Launch your LLC

in minutes

Created for entrepreneurs by entrepreneurs, we've leveled the playing field for side hustlers, innovators, and seasoned starters, too.

Free compliance reminders

No hidden cost business formation

No long-term contracts and subscriptions

Package Comparison

Ready. set. Launch.

Join 1,000,000+

Entrepreneurs like you

As an entrepreneur, you’re in a daring group of innovators, dreamers, change agents and disrupters. You are laying the foundation for the future. We will guide you through each step.

What's Bizee?

Think of us as the point between your business idea, and your business launch. We’ll help you through each step of forming an LLC. We make it easy, fast and effective. And we’ll be with you throughout the process. Your success is our goal.

A Destination for Your Journey

From first forming your business to navigating bumps and question marks along the way, Bizee is here to help.

For Entrepreneurs by Entrepreneurs

We know what it's like to chart our own course — and we've helped more than a million people do the same.

No Gimmicks or Gotchas

Whether it’s day 1 or decade 5, running a business is hard enough. That’s why we offer simple tools and prices.

Simple Pricing with

No Hidden Fees

Forming a business through Bizee is free — only pay a state fee. You can choose to add on any additional services that satisfy your business needs.

100% FREE Formation

Super Fast Filing Speeds

First Year FREE Registered Agent

Free Compliance Reminders

A destination for your journey

What Else Can Bizee Do for Your Business?

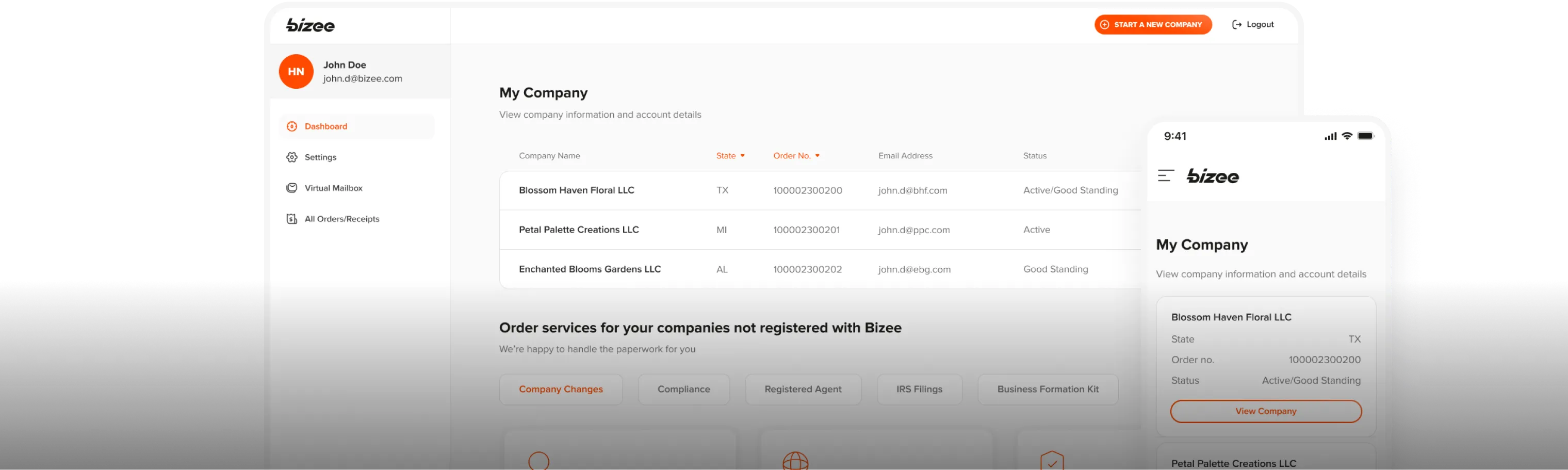

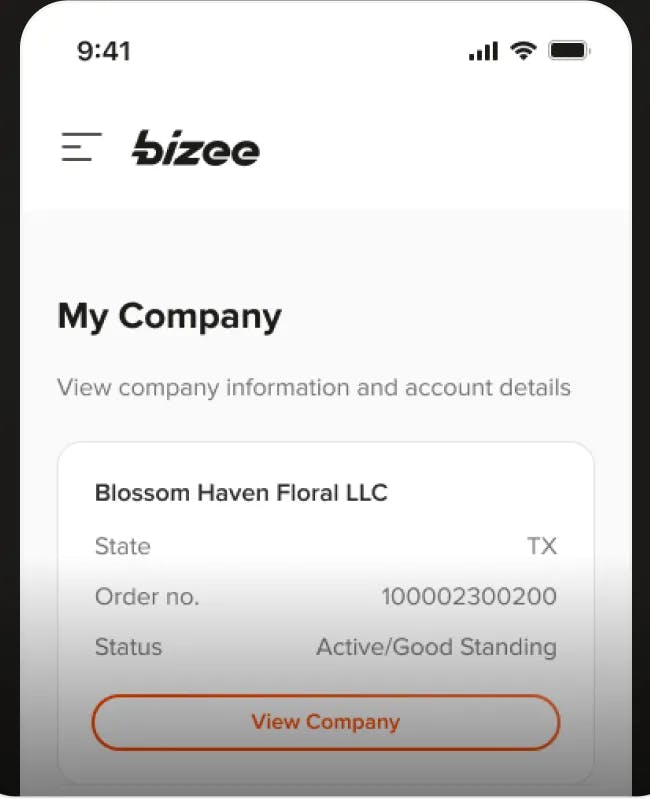

Build Your Personalized Bizee Business Hub

Your business essentials all in one place – from information to reminders, alerts, and additional services.

Bizee's team of experts took care of filing my paperwork so I could get back behind the camera. For an LLC like mine, this is the modern way to get your business started and keep things on track as it grows.

Chad

Owner of Chad Martel Photography

Jacksonville, FL

Bizee made starting my real estate brokerage a breeze. They registered my LLC, helped open a bank account, and connected me to a tax pro without ever leaving my house. It's THE solution for people like me who need to get business done before the kids get home from school.

Stephanie

Owner of Next Door Realty

Austin, TX

My parents always said, “... and a glass of scotch in the other.” With Bizee, I get to be the CEO MY way. With their expert help, I’m a confident business owner and feel in command when it comes to the parts of entrepreneurship I’ve never navigated before.

Isabel

Founder of Isa Paints

San Mateo, CA

incorporate now

Launch your business with bizee

No Contracts. No Surprises. Only $0 + State Fee to Launch Your Business.