. Start your business with confidence today.

Form Your LLC $0 + State Fee.

Includes Free Registered Agent Service for a Full Year.

Get Started Today

Ben Gran

Ben Gran is a freelance writer from Des Moines, Iowa. Ben has written for Fortune 500 companies, the Governor of Iowa (who now serves as U.S. Secretary of Agriculture), the U.S. Secretary of the Navy, and many corporate clients. He writes about entrepreneurship, technology, food and other areas of great personal interest.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC