Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Beginning in 2020, businesses were reintroduced to the 1099-NEC filing form. Since 1982, which was the last year Form 1099-NEC was utilized before its return, business owners relied on Form 1099-MISC (short for “Miscellaneous”) to account for payments made to independent contractors and freelancers. With the start of the 2020 tax year, businesses had to make the switch and return to using the 1099-NEC (short for “Nonemployee Compensation”).

Total payments of $600 or more that were made from businesses to LLCs and partnerships — including self-employed individuals such as subcontractors, gig workers, digital nomads and solopreneurs — must be reported using the 1099-NEC form. A 1099-NEC, however, does not apply if the company is taxed as an S Corp or C Corp.

Why Was the 1099-NEC Reintroduced?

The 1099-NEC form did not replace the 1099-MISC used prior to 2020 to record compensation to freelancers and independent workers that were hired for a service. Rather, the reintroduced form was created to help simplify the reporting of contracted work. It was also more intuitive considering the significant activity and economic output contributed by independent contractors.

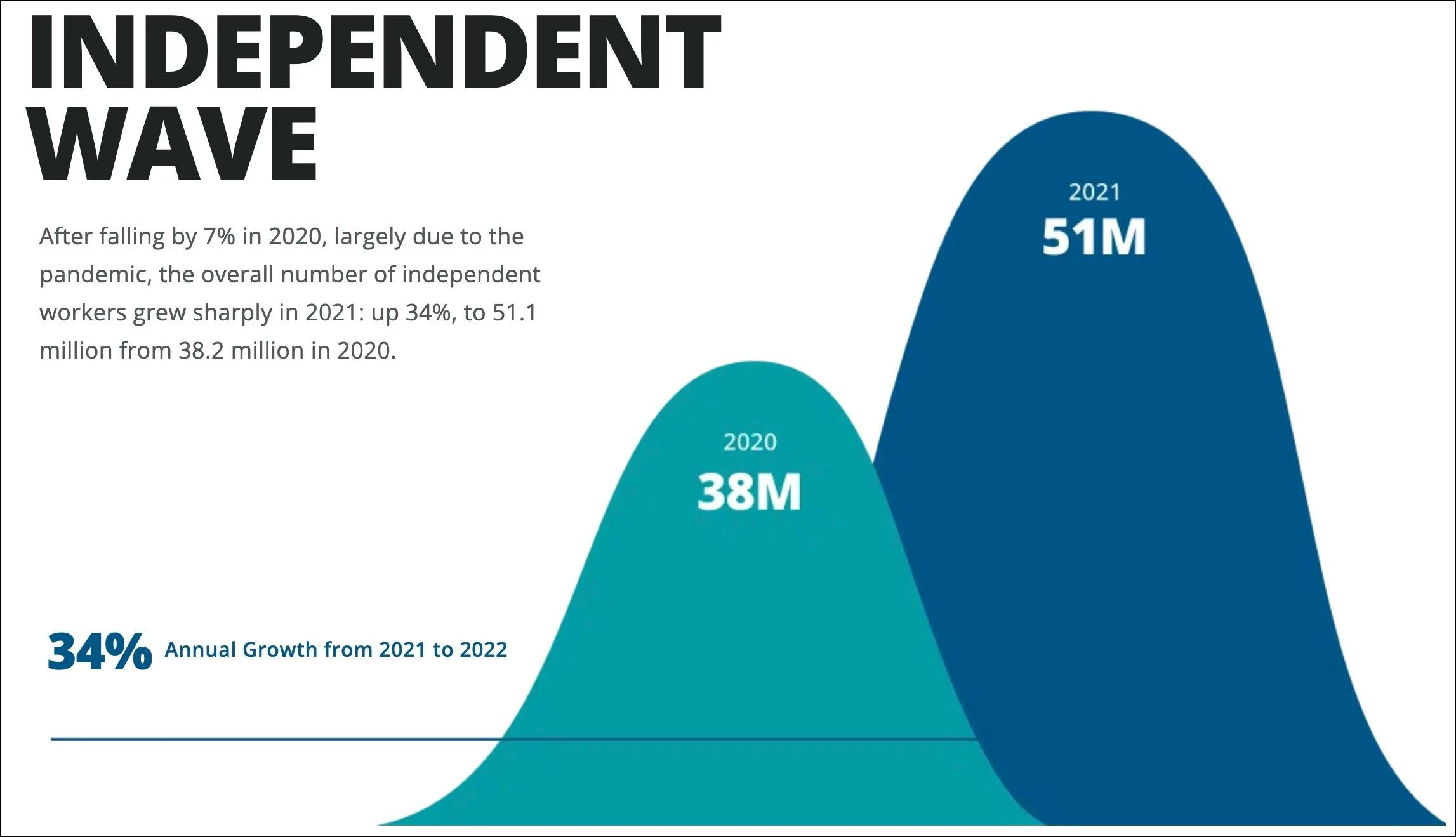

According to Statista, the number of occasional independent workers in the United States has increased significantly, nearly doubling from 12.9 million in 2017 to 23.9 million in 2021. Full-time independent workers also jumped from 13.6 million in 2020 to 17 million by 2021, with the total number of occasional, part-time and full-time workers moving up from 38.2 million to 51.1 million.

What's New for Both 1099-NEC and 1099-MISC?

Unlike the version of the 1099-NEC form used prior to 1982, the new form, which includes Copies A, B, C, 1, and 2, can be filled out online. Form 1099-NEC also designates a specific filing deadline for all independent contractors: January 31.

As for the 1099-MISC form, it is still used to report rents, attorney payments, royalties, prizes, interest and medical costs, among other listed requirements. It also has a different filling date of March 1 if you file on paper and March 31 if you file electronically.

According to the IRS, 2021 instructions and updates for Forms 1099-NEC and 1099-MISC for this tax year include:

1099-NEC

- Box 1 will not be used for reporting under section 6050R, regarding cash payments for the purchase of fish for resale purposes.

- Payers may use either box 2 on Form 1099-NEC or box 7 on Form 1099-MISC to report any sales totaling $5,000 or more of consumer products for resale, on buy-sell, deposit-commission or any other basis. For further information, see the instructions later for box 2 (Form 1099-NEC) or box 7 (Form 1099-MISC).

- The form has been resized (reduced the height).

1099-MISC

- The title for Form 1099-MISC has been changed from Miscellaneous Income to Miscellaneous Information.

- Box 11 includes any reporting under section 6050R, regarding cash payments for the purchase of fish for resale purposes, from an individual or corporation who is engaged in catching fish. For further information, see the instructions for box 11.

Unlike Form 1099-NEC, nonemployee compensation for certain services can no longer be reported on the 1099-MISC. As of 2021, the Internal Revenue Service also revised this form for certain CARES Act subsidized loans, including “waiv[ing] the requirement for lenders to file with the IRS, or furnish to a borrower, a Form 1099-MISC reporting the payment of principal, interest and any associated fees subsidized by the Administrator under section 1112(c) of the CARES Act.”

How Does the 1099-NEC and 1099-MISC Apply to Your Business?

You may wonder which form is better to use: 1099-MISC or 1099-NEC. Depending on the needs of your business during the tax year, you may be obligated to use either a 1099-NEC, 1099-MISC or both. Many businesses are using independent contractors to fulfill a limited need or role in their organization without having to create a full-time position.

Freelancers and independent contractors can be found in a wide variety of ways, including job sites, social media and business networking sites and organizations. For example, if your company needs a website created, it may hire a web developer or a firm to help build a company site. In this case, if the web developer is paid more than $600, then you must fill out a Form 1099-NEC.

When it comes to distributing royalties, paying for the services of a lawyer or paying rent, just to mention a few examples, a Form 1099-MISC will need to be filled. (For a complete list of instances requiring a 1099-MISC, go to the IRS site.

How to File a 1099-MISC and 1099-NEC Form

Filing forms 1099-NEC and 1099-MISC with the IRS is the responsibility of the employer. For Form 1099-NEC, in addition to filing with the IRS by January 31, you must also provide the contractor with a copy by that same deadline.

If you miss the filing deadline with the IRS, you will be liable and will pay a monetary penalty. If you file within 30 days of the deadline, the penalty is $50. If you are more than 30 days late, the fee doubles to $100. Paying after August 1 will increase the penalty to $260. If you experience a delay in filing the 1099-NEC, you can apply for an extension using Form 8809.

To file a 1099-NEC, you will need the following:

- Your company’s information: This includes your company’s name and address and Employer Identification Number (EIN)

- The independent contractor’s information: Including name, address and EIN or Social Security number

- Compensation amount: The total amount paid for the previous tax year should be added to Box 1

- Withholdings information: Boxes 4-7 of the form are for federal or state income tax withheld

To file a 1099-MISC you will need:

- Your company’s information: Much like what is listed above for the Form 1099-NEC. Include the company name, address and EIN

- The independent contractor’s information: Including name, address and EIN or Social Security number

- Compensation amount: The total amount paid for the previous tax year covering nonemployee compensation including medical and healthcare payments, rents, payments in lieu of dividend or interest, etc.

- Withholdings information: Box 4 of the form is for federal income tax withheld

For the most part, both filings are relatively straightforward and easy to complete. The process also includes an Annual Summary and Transmittal Form 1096, which should accompany the submission to the IRS.

Get Help Filing Your 1099

Running a business will take up a lot of your time and energy. Having a professional in your corner to help protect your business and investment is an important decision that every small business owner will need to make. That includes making sure you are meeting all of your filing obligations, including when it comes to compensating nonemployees. Try out Bizee's free tax consultation to see how our Accounting and Bookkeeping service can help.

Peter Mavrikis

Peter Mavrikis is an author and editor with over 25 years of experience in publishing. He has worked as the Editorial Director for Barron’s Educational Series, as well as Kaplan Test Prep, where he ran the test prep, foreign language, and study guide.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC