Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Converting S Corp to an LLC involves planning out the conversion in detail, gaining the approval of all members and shareholders of your company, and filing the required paperwork.

But make no mistake — there are challenges and obstacles to overcome throughout the process. Understanding the fine details of this transition will help you navigate each step with greater ease, especially regarding the tax ramifications involved.

Join the 1M+ businesses that trust Bizee

Get StartedWhy Convert an S Corp to an LLC?

You may find yourself in a position where converting your S Corp to an LLC is highly beneficial. The main reasons most S Corps convert to LLC are to avoid capital gains tax, to get different management options, to allocate profit share differently, and to have more flexibility in how they're taxed.

- Tax advantages. One of the biggest benefits of forming an LLC is not having to pay capital gains tax on passive income. LLCs are subject to pass-through taxation, where company profits (and losses) are divided amongst members per the percentages outlined in their operating agreement and taxed as personal income.

- Enhanced management options. S Corps are limited to 100 shareholders, while an LLC can have an unlimited number of members. Additionally, S Corps are required to have a board of directors, host annual meetings, and take down minutes. But an LLC is member-managed, so it doesn't have to do any of the above. In addition, gaining approval for specific activities within an LLC requires only the approval of the other members, whereas an S Corp requires most decisions to receive full board approval.

- Flexibility for profit and loss. S Corps use shares to distribute profit, where each share is worth an equal amount. Profits are then distributed accordingly, and those with more shares in the company receive more of the profit. In an LLC, profits can be allocated based on ownership interest, but they can also be allocated separately. A member of an LLC with a 15% stake who made a cash contribution higher than other members, for example, could receive a higher profit share without the need to change their ownership stake.

Tax Benefits of Converting S Corp to an LLC

Converting an S Corp to an LLC offers several benefits once the process is complete, which is why it's an attractive option for many businesses. Some of the prominent tax benefits include:

- No capital gains tax. Unlike corporations, LLCs aren't required to pay capital gains tax after investments and capital assets are sold. As a result, LLCs have more freedom to sell assets without tax penalties.

- Flexible taxation. One of the big differences between an LLC vs. an S Corp is that an LLC can choose to be taxed as a partnership, S Corp, or C Corp, depending on what achieves the greatest tax advantage. S Corps are limited to standard pass-through taxation and don't have access to the same flexibility. Choosing an S Corp tax election status for your LLC can help you reduce your self-employment taxes while eliminating the requirement to have a board of directors and meeting minutes.

- Deductions for capital expenses. S Corps aren't allowed to deduct capital expenditures as they aren't deemed necessary by the IRS. LLCs, however, are able to deduct these expenses (goods, equipment, etc.) over a one-year period.

It's important to note, however, that there may be some transitional bumps in the road that your business will have to overcome to reach the above benefits. While some states allow you to initiate a business entity conversion that prevents you from having to dissolve your S Corp, other states will require you to form an LLC, initiate a merger, and then dissolve the S Corp. Alternatively, you can liquidate your business assets by temporarily transferring them to your shareholders.

Regardless of how you do it, if your S Corp has increased in value since formation, the IRS will charge a capital gains tax against your business and its shareholders. That's just the way the cookie crumbles. But once your company is operating as an LLC, your business will enjoy years of flexibility and tax benefits.

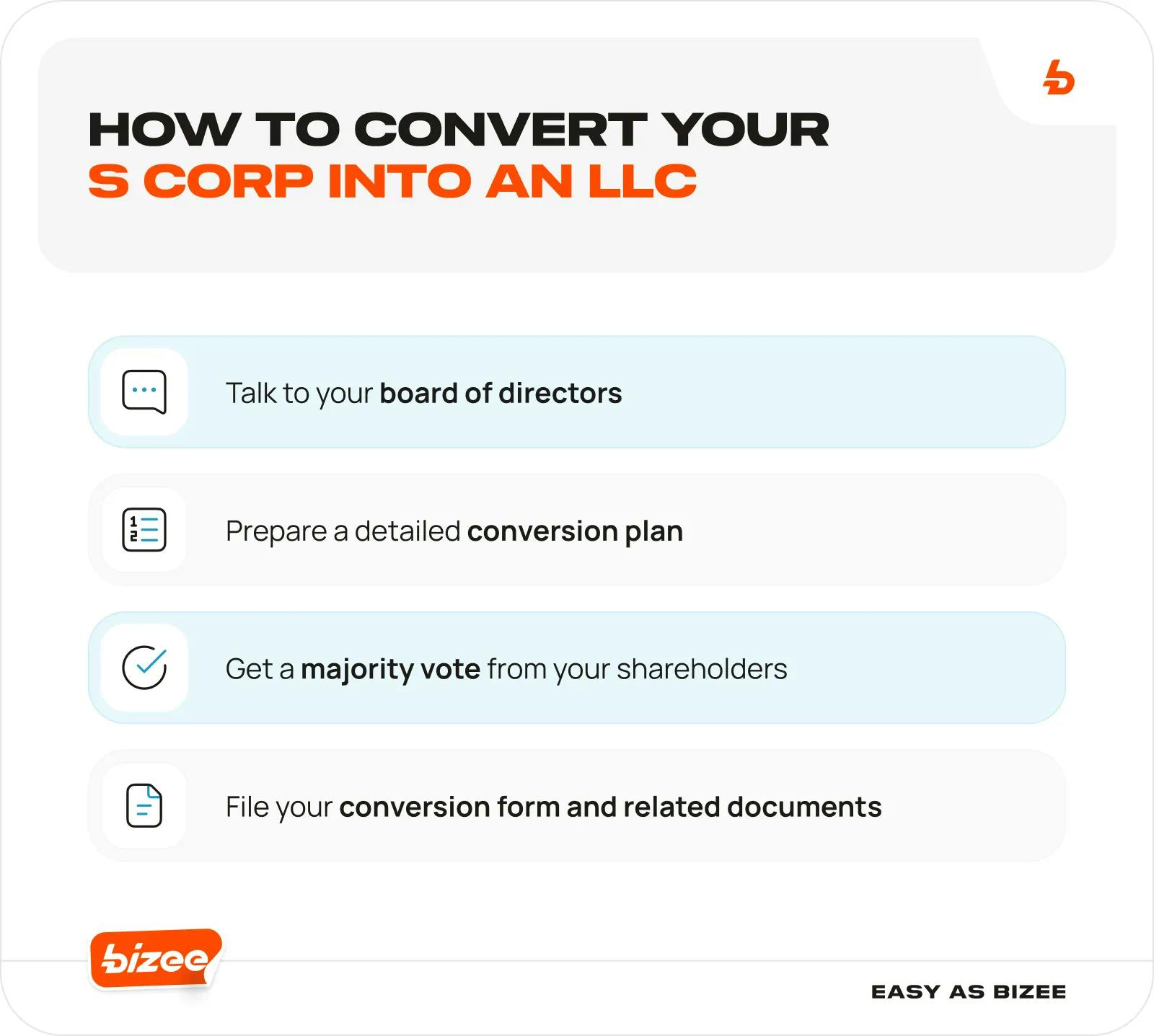

Steps for Converting an S Corp to an LLC

Start the Conversation

If you're the majority shareholder of a company and wish to convert an S Corp to an LLC, start by speaking with other directors to discuss the pros and cons of the transition. You'll need to make sure the right people are on board to carry the decision through to approval.

Will you form a multi-member LLC or a single-member? Is it more costly to convert an S Corp to an LLC than to continue managing the S Corp? You'll also want to consider the additional paperwork required for tax filing, the tax consequences of the conversion depending on the state your S Corp is registered in, and how the conversion will impact your legal and financial obligations.

Create a Plan of Conversion

In most cases, if your state allows you to convert an S Corp to an LLC, you'll be required to prepare a plan of conversion outlining the details of the entity change. You may also be required to gain the approval of the board of directors before you're able to present the conversion to your shareholders.

If it has been specified in your Articles of Incorporation that a specific majority is required for any vote within the corporation, you'll be required to obtain that specified majority in order to carry the vote.

Each state that allows conversion will have different requirements in terms of what must be included in your plan of conversion, so be sure to check with your Secretary of State to confirm these details beforehand.

Gain the Appropriate Approval

If you're required to prepare a conversion plan, it will need to be approved by your board of directors and the majority of your company's shareholders. If your state doesn't require a plan of conversion, then you'll need a majority shareholder vote to convert an S Corp to an LLC.

If it has been specified in your Articles of Incorporation that a specific majority is required for any vote within the corporation, you'll be required to obtain that specified majority to carry the vote.

Prepare and File the Required Documents

To convert an S Corp to an LLC, you'll need to file a conversion form, which has different names depending on your state. Some states refer to it as a certificate, a statement, or "articles of conversion." As forming a new LLC is part of the conversion process, you'll also need to file Articles of Incorporation and pay the filing fees corresponding to your state.

Once your conversion is complete, the assets and liabilities belonging to your S Corp will be automatically applied to your new LLC.

Dissolving a Corporation to Form an LLC

In the case that your S Corp needs to be dissolved in order to convert it to an LLC, there are several steps you'll need to take to fulfill the tax and legal requirements.

Take It to a Vote

To dissolve an S Corp, you'll need shareholder approval. Specifically, this means that you'll need a majority vote from shareholders in order to consider the dissolution of your company at all. To conduct this vote, your board of directors should create a resolution for dissolution and have all shareholders express their vote.

Pause Business Operations

Once a majority vote has been recorded and shareholders agree to the dissolution of the corporation, your business is required to cease any and all operations. At this stage, you are quite literally closed for business, and you cannot take on any new projects or clients.

The focus should shift from running daily operations to performing all the tasks required for dissolution. Any transactions that do occur should be strictly for the purposes of dissolving your S Corp.

Notify Your Creditors

Notification must be sent to any creditors who have open or pending claims against your business. This will allow the appropriate time for both parties to plan how the business will settle these claims and legally end any commitments that are in place when the dissolution vote is carried out. You may be required to post a notice of dissolution in your local newspaper to meet your state's notice requirements.

Liquidate All Your Assets

Any assets that your business owns, including property, must be liquidated. Your company can liquidate by distributing assets according to ownership share or selling to other companies or individual buyers on the open market, but everything must go. The IRS will require you to report any gain or loss on the assets being liquidated, and appropriate taxes will need to be paid depending on the outcome.

Settle Any Open Claims

Any proceeds that result from the sale of your company's liquidated assets must be used to pay creditors and outstanding debts first. Your company can accept or reject creditor claims, but any rejections must be made to the creditors in writing.

Employees must also be paid using these proceeds, if applicable. The dissolution of your S Corp cannot be finalized if outstanding amounts are owed to employees. In addition, if you distribute assets to owners or shareholders, you'll be required to report these distributions to the IRS.

File for a Certificate of Termination

In order to formally dissolve and close your S Corp business, you'll need to file forms with the IRS, your local tax agency, and your state tax agency. The IRS will require you to file Form 966 within 30 days of dissolving and liquidating, and you'll need to provide a copy of your Schedule K-1 to each of your shareholders.

Finalize Your Accounting and Corporate Taxes

After you've given notice to creditors, liquidated your assets, paid your debts, and filed for your certificate of termination, it's time to finalize all of your taxes and open accounts.

For employees and contractors, you'll need to either finalize your payroll or send out W-2 and 1099 forms, respectively. You'll also need to have your accounting department complete your corporate taxes up to the date of the dissolution and determine any amounts owed to the IRS.

Pay Out Any Final Expenses

After dissolution is complete, you'll likely have a few final expenses, such as accounting charges and legal fees, to clear up. Otherwise, the process is considered complete. The IRS will provide you with 90 days to file your final corporate tax return using Form 1120S.

Need a New LLC? Bizee Can Help

Converting an S Corp to an LLC can enable your business to access greater flexibility in how the business is structured, how it's taxed, and how profit is distributed to members. When you decide to make the change and the time comes to form a new LLC, Bizee can help. You can start your new LLC for as little as $0 plus your state fee.

Chad Ruppert

Chad is a freelance writer and former project manager focused on presenting information on SaaS, technology and business formation.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC