Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

In many people's minds, businesses and nonprofits are entirely separate things: One exists solely to make money, one exists solely for charity and never the twain shall meet.

But in reality, businesses and nonprofits don't just share some common ground — it's actually possible to add nonprofit status to a for-profit business, depending on the factors at play.

So if you've been wondering, "Can I add a nonprofit to my business?" Then you'll be glad to know that it's achievable. Here, we'll discuss why you might want to and explore how you can go about it.

Why Add a Nonprofit to a Business?

Before we get into the nitty-gritty details, let's clear up the most important question of all — why would you want to add a nonprofit to a business to begin with?

To discover the answer, we first need to clarify what a nonprofit corporation is. Put simply, it's an organization whose purpose is to do something other than generate revenue. The four major types of nonprofits include:

- Public charities, which provide a free or low-cost service to members of the public. For example, a food bank that provides free meals to low-income people.

- Social advocacy organizations, which are composed of various members and aim to achieve goals as a part of a social agenda. For example, an organization that advocates for the rights of people experiencing homelessness.

- Foundations, which donate to other charities and support events that support their respective missions. For example, an animal welfare foundation that donates to animal shelters and sponsors adoption events.

- Professional or trade organizations, which provide services and benefits to their own members. For example, a trade union that gives its members discounts on health insurance and car rentals.

One thing all those nonprofits have in common is that since their function isn't to make a profit, they're not subject to the same taxes as for-profit businesses. So when we talk about nonprofit status, we're effectively talking about tax-exempt status.

As such, it's easy to see the biggest benefit of adding nonprofit status to a business: exemption from both federal and state taxes. And if you own a business, which seems to fit the definition of a nonprofit but is still required to pay taxes, adding nonprofit status is an undeniably attractive option.

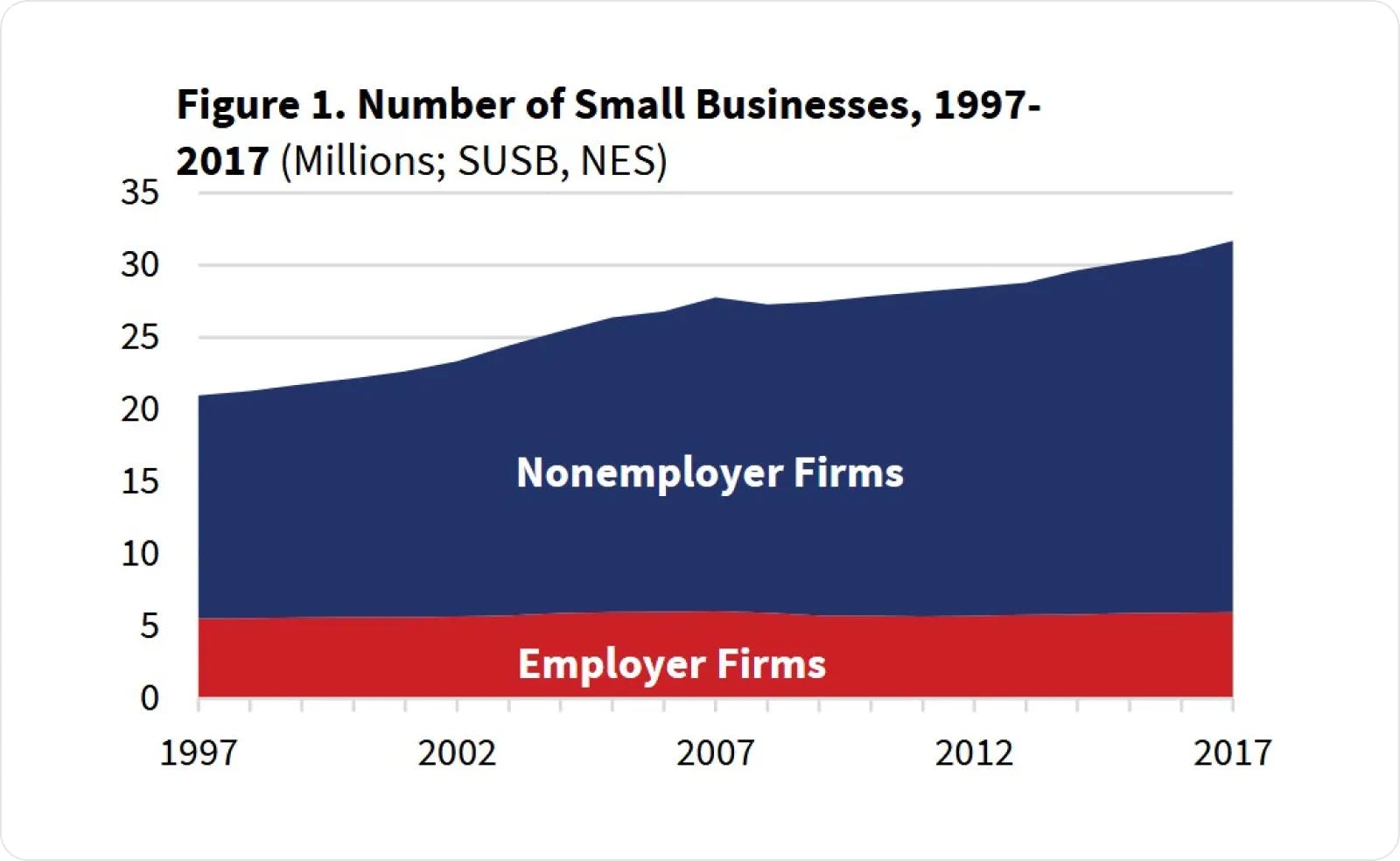

But as you might expect, the Internal Revenue Service (IRS) doesn't hand out nonprofit status willy-nilly. After all, while there were 1.5 million nonprofits registered with the IRS in 2016 (a 4.5 percent increase from a 2006), there were approximately 30 million small businesses in operation that same year:

So while it's both possible and legal to add nonprofit status to an existing business, it's contingent on the business meeting a strict set of criteria and jumping through the IRS's hoops.

How to Turn a For-Profit Business into a Nonprofit Organization

So you think your existing business might be able to qualify for nonprofit status. Now, you can proceed by following these three steps.

1. Do Your Research

To start, begin researching the IRS's exempt organization types. One of the most common is a charitable organization, officially called a 501(c)(3) after the section of the U.S. Internal Revenue Code under the same name. To be considered a 501(c)(3), for instance, an organization:

- must be organized and operated exclusively for exempt purposes;

- must limit their legislative and political activities; and

- must not use its earnings to benefit any private shareholder or individual.

Pay special attention to that last bullet. It means that in order to have nonprofit status, an organization can't have a typical corporate structure with a CEO at the top calling the shots and making the most money. Instead, it must be operated by a board of directors, none of whom can take a salary.

So, the next step is to...

2. Create a Board

The best place to find board members varies for each organization, and the rules and regulations dictating who can be on a board vary by state. But in general, you may be able to source board members from:

- other nonprofits and businesses;

- professional associations;

- business contacts;

- nonprofit support groups; and

- existing donors and volunteers.

Once your organization has its own functioning board, you can finally make things official.

3. Form Your Nonprofit

You're now prepared to officially form your nonprofit and begin the process of applying for nonprofit status from the IRS. You can do so by filling out and submitting Form 1023. To ensure you don't miss any steps, check out the IRS's free course on the application process.

Don't forget that states have their own requirements for filing a nonprofit, too — thoroughly research your state's laws and take your next steps accordingly. (If you're in Arizona, Delaware, Nevada or Wisconsin, then consider yourself lucky — those are the easiest states to start a nonprofit).

What About Donating to Nonprofits?

So you're not sure if fully converting your business into a nonprofit is the right path for you, but you still want to make a positive difference and maybe enjoy a tax break in the process.

In this case, you'd benefit most from donating to nonprofits rather than becoming one. No, you won't gain nonprofit status simply by giving to charity, but you will be able to reap some tax-related benefits while simultaneously giving back to your community, painting your business in a positive light and building a stronger reputation.

Specifically, the IRS states that as of January 2022, "A corporation may deduct qualified contributions of up to 25 percent of its taxable income." But if your business makes a contribution that exceeds that amount, don't worry — it will carry over to the next year.

In this way, even for-profit corporations can benefit from the tax-exempt status of nonprofit organizations (and earn some good karma in the process).

So whether you're looking to add nonprofit status to your existing business or simply make some tax-deductible charitable contributions, you can do so as long as you know which steps to take.

Want to make sure you have all your ducks in a row when starting your own nonprofit? Find out everything you need to know in our comprehensive guide.

Carrie Buchholz-Powers

Carrie Buchholz-Powers is a Colorado-based writer who’s been creating content since 2013. From digital marketing to ecommerce to land conservation, she has experience in a wide range of fields and loves learning about them all. Carrie is fond of history, animals and beauty in equal measure. In her free time, she enjoys knitting, playing video games and exploring Colorado's prairies and mountains with her husband.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC