Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Most nonprofits are formed as corporations as opposed to Limited Liability Companies (LLCs). This may be because the requirements to form a nonprofit corporation are less stringent than what’s required for a nonprofit LLC. But that doesn’t mean that a nonprofit can’t be formed as an LLC. In fact, you actually can as long as you follow the steps — or rules — in forming your nonprofit LLC,

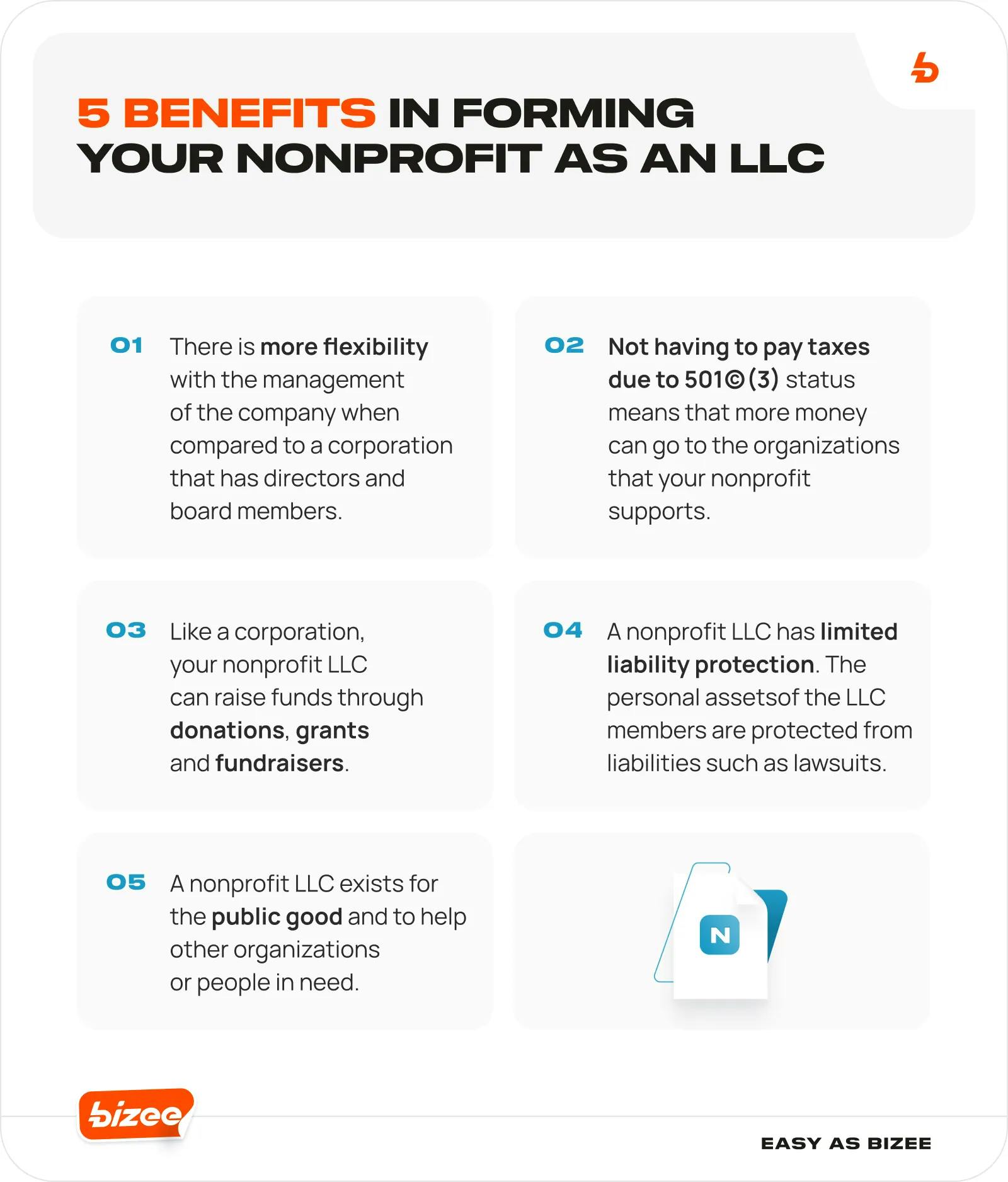

Forming a nonprofit LLC may also allow more flexibility when it comes to actually managing the organization. When compared to an LLC, there are more rules and regulations in running a nonprofit as a corporation, including working with directors and board members. That may be reason enough to form a nonprofit LLC as opposed to a nonprofit corporation.

What Is a Nonprofit LLC?

A nonprofit LLC is formed to meet the same goals as a nonprofit corporation. That is, to serve a public good. Both these entities work to support charities that can cover education, health, hunger relief, housing, economic development and more.

And both types of business structures share an additional commonality — they are not-for-profit businesses. They do not operate to make money for their owners or members. Rather, the money earned is used to support the business and fund their charitable causes.

Can an LLC be a Nonprofit?

The short answer is yes. Though an LLC and a nonprofit are two distinct business entities, each with its own pros and cons, forming a nonprofit LLC can be achieved. But it’s important to keep in mind that the process of becoming a nonprofit LLC is more protracted than the requirements involved with forming the business as a nonprofit corporation.

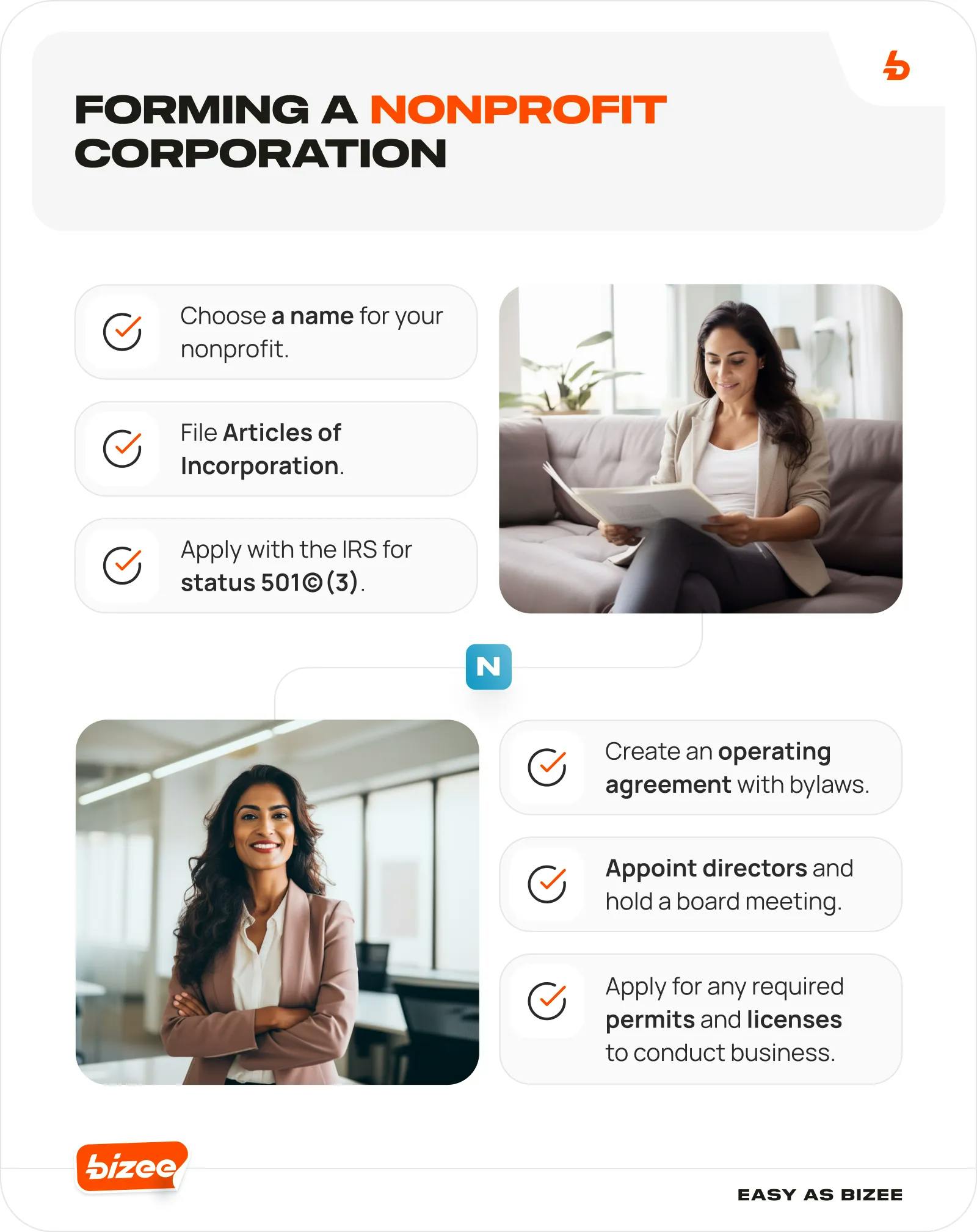

Forming a nonprofit as a corporation is similar to forming a for-profit corporation, with the exception of one added step — applying for 501(c)(3) status with the IRS. Approval of an application for status 501(c)(3) basically means the nonprofit will not be required to pay taxes.

When it comes to forming a nonprofit LLC, there are more rules that need to be followed. For instance, each member or owner of the LLC will need to incorporate as a nonprofit. This makes the process complicated and often acts as a deterrent for forming a nonprofit LLC as opposed to a nonprofit corporation.

Other key requirements to forming a nonprofit LLC have been outlined by the IRS and basically cover 12 key steps outlined in the document "Limited Liability Companies as Exempt Organizations.” A summarized list of these "rules" has been added below.

The 12 Rules for Forming a Nonprofit LLC

To qualify your LLC as a nonprofit, the IRS has outlined 12 criteria, which we will refer to as rules that need to be met. These rules consist of the following:

Rule 1: The LLC’s organizational papers need to include the clear purpose of the company by stating that its activities will be limited to charitable objectives.

Rule 2: The LLC’s organizational papers need to state that the LLC will exist for charitable purposes.

Rule 3: The LLC's members must be approved as 501(c)(3) entities.

Rule 4: Membership interests can only be transferred to other 501(c)(3) organizations.

Rule 5: Interests that are other than membership interests can be transferred to a nonmember who is not part of a 501(c)(3) organization only at fair value.

Rule 6: Upon dissolution of the LLC, all assets will be used for charitable or transferred to other charitable nonprofit organizations.

Rule 7: All the amendments of the operating agreement will need to comply with section 501(c)(3).

Rule 8: The LLC cannot become a for-profit business or merge with a for-profit business.

Rule 9: Members who are no longer part of the LLC cannot receive assets belonging to the nonprofit.

Rule 10: The LLC must have a plan in case one or more members are no longer 501(c)(3) entities.

Rule 11: Exempt members of the LLC will work to protect their interests and rights in the nonprofit.

Rule 12: All the statements and provisions in the operating agreement will abide by and be consistent with the laws within the state.

Once these conditions are met and 501(c)(3) tax exemption status is confirmed for all the LLC members, the organization could function as a nonprofit LLC.

Can a For-Profit Own a Nonprofit?

A for-profit business cannot buy or own and run a nonprofit. Nonprofits are run by boards and are not owned by an individual or groups of members. Their mandate is to function for charitable purposes, so the acquisition of a nonprofit by a for-profit is not allowed.

However, a for-profit business can fund and partner with a nonprofit to support charities and even promote the values of the for-profit business. This is mostly done in the form of a partnership with the nonprofit.

For example, your local pet store may ask you if you would want to donate to an animal shelter by rounding up the payment of your purchase. Another example is a grocery store that partners with a soup kitchen or homeless shelter.

Starting Your Nonprofit LLC

A nonprofit, whether it’s a corporation or an LLC, helps serve the greater social good. Rather than operating as for-profit businesses, these structures have mandates to put all their resources and efforts toward supporting people or causes in need.

If you are ready to start a nonprofit — either as a corporation or LLC — Bizee can help guide you through the process. Refer to our Nonprofit Guide to help you with your next steps.

Peter Mavrikis

Peter Mavrikis is an author and editor with over 25 years of experience in publishing. He has worked as the Editorial Director for Barron’s Educational Series, as well as Kaplan Test Prep, where he ran the test prep, foreign language, and study guide.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC